当前位置:网站首页>Huasheng lithium battery IPO meeting: 9-month revenue of 690million; shenjinliang's family relationship is complex

Huasheng lithium battery IPO meeting: 9-month revenue of 690million; shenjinliang's family relationship is complex

2022-06-25 22:04:00 【leijianping_ ce】

RedI network Lei Jianping 2 month 17 Reported Wednesday

Jiangsu Huasheng lithium battery material Co., Ltd ( abbreviation :“ Huasheng lithium battery ”) Recently, it passed the review of the Listing Committee of the science and innovation board , It is expected that the registration will be submitted in the next step .

Huasheng lithium plans to raise funds 7 Billion . among ,6.74 100 million yuan per year 6,000 Tons of ethylene carbonate 、3,000 Ton fluoroethylene carbonate project ,2650 Ten thousand yuan is used for R & D center construction project .

Estimated annual revenue 10 Billion

Huasheng lithium battery was founded in 1997 year , Is a company focusing on the research and development of electrolyte additives for lithium batteries 、 Enterprises that produce and sell . The company's products mainly include electronic chemicals and special organosilicon , It has highly covered China's domestic market , At the same time, it is exported to Japan 、 South Korea 、 The United States 、 The European 、 Southeast Asia and other countries and regions .

In the field of electronic chemicals , The company is ethylene carbonate (VC) And fluoroethylene carbonate (FEC) One of the leading suppliers in the market , Products are widely used in new energy vehicles 、 Electric two wheeled car 、 Electric tool 、UPS Power Supply 、 Mobile base station power supply 、 Photovoltaic power station 、3C Products and other fields .

The prospectus shows , Huasheng lithium battery 2018 year 、2019 year 、2020 The annual revenue is 3.69 One hundred million yuan 、4.23 One hundred million yuan 、4.45 One hundred million yuan ; Net profit is 6095 Ten thousand yuan 、7608 Ten thousand yuan 、7736.6 Ten thousand yuan ; The net profit after deducting non profits is 5562.29 Ten thousand yuan 、7039 Ten thousand yuan 、6597.78 Ten thousand yuan .

Huasheng lithium battery 2021 Years ago 9 The month's revenue is 6.9 One hundred million yuan , year-over-year 2.93 One hundred million yuan growth 135.61%; Operating profit is 3.1 One hundred million yuan , The operating profit for the same period last year was 4763 Ten thousand yuan ; The net profit after deduction is 2.64 Billion , The net profit after deducting non-profit in the same period of last year was 3447.6 Ten thousand yuan .

Shenjinliang's family relationship is complicated

IPO front , Shenjinliang directly owns Huasheng lithium battery 14.61% Shares of , Shen Ming directly owns Huasheng lithium battery 4.92% Shares of . meanwhile , Shenjinliang served as the executive partner of Huaying No. 3, Huasheng lithium's employee stock ownership platform , It can indirectly control Huasheng lithium battery held by Huaying No. 3 2.61% Voting rights of shares .

Shenming served as the executive partner of Huaying No. 2, Huasheng lithium's employee stock ownership platform , It can indirectly control Huasheng lithium battery held by Huaying No. 2 4.71% Voting rights of shares .

Shenjinliang 、 Shen Ming and his relatives ( Zhang Xuemei 、 Shen Gang 、 Yuan Xuan 、 Yuan Yang ) And some senior managers of the company 、 Core staff ( Li Weifeng 、 Lin Gang 、 Zhangxianlin ) A concerted action agreement was signed , On the board of directors of the company 、 Concerted action at the shareholders' meeting level .

Shenjinliang is the chairman , Shenming is a director 、 The general manager . Shenming 、 Shen Gang is Shen Jinliang's son , Zhangxuemei is shenjinliang's spouse , Yuan Xuan is the son of zhangxuemei , Yuanyang is the grandson of zhangxuemei , Shenyinliang is shenjinliang's brother , Shenqiang is the nephew of shenjinliang , Zhangxianlin is the nephew and son-in-law of zhangxuemei , Zhujieyuan is the spouse of zhangxuemei's sister .

From a relational point of view , Shenjinliang and zhangxuemei should be the family of the latter group , Each has his own son , Without a common son . It also makes , Huasheng lithium battery family business has a strong color , And it's complicated .

As of the date of this prospectus , Shenjinliang and Shen Ming can actually control Huasheng lithium battery held by the above persons acting in concert 7.16% Voting rights of shares .

Shenjinliang can actually control Huasheng lithium battery held by jinnonglian related enterprises 22.80% Voting rights of shares 、 Huasheng lithium battery held by relevant enterprises of Dunhang 24.51% Voting rights of shares .

in summary , Shenjinliang 、 Shenming controls Huasheng lithium battery in total 81.31% Voting rights of shares ( Including shenjinliang 、 Directly held by Shenming and the persons acting in concert 34.00% Voting rights of shares and related enterprises of jinnonglian 、 The total amount entrusted to shenjinliang by relevant enterprises of Dunhang bank 47.31% Voting rights of shares ), It can have a decisive impact on the decisions of the shareholders' meeting of Huasheng lithium , For the controlling shareholder of the company 、 Actual controller .

BYD is also a shareholder of Huasheng lithium , The shareholding is 2%.

IPO after , Zhangjiagang jinnonglian Industrial Co., Ltd. holds shares of 14.76%, Shenjinliang holds 10.89%, Suzhou Dunhang value No. 2 Venture Capital Partnership ( Limited partnership ) The shareholding is 7.35%, Suzhou Dunhang value No. 3 Venture Capital Partnership ( Limited partnership ) The shareholding is 7.31%;

Suzhou Huizhang Venture Capital Partnership ( Limited partnership ) The shareholding is 4.29%, Shen Ming holds shares of 3.67%, Zhangjiagang Free Trade Zone Huaying No. 2 management consulting Partnership ( Limited partnership ) The shareholding is 3.51%, Suzhou Dunhang value Venture Capital Partnership ( Limited partnership ) The shareholding is 3.24%;

Changzhou Zhongding Tiansheng venture capital partnership ( Limited partnership ) The shareholding is 2.77%, Zhangjiagang Dongjin Industrial Co., Ltd. holds shares of 2.24%, Zhangjiagang Free Trade Zone Huaying No. 3 management consulting Partnership ( Limited partnership ) The shareholding is 1.95%, BYD Co., Ltd. holds 1.48%.

———————————————

Lei Di was founded by Lei Jianping, a senior media person , If reproduced, please indicate the source .

边栏推荐

- Leetcode topic [array] -18- sum of four numbers

- IAAs, PAAS, SaaS, baas, FAAS differences

- GridView component of swiftui 4 new features (tutorial includes source code)

- HNU计网实验:实验一 应用协议与数据包分析实验(使用Wireshark)

- Devops之制品库平台nexus实践

- Support JPEG format in GD Library in php7.4

- 用idea建立第一个网站

- Free cloud function proxy IP pool just released

- Client cannot authenticate via:[TOKEN, KERBEROS]

- Beyond natural motion: exploring the discontinuity of video interpolation

猜你喜欢

实验三的各种特效案例

Win11 start menu right click blank? The right button of win11 start menu does not respond. Solution

Writing manuals using markdown

ASC - DAY2

js禁用浏览器 pdf 打印、下载功能(pdf.js 禁用打印下载、功能)

剖析虚幻渲染体系(16)- 图形驱动的秘密

IAAs, PAAS, SaaS, baas, FAAS differences

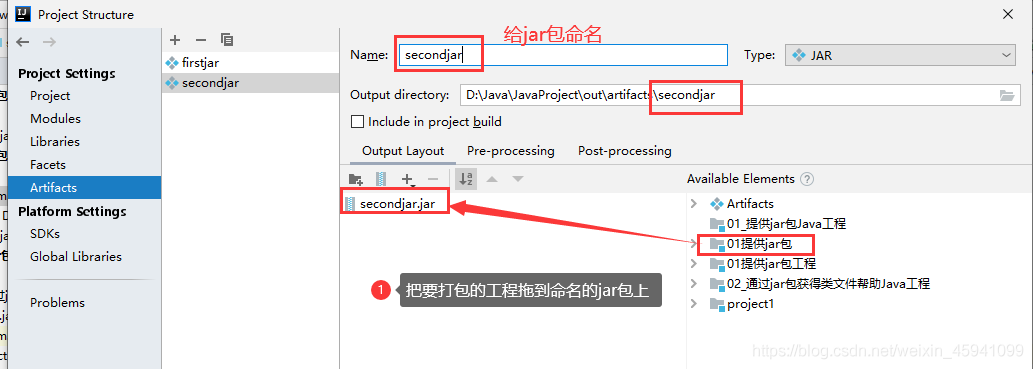

idea怎么把自己的项目打包成jar包

Local Yum source production

Apache uses setenvif to identify and release the CDN traffic according to the request header, intercept the DDoS traffic, pay attention to the security issues during CDN deployment, and bypass the CDN

随机推荐

What is the difficulty of the form tool that costs billions of dollars? Exclusive interview with si no

STM32F103RCT6

Winget: the "Winget" item cannot be recognized as the name of cmdlet, function, script file or runnable program. Win11 Winget cannot be used to solve this problem

Common singleton functions traverse dictionary functions

Where is win11 screen recording data saved? Win11 screen recording data storage location

Apache uses setenvif to identify and release the CDN traffic according to the request header, intercept the DDoS traffic, pay attention to the security issues during CDN deployment, and bypass the CDN

Pat 1050 string subtraction (20 points) string find

PHP runtime and memory consumption statistics code

When we talk about the metauniverse, what are we talking about?

Support JPEG format in GD Library in php7.4

Jmeter- (III) create user test cases for interface testing

Preliminary solution of i/o in socket programming

Understand two major web development patterns

剖析虚幻渲染体系(16)- 图形驱动的秘密

Circular structure and circular keywords

Generic cmaf container for efficient cross format low latency delivery

JS disable the browser PDF printing and downloading functions (pdf.js disable the printing and downloading functions)

Pytest assert encapsulation

Beyond natural motion: exploring the discontinuity of video interpolation

数字图像处理知识点总结概述