当前位置:网站首页>Five level classification of loans

Five level classification of loans

2022-06-24 08:18:00 【BabyFish13】

The five level classification of loans refers to the five level classification of loan quality by commercial banks according to the borrower's actual repayment ability . That is, loans are divided into five categories according to the degree of risk : normal 、 Focus on 、 secondary 、 Suspicious 、 Loss , The last three are non-performing loans .1998 year 5 month , The people's Bank of China shall refer to international practice , Combined with China's national conditions , Formulated the 《 Loan classification guidelines 》.

Early classification

1998 Years ago , The loan classification method of Chinese commercial banks basically follows that of the Ministry of finance 1993 enacted 《 Financial system of financial and insurance enterprises 》 The loan is divided into normal 、 Within the time limit 、 dull 、 Bad debts Four types , The latter three are collectively called non-performing loans , Abbreviation in China “ Stay for more than two ”. Overdue loans are loans that are overdue , As long as more than one day is overdue ; Sluggishness refers to the delay of two years or the cessation of business even though it is less than two years 、 Loans for the project ; Bad debts refer to those that have been determined to be uncollectible in accordance with the relevant provisions of the Ministry of finance , Loans that need to be written off against bad debt reserves . Most of the bad debt loans of Chinese commercial banks have formed a historical problem that should be written off but failed to be written off .

This classification method is simple and easy , Under the enterprise system and financial system at that time , It did play an important role , however , With the gradual deepening of economic reform , The drawbacks of this approach are gradually emerging , It can no longer meet the needs of economic development and financial reform . For example, an undue loan , Whether or not there is actually a problem , Are considered normal , Obviously the criteria are not clear , Another example , It seems too strict to classify loans that are one day overdue as non-performing loans . In addition, this method is a kind of post management , Only if the loan term is exceeded , Will be shown as non-performing loans in the bank's accounts . therefore , It is important to improve the quality of bank loans . Take certain protective measures for problematic loans in advance , Is often powerless . So as the problem of non-performing loans becomes more and more serious , This kind of classification method has also reached the point that it must be changed .

Current classification

Normal loans

The borrower is able to perform the contract , Have been able to pay the principal and interest normally , There are no negative factors that affect the timely and full repayment of the loan principal and interest , The bank is fully confident that the borrower will repay the loan principal and interest in full and on time . The probability of loan loss is 0.

Focus on loans

Although the borrower is able to repay the loan principal and interest , However, there are some factors that may adversely affect the repayment , If these factors continue , The borrower's ability to repay is affected , The probability of loan loss will not exceed 5%.

Subprime loans

There are obvious problems in the borrower's repayment ability , The loan principal and interest cannot be repaid in full by relying solely on its normal operating income , It is necessary to repay interest by disposing of assets or external financing or even executing mortgage guarantee . The probability of loan loss is 30%-50%.

Suspicious loans

The borrower cannot repay the loan principal and interest in full , Even if the mortgage or guarantee is executed , It will certainly cause some losses , Just because there is a borrower restructuring 、 Merger and acquisition (m&a) 、 Merge 、 Collateral disposal and pending litigation are pending factors , The amount of the loss is uncertain , The probability of loan loss is 50%-75% Between .

Loss loan

It refers to the possibility that the borrower has repaid the principal and interest free of charge , No matter what measures are taken and what procedures are performed , Loans are doomed to loss , Or although it can recover a small part , But its value is also very small , From the bank's point of view , There is no sense and necessity to keep it as a bank asset in the accounts , Such loans shall be written off immediately after the necessary legal procedures have been performed , The probability of loan loss is 75%-100%.

边栏推荐

- 搜索与推荐那些事儿

- Latest news of awtk: new usage of grid control

- Unity culling related technologies

- LabVIEW查找n个元素数组中的质数

- June 27, 2021: given a positive array arr, it represents the weight of several people

- [ACNOI2022]不是构造,胜似构造

- Swift foundation features unique to swift

- [run the script framework in Django and store the data in the database]

- 复习SGI STL二级空间配置器(内存池) | 笔记自用

- Introduction to software engineering - Chapter 2 - feasibility study

猜你喜欢

Introduction to software engineering - Chapter 2 - feasibility study

More than observation | Alibaba cloud observable suite officially released

C language_ Love and hate between string and pointer

问题3 — messageBox弹框,修改默认背景色

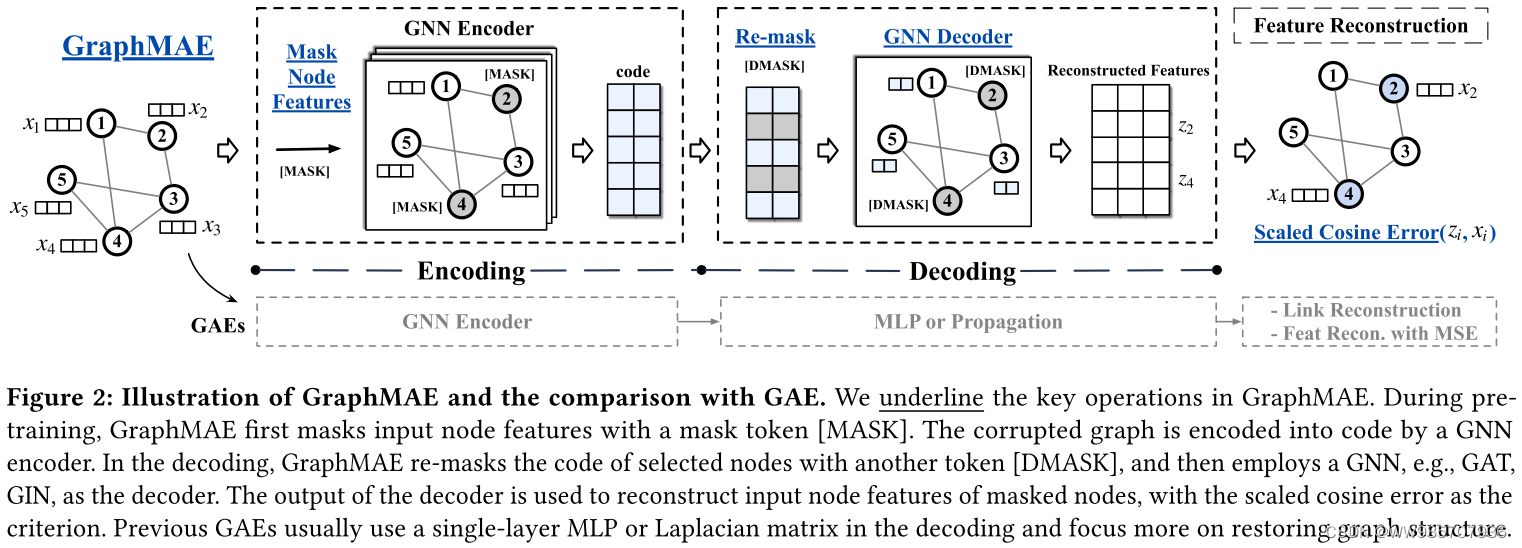

GraphMAE----论文快速阅读

![[008] filter the table data row by row, jump out of the for cycle and skip this cycle VBA](/img/a0/f03b8d9c8f5e53078c38cce11f8ad3.png)

[008] filter the table data row by row, jump out of the for cycle and skip this cycle VBA

OC extension detects whether an app is installed on the mobile phone (source code)

C语言_字符串与指针的爱恨情仇

Swift extension networkutil (network monitoring) (source code)

Search and recommend those things

随机推荐

一文带你了解Windows操作系统安全,保护自己的电脑不受侵害

Leetcode 515 find the leetcode path of the maximum [bfs binary tree] heroding in each row

搜索与推荐那些事儿

Atguigu---16-custom instruction

Signature analysis of app x-zse-96 in a Q & a community

Vulnhub target: boredhackerblog: social network

Question 1: the container that holds the most water

Teach you how to use the reflect package to parse the structure of go - step 1: parameter type check

Pipeline concept of graphic technology

Chapter 3 curve graph of canvas

Selenium IDE的安装以及使用

QOpenGL显示点云文件

Transformers pretrainedtokenizer class

Leetcode exercise - jumping game, combination summation

Ad-gcl:advantageous graph augmentation to improve graph contractual learning

一文理解同步FIFO

decltype用法介绍

问题4 — DatePicker日期选择器,2个日期选择器(开始、结束日期)的禁用

You get in Anaconda

Interview tutorial - multi thread knowledge sorting