当前位置:网站首页>Raytheon technology rushes to the Beijing stock exchange and plans to raise 540million yuan

Raytheon technology rushes to the Beijing stock exchange and plans to raise 540million yuan

2022-07-01 15:18:00 【I dark horse】

source : Straight through IPO(ID:zhitongIPO) author : Sheng Jiaying

In recent days, , New third board enterprise Raytheon Technology North Stock Exchange IPO Application accepted . The reserve price of this issue is 32 element / stocks , Without considering the over allotment option , The number of this issue does not exceed 1666.67 Thousands of stocks , And the shareholding ratio of public shareholders after the issuance shall not be less than 25%.

last year 4 month 29 Japan , Raytheon technology has launched listing counseling , However, the listing guidance is in 2021 year 12 month 7 Day termination . Then ,2021 year 12 month 9 Japan , Raytheon technology once again submitted the application materials for the company's initial public offering and listing on the Beijing stock exchange to Qingdao Securities Regulatory Bureau , The coaching institution was changed from Haitong Securities to Guotai Junan .

2022 year 6 month 24 Japan , Raytheon technology completed the listing guidance . according to the understanding of , Raytheon technology plans to raise funds 5.4 One hundred million yuan , For brand upgrading and headquarters operation center construction projects 、 Product development and design center construction and hardware product development and design projects .

Haier incubation , It is the actual controller of Raytheon Technology

Raytheon technology was founded in 2014 year , Haier Group “ Rendanheyi ” Star Maker Companies incubated under the investment mode ,2017 Listed on the new third board in . Our main products include notebook computers 、 Desktop computer 、 Peripherals and peripherals ( Monitor 、 keyboard 、 mouse 、 Headphones, etc ).

at present , Raytheon technology has been formed “ The thor ” and “ machinist ” Two major computer hardware brands and those mainly for business office and domestic information creation “ haier ” Brand system of computer hardware .

In terms of equity structure , The controlling shareholder of Raytheon technology is Suzhou Haixin . The latter is a wholly-owned subsidiary of Haier Group , At the same time, Haier Group also indirectly controls Haili ark holding company 2.22% The right to vote . in other words , Haier Group controls the company 38.01% The right to vote , For Raytheon technology to actually control people .

Among the top ten shareholders of the company , The controlling shareholder Suzhou Haixin 、 Qingdao Riri shunhuitong Investment Management Co., Ltd., a limited partner of Guangzhou Heying, a shareholder 、 Qingdao RI RI Shun Chuangzhi Investment Management Co., Ltd., the limited partner of Huizhi Xiangshun, the shareholder, and Qingdao RI RI Shun Huizhi Investment Co., Ltd., the executive partner 、 Haier Zhijia Co., Ltd., a limited partner of Haier Saifu, a shareholder, and Qingdao Haier Venture Capital Co., Ltd , Are enterprises controlled or held by Haier Group, the actual controller , Have a relationship .

2021 Annual revenue amounted to 26 Billion , Products rely on external procurement

During the reporting period , The company achieved revenue respectively 20.91 One hundred million yuan 、22.54 Million dollars 26.42 One hundred million yuan , The compound growth rate of revenue reached 12.42%; Net profit is 5676.18 Ten thousand yuan 、5936.09 Ten thousand yuan 、7604.81 Ten thousand yuan .

Judging from the composition of Raytheon's main business income , The company's main products are notebook computers 、 Desktop computer 、 Peripherals and peripherals . Among them, the proportion of notebook computers and desktop computers shows a downward trend , from 2019 Year of 78.85% Drop to 2021 Year of 73.57%, However, the proportion still reaches 70%, Revenue is still mainly dependent on laptops and desktops .

Although the proportion of peripherals and peripherals has increased year by year , But to 2021 The annual proportion is only 10.48%.

It is worth noting that , Although notebook computers and desktops are its main businesses , However, the production process is mainly completed by entrusting professional outsourcing manufacturers .

According to the prospectus ,2019 year 、2020 year , Raytheon technology products are produced by outsourcing . Until last year 8 month , Raytheon technology has just set up a subsidiary in Dongguan, Raytheon Technology , Engaged in the assembly and production of some desktop and notebook computer products with simple technology .

2021 year , Raytheon technology produces its own desktop and notebook computers 5 Ten thousand units , yield 3.82 Ten thousand units , Capacity utilization 76.48%, Production and marketing rate 84.61%. For all that , Raytheon technology still has strong external dependence .

During the reporting period , Raytheon technology's procurement scale is increasing year by year , The total purchase amount of main raw materials is 10.27 One hundred million yuan 、12.52 Million dollars 15.11 One hundred million yuan . The main purchased products are CPU、 The screen 、 Memory 、 Hard disk 、 Video memory and chipset , The total proportion reaches 97.6%、95.23% and 87.45%.

边栏推荐

- ArrayList 扩容详解,扩容原理[通俗易懂]

- 《QT+PCL第九章》点云重建系列2

- 网速、宽带、带宽、流量三者之间的关系是什么?

- 这3款在线PS工具,得试试

- Wechat applet 03 - text is displayed from left to right, and the block elements in the line are centered

- The solution to turn the newly created XML file into a common file in idea

- IDEA全局搜索快捷键(ctrl+shift+F)失效修复

- One of the first steps to redis

- Opencv Learning Notes 6 -- image mosaic

- TypeScript:const

猜你喜欢

《QT+PCL第六章》点云配准icp系列2

Markdown编辑器使用基本语法

定了!2022海南二级造价工程师考试时间确定!报名通道已开启!

智能运维实战:银行业务流程及单笔交易追踪

An intrusion detection model

Written on the first day after Doris graduated

Take you to API development by hand

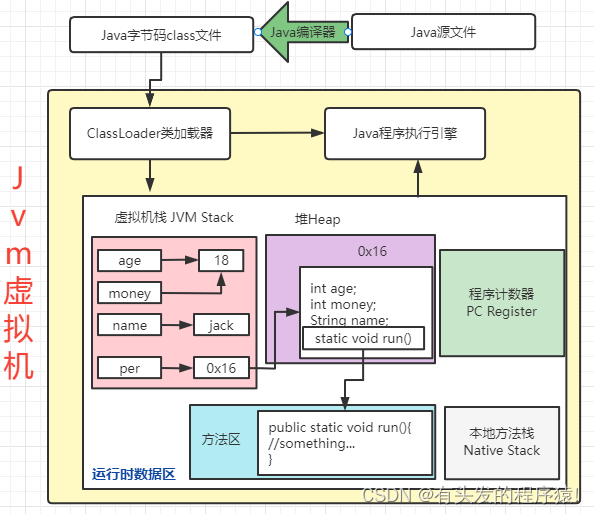

The first word of JVM -- detailed introduction to JVM and analysis of runtime data area

Basic operations of SQL database

微信公众号订阅消息 wx-open-subscribe 的实现及闭坑指南

随机推荐

Opencv learning notes 5 -- document scanning +ocr character recognition

【锁】Redis锁 处理并发 原子性

Day-02 database

《QT+PCL第六章》点云配准icp系列2

Apk signature principle

The solution to turn the newly created XML file into a common file in idea

Basic use process of cmake

Tableapi & SQL and MySQL insert data of Flink

Solid basic basic grammar and definition function

Basic operation of database

Flink 系例 之 TableAPI & SQL 与 Kafka 消息插入

Some thoughts on software testing

定了!2022海南二级造价工程师考试时间确定!报名通道已开启!

[Cloudera][ImpalaJDBCDriver](500164)Error initialized or created transport for authentication

采集数据工具推荐,以及采集数据列表详细图解流程

Solid smart contract development - easy to get started

JVM第一话 -- JVM入门详解以及运行时数据区分析

榨汁机UL982测试项目有哪些

Filter &(登录拦截)

Tableapi & SQL and Kafka message acquisition of Flink example

Anonymous users

Anonymous users