当前位置:网站首页>Solend abolishes the proposal to "take over the giant whale" and liquidates the "bomb"

Solend abolishes the proposal to "take over the giant whale" and liquidates the "bomb"

2022-06-22 10:00:00 【Honeycomb Tech】

The crypto asset market has been down for days , Liquidity risk begins to move towards the blockchain chain DeFi Application transfer . stay Solana On the chain , The largest lending platform Solend Recently, I have been worried about bad debts .

6 month 19 Japan ,Solend Suddenly in the community, it was named 「SLND1: Reduce the risk of giant whales 」 The governance proposal of , It is planned to raise the clearing threshold for users of large mortgage positions and take over a giant whale account with clearing risk . The first proposal launched by the platform since its establishment , Only in 5.5 It ended in an hour of hasty voting , Invite criticism from users , Especially taking over the account of the giant whale .

In the voice of criticism ,Solend On 6 month 20 A new proposal was urgently issued on the th , The abolition of 「SLND1」, While extending the voting time , Commit that the authorization to take over the account will not be involved in the future proposal . The proposal was subsequently voted through .

Although the governance strategy has been updated in a timely manner , But under the general downward trend of the encryption market ,Solend The liquidation risk of the giant whale on the has not been removed , Also suffered from the loss of funds due to the crisis of trust . In the past few days , The total lock up value of the platform's encrypted assets (TVL) from 3 Above $billion, it fell to 2.65 Billion dollars ,USDT and USDC The utilization ratio of loan pool once reached 100%, This makes it difficult for depositors to withdraw cash .

As the crypto asset market goes bear , Market liquidity is also tightening ,DeFi The anti risk capability of the platform has been tested . One side , Due to insufficient liquidity in the chain , Large amount liquidation can easily lead to a series of position explosion , Asset prices will be hit ; On the other hand , In the plummeting market , User mortgage at DeFi The position value of the lending platform has shrunk , Insolvency may occur , Eventually, bad debts occurred on the platform .

DeFi How to deal with the liquidity crisis ? This problem has been highlighted after the bear in the encryption market .

Solend「 Take over the Jujing account 」 The proposal was overturned

threat Solend Of 「 whale 」 It is a huge amount of mortgage on the platform SOL Address of the asset .

Solend According to , One starts with 「3oSE9C」 The Jujing address account of has a huge position on the platform , The account was previously mortgaged 570 over SOL( About then 1.7 Billion dollars ), The total value lent 1.08 $ USDC and USDT. The assets held in this account account account for Solend Total locking value of the platform (TVL) Of 25%, Occupy SOL Of the main deposit pool 95%, Borrowed USDC Occupy USDC Primary pool 88%.

according to Solend The conventional 20% To calculate the liquidation rate , once SOL Fell to 22.3 dollar , The giant whale account will face liquidation . When the , The account is mortgaged 570 over SOL Will be sold to the market ,SOL If the price drops sharply , There is a probability that this account will be mortgaged SOL Not enough to repay the loan , This leads to bad debts .

「Solend Have 2000 Million dollars in treasury funds , Can be used to help repay bad debts , But in the worst case , Maybe the money is still not enough .」Solend call , At present, the platform is actively trying to make the giant whale repay its position , But I haven't been able to get in touch with him , And by the 6 month 19 Japan , The address of the giant whale has 12 There is no activity on the chain .

therefore , Voting hours are only 5.5 An hour's proposal appeared , The proposal puts forward two special restrictions for users of the giant whale .

First , Of the total loans 20% The above-mentioned giant whales are subject to special deposit requirements , If the user's credit amount exceeds the total credit amount of the primary pool 20%, It is necessary to change the threshold of clearing rate from normal 20% Up to the 35%.

The liquidation rate is increased to 35% It means that the price for triggering liquidation of the Jujing account will be raised , On this basis , once SOL achieve 25 Above the dollar , The account 570 ten thousand SOL Will be cleared . As of press time ( Beijing time. 19:46),SOL The market price of is 36.5 Near the dollar ,6 month 18 When the encryption market as a whole goes down , That is to say Solend The day before this proposal was introduced ,SOL The lowest market price reached 27.15 dollar , indicating contrast 6 month 14 Japan ,SOL It fell to a new low in the year , by 25.86 dollar .

「SLND1」 The second requirement put forward in the proposal is that the community grants the official team of the platform Solend Labs The emergency power to take over the Jujing account , So that clearing can be carried out in OTC transactions , Avoid SOL( The price of ) Push to the limit , This will be done through smart contract upgrade . Once the whale account reaches a safe level , Emergency powers will be revoked .

because 「SLND1」 Voting time for proposals is only 5.5 Hours , Many platform users do not yet know what has happened , The voting is over . Final , The proposal is based on 115.5 ten thousand (97.5%) In favor of ,3 ten thousand (2.5%) A negative vote was passed .

Out of concern about the risk of bad debts ,Solend Launched this special proposal , But users don't buy the result , The voice of doubt was overwhelming , In particular, the official team wants to take over the account of the giant whale .

On social networks , Yes KOL use 「 Out of line 」 To evaluate 「SLND1」 The proposal . He said , On a public chain with top ten market values , There are many institutional investments 、 Maximum lending agreement for one year of operation , No proposal has been made to discuss the complete risk control framework . The first proposal is to discuss how to deprive a user of legal property ownership , And only to the community 6 The vote was passed in hours .

And users are worried ,Solend You can manipulate the voting results through the governance token controlled by yourself , If the Jujing account can be so controlled , Then control all accounts by voting 、 It is not impossible to complete the plundering of user assets .

There is great controversy ,Solend Immediately after 6 month 20 On the th 「SLND2」 The proposal , The contents are respectively cancellation SLND1 The proposal ; Increase governance voting time to 1 God ; Develop new proposals that do not involve taking over the account .

Solend Team initiated 「SLND2」 The proposal

Final ,「SLND2」 The proposal is in the form of 99.8% The support rate of was passed , This means that the clearing threshold for the giant whale account is still 20%, The project team temporarily gave up taking over the account of the giant whale .

Liquidity crisis challenges DeFi Platform risk control

Solend Of 「SLND1」 The proposal was overturned after public criticism , It seems to be DeFi Users use voting governance to limit the victory of evil , But the risk is still there .

although SOL The price rebounded to 36 About $ , The alarm for clearing the position of the giant whale is reduced , But the downward trend of the encryption market is still , The time bomb has not yet been disarmed , In fact, users also used voting to buy some time for the giant whale to deal with liquidation , Eyes began to focus on the address of the giant whale .

「 No one can be reached 」 The giant whale has not changed yet , Another kind of speculation began to appear :Solend Is it possible that the Jujing account on has not planned to repay since the beginning of the loan ? Some people think ,570 over SOL If it is shipped in the secondary market , May cause a series of stampedes , Finally, the actual value of the giant whale is insufficient 1.08 Billion dollars , therefore , He might as well choose a loan agreement to disguise a stable currency asset .

however , Some people argue that this is unlikely ,「 according to SOL stay Solend On 75% Mortgage asset value ratio , The user could have lent value 1.275 $billion in assets , But he only borrowed 1.08 Billion dollars ; He can also offset part of the slide by selling short while shipping in the secondary market , There is no need to use value 1.7 $ SOL in 1.08 Billion dollars .」

The refuter still reserved the greatest kindness to the whale , But in fact , Use huge quantities with large price fluctuations SOL The operation of setting up stable currency assets by mortgage can indeed be realized , And do not violate the rules of the lending platform , But the risk is completely thrown to the platform and its users . No problem with the program , But the result was terrible .

Solend After the storm over the proposal , Some funds are being withdrawn from it .

Solend Of TVL Continued decline

It can be seen from the data on the chain , In the past few days ,Solend Of TVL from 3 Above $billion, it fell to 2.74 Billion dollars . among USDC and USDT The capital loss of the two loan pools is significant , As many users withdraw money , The utilization ratio of these two pools once soared to 100%. This shows that , These two types of deposits on the platform may be exhausted , If the borrower is late in repaying , Depositors don't say they lost interest , The principal may not be recovered .

By 6 month 20 On the afternoon of Sunday 4 spot ,Solend USDC The total deposits and total borrowings in the loan pool are 1.2 Billion dollars , The utilization of this pool is close to 100% The state of , Despite the USDC The deposit rate has risen to 64.85%, But there is no significant capital inflow .

DeFi The risk control capability of the agreement is being tested , Especially the lending and financing platforms with certain leverage characteristics , With the possibility of mortgage assets plummeting , Such platforms are faced with the potential risk of bad debts .

Some insiders think ,DeFi The agreement should combine different market conditions , Formulate corresponding risk control strategies , For example, when the market fluctuates violently , Reduce the mortgage rate of assets , And appropriately raise the liquidation threshold , To prevent systemic risks .

「 in the final analysis , During the bear market , The liquidity of the entire crypto asset market has tightened , The liquidity of assets on the chain is greatly reduced , This will often result in users' inability to withdraw their deposits , And the market plummeted due to large amount liquidation .」 Said by , During the bull market , Market funds are active , Various mainstream DeFi There is sufficient capital reserve in the agreement , Relatively sufficient liquidity . Once the market goes bear , Many institutions and users will choose to propose assets ,DeFi The liquidity of the agreement will become very poor . here , If liquidation occurs on the chain , A small amount of money can make a huge decline , It's easy to cause a series of positions explosion .

DeFi It broke out in the prosperity of encryption asset market 2020 year , but 2 Years later, , The market goes into the decline cycle . In the near future , Centralized lending platform Celsius In case of liquidity crisis, cash withdrawal is suspended , Encryption hedge fund Sanjian capital is on the verge of bankruptcy due to large amount of debt , Crypto asset exchange AEX Run on , These crises are related to DeFi Has to do , It also shows that the risks of the market on the chain and the centralized market are conducting each other , There is an increased chance of systemic risk .

stay Solend When facing bad debt risk due to liquidity crisis , other DeFi The agreement also ushered in a big test in the market with tight liquidity , All kinds of clearing on the chain are like time bombs , It may bring a heavy blow to the encryption market at any time , The design of risk control mechanism is still DeFi Challenges that cannot be bypassed .

( Statement : Please strictly abide by the local laws and regulations , This article does not represent any investment advice )

Do you think DeFi What should the platform do to cope with the bear market ?

边栏推荐

- PowerDesigner tip 2 trigger template

- Realize multi-user isolated FTP in AD environment

- 秋招秘籍C

- 追更这个做嵌入式的大佬

- Former amd chip architect roast said that the cancellation of K12 processor project was because amd counseled!

- PAT甲级 - 1012 The Best Rank(坑点)

- TCP 拥塞识别

- Bloom filter optimization - crimsondb series of papers (I)

- 蓝牙、wifi、zigbee和lora、NB-lot,通话信号,网络信号4G

- PAT甲级 - 1014 Waiting in Line (银行排队问题 | queue+模拟)

猜你喜欢

软件项目管理 8.3.敏捷项目质量活动

Introduction to code audit learning notes

Who says PostgreSQL has no reliable high availability (2)

编译basalt时出现的报错

Realize multi-user isolated FTP in AD environment

Debian10配置RSyslog+LoganAlyzer日志服务器

![[popular science] to understand supervised learning, unsupervised learning and reinforcement learning](/img/24/d26c656135219a38fd64e4d370c9ee.png)

[popular science] to understand supervised learning, unsupervised learning and reinforcement learning

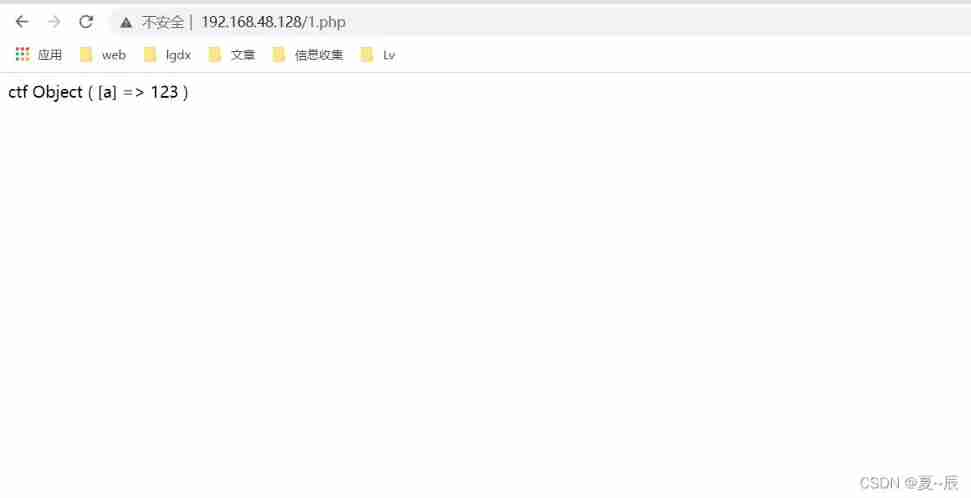

Learning serialization and deserialization from unserialize3

Open a safe distance: the international space station has taken measures to actively avoid space debris

SQL编程task04作业-集合运算

随机推荐

追更这个做嵌入式的大佬

It was exposed that more than 170million pieces of private data had been leaked, and Xuetong responded that no clear evidence had been found

[ZOJ] P3228 Searching the String

【深度学习】不得了!新型Attention让模型提速2-4倍!

快速掌握 ASP.NET 身份认证框架 Identity - 登录与登出

C语言编写一个双向链表

office2016+visio2016

Catch up with this big guy

全力以赴把防汛救灾措施落细落实落到位 坚决守护好人民群众生命财产安全

三个月让软件项目成功“翻身”!

7-1 group minimum

拉开安全距离:国际空间站采取了主动避让太空垃圾碎片的措施

6-43 sum of ordered sparse polynomials

DHCP Relay

It is said that the price of the iPhone 14 will rise; TikTok US user data is transferred to Oracle, and bytes cannot be accessed; Seatunnel 2.1.2 releases geek headlines

6-44 traversal of binary tree

6-32 construction of linked list by header insertion method

[hdu] P7058 Ink on paper 求最小生成树的最大边

IPO配置指南

VS2022连接sqlserver数据库教程