当前位置:网站首页>Real estate industry reshuffle

Real estate industry reshuffle

2022-07-25 19:10:00 【Yuan Guobao】

This article outlines :2021 The real estate industry has been advancing steadily before , Although the sudden epidemic hit the industry unprepared , starts 、 The progress of land acquisition has been seriously frustrated , But the most fundamental demand for housing is still , The willingness of home buyers still exists .

The real accident is 2021 In the second half of .2021 year 7 month , Send documents to regulate the real estate market , Second hand housing guide price 、 Restricted business loan 、 Home purchase restrictions 、 restricted 、 Heavy measures such as cracking down on real estate speculation have been significantly increased and upgraded , A massive three-year rectification action of the property market has been carried out nationwide .

2021 year 9 month , Head of the real estate enterprise under the banner of Evergrande “ Evergrande wealth ” The product is exploded and cannot be cashed , There are rumors of suspected thunderstorms , Just like the first domino that fell , Produced a series of negative chain reactions ,

After Evergrande , China has more than 100 billion 、 Trillion real estate enterprises have been thundering , Obviously, this is not the problem of poor management of individual real estate enterprises , But the whole industry is facing a huge crisis .

1、 Room for not stir , The purchase restriction policy reversed the upward trend

2、 Late delivery , Credit is lost in a vicious circle

3、 Create value , Real estate needs to regain liquidity

Room for not stir , The purchase restriction policy reversed the upward trend

Chinese real estate is finance from the very beginning —— Sell the land 、 Selling a house is financing , Buy land 、 Buying a house is an investment .

Although policy makers have been trying to solve the problem through the real estate market “ live ” The problem of , But financing and consumption are incompatible in nature . Whether it's “ purchase restriction order ” still “ Control house prices ”, Macro-control has limited control over the real estate market , High housing prices seem to have become an unquestionable fact .

2020 Beginning of the year , The epidemic has brought a wave of crisis to real estate developers , The sudden epidemic made the market press the pause button . But live selling 、 Short video planting grass 、VR Daikan and other online marketing are hot , Let the real estate industry see the spring under the epidemic .

Real estate developers who survived the impact of the epidemic never thought , The challenge is just beginning .

2021 Beginning of the year , Industry changes that are more disruptive than the epidemic have taken place . People's Bank of China 、 The bank insurance regulatory commission issued “ Real estate loan restriction order ”, According to the asset scale of banking financial institutions 、 The type of organization, etc , Set the concentration management requirements of real estate loans by grades .

“ Room for not stir ” For years , But this time the buyers found that the situation seemed different . The bank is unable to lend money , The housing loan approval cycle is constantly lengthened . Several cities have successively spread the news of tightening the loan quota , The loan period was extended to threeorfour months , Even some banks stop handling new houses 、 Second hand housing loan business .

In addition to the tightening of loan policy , The central coordinating measures also include “ Excessive volume and underpricing ”, By increasing the supply of land in the market , Suppress the rapid rise of house prices , To correct the land dependence of local governments , Let the local government take the responsibility “ live ” Responsibility for .

House prices have come down , The real estate industry is beginning to show crisis . High leverage real estate enterprises that used to rely on financing to maintain normal capital turnover , Cash flow crisis due to financing constraints ; Consumers who rely on bank loans to buy and speculate in real estate , As the lending cycle lengthens, the willingness to buy decreases , It also has a huge impact on the sales of real estate enterprises .

In addition, the epidemic situation repeatedly interferes with the normal marketing rhythm , The three red lines and other policy factors squeeze the living space of real estate enterprises , Some real estate enterprises have exploded , Most real estate enterprises are deeply involved in the vortex of risk clearing , The real estate market has broken the continuous rise of house prices 、 The myth of rapid expansion , Really meet the challenge .

Such a challenge , In the final analysis, it is the result of trade-offs in real estate policy design —— If we want to achieve “ live ”, You have to sacrifice “ Fried ”. If sacrifice “ Fried ”, Economic growth will result in insufficient capital , If it is light, the economy will decline , The most important thing is to fall into crisis .

But the government's policy does not deviate from the market , With the aging of society , The urbanization rate peaked , The supply of residential land shows a decreasing trend . Governmental “ Room for not stir ” The policy has been shouted for many years , until 2021 It took years to achieve real results , It shows that the market reaction is in line with expectations , Deep ploughing and focus are replacing the bold , It has become the direction that the real estate industry has to upgrade .

Late delivery , Credit is lost in a vicious circle

The new policy for real estate enterprises , The blow is profound .

By 2022 year 5 month , Only a dozen listed real estate enterprises have publicly disclosed their annual performance targets , The number is higher than that in previous years 40 The level around home has dropped sharply . Among the real estate enterprises that publicly disclose their annual performance objectives , The sales targets of most enterprises have fallen back to varying degrees .

Real estate enterprises are facing an unprecedented crisis , Bankruptcy 、 Explosion ray 、 layoffs 、 Safeguarding rights and unfinished business have become hot words in the real estate industry . People's court announcement network shows ,2021 The number of bankruptcies of real estate enterprises in was as high as 396 home , Average daily over 1 home .

Evergrande's thunder , It is the epitome of real estate enterprises under the changing situation .2020 year , Evergrande's sales amount to 7035 One hundred million yuan , But the debt scale is as high as 1.97 One trillion .

Real estate enterprises represented by Evergrande , In the process of expansion, rely on rapid growth of business scale , Take the land 、 Covered building 、 sales 、 The collection is completed within a few months at ultra-high speed , And large-scale borrowing at home and abroad 、 High liabilities of on balance sheet and off balance sheet debt .

In a stable macro and market environment , Such a development model seems to have no problem : Upstream and downstream enterprises have orders , Real estate enterprises have made profits , Both real estate speculators and home buyers gain income through the continuous growth of house prices .

But when the policy changes , When the capital chain breaks , The past profit model has become the sword of Damocles hanging on the head of Evergrande .

“ business with no cost ” It condenses too many contradictions , Obtain funds through pre-sale of houses 、 Keep getting the ground 、 The mode of continuing financing , Make accounts payable 、 Acceptance bill commercial bill 、 Houses that have been pre sold but not delivered 、 The land that has been obtained but has not been paid has become straw that kills camels . Capital is difficult to flow , Debt is difficult to pay , Evergrande was crushed by high leverage .

In order to occupy funds , Real estate developers have tried their best : They artificially lengthen the construction period , Slow down the payment of project funds ; They delayed the delivery , Let consumers suffer from uncompleted residential flats bought with heavy money .

And when the policy changes , The past “ wits ” Have become a drag on the development of enterprises , Real estate enterprises have been financing , Even financing at high cost , While making the enterprise bigger and bigger , Make the debt pile bigger and bigger . Such development is an expansion of the pie 、 It is an expansion at the cost of consuming consumer confidence and trust , It is also a development model that will be abandoned by the market .

On this level , Evergrande's thunder explosion is a policy response , It is also used in the market “ Invisible hand ” The result of deployment .

When there are problems in the industry development mode , When a simple demographic dividend cannot create rich profits , Capital is doomed to lose information 、 Gradually withdraw from the property market , Real estate enterprises have lost their original financing chain , Bear the huge pressure of capital turnover alone .

Create value , Real estate needs to regain liquidity

Although the state curbs the overheated development of the real estate industry , But when real estate is under heavy pressure alone , The state still needs to rescue the market .

One side , Local governments have frequently revised the previous too strict pre-sale fund supervision policy , The content involves accelerating the efficiency of approval 、 The proportion of deregulated capital supervision 、 Equivalent replacement of bank guarantee .

Such as 2022 year 3 month 1 Japan , Zhengzhou issued a new deal for the property market 19 strip , The purchase and loan restrictions have been fully relaxed , Stir the whole real estate circle . Hangzhou 、 Chengdu 、 Changsha and many other popular cities also quickly followed up , Related measures include reducing mortgage interest rates 、 Reduce the down payment ratio 、 Increase the amount of provident fund loans 、 Increase housing subsidies 、 Reduce taxes and fees on house purchase , a " have everything that one expects to find ".

On the other hand , Banks have also relaxed their credit policies . For the projects of real estate enterprises in danger , Many banks have also launched real estate M & a theme bonds , Encourage high-quality real estate enterprises to carry out M & a loan financing .

Such as 2021 year 12 month 5 Japan , The cbcirc guides financial institutions to focus on meeting the requirements of the first set of housing 、 Improved housing mortgage demand , Reasonably issue real estate development loans and M & A loans , M & A loans were first mentioned .

But the market has obviously not come out of the pain , Repeated outbreaks 、 Uncontrollable factors such as economic downturn , As a result, property buyers generally adhere to “ Safety first ” Conservative mentality , wait for 、 There was a strong wait-and-see atmosphere .

2022 year 4 month ,70 The price of new houses in large and medium-sized cities ushered 6 For the first time in years , The sales price of commercial housing decreased and the number of cities increased , The sales price of commercial housing in the first, second and third tier cities showed an overall downward trend month on month 、 It continued to decline year-on-year .

Just like this, I have been shouting for many years “ Room for not stir ” It doesn't work , It is still difficult for the government to turn things around in a short time .

But fortunately, , With the help of the government 、 Experienced this blow , Real estate enterprises are breaking the original development model , Explore a new way of self-help .

First , Is to break the original ” Real estate “ Pattern , Improve delivery . Such as 2021 year 3 month , The first batch of commercial houses of power construction real estate Foshan Mingyue Peninsula project were successfully delivered , The rate of visiting and repossession is as high as 99.46%;2022 year 1 In June, Chongqing Longyue Huafu project was delivered in three batches ,100% Smooth delivery .

secondly , Is to break the original “ High debt ” level . For example, China Austria real estate insists on scale 、 Profit margin and debt ratio “ Triangle balance “ Business model , Rely on its own funds to develop , Do not rely on trust blood transfusion , Liquidity risk is extremely low .

Last , Is to break the original “ Extensive ” Development model . Some real estate enterprises have made intensive efforts in the region , The foundation of winning customers and market with high-quality products , Use quality as the guarantee for exploring new development models .

The pain of the industry continues , But the real estate enterprises did not sit idly by , Instead, we found a feasible high-quality development model from adversity .

Maybe in the future , House prices are stabilizing ,“ premium ” Squeeze out slowly , The era of soaring house prices in the past is difficult to reproduce , But the real estate enterprises that have gone through the waves , It will appear in front of consumers with a new attitude .

边栏推荐

- 软件测试流程(思维导图)

- MySQL sub query (selected 20 sub query exercises)

- Summer Challenge [FFH] this midsummer, a "cool" code rain!

- Intouch高级报警(报警筛选)

- [cloud native kubernetes] management of secret storage objects under kubernetes cluster

- Youwei low code: use resolutions

- srec_cat 常用参数的使用

- Have you ever seen this kind of dynamic programming -- the stock problem of state machine dynamic programming (Part 1)

- Go code checking tool

- i3-status 配置

猜你喜欢

Pymoo learning (5): convergence analysis

小程序毕设作品之微信校园维修报修小程序毕业设计成品(8)毕业设计论文模板

SQL Server 2019 installation tutorial

Pixel2mesh generates 3D meshes from a single RGB image eccv2018

Care for front-line epidemic prevention workers, Haocheng JIAYE and Gaomidian sub district office jointly build the great wall of public welfare

果链“围城”:傍上苹果,是一场甜蜜与苦楚交错的旅途

Analysis of the internet jam in IM development? Network disconnection?

【Web技术】1391- 页面可视化搭建工具前生今世

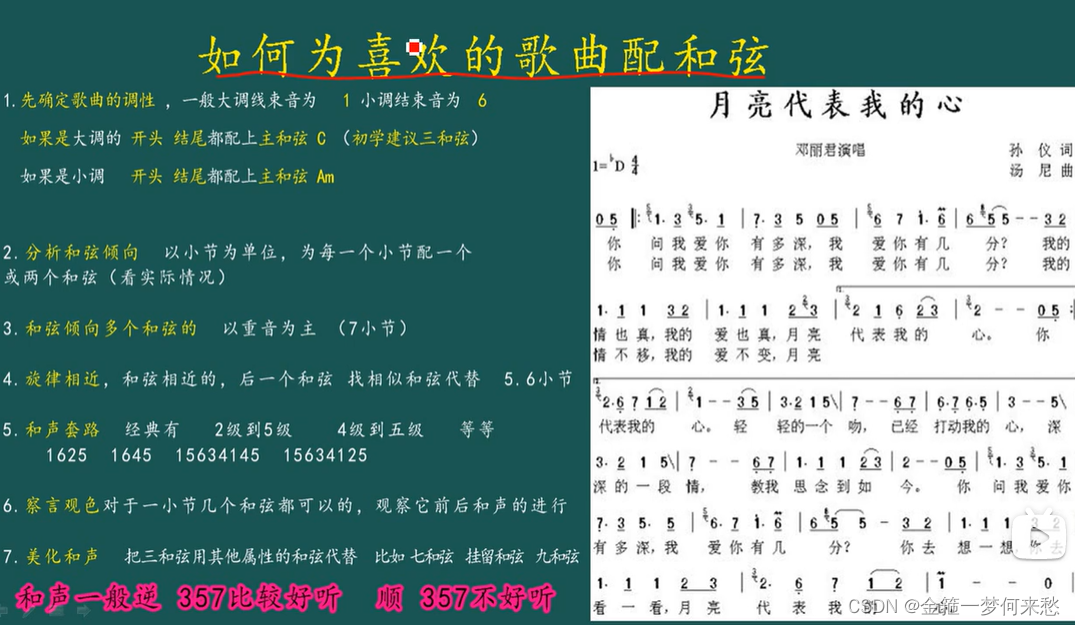

Basic music theory -- configuring chords

![[help center] provide your customers with the core options of self-service](/img/66/5a927e3bdcc165b78d4a9dee324871.png)

[help center] provide your customers with the core options of self-service

随机推荐

21 days proficient in typescript-4 - type inference and semantic check

软件测试流程(思维导图)

jmeter性能测试实战视频(常用性能测试工具有哪些)

无惧高温暴雨,有孚网络如何保您无忧?

接口自动化测试平台FasterRunner系列(二)- 功能模块

Baklib: make excellent product instruction manual

In the first half of the year, the shipment volume has exceeded that of the whole year of last year, and centritec millimeter wave radar has "captured" the international giant

How to change the chords after the tune of the song is changed

The bank's wealth management subsidiary accumulates power to distribute a shares; The rectification of cash management financial products was accelerated

阿里云免费SSL证书申请详细流程

这种动态规划你见过吗——状态机动态规划之股票问题(上)

Software testing (mind mapping)

telnet安装以及telnet(密码正确)无法登录!

Baklib:制作优秀的产品说明手册

小程序毕设作品之微信校园维修报修小程序毕业设计成品(5)任务书

[iniparser] simple use of the project configuration tool iniparser

有孚网络受邀参加2022全国CIO大会并荣获“CIO信赖品牌”称号

iMeta | Sangerbox: 交互式整合临床生信分析平台

【云原生之kubernetes】kubernetes集群下Secret存储对象的管理

Single arm routing experiment demonstration (Huawei router device configuration)