当前位置:网站首页>The Federal Reserve raised interest rates again, Powell "let go of doves" at 75 basis points, and US stocks reveled

The Federal Reserve raised interest rates again, Powell "let go of doves" at 75 basis points, and US stocks reveled

2022-07-29 03:10:00 【Fire elephant Trading】

7 month 28 Early morning 2 when , The Federal Reserve issued the latest interest rate decision , Raise the benchmark interest rate 75 BPS to 2.25% to 2.50% Section , thus ,6-7 The monthly cumulative interest rate increase reached 150 BPS , The range is 1980 Paul in the early S - Volcker is the biggest since he took charge of the Federal Reserve . At the press conference, Federal Reserve Chairman Powell talked about the possibility of slowing down the pace of interest rate hikes , Interpreted by the market as a dove signal . Then U.S. stocks rose sharply , The dollar fell in the short term . The Federal Reserve has increased interest rates by leaps and bounds , It means the end of the monetary easing cycle after the epidemic .

How about the market performance and the trend of interest rate hike in the future ?

After the Federal Reserve announced its decision to raise interest rates , There has been no major fluctuation in the financial market . But after Powell's press conference , US stocks soared , S & P closed higher than... For the first time in seven weeks 4000 spot , NASDAQ Index 100 rose 4% gen 20 Best month , The dollar fell to a session low , Two year Treasury yields fell below 3%. From the specific data , As of the close , Dow up 436.05 spot , Increase is 1.37%, newspaper 32197.59 spot ; Index inflation 469.85 spot , Increase is 4.06%, newspaper 12032.42 spot ; The s&p 500 rose 102.56 spot , Increase is 2.62%, newspaper 4023.61 spot .

source :Wind

source :Wind

source : The Internet

According to the relationship between the reverse movement of interest rates and stock price changes , US stocks “ abnormal ” There may be two reasons behind the sharp rise , One is Powell's release of dove signals , Or ease the market's worries ; The other is that the market interprets it as a signal of all bad things , Market investment sentiment is gradually restored . however , It is worth noting that , US stocks in 5 month 、6 There has been a sharp rise in interest rates during the month 、 The drama of the next day's sharp fall . Local time 5 month 4 Japan , The Fed raised interest rates as scheduled 50 BPS , The Dow rose more than 900 spot , But on the next day, it was rare that it fell by more than a thousand points . Local time 6 month 15 Japan , The Fed raised interest rates as scheduled 75 BPS , U.S. stocks rose across the board that day , But the next day, the NASDAQ plunged more than 4%. Whether a similar situation will appear this time remains to be further observed .

For the Fed, which has attracted much attention from investors 9 The trend of interest rate hike in August , Powell said whether to implement the unconventional interest rate hike again depends on the economic data , If necessary, we will not hesitate to take greater action . As interest rates become more restrictive , It may be appropriate to slow down the pace of interest rate hike at some time . But the Federal Reserve has also learned from the lessons of previous forward-looking guidelines that have repeatedly failed , Not right 9 The monthly interest rate hike gives clear guidance . If next 7 The month and 8 The monthly inflation data showed a downward trend , be 9 The interest rate hike may slow down to 50bps, And if it reaches a new high or there is no obvious decline , It does not rule out the Fed continuing 75bps Interest rate hike ,9 month 13 Released by the day 8 month CPI The data may have important reference significance .

What impact does the Fed's unconventional and continuous interest rate hike have on China's economy ?

In terms of overall impact , if , The United States continues to tighten rapidly , For a period of time, the dollar is in a strong position , There is a pressure on the RMB , But if the United States can better control inflation , The inflationary pressure on China's imports will be less , It will reduce imported inflation . Because the demand of American goods market and energy market is not so strong , There will be no inflationary pressure on China . But it will have an impact on China's export demand , Looking back from now on , China will definitely increase domestic demand development , If the US economy slows down , It's bad for us .

Monetary policy , With Japan 、 Compared with EU countries , China is less dependent on energy imports , The impact of imported inflation is relatively low , Consumer prices are more stable , China's monetary policy operation pays more attention to the internal needs of economic development . Allocating RMB assets is conducive to dispersing risks . at present , Except Japan , The world's major central banks followed the Federal Reserve to tighten monetary policy , And China's monetary policy remains stable , There is still room , Marginal improvement of economic expectation , It will support RMB assets .

On the stock market , The Federal Reserve has entered a tightening cycle , For most risky assets , The valuation level may all decline . But yes A Shares are different , At the current time , The epidemic situation in China has been controlled in stages , The economy of major cities is recovering , At the same time, it should cooperate with the strong economic stabilization policy ,A Stocks will have strong support . When the valuation of global risky assets declines ,A The valuation of shares may remain stable , But the possibility of a substantial increase is not high .

Sum up , At the end of the day , The Fed's interest rate hike will have a negative impact on China's capital flows 、 Monetary policy 、 The exchange rate may cause a certain impact , But overall , The impact is relatively small , Our monetary policy is stable and unique , It has been proved that it can withstand the test and risk impact .

边栏推荐

- Shell编程规范与变量

- mycat读写分离配置

- Analysis of concepts and terms in data warehouse

- 第09章_性能分析工具的使用

- The basic concept of the origin and connotation of maker Education

- Let's talk about the summary of single merchant function modules

- [freeswitch development practice] media bug obtains call voice flow

- C陷阱与缺陷 第3章 语义“陷阱” 3.7 求值顺序

- Flask的创建的流程day05-06之创建项目

- 融云实时社区解决方案

猜你喜欢

Interpreting AI robots' pet raising and leading fashion trends

12_ UE4 advanced_ Change a more beautiful character model

力扣刷题之数组序号计算(每日一题7/28)

逐步分析类的拆分之案例——五彩斑斓的小球碰撞

sqlilabs less-32~less-33

融云 IM & RTC 能力上新盘点

Flask的创建的流程day05-06之创建项目

13_ UE4 advanced_ Montage animation realizes attack while walking

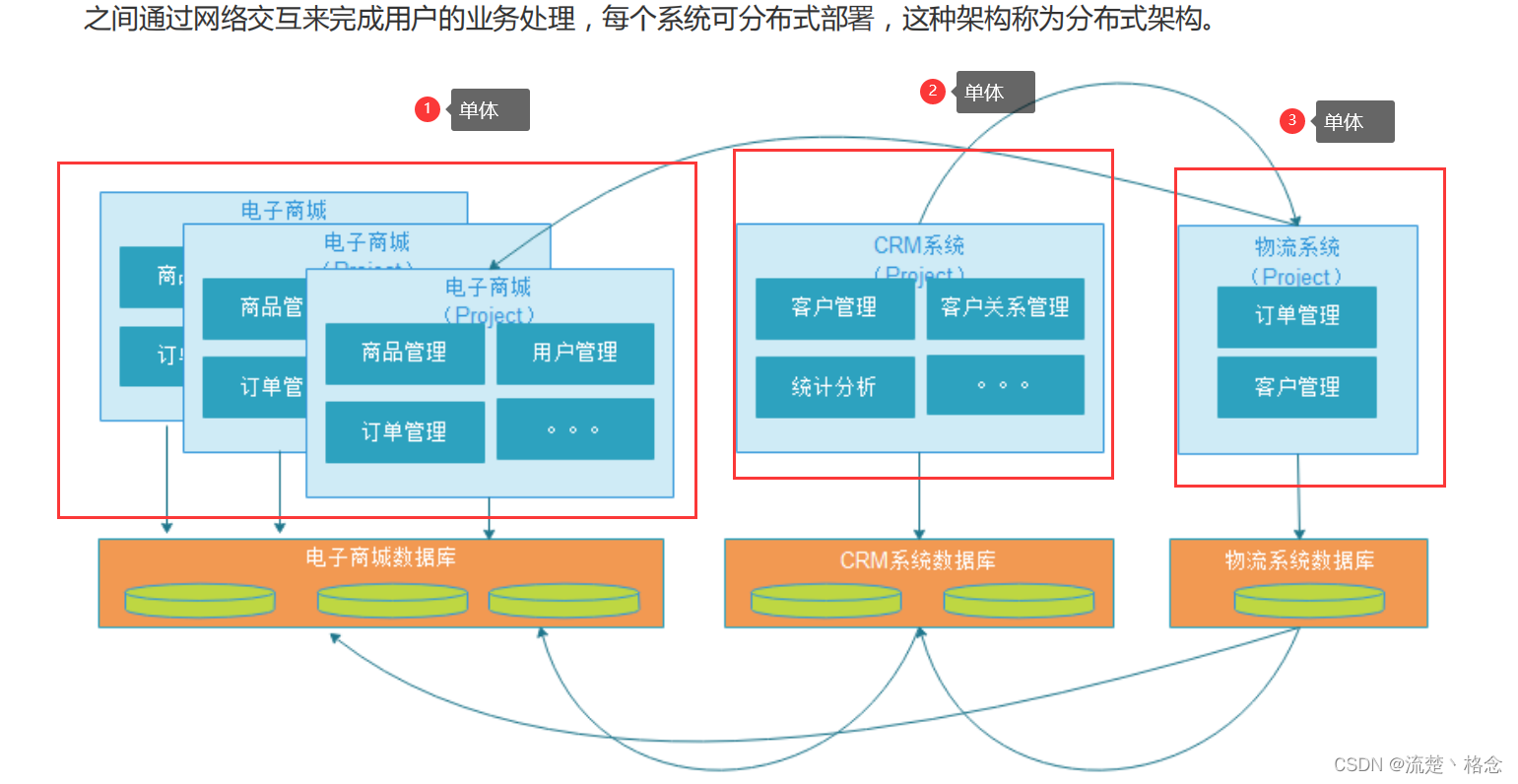

SOA(面向服务架构)是什么?

![[freeswitch development practice] media bug obtains call voice flow](/img/14/9a359403606c312b30733d4a015fa5.png)

[freeswitch development practice] media bug obtains call voice flow

随机推荐

Analysis of concepts and terms in data warehouse

Flask creation process day05-06 creation project

盘点国内外项目协同管理软件:SaaS和定制化成趋势

Weekly recommended short videos: how to make product development more effective?

Typescript learning (I)

接口自动化测试实践指导(上):接口自动化需要做哪些准备工作

MySQL operation database data error: fatal error encoded during command execution

04 | 后台登录:基于账号密码的登录方式(上)

力扣刷题之数组序号计算(每日一题7/28)

Typescript学习(一)

C陷阱与缺陷 第2章 语法“陷阱” 2.6 “悬挂”else引发的问题

C traps and defects Chapter 3 semantic "traps" 3.4 avoid "couple method"

MySQL compound query (important)

sqlilabs less-32~less-33

Alibaba Sentinel - 工作流程及原理解析

[NPM error] - NPM err code eresolve and NPM err eresolve could not resolve problems

Restfulapi - C - add header username and password authentication

SAP 中国本地化内容汇总

Interpreting AI robots' pet raising and leading fashion trends

centos安装mysql8