当前位置:网站首页>Runmaide medical passed the listing hearing: it is expected that the loss will increase, with huoyunfei brothers holding about 33%

Runmaide medical passed the listing hearing: it is expected that the loss will increase, with huoyunfei brothers holding about 33%

2022-06-21 17:44:00 【Bedouin Finance】

In recent days, , Runmaide Medical Co., Ltd ( Hereinafter referred to as “ Runmaide ” or “ Runmaide Medical ”) Heard by the Hong Kong Stock Exchange and held on 6 month 20 Disclosure of the prospectus after the hearing . It means , Runmaide medical will launch the offering in the near future , And achieve listing on the Hong Kong stock exchange .

According to BeiDuo finance and Economics , The full name of runmaide medical is “ Suzhou runmaide Medical Technology Co., Ltd ”, Founded on 2016 year , The current registered capital is 24922.7697 Million Hong Kong dollars . at present , The sole shareholder of the company is Hong Kong Rainmed Medical Limited( namely “ Hong Kong runmaide Medical Co., Ltd ”).

And according to the prospectus , Runmaide medical was founded in 2014 year , Is a medical device company , The current focus is on the fractional flow reserve system for coronary angiography (“caFFR System ”) And coronary angiography microvascular resistance index system (“caIMR System ”) The design of the 、 Development and commercialization .

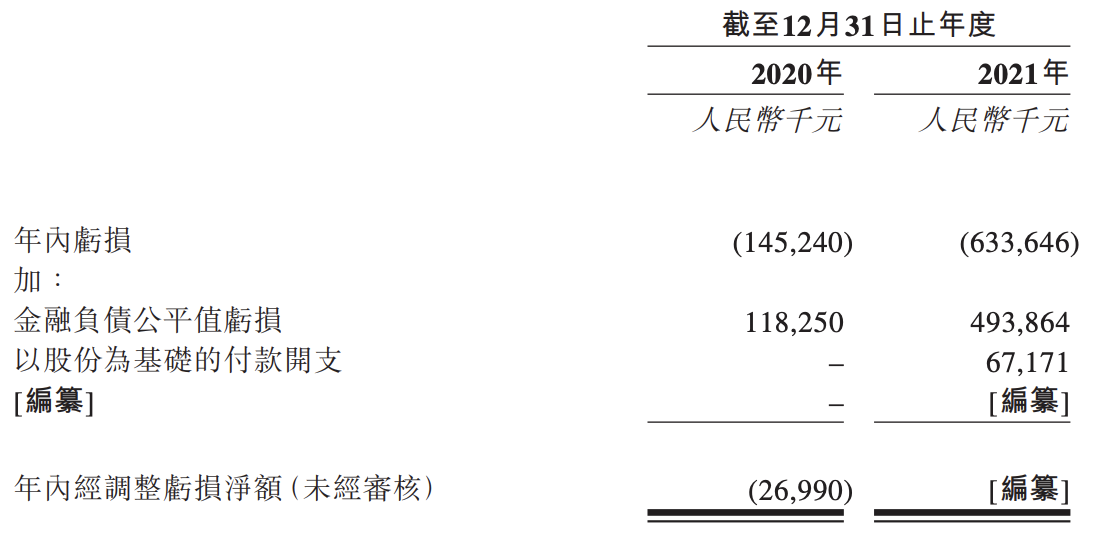

During the past record period , Runmaide medical is 2019 year 10 month caFFR After the commercialization of the system , Just started to generate revenue . By 2020 Years and 2021 year 12 month 31 End of day year , The company separately recorded earnings ( income ) RMB 609.7 Ten thousand yuan 、8119.9 Ten thousand yuan , Generate net losses respectively ( Loss during the year )1.45 Million dollars 6.34 One hundred million yuan .

Runmaide medical said in the prospectus , Mainly due to (i) The fair value loss of financial liabilities increased significantly , Mainly because with 2021 The valuation of the group increased in , The fair value of the preferred shares increases accordingly and (ii) General and administrative expenses and sales expenses increased significantly , Mainly due to the fact that the company 2021 Share awards granted in .

Runmaide medical said , From the end of the track record period , The company continues to develop its business . meanwhile , Runmaide medical expects 2022 The net loss for the year will increase , This is mainly because the company expects to provide funds for the ongoing and future clinical trials of its core products and the preclinical research of other products under development , Will continue to generate significant R & D expenditures .

Under non HKFRS measurement , Runmaide Medical 2020 Net adjusted loss for the year ( Without audit ) by 2699.0 Ten thousand yuan . By 2021 year 12 month 31 Japan , The net debt of runmaide medical is 7.75 One hundred million yuan , Cash and cash equivalents are 5.59 One hundred million yuan .

Since its establishment , Runmaide medical has completed Angel-1 round 、Angel-2 round 、A+ round 、B round 、C-1 round 、C-2 Wheel and D Round of funding . It's just 2021 year 9 month , Runmaide medical has announced the completion of 7200 Ten thousand dollar financing , Ping An capital, the core private equity platform of Ping An, China, leads the investment ,Seresia Asset Management、Lighthouse Canton Wait for the follow-up shot .

In the equity structure before this listing , Ping An investment holds 6.29%; Executive director of runmaide Medical 、 Huoyunfei, chairman of the board of directors and chief executive officer, passed Opera Rose holding 18.77%, His brother huoyunlong passed Vermilion Bird holding 13.98%, total 32.75%; Lvyonghui, executive director and co CEO of runmaide medical, passed the Mingze holding 2.70%.

meanwhile , Gu Yang, executive director and vice president of runmaide medical, passed ASHG HK holding 0.47%, Executive director 、 Zhang Liang, chief financial officer and co Secretary of the company, passed ANC HK holding 0.39%, Liuguangzhi, chief technology officer, holds the shares AIMEI holding 1.66%, Wu Xingyun, vice president, holds shares 1.24%, LiuKangJian, vice president and Secretary of the board of directors, passed NEXT DAWN holding 0.39%, Duanning, the sales director, holds the shares 0.23%.

To further enhance the liquidity situation , On 2022 year 5 End of month , Runmaide medical obtained RMB from two Chinese commercial banks respectively 5000 Letter of intent for RMB 10000 loan financing , total 1 One hundred million yuan . This represents a , The debt scale of runmaide medical will be further expanded .

On 2020 Years and 2021 year , The R & D expenditures of runmaide medical are respectively 1180 Wan Yuan and 2700 Ten thousand yuan . among , The R & D expenses of core products are 860 Wan Yuan and 2070 Ten thousand yuan . As of the latest practicable date , The company owns 81 Patents granted ( Include 79 Item was approved in China 、 One was approved in the United States and one in Japan ),145 Pending patent applications .

And according to smart bud data , Runmaide Medical Co., Ltd 245 Patent application information , as well as 10 Software copyright registration information . Through algorithm analysis , The company's patents mainly focus on the coronary artery 、 Contrast image 、 Center line 、 Analysis system 、 Blood pressure sensor and other technical fields .

According to the prospectus , Runmaide Medical Co., Ltd 2022 year 3 In June, the project was completed in China caIMR Systematic confirmatory clinical trials ,116 Subjects were enrolled . The results of clinical trials show that ,caIMR The display accuracy of the system is as high as 93.8%(95% CI 87.7% to 97.5%). And then 2022 year 4 month , Runmaide medical submitted the results to the State Food and Drug Administration for regulatory approval .

边栏推荐

- 程序员进修之路

- PTA l3-032 questions about depth first search and reverse order pair should not be difficult (30 points)

- How to write technical documents software engineering at Google

- Is it safe and reliable to open futures accounts on koufu.com?

- 3DE 网格坐标点与物体的附加

- Not this year's 618?

- Iframe cross domain value transfer

- Google play 应用签名密钥证书,上传签名证书区别

- Bm22 compare version number

- IEC62133与EN62133有何区别?主要测试哪些项目?

猜你喜欢

The next stop of Intelligent Manufacturing: cloud native + edge computing two wheel drive

《MATLAB 神经网络43个案例分析》:第27章 LVQ神经网络的预测——人脸朝向识别

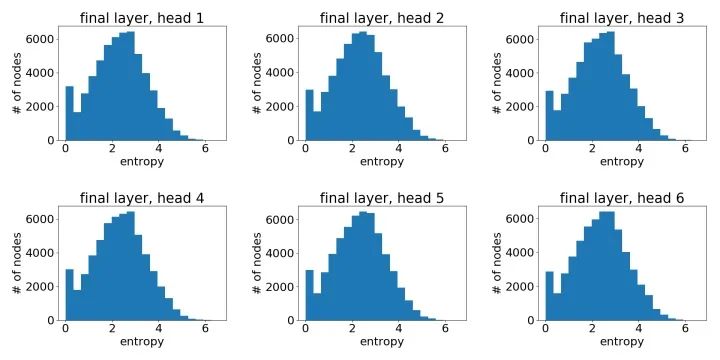

深入理解图注意力机制

Google play application signature key certificate, upload signature certificate difference

不是一流大学毕业,却通过自学软件测试,进了阿里年薪初始22K

多维分析预汇总应该怎样做才管用?

鱼佬:电信客户流失预测赛方案!

众安保险联合阿里健康、慧医天下 探索互联网慢病管理新模式

PingCAP 入选 2022 Gartner 云数据库“客户之声”,获评“卓越表现者”最高分

Jetpack compose management status (I)

随机推荐

Kubernetes + Yanrong SaaS data service platform, personalized demand support has never been lost

Your cache folder contains root-owned files, due to a bug in npm ERR! previous versions of npm which

MySQL 1055错误-this is incompatible with sql_mode=only_full_group_by解决方案

module.exports指向问题

BFS and DFS

Let, with, apply, also, run

潤邁德醫療通過上市聆訊:預計虧損將增加,霍雲飛兄弟持股約33%

为什么RedisCluster设计成16384个槽?

Differences between fragmentstatepageradapter and fragmentpageradapter

PingCAP 入选 2022 Gartner 云数据库“客户之声”,获评“卓越表现者”最高分

path.join() 、path.basename() 和 path.extname()

Go corn timing task simple application

程序员进修之路

Jetpack Compose 的阶段

go corn定时任务简单应用

How can aggressive programmers improve R & D efficiency Live broadcast Preview

fs.readFile() 和 fs.writeFile()

LeetCode_ String_ Simple_ 387. first unique character in string

室内膨胀型防火涂料根据BS 476-21 耐火标准测定需要符合几项?

钣金行业MES系统的特色需求