当前位置:网站首页>How can Delma's own brand "take off" when Philips is listed on the market?

How can Delma's own brand "take off" when Philips is listed on the market?

2022-06-11 02:40:00 【Pinecone Finance】

Ever since “ House economy ” Lift the hands of an air fryer , Up to now “ Camping fever ” Driven by “ Camping department ” Small household appliances are hot , Small household appliances seem to be back in the past

In recent days, , Known as the “ Xiaomidai factory ” Small household appliance enterprises , Delma is finally in Shenzhen Stock Exchange IPO After the first meeting , It is expected to log on to the gem , This is also another case of the wave of listing of domestic household appliance enterprises .

In the past three years , There are already bear appliances 、 Shimi technology 、 Times easy and other home appliance enterprises have successively completed listing IPO, Among them is “ The first strand of the air fryer ” Bye shares .

Now , Delma's trial also seems to indicate that the small household appliance market will usher in another powerful competitor .

Become a brand authorization

At first , Delma is not doing ODM Substitute processing .

2007 year , Years old 19 Caitieqiang, the - year-old founder of Delma , Come to Foshan Shunde , With the accumulated design experience , Set up a design team named flying fish , The main poster 、 Leaflets 、 Album and other advertising design .

At the time , With the popularization of mobile Internet , The e-commerce industry is gradually rising , Caitieqiang, who saw the opportunity , And set up flying fish e-commerce and flying fish marketing , It is mainly engaged in e-commerce agent operation business .

They took over a brand of Hang ironing machine , Through repackaging , In less than a year , Create for the brand 7000 More than ten thousand yuan of sales , Make a name for yourself . And then , And vantage 、 Baide 、 Dongli 、 Lei Mingdeng et al 20 Many well-known brands at home and abroad have achieved cooperation .

But later , As the e-commerce agent operation outlet is getting farther and farther away , For enterprise transformation .

2011 year , The founding team of the company launched its own brand of small household appliances “ Delma ”. adopt “ Hot style ” Strategy , Successively push out the wool ball trimmer 、 Juice shaker 、 Humidifier and other products , Gain a firm foothold in the market , We have gained a group of loyal fans .

2014 year , After accumulating a wealth of small household appliance supply chain management capabilities , Delma began to build its own production capacity gradually , Deeply participate in product production , In R & D 、 production 、 Sales and other links form their own systems .

After three years of development , here we are 2017 About years ago , Delma's sales have reached a certain volume . There is data showing ,2017 year , Delma's revenue has reached 6.54 One hundred million yuan .

The turning point of the story happened in 2018 year .

at that time , The Dutch brand Philips, which has been in the domestic market for more than ten years, seeks to upgrade its business , Begin to withdraw from the Chinese market , Will be its Chinese market “ Traditional business ” be stripped , Including Philips water health business .

With the support of CITIC Industrial Fund , Delma approached 5 Acquired the trademark use right of Philips water health business at a price of billion yuan . Benefits to Delma through the acquisition of Philips water health business , Also visible to the naked eye .2020 In, the business income of Philips brand in Delma exceeded 6 Billion , Account for the total income of the company 31.35%.

And then , Delma and Weixin 、 Vatti 、 Nature and other brands , Won the authorization of multiple home appliance brands , This also makes Delma's performance advance by leaps and bounds . The prospectus shows ,2019 - 2021 year , Delma's revenue also increased from 15.17 Billion yuan up to 30.38 One hundred million yuan , The year-on-year growth has doubled .

among , By Philips 、 Vatti and other brand authorized revenue , from 2019 Year of 4.85 Billion yuan up to 2021 Year of 12.01 One hundred million yuan , The revenue share is close to 40%. Just like the Antarctica , By selling brands, we can make more than ten billion yuan a year , Delma also relies on brand authorization to impact the listing .

“ You can't have both. ” The rice family OEM

“ You can't have both fish and bear paws ”.

by ODM The business has enabled Delma to achieve rapid growth in revenue , But the cooperation with Xiaomi can also be regarded as a double-edged sword .

The form of cooperation between Delma and Xiaomi is also agent processing , Delma is responsible for product development 、 Material procurement and finished product production , And then sell it to Xiaomi at the agreed price , Even the sales channel is Xiaomi's own channel .

The benefits of cooperating with Xiaomi are obvious , That is, you can hold Xiaomi “ strong ” The thighs of , Let yourself have a stable and continuous source of revenue , At the same time, we can also make use of Xiaomi's channels to achieve large revenue .

The prospectus shows , stay 2019-2021 During the year , Delma ODM Business revenue has increased from 1.17 100 million yuan increase to 6.71 One hundred million yuan , The proportion of revenue is from 7.76% Add to 22.11%. about ODM Business revenue growth , Delma also said , Mainly from 2019 Started to cooperate with Xiaomi in production “ Rice house ” Brand small household electrical appliances .

However, the disadvantages of OEM for Xiaomi are also obvious . Because Xiaomi's gross profit margin on hardware is not high , that , As Xiaomi “ Agent factory ” It is difficult for Delma to make more breakthroughs in gross profit margin .

The prospectus shows ,2019 - 2021 year , The delmami family ODM The gross profit margin of the business is 27.53%、19.18% And 12.57%, It's going down year by year , Both are lower than the gross profit margin of Delma in the same period .

ODM The decline of gross profit margin of business has also directly affected the gross profit margin of Delma's main business . The prospectus shows , from 2019 - 2021 year , The gross profit margin of Delma's main business has increased from 36.37% Slide down to 29.21%. In view of the decline in gross profit margin , One of the main reasons pointed out by Delma , It is the rice family ODM The proportion of product revenue has increased year by year , Rice house ODM The gross profit margin of products is low , It has an impact on the overall gross profit margin of the enterprise .

More Than This , Xiaomi also invested through its golden rice , stay 2020 In, I got Delma through investment 2.37% Shares of , Let the cooperative relationship between Delma and Xiaomi be more stable , By the way, Delma caught up with Weiya and headed for “ Hot style ” The express of the road to .

In the general direction , There is nothing wrong with Delma's choice of live broadcast and goods , Traffic and benefits brought by live e-commerce and head anchor , No brand can refuse . But after the Weiya affair , Delma's growth in the field of live broadcast e-commerce has also been affected , Private brands need to find new growth channels .

Of course , Delma was also immediately in Tiktok 、 Tmall 、 JD and other e-commerce platforms set up their own brand live broadcasting rooms , But in terms of sales volume and online population, the response is mediocre .

Just on the Tiktok platform , The author observed that the number of online viewers of its official flagship store was only 30 People float from side to side , The best selling item in the window interface is a product with a price of 1878 Yuan's all-in-one wireless floor washer , But the sales volume is only 121 Pieces of .

Now , Delma goes farther and farther on the road of OEM , It seems that the whole enterprise relies on the cooperative brand .

After the listing , Need to redefine “ Delma ”

The present , Delma's biggest problem is that it relies on authorized brands and ODM Business .

In Delma's current brand , The proportion of revenue of authorized brands Philips and vatti under Delma is on the rise , In contrast, the proportion of private brand revenue is declining year by year .

The prospectus shows , Up to 2021 year , The total revenue of Philips and vantage brands has reached 38.92%, More than Delma's own brand “ Delma ” And the proportion of the sum of Weixin's revenue 38.29%.

After the listing , Delma wants to compete in the current home appliance market , Have your own place . The most important thing is to gradually expand the private brand 、 And stronger , Reduce brand authorization 、 The dependence of OEM business .

because , Authorized brands are not private brands , If Delma has business problems 、 The level of payment of license fee is not reached 、 Failure to comply with the trademark license agreement or damage the reputation of the Licensor , There will be no renewal , The risk that the trademark may be withdrawn . Once the trademark license is withdrawn , Then Delma will lose access to 40% Revenue .

How to reduce this risk , Is to reduce the dependence on authorized brands , Put your own brand “ Development 、 growing ”.

How to re embrace the value of private brands ?

In my opinion , First , Technology investment and independent research and development are definitely inseparable . For being joked by insiders “ I can't do anything except to think of it ” In terms of the small household appliance market , Seizing the opportunity of popular models is a key to get sales out of the circle , And the consideration behind this is the enterprise's independent R & D and innovation ability .

although , Delma has always emphasized its own independent R & D ability and original design ability , But how much is the R & D cost of an enterprise , To a certain extent, it can also reflect the level of independent R & D and innovation ability .

The prospectus shows ,2021 In, Delma's R & D investment was only 7496.98 Ten thousand yuan , The category of R & D expenses reaches 3.64%. Compare bear electric appliance 、 Stone technology 、 Xinbao Co., Ltd. is an enterprise of the same type , Over 100 million yuan 、 Hundreds of millions of yuan of R & D expenses , Delma's investment in R & D costs may continue to strengthen .

also , Is to seize the market opportunity of new consumption upgrading , face 90、95 And then even 00 The new consumers after , There is a need for brands to change from generation to generation . Delma can define its own brand positioning and user groups , towards 90 after 、Z Generations close .

After all , As one of the hottest tuyeres in recent years ,Z The traffic of generations always needs to be rubbed . And now 90 after 、Z The demand for home appliances is surprisingly strong for generations ,“ Camping fever ” The rise of , It has also led to a number of “ Camping department ” The popularity of small household appliances . Delma may be able to seize these market outlets and segment demand , Launch a batch of small household electrical appliances aimed at the needs of small groups of people .

Last , Although Delma has a broad product line , It involves multiple categories of household appliances , But Delma doesn't seem to have any competitive advantage , Besides the low price , Maybe I can't find anything “ Can fight ” The place of . Count the products of Delma , Become “ Hot style ” It's just 99 Yuan's vacuum cleaner ,69 Yuan humidifier ,99 Block electric kettle .

however , Delma revealed that she prefers small environmental appliances , But for consumers , The choice of such small household appliances may be more inclined to brand 、 These big brands of Midea with more reliable performance . Look at other enterprises , Xiaoxiong electric appliance has a good reputation , Jiuyang electric appliance is more grounded .

however , This also forces Delma to establish brand advantages , Functional 、 Try some new designs on your appearance . After all, price cannot be a spear , Another shield , The two contradict each other . The core of the enterprise is to make profits , Low price means less gross profit , This is the last thing any enterprise wants to see .

Actually , There are many more suggestions about Delma , The author only gives one in ten thousand . No matter how changeable the suggestions are , Its core is to actively use new ideas 、 A new model 、 New technology 、 New channels to form their own competitive moat , To embrace a new future .

source : Pinecone Finance

边栏推荐

猜你喜欢

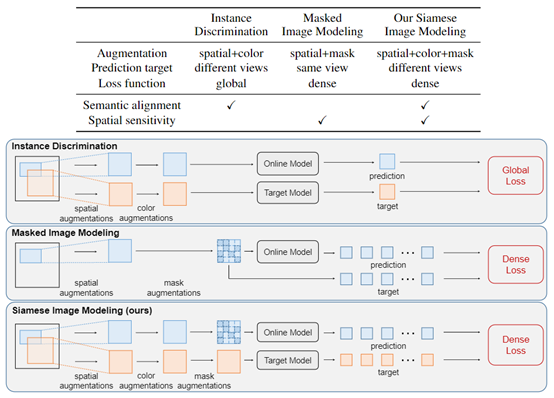

【AI周报】AI与冷冻电镜揭示「原子级」NPC结构;清华、商汤提出「SIM」方法兼顾语义对齐与空间分辨能力

学习太极创客 — ESP8226 (二)

mysql重装时写my.ini配置文件出错

The Google search console webmaster tool cannot read the sitemap?

WordPress article directory plug-in luckywp table of contents setup tutorial

Project load failed

軟件測試英語常見詞匯

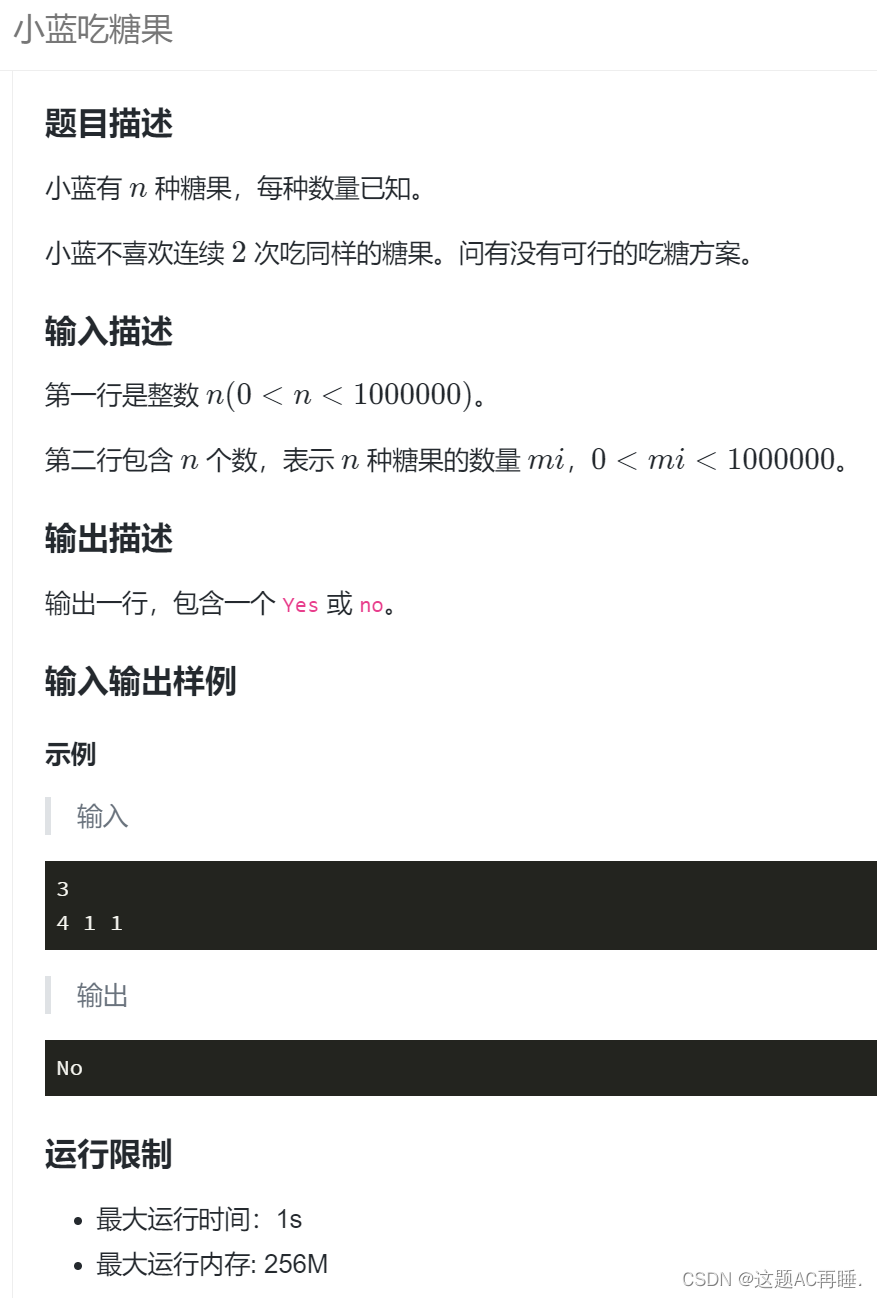

蓝桥杯_小蓝吃糖果_鸽巢原理 / 抽屉原理

那些笑着离开“北上广”的人,为何最后都哭了?

![[Fibonacci series]](/img/03/70b1363e91142a8600d97c59b01b0f.png)

[Fibonacci series]

随机推荐

扁平数据转tree与tree数据扁平化

Executeineditmode property details

CPT 102_LEC 17

Penetration test - security service system +owasp top 10

ADVANCE.AI首席执行官寿栋将在2022新兴市场品牌出海线上峰会分享跨境电商运用AI技术合规

[MySQL 45 -10] Lesson 10 how MySQL selects indexes

Uni app - one click access to user information

Link list of high frequency written interview question brushing summary (distribution explanation & code annotation)

[interview question 17.04. missing numbers]

蓝桥杯_小蓝吃糖果_鸽巢原理 / 抽屉原理

WordPress upgrade error: briefly unavailable for scheduled maintenance [resolved]

1031. maximum sum of two non overlapping subarrays

Unity3d model skin changing technology

Tests logiciels vocabulaire commun anglais

Google Gmail mailbox marks all unread messages as read at once

helm 部署traefik ingress

【189. 轮转数组】

92. CompletableFuture 实战

AOSP ~ WIFI默认开启 + GPS默认关闭 + 蓝牙默认关闭 + 旋转屏幕关闭

A数位dp