当前位置:网站首页>More than half of 2022, no new air outlet

More than half of 2022, no new air outlet

2022-06-22 11:54:00 【I dark horse】

source : Deep burning (ID:shenrancaijing) author : Wang min. edit : Xiang Xiaoyuan

The investment rhythm of the whole market is slowing down .

2022 More than half a year , The wind stopped .

In the first half of the year , The pace of the entire investment market has slowed down significantly , The investment amount in the first quarter decreased by nearly half compared with the same period last year . Relevant data of Zero2IPO Research Center shows that ,2022 In the first quarter of, there were... In China's equity investment market 2155 Starting investment , Year-on-year decline in 27.5%; The disclosed investment amount is 1968.22 RMB 100 million , Year-on-year decline in 47.1%.

In the past six months , Complex international environment 、 A global economy full of uncertainty , And Beijing 、 The epidemic situation in Shanghai and other places has been repeated , The institutional fund-raising environment is worse 、 Activity decreased significantly . Many investors have been on the sidelines for a long time , Getting more and more cautious . Although there was no online education in the market last year 、 Community group buying and other large-scale track collective contraction events , But the overall trend is not good , There is not even a new air outlet .

After the cold of new consumption last year , Investors focus on two main directions , It represents the next generation Internet and the future Web3、 Metacosmic plate , And carbon neutrality with obvious policy and capital dividends 、 Hard technology sector . among ,Web3、 Related companies in the field of new energy , In the first half of the year, the valuation increased significantly .

In the cold winter of the market , Whether these directions are real future or short-term foam , There is no final conclusion yet , But this is one of the few places in the current market where we can see the direction of growth .

Carbon neutralization 、 Hard technology : The remaining tuyere new energy :“ Do not invest in new energy now , Like 20 I didn't buy a house years ago ”

“ Do not invest in new energy now , It's like 20 I didn't buy a house years ago ”, Recently, economist renzeping's sentence has been widely spread . In his opinion , The present , New energy related industries are the most promising industries for China's economy in the future 、 The most explosive field .

“ Hard technology is one of the few industries that is still relatively prosperous this year ”, Hard technology investor linjialiang also expressed to shenran ,“ First half of this year , In particular, some new energy projects are developing at a faster pace .”

With some track investors affected by the economic environment 、 Policy factors affect the initiative to slow down the pace of investment , An investor in the field of new energy pointed out , The agency wants to speed up , But affected by the epidemic , Forced to slow down the pace .

For example, Zhang Hong, a new energy investor in Beijing, said ,“ Many projects , Don't go to the site to make adjustments , It is impossible to make the final investment decision .” Affected by the epidemic in the first half of the year , He missed two projects that he had been following for a long time .

Under the influx of capital , The valuations of some projects in the field of new energy have gone up . A hard technology investor mentioned , An insignificant new energy company , Just after mass production , Valuation is the first step 20 $ ,“ It's really crazy ”.

Subdivisions in the new energy sector , In the secondary market , This 6 month , Wind power 、 Photovoltaic 、 Lithium battery in A Stocks and related sectors rose sharply . In the primary market , Energy storage 、 Hydrogen energy is the focus in the first half of this year .

As a photovoltaic 、 The energy storage industry, which is an important supporting link for the development of new energy such as wind power , It has become the focus of energy transformation , It's the realization of “ Double carbon ” The only way . According to the forecast of Everbright Securities , To 2025 year , China's energy storage investment market space will reach 0.45 Trillion yuan ,2030 Annual growth to 1.30 About trillion yuan . According to linjialiang , Some companies in the field of energy storage , The annual revenue can increase several times .

The specific term , At present, the main energy storage methods are , Electrochemical energy storage is widely used 、 The development potential is the greatest , At present, lithium batteries are the main products , And has entered the stage of large-scale commercial application .

According to the data of Zero2IPO Research Center ,2016 year -2022 First quarter , The number of investment cases in China's clean energy sector is mainly concentrated in new energy power generation 、 Energy storage field , The proportion of investment cases is 38%、34%; Investment in energy storage , The investment activity of energy storage lithium battery is the highest , The number of investment cases accounts for... Of the total investment cases in the energy storage field 75.9%.

Hydrogen energy is another focus , This year 3 Released on 《 Medium and long term planning for the development of hydrogen energy industry (2021-2035 year )》 of . It means , Hydrogen energy has risen to the strategic position of national energy .

The industry also knows , Hydrogen energy is still a long way from large-scale industrial implementation .“ Storage and transportation of hydrogen energy , The cost is too high ”, Zhang Hong pointed out , But this does not affect the high attention of the market .

Semiconductor chip : Heat does not decrease. , But valuation correction

With continuous policy support , The domestic substitution in the field of semiconductor chips has accelerated in the past two years . Relevant reports of Zero2IPO research show that ,2022 In the equity investment market in the first quarter of , Semiconductor and electronic equipment industry is the industry with the highest amount of investment , reach 448.02 One hundred million yuan , Compared with the second largest industry IT In the field of 353.03 Billion yuan is nearly 100 Billion .

While absorbing countless amounts of money , There is also a foam in the semiconductor field . As early as 2021 year , The seizing of high-quality projects in the semiconductor field has been very fierce , The early financing amount of the industry is basically hundreds of millions of yuan . There is a view that , At that time, it had become the hardest hit area of the foam .

Zhang Hong will focus on new energy this year 、 The new material , It is because of the semiconductor project , It is often the head star and large organization involved .“ These large institutions have raised the valuation of the project especially high , Split up the share .” His organization began to worry , The valuation of the primary and secondary markets of the semiconductor sector is seriously inverted , Whether we can still get a reasonable return in the end , therefore , We are very cautious about investing in the semiconductor field .

“ last year , The market is expecting too much from the semiconductor field , This year is somewhat lower than last year .” Linjialiang pointed out , since this year on , The valuation of some semiconductor projects in the primary market has been loosened , The rise of valuation has slowed down significantly .

Part of the reason why valuations tend to be conservative is , The growth rate of the global semiconductor market is declining . The data recently released by the world semiconductor association shows that , expect 2022 The growth rate of the semiconductor market in 15%, The growth rate is lower than that of the previous year 10% about , and 2023 The growth rate slowed down further in , Expected to be 5%. The demand for mobile phones and other terminal markets is declining , It also leads to overcapacity in the semiconductor field , There is “ Chopping single tide ”.

The correction of the secondary market is also part of the reason .A The stock market on the field , Semiconductor projects have broken one after another 、 Valuation decline .4 month ,5 home IPO Of semiconductor companies ,4 Home breaking , Among them, Weijie Chuangxin fell by... On the first day of listing 36%, The market value has evaporated nearly 10 billion yuan . Including Aojie technology 、 A large number of semiconductor companies, including Guoxin technology, still suffered long-term losses after listing . from 2021 year 11 Month begins , At home A The semiconductor sector continued to decline , By the end of this year 4 End of month , The sector index fell more than 30%.

Although the semiconductor industry received the most funds in the first quarter , But the financing amount , Compared with last year, there has been a decline . Relevant reports of Zero2IPO research show that , During the first quarter , The number of financing in the semiconductor and electronic equipment industries increased year on year 11.8%, And the amount decreased year on year 19%. Besides , Investment and M & A events at the industrial end of the semiconductor field are also increasing , Head institutions are expanding their industrial lines in the form of mergers and acquisitions , Build the advantage .

Against the background of the global slowdown , At home , The domestic substitution in the semiconductor field is still of great concern , After all, the overall localization rate of China's semiconductor equipment industry is still in its infancy . After the false fire of investment fades , The market can return to the law of rational development .

Meta universe 、Web3: Hot and controversial parallel metauniverse : The time has not come , Bury your head in paving the road

Second half of last year , The concept of the meta universe , But it is also after the public realized that the meta universe can not be realized overnight , The heat went down .

however , Industrial end 、 The investor's enthusiasm for metauniverse has not decreased significantly . In the virtual human related to the meta universe 、 social contact 、VR/AR Other fields , There is no shortage of large companies .

Since the beginning of this year , Virtual digital people have become the darling of the investment community , In the first month, it raised nearly 100 funds , Accumulated amount exceeds 4 One hundred million yuan . Bytes to beat 、 Tencent and other Internet companies 、 Entertainment company , One after another, they are laying out virtual digital people , Release digital human products .

VR/AR Although there is no technical innovation in this field , However, it does not affect the industry's optimism in this field . Some people think that ByteDance has the potential to grow in the future , One is TikTok、 The other is VR equipment Pico The business division in which it is located . LuoYongHao also said publicly recently , The direction of starting a business again is AR, call AR It's the next generation of computing platforms .

Metacosmic social class APP They are constantly hatched . First, the gel goes online and then quickly goes off the shelf 、 The Party Island under byte, which is regarded as a meta universe social product by the outside world, is also under internal test .6 month , Once the “ Live first ” Yingke company changed its name to “ Reflect the universe ”, And to transform the business to the meta universe .

For the distant metauniverse , What investors pay close attention to is the technological innovation in the field of infrastructure construction . Wang Sheng, partner of Innolux angel fund, has been focusing on metauniverse in the past year , Pay special attention to relevant infrastructure projects .

“ Now let's talk about the realization of the metauniverse , It is equivalent to that the roads have not been repaired , Water and electricity have not been connected yet , Disney will be built ”, Wang Sheng pointed out , The basic construction of the meta universe is still at a very early stage . Take virtual digital people for example , One side ,3D The production cost of animation is very high and the cycle is long ; On the other hand , It should have been an immersive digital human 3D image , At present, it is still mostly presented in the form of short video .

He thinks that , Metacosmic infrastructure should focus on the following directions , Including computing power and infrastructure , To support the massive computing needs of the meta universe ; Artificial intelligence technologies such as AI Perceptual algorithms to enhance the virtual real connection ;3D Construction of graphics and related production tools , To build a virtual digital space .

“ Next three to five years , The meta universe must first be upgraded at the infrastructure level , Only on the basis of continuous improvement of infrastructure construction , There will be rich content ecology .” Wang Sheng said .

Web3: The meta universe has not yet arrived ,“ Next generation Internet ” Go ahead ?

stay 2022 The concept of Nian yuan universe is relatively “ convergence ”、 Industrial end 、 When the investment side is laying the road ,Web3 It has become the hottest and most controversial outlet in the venture capital circle .

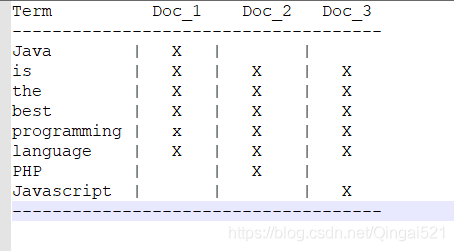

Web3 Based on blockchain , Emphasis on decentralization , Compare with Web1.0 The era can only read information in a static one-way way ,Web2.0 Era users can read 、 Writable information , Participate in interaction ,Web3.0 Time , Users can read and write information , And have ownership of the data .

In Wang Sheng's opinion , Compared with the meta universe, it is the innovation of productivity ,Web3 It is the innovation of production relations . On the basis of the gradual maturity of the underlying technology of blockchain , How to build an economic system 、 Accelerate the landing of applications , It's exploration Web3 The focus of the field .

Web3 Why can fire , Partly because , It is fast in the eyes of some investment institutions “ Make rich ” New areas of . Overseas , More and more companies are valued at ten times 、 A hundred fold increase , Bring ten times to investors 、 A hundredfold high yield .

Since last year ,a16z、Paradigm And other venture capital institutions , Have set up billions of dollars Web3 fund . This year, 6 month , Sequoia Capital has launched a total scale of 28.5 Two new funds worth billion dollars , Will expand Web3 Field investment , according to an uncompleted statistic , Only this year ago 4 It has been invested for nearly three months 20 home Web3 company .

Web3 Field unicorns also appear one after another .Web3 Safety company CertiK On 4 Announced the completion of 8800 Thousands of dollars in B3 Round of funding , The post investment valuation reached 20 Billion dollars ( about 120 RMB ) .5 month , Crypto financial service provider Babel Finance complete B round 8000 Ten thousand dollar financing , The valuation 20 Billion dollars .

“Move to Earn”Web3 game STEPN Also since last year 11 After the launch in June , It was announced that the valuation had broken through within half a year 10 Billion dollars , The circulating market value of platform tokens exceeded 200 Billion dollars .

An investor mentioned to shenran , It is different from the traditional primary market investment , some Web3 The investment mode of the project is to develop Token, After unlocking , The organization can exit quickly , The lock-in period is short , Liquidity is also better .“ Compared to the distant metauniverse ,Web3 The tempting thing is , It can be quickly realized and profitable ”.

however , The other side of high yield is high risk ,Token The token mechanism is Web3 A catalyst for ecological development . A huge complex 、 Fast growing and unregulated areas ,Token If the mechanism is not perfect , It may lead to disastrous consequences , Bring huge losses to investors and ordinary users .

In recent days, , By the Fed's interest rate hike 、Luna Thunderstorm and other factors , The price of bitcoin, the world's largest cryptocurrency by market value, has also plunged one after another ,6 month 19 Early morning , Bitcoin once fell below 18000 dollar , Hit a 2020 The lowest since the end of the year .

Besides ,Web3 The risks of application cannot be ignored . With STEPN For example , Its presence 5 After the announcement of checking mainland users was released in late September , The price of tokens has been plunging , At one point it fell 40%.

so far ,Web3 There are still big disputes in China , Some people think , It cannot be defined by blockchain technology alone Web3. and , The circulation of cryptocurrency is restricted by compliance in China . Therefore , Dollar funds are flocking to Web3 Time of day , A lot of tradition VC Still skeptical .

however , Investors have a consensus that , about Web3 Learning and attention , Can't fall .

The new consumer 、TMT: Bring down a fever 、 Shift to new consumption : From overheating to cooling

“ If we say that the new consumption investment in the second half of last year was a cooling down of the market , The situation in the first half of this year is full of sadness ”, Chenminghui, a consumer investor, describes it this way . According to his observation , since this year on , Many funds directly cut down the consumption group , There are many investors and friends who watch consumption , Or you can change your job and look in other directions , Or lose your job .

from 2018 In, he began to pay attention to the consumption field , Chenminghui can be said to have witnessed the whole cycle of new consumption from going up the wind to returning to rationality .

2019 The horn of new consumption sounded in the year , Perfect diary 、 Energetic Forest 、 New brands such as three and a half tons rely on Internet traffic , Soaring sales , The capital rushed into mass action , Rush for new consumption .

To 2021 In the first half of , The investment and financing of new consumption has made great progress , It has become the hottest track for investment and financing in the whole industry . The data show that ,2021 In the first half of, the number of consumer investment and financing reached 333 rise , The total amount of financing exceeds 500 One hundred million yuan , Than 2020 The total amount of financing for the whole year is even higher .

But since the second half of last year 7、8 Month begins , The number and scale of financing in the primary market began to decline significantly .2022 The year was even colder , According to incomplete statistics of blue shark consumption ,2022 year 4 month , A total of... Have been announced in the new consumption field 71 Investment and financing events , comparison 3 Of the month 98 rise , Reduction in chain ratio 27.6%; Compared with six months ago (2021 year 11 month ) Of 128 At first it was cut 44.5%.

Behind the cooling of the primary market , It is the stock price of new consumer brands that plummeted in the secondary market 、 Market capitalization . Since listing , The share price of Naixue's tea once plummeted by more than 75%, By 6 month 21 Japan , The share price of bubble mart is still lower than the issue price , Compared with the highest share price, MARUMI's market value evaporated more than 200 One hundred million yuan .

The secondary market does not pay , The operation of new consumer enterprises has also encountered difficulties . Since the beginning of the year , New areas of consumption , layoffs 、 Put up the shutters 、 The declining trend of continuous losses is getting worse .

“ Investors find , After the project growth fails to match the expectation , The valuation foam began to burst ”, Chenminghui pointed out . actually ,2021 Since the second half of , Practitioners gradually understand , New consumer brands have fallen into the dilemma of playing failure , Achieved explosive growth with Internet traffic , When the flow bonus ebbs , Brands that lack the motivation for sustainable growth will fall into a growth dilemma .

Now chenminghui's organization , Still looking at consumption , But more restrained and rational .“ The project we recently invested in , Both are minor innovations under the relatively mature market demand , Probably not very ‘ sexy ’, But it is relatively stable and visible growth and income ”, He said ,“ The basic price of China's consumer market is still , Every year, there will still be 35 segments of the head of the circuit , All we have to do is grab these heads ”.

TMT: High growth is no longer , Investors change careers

Insiders talk about the rise of new consumption outlets , It's always necessary 2019 That year TMT Investors' turn .

TMT By technology 、 The three English letters of media and communication are integrated , But in the last decade , The popularity of mobile Internet , Also let TMT The word "Internet" has become synonymous with the direction of the Internet .

However ,TMT But now it encounters periodic challenges .2019 in , The dollar fund has abundant funds , We are looking for the next air outlet . Mobile Internet Era , The market Matthew effect is obvious , The valuation of a leading company can rise 100 times a year .

but 2019 Since then , Investors find , There are few such opportunities in the market , byte 、 A lot of spelling 、 It is difficult to duplicate cases like meituan .2019 year , Li Kaifu, the founder of innovation factory, once pointed out , The dividend of mobile Internet is gradually disappearing , Investors should seize the next growth point driven by technology .

Since the third quarter of last year , The amount of investment and financing in China's Internet sector is declining ,2022 The decline was particularly evident during the first quarter of the year . According to the relevant reports of the Institute ,2022 First quarter of 2009 , The amount of Internet investment and financing in China 35.1 Billion dollars , Reduction in chain ratio 42.6%, fell 76.7%.

TMT Investment in the field has declined , It is closely related to the situation of the Internet companies . An investment banker said , Since last year 7 Since the month , Investment Banks' TMT The business presses the pause button , Into the cold winter . Once the high-speed development of the market led to monopoly 、 Excessive competition and other behaviors emerge in endlessly , In the past year , Regulatory authorities are also anti-monopoly 、 Oppose the disorderly expansion of capital and make great efforts to rectify . Closing of the listing channel , It also leads to more TMT Investors adjust their direction .

before , Some investors are switching to new consumption , But in the second half of last year , The investment logic in the Internet field is cold after the new consumption field , They are trying to turn to hard technology again . However , The threshold for hard technology investment is high , Investors with industrial background have more advantages , Many lack industrial background TMT investors , Then the yuan universe 、Web3 Looking for opportunities for new exports .

But all in all , In the field of investment , The myth of creating wealth in the mobile Internet era has disappeared .

“ Just stand on the tuyere , Pigs can fly ”, stay 21 In the golden age of Internet development in the first 20 years of the 20th century , Capital has created one outlet after another . Get into 2022 year , The Internet industry has entered a downward turning point , Coupled with the instability of the economic environment , Whether it's investors or entrepreneurs , Need to be more cautious .

* Respondent's request , In this article, Zhang Hong 、 Chenminghui is a pseudonym .

边栏推荐

- Successful cases | an Chaoyun helped the second hospital of Lanzhou University build a new IT infrastructure platform to improve the utilization of medical information resources

- Security risks exist in open source code: an average of 49 vulnerabilities exist in a project

- Kruskal reconstruction tree

- CF736 D2

- 俞敏洪称未来可能开电商学院;马斯克儿子申请断绝父子关系;饿了么回应大量用户收到免单信息;B站上线付费视频...

- 2022过半,没有新风口

- Application of divide and conquer in massive data processing

- 牛客挑战赛54E题解

- How many of the eight classic MySQL errors did you encounter?

- 成功案例 | 安超云助力兰州大学第二医院搭建新型IT基础设施平台 提升医疗信息资源利用率

猜你喜欢

俞敏洪称未来可能开电商学院;马斯克儿子申请断绝父子关系;饿了么回应大量用户收到免单信息;B站上线付费视频...

Install pyGame

Getting to know elastricearch

关于缓存异常:缓存雪崩、击穿、穿透的解决方案

SPI 与 API的区别

Typical life cycle model of information system project

Security risks exist in open source code: an average of 49 vulnerabilities exist in a project

【软工】 软件体系结构

2022过半,没有新风口

在C#开发中使用第三方组件LambdaParser、DynamicExpresso、Z.Expressions,实现动态解析/求值字符串表达式

随机推荐

[Software Engineering] Introduction & process and life cycle modeling

IO之Reader案例

Promise upgraded async, await is coming, which is more fragrant with try+catch

MATLAB中cellstr函数的使用

[安洵杯 2019]iamthinking

How many of the eight classic MySQL errors did you encounter?

迪利克雷前缀和学习笔记

Pychart debugging is stuck and connected appears

Arc128 C convex hull optimized suffix and?

如果你是个半路出家的程序员,请一字一句的看完

IO之Buffered流案例

牛客挑战赛53E题解 & 带花树学习笔记

Interpretation of basic requirements for classified protection of network security (GBT 22239-2019)

From prototype chain to inheritance, illustrate the context and recommend collection

二叉树的前序、中序、后序遍历的两种实现

CF751D Difficult Mountain

Bytearraystream case of IO

Vector data of Zunyi city's benchmark land price in 2022 (WGS84)

SAP Marketing Cloud 功能概述(二)

puzzle(019)平面正推问题

Anonymous users

Anonymous users