当前位置:网站首页>You should negotiate the handling fee before opening a futures account

You should negotiate the handling fee before opening a futures account

2022-07-27 05:44:00 【Zhang Youwei】

Do not open an account directly in a futures company , First talk to the agent about the handling fee before opening , Otherwise, the handling fee is very high , At present, the lowest handling fee is the exchange +1 branch , The minimum deposit is +0, However, novices do not recommend that the margin be adjusted to +0, Reducing margin is to expand leverage , Novices should focus on summing up experience at the beginning , When there is a mature trading strategy, it is not too late to adjust the margin of the exchange , An agent must find someone who is professionally responsible , Don't look for that kind of temporary rookie .

For example, is this opening for short-term or band in the day , Or medium and long term , After opening the position, set the stop loss and stop profit accordingly , Never place an order blindly , And don't take chances , For example, the short-term list within the day must not be overnight , Be sure to close your position before closing , Because there are too many uncertainties overnight , Especially the varieties with outer disc , The opening moment was completely uncontrollable ; For long-term orders, we need to understand the supply and demand of spot goods in recent times 、 Inventory and what may happen in the future , Then do the corresponding treatment , And strictly implement .

If it is a short-term day , If there is a clear stop loss position, the position can be higher , And the margin is also recommended to be transferred to the exchange +0, Make full use of the leverage advantage of futures , But if it is an overnight medium and long-term transaction , It is better to keep the position within 50% , About 30% is enough , Futures are long and short in two directions , The probability of the general direction accounts for 50%, Many people can see the general direction, but they just can't make money , The main reason is that the funds are not managed well , Washed out by the fluctuation in the middle , And the stop loss position in the medium and long term will be larger than that in the short term , If the position is heavy, a larger fluctuation of the principal may be halved , Or be forced flat , Even if the later trend is according to your plan, it has nothing to do with you , Therefore, fund management must be clear .

Futures mentality is better , Don't be surprised to see a little fluctuation , If there is no big heart to make money , No matter how good your skills are, you can't make a lot of money , Regardless of profit or loss, don't look at the account numbers , It depends on the trend of the market , If you want to have a good attitude , First of all, we must use our spare money , Even the loss of money does not affect life , Never borrow money or all your family savings , Even loans , If these funds are used to trade , How can you keep an ordinary mind to trade ?

Another major factor in a bad state of mind is the fear of the unknown , Always worry about this and that , Looking at the slightly big fluctuation of the market, my psychology keeps plopping , I feel that every time I make money, I am so lucky , The solution is very simple , That is to set the stop loss position , The big deal is to lose so much money , With this protective umbrella, the mentality will naturally be calmer , The second is how to hold the profit sheet , Psychology will always worry about whether it will retreat , In fact, it's OK to set a moving profit stop , After profits and losses are controllable , There is no fear of the unknown , The mentality is naturally good , And don't look at the middle process , Looking at the fluctuation of the market is the most influential factor , Just follow the plan , Set the stop loss and stop profit .

A final reminder , The way others make money is not necessarily suitable for you , So if you want to survive for a long time, you must have your own operation style , When you have your own trading system, you will feel that futures is very simple , Never trade by luck , Sooner or later, the money earned by luck will be lost by strength , Don't imagine that someone will bring you to make money , People who can really make money in this market disdain to guide you , The people who come to trade with you are all for your money , Self improvement is the king .

边栏推荐

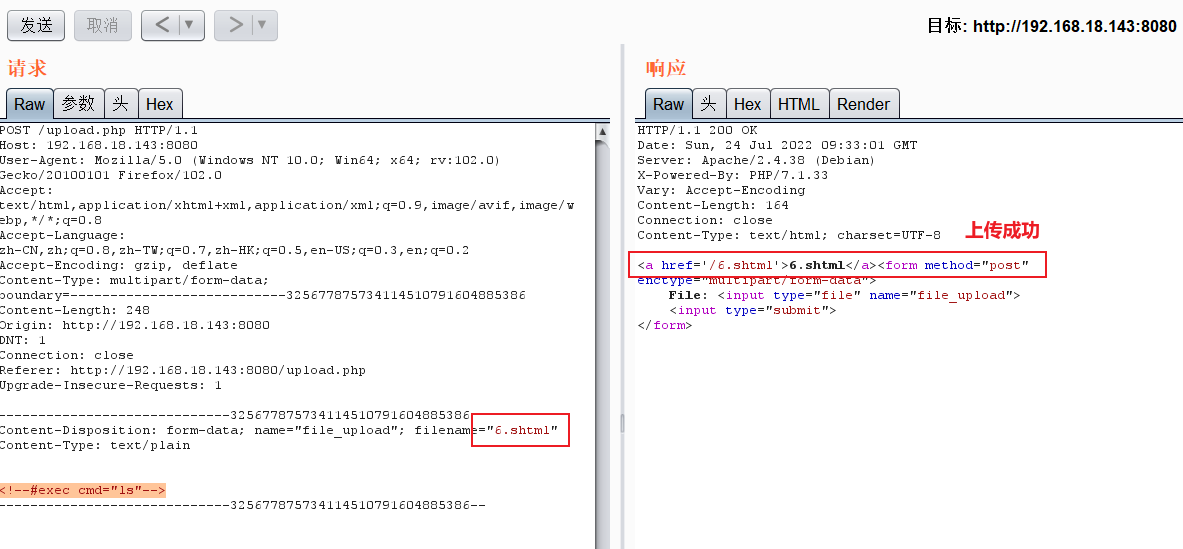

- [网鼎杯 2020 朱雀组]Nmap 1两种解法

- User management - paging

- 深度优先搜索(dfs)简介

- Edit delete user

- [NPUCTF2020]ReadlezPHP 1

- Project login and registration ideas

- Application of store Redux in project

- Dimitra 和 Ocean Protocol 解读农业数据背后的秘密

- MOVE PROTOCOL推出测试版,更可“0撸”参与P2E

- When opening futures accounts, you should discuss the policy in detail with the customer manager

猜你喜欢

随机推荐

Okaleido上线聚变Mining模式,OKA通证当下产出的唯一方式

Js== mandatory type conversion provisions of operators

beef-xss安装与使用

期货开户要和客户经理详谈政策

「PHP基础知识」布尔型的使用

Page configuration

二十五家互联网大厂软件测试笔试题总结,遇到包过。

What are the conditions and procedures for opening crude oil futures accounts?

存储过程试炼2--建立Test表测试不同类型的存储过程

信息学奥赛一本通1178题——成绩排序

How to use for..Of to traverse objects in JS

基于PG-Oracle和MySQL的三库通用sql代码开发

SeekTiger即将上线STI聚变Mining功能,获取OKA通证

graph-node部署

Personal collection code cannot be used for business collection

Package JWT

深度优先搜索(dfs)简介

MD5 password encryption

[CISCN2019 华东南赛区]Web11 1

Prototype and prototype chain in JS

![[BJDCTF2020]EasySearch 1](/img/ea/90ac6eab32c28e09bb1fab62b6b140.png)