当前位置:网站首页>Nine charts overview the cycle law of encryption Market

Nine charts overview the cycle law of encryption Market

2022-07-23 10:11:00 【Blockchain metauniverse chaingame NFT digital collection】

The encryption market has four cycles

Like the traditional economy and financial markets , Encryption also has fluctuating cycles . The encryption market cycle lasts on average about 4 Year or about 1275 God . We can use bitcoin price as a parameter , By realizing that the price is lower than the market price ( The current transaction price of the asset ) To quantitatively define the cycle . From a qualitative point of view , Each cycle marks progress in product and adoption , It provides a springboard for the next cycle .

The following is an overview of self 2012 The beginning of the annual encryption market cycle :

2012 - 2015 year : The age of hackers Ethereum started

The main theme of this cycle is the proliferation of new encrypted exchanges and wallets .

2016 - 2019 year :ICO Experimental age & DeFi Be born

The price fell sharply , But this sell-off did not destroy the entire market . contrary , Capital turns to stable currency and ICO Tokens, . Laid down DeFi Summer The basis of .

2020 year - at present : leverage 、 Institutions and DeFi Combat effectiveness test

2020 The theme of the market cycle in is leverage , Because investors began to leverage .

Encrypt the market cycle chain

The price of digital assets represents only part of the broader ecosystem in the development of the encryption industry . Despite the uncertainty in the market , The price of bitcoin fluctuates with traditional financial assets , But its basic network continues to operate as designed , And it is expected to deal with nearly 18 Trillions of dollars worth of assets , higher than 2021 Year of 13 Trillions of dollars , As shown in the figure below . Mexico is the third largest recipient of remittances , It is also one of many countries that turn to this technology . Cryptocurrency exchange, headquartered in Mexico Bitso stay 2021 First quarter to 2022 Cross border remittances increased during the first quarter of 4 times .

Bitcoin network value transfer ( dollar )

Like Ethereum and Solana Such a smart contract network can also be used for remittance , For example, transfer to stable currency . No matter what blockchain is used , Suppose it has strong network security , Users can connect through the Internet , Safely transfer value to anyone in the world , Sometimes the cost is lower than traditional remittance payment .

30 Change in net position of the stock exchange on the day of ( Measure the number of bitcoins in centralized exchanges ) stay 2022 year 6 Menstruation experienced the largest outflow ever recorded , It shows that holders are transferring their bitcoin from exchanges and centralized lending platforms . This shows that , Investors may be cautious about putting funds on centralized lending platforms , Because when these institutions use user funds , Adopting a more risky strategy may lead to liquidity problems . contrary , Users seem to choose to passively hold their digital assets .

The currency : Change in net position of the exchange (BTC)—— All exchanges

Many of these outflows may be due to investors taking advantage of this opportunity to increase their positions at a discount . hold BTC The number of wallet addresses has increased dramatically , Reach an all-time high . This marks an interesting change in market sentiment , Because historically , Investors with small amount of funds reduce the size of their positions when they are uncertain about the market situation —— Especially in 2018 In, the price of bitcoin increased from about 2 Million dollars fell .

The currency : Small holder balance

Facing bankruptcy CeFi Companies and hedge funds combine DeFi agreement ( Such as Aave) And centralized lending institutions to borrow capital . Interestingly ,DeFi The position of is repaid before the central bank or equity holders . According to the code written in the smart contract , Decentralized loan agreements can operate autonomously . For decentralized loan agreements , There is no way to negotiate the terms of the position , Because if it is lower than the loan to value ratio , It will be liquidated .

The transparency of activities on the chain also allows market participants to gain insight into the situation of these institutions , Traditional markets may be more opaque —— Give the market time to prepare and adjust for potential liquidation . Although user deleveraging leads to capital outflows , But in Aave and MakerDAO The total loan amount on the loan platform is still higher than 2022 Beginning of the year .

Total borrowings of decentralized lending platform (ETH)

Uniswap Remarkable growth and performance have also been achieved in this cycle .Uniswap Founded on 2018 year 11 month , During the bear market , Has developed into DeFi The core pillar of ecosystem .Uniswap Foundation and Paradigm According to the study ,Uniswap Yes ETH/USD and BTC/USD Trading pairs have greater market depth . This is particularly impressive , because Uniswap Owned and delivered all assets being traded , under these circumstances , Centralized exchanges do not need to transfer or deliver assets , Until the user exits to self custody .

Among them, the liquidity of stable currency trading pairs is also higher than that of centralized exchanges ,Uniswap stay USDC/USDT The liquidity of trading pairs is almost money safe 5.5 times .

ETH/USD Stable currency and ETH/BTC Market depth comparison

When the market fluctuates ,DEX Monthly trading volume also remained stable .2021 year 6 month ,DeFi Almost lost its status , and DEX Handled billions of dollars of trading volume . By 2022 year 6 month , In Ethereum DEX And Uniswap equally , The transaction volume is about 750 Billion dollars .2022 year 7 Of the month DEX Trading volume is also closely related to 2022 year 2 Flat month , At that time, the price of Ethereum was about higher than 2.5 times , Respectively about 2800 The dollar and 1100 dollar .

Ethereum decentralized trading volume ( dollar )

Metauniverse is one of the fastest growing categories in the field of encryption , according to CoinMarketCap The data of , The metauniverse has 230 Multiple assets , Worth more than 110 Billion dollars .Axie Infinity It is a chain game based on Ethereum , in the past 30 There are more than 77.8 Ten thousand activity addresses are playing the game . Existing companies are also interested in the interaction between encryption and game entertainment . Blockchain game developers Gala games Recently and 《 Fort night 》 The studio of Epic games Achieve cooperation .Gala and Epic Games Our cooperation will be more than 1.94 Million users provide convenient access and touch , This may be their first blockchain based video game in history , This is a great progress in the development of the industry .

Another segment of the encryption market is decentralized infrastructure . Decentralized file storage network Filecoin On 2021 year 6 In September, the superluminal upgrade was launched , Transaction throughput increases 10-25 times .

As shown in the figure below , Although Internet usage is growing exponentially , However, the agreement revenue is flat after the network upgrade ( Daily active trading ). Although the agreement revenue is very important , But development does not always depend on it . With Filecoin For example , This upgrade expands the network , Continue to provide file storage , The cost is only Amazon S3 Cloud storage file storage costs 0.001%.

Filecoin Active trading

summary

For emerging asset classes , Violent price fluctuations and 80% The sudden withdrawal of funds is expected . Blockchain technology will completely change all aspects of digital life , At present, we are helping developing countries to provide inclusive finance and equity 、 Stimulate innovation in finance and cryptography , And promote the Internet to enter a new stage of decentralization .

Every market cycle experienced by the encryption industry makes this ecosystem stronger . The market cycle has provided us with the experience “ Pressure test ” Of DeFi 、 Infrastructure agreement 、 The innovation of large-scale solutions and the growing meta universe industry . Despite the decline in prices 、 Liquidation and volatility , The encryption industry continues to build and innovate , Constantly push forward the industry boundary .

边栏推荐

- PHP RSA generates public key and private key PSA2 encryption and decryption

- 【机器学习基础】特征工程常用操作

- Transfer software testing salary 10K | there is food in the hand and a bottom in the heart, which is the truth at all times

- Arcgis 计算两个栅格图层相关性

- Multi UA V cooperative exploring for the unknown interior environment based on dynamic target tracking

- Baidu map eagle eye track service

- 这个工具,补齐了 JMeter性能分析最后一公里短板

- Multi-UA V Cooperative Exploringfor the Unknown Indoor EnvironmentBased on Dynamic Target Tracking翻译

- redis分片集群如何搭建与使用

- Tsinghua, air, Tencent | 3D isovariant molecular map pre training

猜你喜欢

随机推荐

三数之和:(排序+双指针+剪枝)

How to build and use redis fragment cluster

七大排序--万字详解

Time series - third party Library: tsfresh [feature extraction, feature selection]

枚举类的使用和实现

【Azure 事件中心】Azure Event Hub 新功能尝试 -- 异地灾难恢复 (Geo-Disaster Recovery)

Is it safe for outsiders to open accounts in Huatai? Will you be cheated

数据库设计

【MySQL】游标「Cursor」

PHP RSA generates public key and private key PSA2 encryption and decryption

30行自己写并发工具类(Semaphore, CyclicBarrier, CountDownLatch)是什么体验?

【南瓜书ML】(task3)决策树(更新ing)

中小企业的福音来咯!JNPF渐火,助力业务数字化升级

Kill a process on Linux

Hide the PHP version information in the response header of the website server

十年架构五年生活-05第一次出差

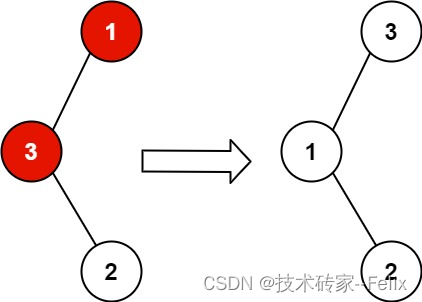

leetcode-99.恢复二叉搜索树

1.赋值语句

【PyTorch】cuda()与to(device)的区别

亿级融资事件占比超30%,超自动化的下一站是何处?丨曼孚科技