当前位置:网站首页>Noah fortune plans to land on the Hong Kong Stock Exchange: the performance fell sharply in the first quarter, and once stepped on the thunder "Chengxing case"

Noah fortune plans to land on the Hong Kong Stock Exchange: the performance fell sharply in the first quarter, and once stepped on the thunder "Chengxing case"

2022-06-22 17:28:00 【Bedouin Finance】

6 month 22 Japan , Noah fortune, a company listed on the New York Stock Exchange (NYSE:NOAH, abbreviation “ Noah ”) With “ Noah holdings private wealth Asset Management Co., Ltd ” Submitted the post hearing data set for the subject at the HKEx ( Prospectus ). It means , Noah fortune will be listed on the Hong Kong stock exchange for the second time .

Not long ago , Noah wealth announced 2022 The results of the first quarter of , The company 2022 First quarter revenue 7.96 One hundred million yuan , a 2021 In the same period of 12.25 Decrease of RMB 100 million 35.0%; The net profit attributable to ordinary shareholders is 3.05 One hundred million yuan , a 2021 In the same period of 4.54 Billion decline 32.8%.

By 2022 year 3 month 31 Japan , The total number of registered customers of Noah wealth is 415082, Year-on-year growth 8.1%.2022 First quarter , Noah wealth's active customers ( Excluding mutual fund only clients ) The total number is 2818 people , Year-on-year decline in 55.3%; The number of clients including mutual fund transactions only is 14970 people , Year-on-year decline in 46.2%.

2022 First quarter , The total value of investment products issued by Noah wealth is 150 One hundred million yuan , Year-on-year decline in 44.6%. Regarding this , Noah fortune said , Mainly due to private secondary products 、 Private equity products and mutual fund products declined respectively 68.7%、33.2% and 17.8%.

Noah fortune quoted frost Sullivan in the prospectus as saying , Press 2021 According to the total annual income , The company is the eighth largest wealth management service provider in China , It is also the largest independent wealth management service provider in China , Focus on providing services to high net worth and ultra-high net worth investors .

Noah fortune said , adopt 1300 A global network of financial planners , The company is 2021 Annual direction 42,764 Customers distributed RMB 972 One hundred million yuan (153 Billion dollars ) Investment products , The number of customers is 2020 Year of 34,213 It's growing 25.0%, By 2021 year 12 month 31 Japan , The asset management scale reaches RMB 1560 One hundred million yuan (245 Billion dollars ).

According to the prospectus ,2019 year 、2020 Years and 2021 year , Noah wealth's total income is expressed in 12.6% The compound annual growth rate of . According to introducing , In mainland China 84 Cities and Hong Kong 、 Taiwan 、 New York 、 Silicon Valley and Singapore , among 2021 In, domestic and overseas businesses accounted for% of the total revenue respectively 76.6% And 23.4%.

The prospectus shows ,2019 year 、2020 Years and 2021 year , The total income of Noah wealth is 34.13 One hundred million yuan 、33.25 Million dollars 43.27 One hundred million yuan , The net income is respectively 33.92 One hundred million yuan 、33.06 Million dollars 42.93 One hundred million yuan ; Net profit 8.64 One hundred million yuan 、-7.44 Million dollars 13.06 One hundred million yuan , The net profits attributable to shareholders are 8.29 One hundred million yuan 、-7.45 Million dollars 13.14 One hundred million yuan .

In the track record period , Noah wealth's total income is from 2019 Year of 34.13 Billion yuan less 2.6% to 2020 Year of 33.25 One hundred million yuan , Noah wealth explained , Mainly due to COVID-19 The negative impact of the epidemic , But its total revenue has increased further 30.1% to 2021 Year of 43.27 One hundred million yuan .

Noah wealth said in the prospectus , Its net profit ( Loss ) The fluctuation was mainly attributed to the settlement expenses related to the Chengxing event in RMB 18.29 Billion yuan 2020 Other expenses incurred in the year . For other businesses , In its 2020 Annual operating losses 1880 Ten thousand yuan , and 2019 In, the company recorded operating income 8590 Ten thousand yuan .

On 2021 year , The operating loss of other businesses of Noah wealth further increased to 2.08 One hundred million yuan (3260 Thousands of dollars ), Mainly due to the increase in the provision for credit losses 8910 Ten thousand yuan (1400 Thousands of dollars ), Increase in sales and general and administrative expenses ; Other operating expenses increased , In its 2021 The purchase of the new headquarters property in resulted in an increase in depreciation expenses 5380 Ten thousand yuan .

By revenue segment , Noah wealth's income mainly includes three sectors , They are wealth management businesses 、 Asset management business and other businesses . During the reporting period , Its income from wealth management business is 23.30 One hundred million yuan 、23.80 Million dollars 32.12 One hundred million yuan , Maintain an overall growth trend .

At the same time , The income from Noah wealth's asset management business is 7.88 One hundred million yuan 、8.80 Million dollars 10.46 One hundred million yuan , Also maintain the growth trend . by comparison , Other business income is respectively 2.96 One hundred million yuan 、6520 Million and $ 6820 Ten thousand yuan (1070 Thousands of dollars ), Obvious decline .

Noah wealth explained , Mainly because the company strategically shifted its business focus to core wealth management and asset management business . During the reporting period , The operating profit income rates of wealth management business of Noah wealth are 18.9%、34.5% and 28.8%, The asset management businesses are 49.9%、52.5% and 52.5%, Other businesses are 29.7%、-29.4% and -366.3%.

Public information display , Noah's wealth lies in 2010 year 11 month 10 Japan is listed on the New York Stock Exchange , So far 11 Over the year .2019 year , Noah wealth once stepped on thunder “ Chengxing case ”, And in 2020 year 8 In June, it announced a settlement agreement with Chengxing investors , The amount of the related one-time settlement fee is 18.29 One hundred million yuan .

thereafter , The Chengxing case once fell into “ Luoshengmen ”. Final , Noah wealth cashed the losses related to the case . It is so , Noah's wealth is 2020 Large losses occurred throughout the year , among 2020 The fourth quarter of 2014 recorded a net loss of nearly 16 One hundred million yuan .

According to the official ( The second branch of Shanghai Municipal People's Procuratorate ) notification , The prosecutor's office charged ,“2015 year 2 Month to 2019 year 6 month , The defendant Luo Jing 、 Luo Lan is running “ Chengxing ” In the process of the company , Use the business cooperation background with well-known companies , Personally or under the direction of Liang Zhibin, etc 8 Defendants , By privately engraving the seals of other companies 、 Forging purchase and sales contracts, etc , Fictitious accounts receivable , Sign contracts such as accounts receivable transfer and repurchase agreement with the victim unit , And pretend to be employees of other companies , Intercept and forge the confirmation document of accounts receivable creditor's rights , As of the crime , The total economic losses caused to the victim unit are 80 Over 100 million yuan .”

It was reported that ,2016 year 9 Month begins , stay “ Chengxing system ” In the process of the company defrauding the victim's financing fund , To expand the financing scale 、 Accelerate the progress of financing business , Approved by Luo Jing , Luo Lan has repeatedly offered bribes totaling HK $to the relevant staff of the business partner 300 More than ten thousand yuan .

About Noah's wealth stepping on thunder , Director of China Private Economy Research Association 、 Tanhaojun, the professional tutor of Huazhong University of science and technology, once commented that , Noah ( Wealth ) As a wealth management institution , The scale of its projects is huge , The content is complex , Wide range . In view of the more investment , The greater the risk , In this case , Stepping on thunder is inevitable .

Tanhaojun also said , Noah has many projects , Decided to need many corresponding project managers . The latter judges things 、 Operating items , And expectations 、 The ability to control risks , To a large extent determines itself , Even the level of Noah's wealth management . If not , It will bring a greater probability of stepping on thunder .

According to media reports , Noah wealth believes that , Since the establishment of Noah wealth , By 2020 And a half years in the annual report , Total assets allocated to customers 7313 One hundred million yuan , The total risk product scale is 53.25 One hundred million yuan , The proportion does not exceed 0.8%, said “ The disposal of risk assets requires ‘ Time for space ’. Please investors and media , Give calm attention .”

边栏推荐

- MySQL string field to floating point field

- .NET 发布和支持计划介绍

- client-go gin的简单整合十-Update

- Service or mapper cannot be injected into a multithread

- Problems and recovery of spark streaming checkpoint

- Gridhome, a must-have static site generator for beginners

- You call this crap high availability?

- 基于.NetCore开发博客项目 StarBlog - (12) Razor页面动态编译

- Review the executor from the perspective of application submission

- Stop automatically after MySQL server starts

猜你喜欢

可能是全网最全的Matplotlib可视化教程

面试突击58:truncate、delete和drop的6大区别!

WPF效果第一百九十篇之再耍ListBox

Qt Notes - qmap Custom key

【阿里云服务器-安装mysql的5.6版本安装,重装】

Partage de l'architecture du système de paiement du Groupe letv pour traiter 100 000 commandes simultanées élevées par seconde

![[face recognition] matlab simulation of face recognition based on googlenet deep learning network](/img/e8/050ca85542ccbf1402b84c5dbf6f5e.png)

[face recognition] matlab simulation of face recognition based on googlenet deep learning network

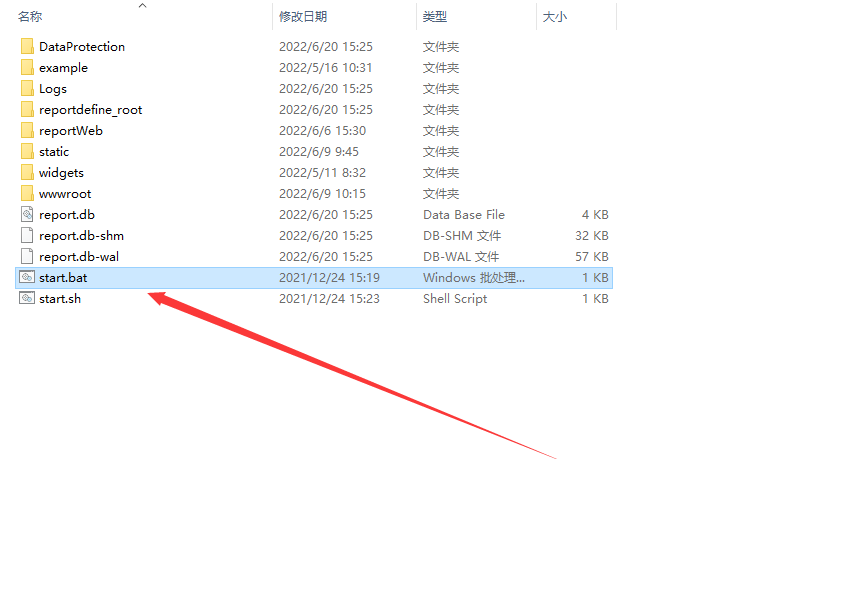

Tried several report tools, and finally found a report based on Net 6

. Net release and support plan introduction

【人脸识别】基于GoogleNet深度学习网络的人脸识别matlab仿真

随机推荐

The win10 desktop icon disappears and the toolbar turns black

How to understand volatile

hydra安装及使用

数据库mysql 主从方案

Ad20/altium Designer - oil for manhole cover

What is flush software? Is it safe to open a mobile account?

系统吞吐量、TPS(QPS)、用户并发量、性能测试概念和公式

Spark streaming receiver startup and data receiving

Source code analysis of spark cache

MYSQL_ ERRNO : 1205 MESSAGE :Lock wait timeout exceeded; try restarting transacti

Mybaits: common database operations (Neusoft operations)

MySQL master-slave connection prompt of docker: communications link failure

Blazor University (30) form - derived from inputbase

Social responsibility: GAC Honda advocates children's road traffic safety in "dream children's travel"

What is a flush? Is online account opening safe?

有同学问PHP要学什么框架?

Mybaits:接口代理方式实现Dao

网传学习通1.7亿密码泄露!有什么补救措施?

WPF 实现星空效果

MySQL stored procedure exception handling error code: 1337