当前位置:网站首页>What noteworthy technologies of gold: the importance of fund management

What noteworthy technologies of gold: the importance of fund management

2022-06-21 20:40:00 【sino_ sound】

In the gold trading platform , Need to focus on balance . Only when there is balance can we maintain the stability of the situation , Try to keep everything in the plan as much as possible , Including market conditions, profit and loss, etc , Of course it's just as much as possible . So how to find the balance in the market ?

Actually , Gold investment is a systematic project . Whether the investment is successful or not , In addition to the accuracy of market analysis , fund management 、 Risk management 、 Experience 、 Trading skills and luck , They are very important factors . Especially in the international gold market , Its trading mechanism is leverage ( Margin trading ), Investors can trade their principal 50 Times and even 100 Times the transaction amount , This determines that margin trading is a high risk 、 High yield investment . If there is no perfect capital and risk management , The failure of a transaction , It is possible for investors to give up their previous efforts or lose their money .

So-called “ Systems engineering ” Another understanding of , Investors invest in the gold market , The profit or loss of a transaction does not mean anything ( Unless you have a good time ), Investors should pursue stable and sustainable profits , Because even if the transaction made a huge profit at the beginning ( Often this kind of windfall profits is the result of gamblers' psychology ), Finally, it should be returned to the market , Even the capital is lost , Because it was just a moment of luck . The gold market is not a casino , Investors are not gamblers , The investment made cannot be equated with gambling . The failure of such people is due to ignorance of these , I have not learned the experience and skills to survive in this market .

According to the author's experience and the understanding of some successful peers , If investors want to obtain long-term and stable profits in the gold market , Whether the market analysis is right or wrong can only account for 30%, Capital and risk management definitely account for 50% above .

Fund management is how to allocate funds in the investment , Make the most of your money , To get the maximum possible profit ; And risk management , Is to consider the risk level of the transaction 、 Investor affordability , To minimize investment risk .

The most important content of risk management is how to stop loss , Next is how to stop winning . As people usually understand ,“ Profit and risk are twin brothers ”, Fund management and risk management also need to be skillfully combined , So as to achieve the balance between maximizing income and minimizing risk . Next, the author introduces several common methods of fund management and application in combination with graphics , Each method has its own advantages and disadvantages , The key still lies in how investors flexibly use .

边栏推荐

- 如何在电脑成千上万支文件中找到想要的文件?

- 大鱼吃小鱼小游戏完整版

- Xcode插件管理工具Alcatraz

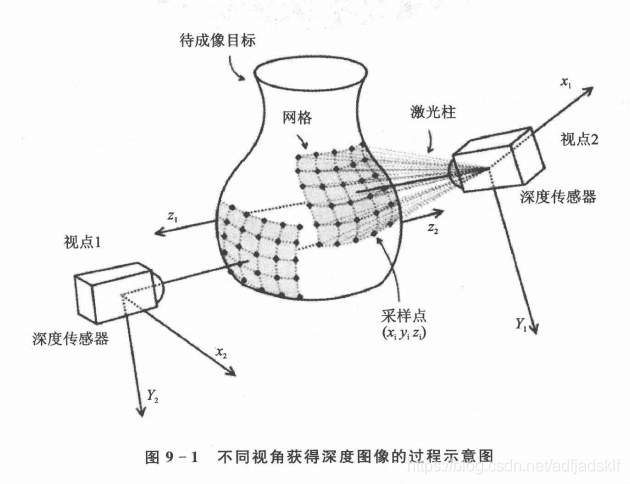

- 点云转深度图:转化,保存,可视化

- 互联网协议入门详解--五层模型

- How to query all tables in MySQL

- Problems caused by redis caching scenario

- 某大厂第二轮裁员来袭,套路满满

- Goldfish rhca memoirs: do447 managing user and team access

- It is said that the price of the iPhone 14 will rise; TikTok US user data is transferred to Oracle, and bytes cannot be accessed; Seatunnel 2.1.2 releases geek headlines

猜你喜欢

BTC投资者损失预计达73亿美元!“割肉式”抛售来袭?加密寒冬比预期更冷、更长!

点云转深度图:转化,保存,可视化

RPA financial process automation | Shanghai Pudong Development Group and cloud expansion technology accelerate financial digital operation

How to distinguish between machine learning and pattern recognition?

![[wechat applet] collaboration and publishing data binding](/img/9a/a986fe169cf9bee0bb109750590a22.png)

[wechat applet] collaboration and publishing data binding

大鱼吃小鱼小游戏完整版

Redis 做缓存场景引发的问题

Pfsense configuring tinc site to site tunneling tutorial

M3608升压ic芯片High Efficiency 2.6A Boost DC/DC Convertor

IAR major upgrade, support vs code, St release the first sensor with processing unit

随机推荐

Laravel 使用 PhpOffice 导入导出 Excel

SQL 面试题:2022 年最热门的 15 个问题

jmeter线程持续时间

Sd6.20 summary of intensive training

Snake game project full version

It is said that the price of the iPhone 14 will rise; TikTok US user data is transferred to Oracle, and bytes cannot be accessed; Seatunnel 2.1.2 releases geek headlines

浅析Js中${}字符串拼接

[wechat applet failed to change appid] wechat applet failed to modify appid all the time and reported an error. Tourist appid solution

Kubernetes-23:详解如何将CPU Manager做到游刃有余

粗读Targeted Supervised Contrastive Learning for Long-Tailed Recognition

带你区分几种并行

1157 Anniversary

MySQL CentOS installation MySQL L8

Is it possible to update some fields through flinksql?

【基于合泰HT32F52352的智慧垃圾桶总结】

M3608升压ic芯片High Efficiency 2.6A Boost DC/DC Convertor

How to debug reorganization in jetpack compose

Netcore3.1 Ping whether the network is unblocked and obtaining the CPU and memory utilization of the server

The second round of layoffs in a large factory is coming, and the routine is full

Flutter TabBarView组件