当前位置:网站首页>[fxcg] inflation differences will still lead to the differentiation of monetary policies in various countries

[fxcg] inflation differences will still lead to the differentiation of monetary policies in various countries

2022-07-03 04:17:00 【FXCG_ exchange】

This year in the United States 1 Monthly inflation continued to soar to record 40 Year high , Among them, the non seasonally adjusted data is from 7% Further up to 7.5%, This is the 2021 year 6-8 Monthly inflation seems to be stable after another continuous 5 Months up .1 Monthly core inflation also increased from the previous value 5.5% Up to 6%, Maintain the trend of synchronizing with the data of non seasonal adjustment . thus , The market to the Fed 3 The range of the first interest rate hike in May or may reach 50 spot 、7 The cumulative interest rate increase before the month exceeded 100 The expectation of point is rising again , The monetary policy turn that the Federal Reserve cannot wait for is about to become a reality . By contrast , The monetary policy orientation of the central banks of other developed countries is not surprisingly related to the reality and Prospect of domestic inflation , The inflation performance of developed countries is roughly divided into three echelons, showing the situation of global differentiation , This will also lead to the prospect of further differentiation of global monetary policy in the future .

First tier : The era of rapid but prepared interest rate hikes by the Federal Reserve due to soaring inflation is approaching . The second tier : Firmly regulating inflation is the key for Britain and New Zealand to increase interest rates . With the Fed's rising interest rate expectations last year , The Bank of England and the Federal Reserve of New Zealand have taken the lead in raising interest rates , This is mainly because both Britain and New Zealand belong to the second tier of high inflation in developed countries . Third echelon : Economic entanglement and controllable inflation are wait-and-see policies dominated by the European Central Bank .

Australian inflation should belong to the third tier of developed countries , Its highest inflation level in the past year is 2021 In the second quarter of 3.8%, At present, it is 3.5%, Compared with the above-mentioned developed countries, this situation is low , Although its inflation may rise further in the future , The market has expectations for the RBA to raise interest rates , After all, the New Zealand dollar, which is also a commodity currency, has raised interest rates . However, the RBA has repeatedly suppressed market expectations for interest rate hikes , Lowe, chairman of the Australian Federal Reserve, said that wage growth was relatively slow , There are few sources of inflationary pressure , The economy may reach the target of raising interest rates in 2024 year .

Japan is still the worst inflation student in developed countries , The situation of perennial low inflation and even deflation is the end goal of the Bank of Japan, which has a long way to go , Although inflation in Japan has also increased slightly recently , But compared with any other developed countries, it is at a low level . therefore , The Bank of Japan is also deeply trapped in negative interest rates and super loose policy , There is almost no possibility of the end for a long time in the future , So it's normal for Japan to keep still .

From this we can see that , since 2020 The global outbreak that began in is the background that affects inflation in all countries , However, the monetary policies of the central banks to adjust or cooperate with other rescue measures from lenient to tight have been affected differently , It is a reality that each central bank will suffer its own consequences . The Fed will still dominate the market , But the Fed's own assessment of the economy is key , At present, the personality of the new cycle and new situation of the U.S. economy is outstanding , US stocks fell temporarily as the Federal Reserve raised interest rates , But the long-term bullish outlook will still be an economic barometer , But at present, when the U.S. economy is stable and improving, the time for the Federal Reserve to raise interest rates cannot be missed , In the future, the core demand of the Federal Reserve for the prospect of raising interest rates will shift to further control of global financial markets .

The European Central Bank will still struggle , After all, the differences among member states have been difficult to solve for many years , Everyone knows the dilemma of difficult unification of monetary and fiscal policies , It is difficult for the European Central Bank to adjust monetary policy . The outlook of the Bank of England deserves attention to risks , At present, the Bank of England has made a historic back-to-back interest rate hike , Further interest rate hikes are expected in the future , But in the post brexit era, the British economy needs to find a more stable development point , For the time being, it is difficult to effectively solve the problems of peripheral economic and trade relations and Fisheries , Therefore, whether raising interest rates too fast and too high will backfire on the economic momentum is the key .

therefore , It is expected to face the future under the uncertainty of the global epidemic , The financial market will still be in an abnormal period , Economic structure of countries 、 The differences in inflationary pressures will be more differentiated , Countries should first return to relatively normal economy and inflation , And currency issuance and monetary policy are the key points to control and regulate inflation , But in the future, countries will still be divided .

边栏推荐

- MongoDB 慢查询语句优化分析策略

- 【毕业季·进击的技术er】职场人的自白

- [pat (basic level) practice] - [simple simulation] 1063 calculate the spectral radius

- 毕设-基于SSM宠物领养中心

- Mutex and rwmutex in golang

- Appium automated testing framework

- eth入门之DAPP

- leetcode:297. Serialization and deserialization of binary tree

- xrandr修改分辨率與刷新率

- 220214c language learning diary

猜你喜欢

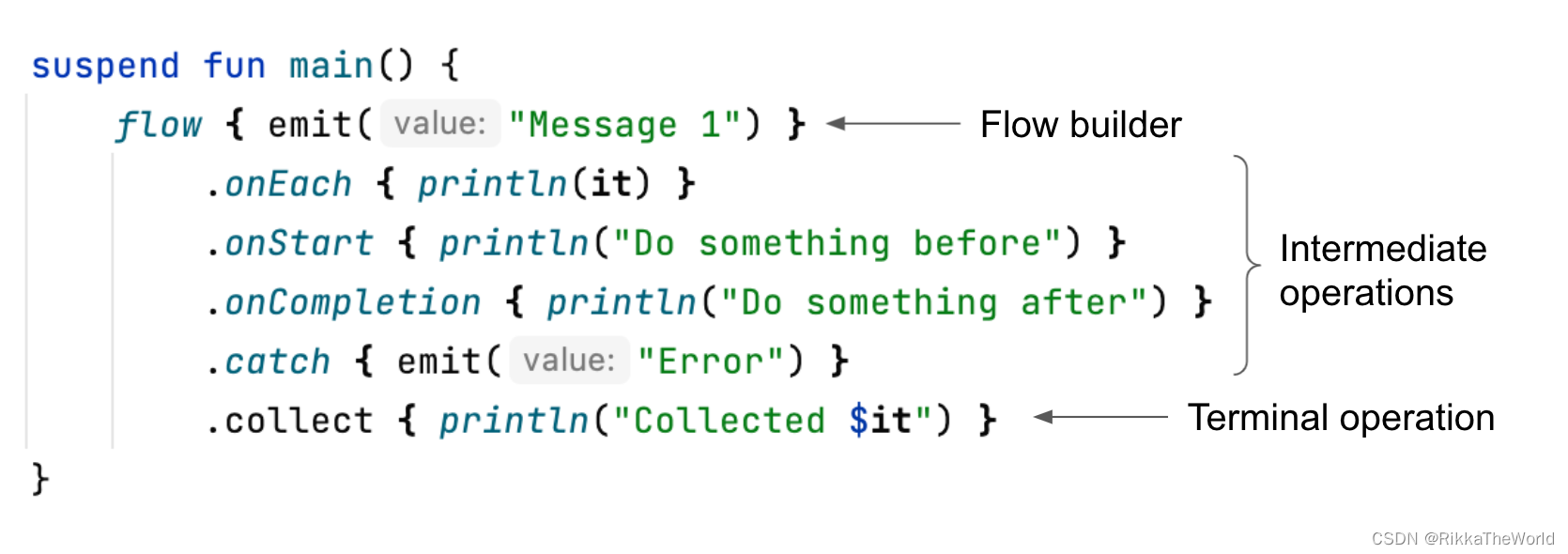

深潜Kotlin协程(十九):Flow 概述

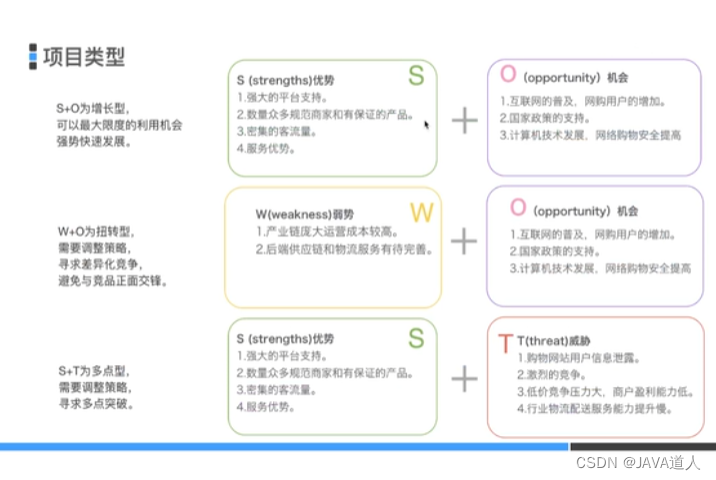

竞品分析撰写

The time has come for the domestic PC system to complete the closed loop and replace the American software and hardware system

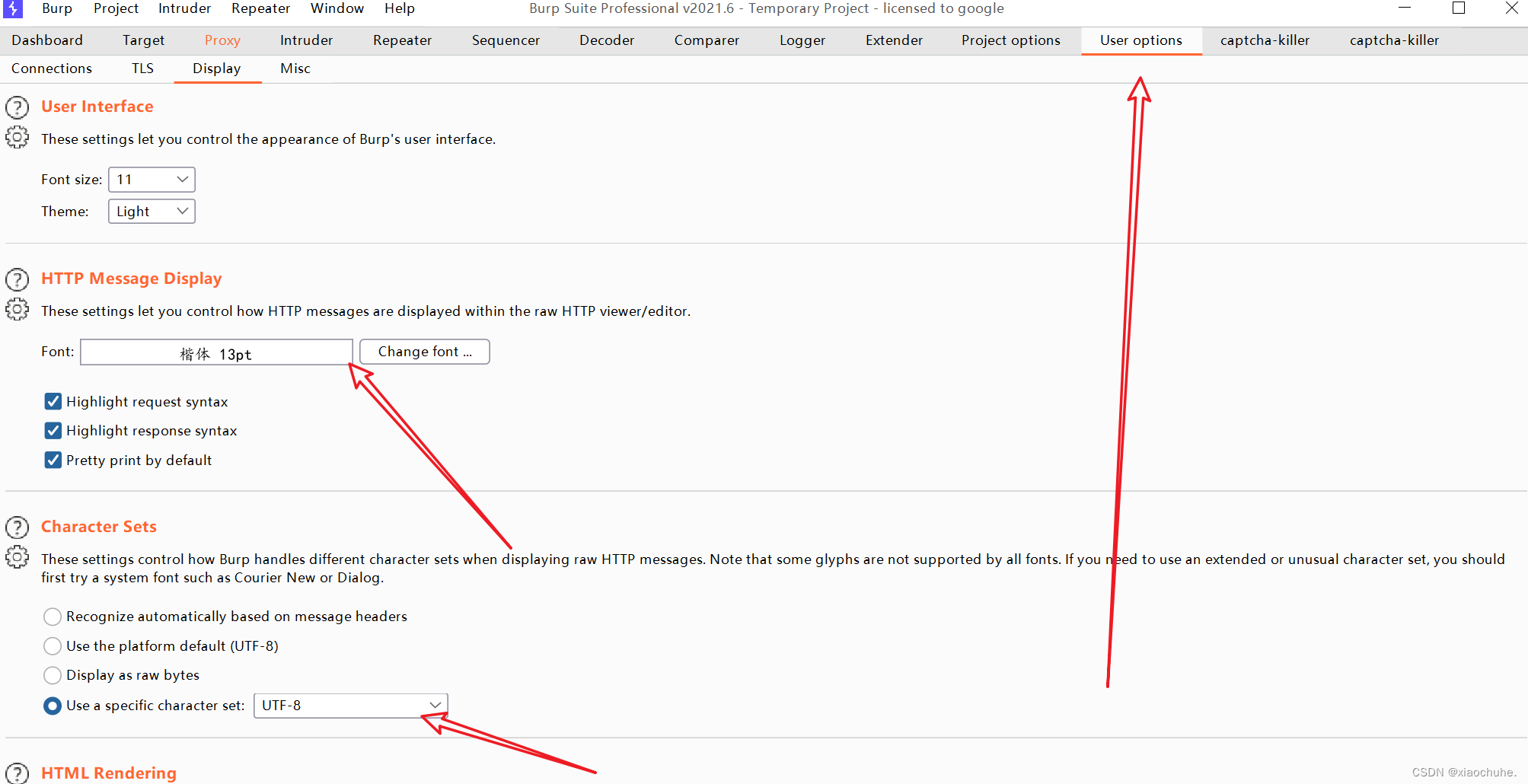

解决bp中文乱码

Causal AI, a new paradigm for industrial upgrading of the next generation of credible AI?

【刷题篇】 找出第 K 小的数对距离

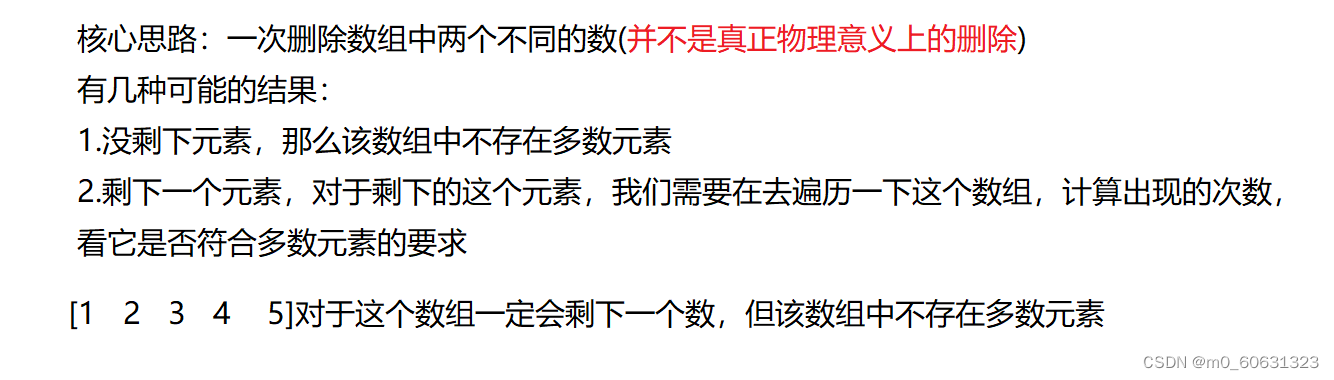

【刷题篇】多数元素(超级水王问题)

The 10th China Cloud Computing Conference · China Station: looking forward to the trend of science and technology in the next decade

CVPR 2022 | Dalian Technology propose un cadre d'éclairage auto - étalonné pour l'amélioration de l'image de faible luminosité de la scène réelle

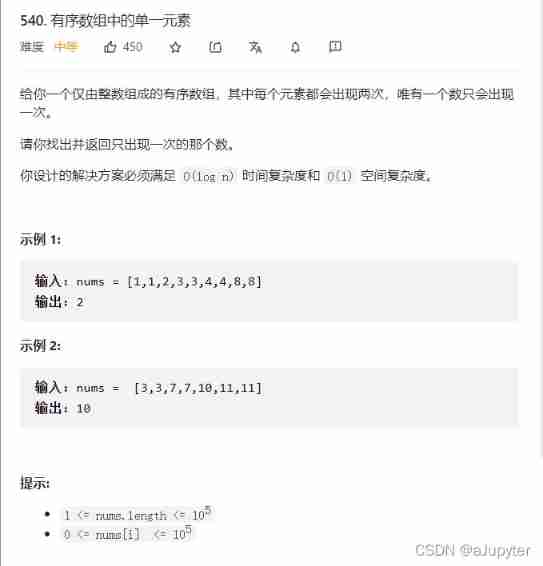

540. Single element in ordered array

随机推荐

How to process the current cell with a custom formula in conditional format- How to address the current cell in conditional format custom formula?

因子选股-打分模型

How to connect WiFi with raspberry pie

Which code editor is easy to use? Code editing software recommendation

以两列的瀑布流为例,我们应该怎么构建每一列的数组

[mathematical logic] predicate logic (toe normal form | toe normal form conversion method | basic equivalence of predicate logic | name changing rules | predicate logic reasoning law)

MPLS setup experiment

Interface embedded in golang struct

redis 持久化原理

Is it better to speculate in the short term or the medium and long term? Comparative analysis of differences

跨境电商多商户系统怎么选

2.14 simulation summary

[brush questions] connected with rainwater (one dimension)

Interaction free shell programming

vulnhub HA: Natraj

Fcpx template: sweet memory electronic photo album photo display animation beautiful memory

Basic syntax of class

220214c language learning diary

[Apple Push] IMessage group sending condition document (push certificate) development tool pushnotification

Arduino application development - LCD display GIF dynamic diagram