当前位置:网站首页>Time series analysis 41 - time series prediction tbats model

Time series analysis 41 - time series prediction tbats model

2022-07-28 09:49:00 【Magic Ktwc37】

Timing analysis 41

Timing prediction TBATS Model

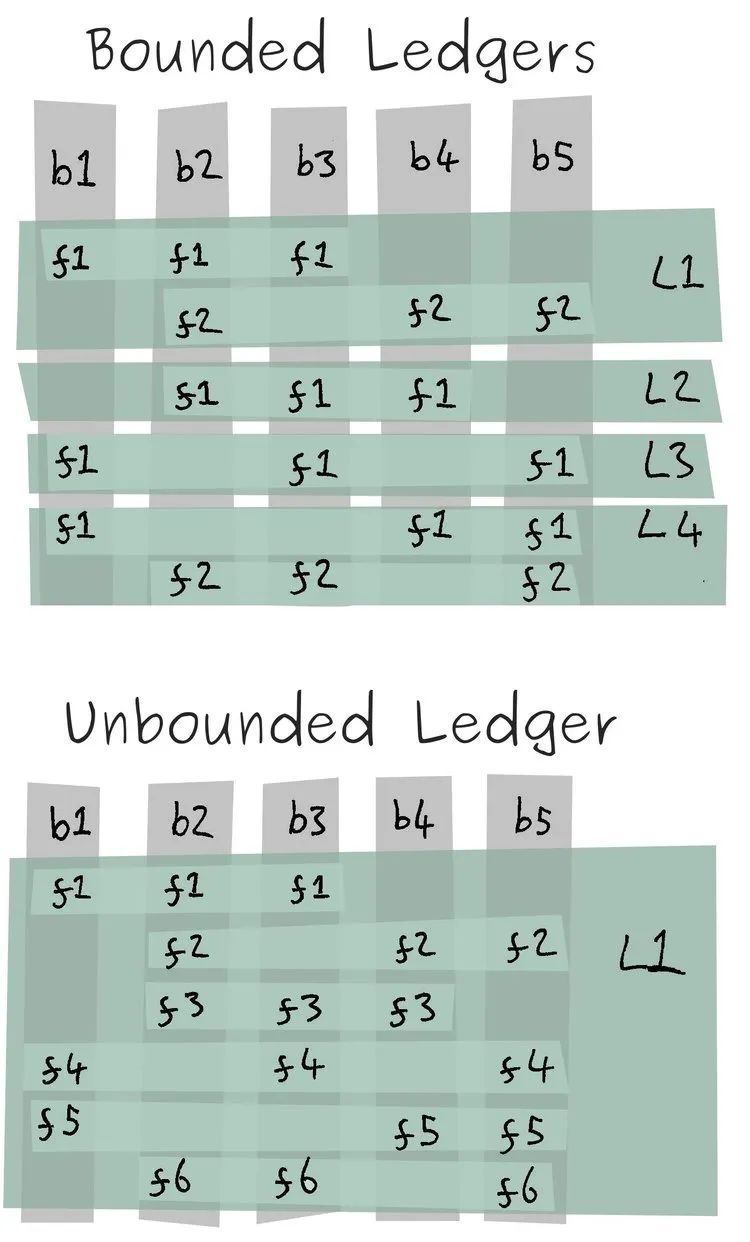

We introduced (S)ARIMA(X) Series model 、Prophet And other methods to predict time series data , In this article, we try to use TBATS Model for time series prediction .TBATS The main goal of the model is to model complex seasonal factors in an exponential smoothing way . Please look at the chart below. ,

TBATS: Trigonometric seasonality, Box-Cox transformation, ARMA errors, Trend and Seasonal components.

brief introduction

Generally speaking, the problem of time series prediction is to predict the future value of time series according to the historical observations of the time series data . In the process of modeling, one of the headache problems of menstruation is the uncertainty of time series , It changes according to the data scenario .

And this article will introduce TBATS The model mainly uses exponential smoothing method to solve complex periodic problems .

TBATS Different options will be considered to model the period of time series , Include :

- Conduct Box-Cox Convert and do not Box-Cox transformation

- Consider timing trends and ignore trends

- Use trend attenuation and inapplicable trend attenuation

- Use for model residuals ARIMA(p,q) Or not

- No seasonal model

- Balance seasonal factors to varying degrees

Please look at the chart below. :

The final model selection uses Akaike information (AIC, Akaike information criterion).

Be careful : Automatically ARIMA It is used to determine whether the residuals need modeling or find appropriate parameters (p,q).

A simple example

Let's take a look at the simplest example

from tbats import TBATS

import numpy as np

# required on windows for multi-processing,

# see https://docs.python.org/2/library/multiprocessing.html#windows

if __name__ == '__main__':

np.random.seed(2342)

t = np.array(range(0, 160))

y = 5 * np.sin(t * 2 * np.pi / 7) + 2 * np.cos(t * 2 * np.pi / 30.5) + \

((t / 20) ** 1.5 + np.random.normal(size=160) * t / 50) + 10

# Create estimator

estimator = TBATS(seasonal_periods=[14, 30.5])

# Fit model

fitted_model = estimator.fit(y)

# Forecast 14 steps ahead

y_forecasted = fitted_model.forecast(steps=14)

# Summarize fitted model

print(fitted_model.summary())

Use Box-Cox: True

Use trend: True

Use damped trend: True

Seasonal periods: [14. 30.5]

Seasonal harmonics [2 1]

ARMA errors (p, q): (0, 0)

Box-Cox Lambda 0.654044

Smoothing (Alpha): 0.132425

Trend (Beta): 0.023495

Damping Parameter (Phi): 0.947184

Seasonal Parameters (Gamma): [-9.18866163e-09 -4.37211750e-09 -1.04956292e-08 -1.81209981e-08]

AR coefficients []

MA coefficients []

Seed vector [ 5.69510575e+00 -1.36715628e-01 4.70120645e-04 4.91577774e-02

-3.14318406e-02 1.93662153e+00 6.22414387e-01 9.31711655e-02]

AIC 1028.837243

# Time series analysis

print(fitted_model.y_hat) # in sample prediction

print(fitted_model.resid) # in sample residuals

print(fitted_model.aic)

[12.00026315 15.37130609 15.92513946 12.92209113 8.86829808 6.55044357

6.98379669 9.80510678 12.96461526 13.46459656 10.73401852 6.96869927

4.88388936 5.2411647 7.89921391 11.16766831 12.01242589 9.84585836

6.61337902 4.99937038 5.90163047 9.22357233 13.21064516 14.63622867

12.54077865 9.32236216 7.62704064 8.86253335 12.72529442 16.732014

17.97565652 15.35674111 11.53204899 9.35938536 10.22652865 13.76843469

…

[-2.63150260e-04 4.92298548e-01 7.81058008e-01 1.04674185e+00

4.74485095e-01 -2.89650437e-01 -1.09380563e-02 7.11659349e-01

7.52445725e-01 1.52818057e+00 7.74776582e-01 2.21684967e-01

-1.03614988e+00 -3.83613709e-01 1.26200022e+00 1.11129016e+00

2.11411936e+00 9.74278300e-01 5.82900889e-01 -3.77720695e-01

-1.42384359e-01 1.28154205e+00 1.23632142e+00 9.87393000e-01

1.61135725e+00 5.23587924e-01 3.71403105e-01 4.83700871e-01

…

1028.8372428992702

# Reading model parameters

print(fitted_model.params.alpha)

print(fitted_model.params.beta)

print(fitted_model.params.x0)

print(fitted_model.params.components.use_box_cox)

print(fitted_model.params.components.seasonal_harmonics)

0.13242488070375835

0.023495267045578822

[ 5.69510575e+00 -1.36715628e-01 4.70120645e-04 4.91577774e-02

-3.14318406e-02 1.93662153e+00 6.22414387e-01 9.31711655e-02]

True

[2 1]

A more complicated example

We still use the front SARIMAX Data used in the series of blog posts , This data is a daily sales data , contain 5 year 10 In storage 50 Sales data of products . In this example, we use warehousing 1 Products in 1 related data .

import pandas as pd

df = pd.read_csv('walmart/train.csv')

df = df[(df['store'] == 1) & (df['item'] == 1)] # item 1 in store 1

df = df.set_index('date')

y = df['sales']

y_to_train = y.iloc[:(len(y)-365)]

y_to_test = y.iloc[(len(y)-365):] # last year for testing

We can see the weekly and annual periodicity in the figure , This indicates that there are multiple cycles in the sequence

TBATS Model

from tbats import TBATS, BATS # Fit the model

estimator = TBATS(seasonal_periods=(7, 365.25))

model = estimator.fit(y_to_train)# Forecast 365 days ahead

y_forecast = model.forecast(steps=365)

Note that the annual cycle is defined as 365,25, Not an integer , But it doesn't matter ,TBATS The model can be supported .

it seems ,TBATS The model fits well for two kinds of mixed periodicity .

Annual periodic fitting

Weekly periodic fitting

The model parameters are as follows :

Use Box-Cox: True

Use trend: False

Use damped trend: False

Seasonal periods: [ 7. 365.25]

Seasonal harmonics [ 3 11]

ARMA errors (p, q): (0, 0)

Box-Cox Lambda 0.234955

Smoothing (Alpha): 0.015789

TBATS Three equilibrium strategies are used for weekly periodicity , For annual periodicity 11 An equilibrium strategy ; At the same time Box-Cox Method ,lambda by 0.234955; There is no trend modeling , Not used ARMA Modeling residuals .

SARIMA Model weekly periodicity

SARIMA Only one cycle can be modeled , And the cycle cannot be too long . Let's try to use SARIMA Model the time series data , It can be done with TBATS Compare the .

from pmdarima import auto_arima

arima_model = auto_arima(y_to_train, seasonal=True, m=7)

y_arima_forecast = arima_model.predict(n_periods=365)

Autoarima I chose SARIMA(0, 1, 1)x(1, 0, 1, 7) model, Annual periodicity is not modeled .

SARIMAX + Fourier term

We can use SARIMAX Model , Take Fourier term as external variable to fit the second periodic factor .

# prepare Fourier terms

exog = pd.DataFrame({

'date': y.index})

exog = exog.set_index(pd.PeriodIndex(exog['date'], freq='D'))

exog['sin365'] = np.sin(2 * np.pi * exog.index.dayofyear / 365.25)

exog['cos365'] = np.cos(2 * np.pi * exog.index.dayofyear / 365.25)

exog['sin365_2'] = np.sin(4 * np.pi * exog.index.dayofyear / 365.25)

exog['cos365_2'] = np.cos(4 * np.pi * exog.index.dayofyear / 365.25)

exog = exog.drop(columns=['date'])

exog_to_train = exog.iloc[:(len(y)-365)]

exog_to_test = exog.iloc[(len(y)-365):]# Fit model

arima_exog_model = auto_arima(y=y_to_train, exogenous=exog_to_train, seasonal=True, m=7)# Forecast

y_arima_exog_forecast = arima_exog_model.predict(n_periods=365, exogenous=exog_to_test)

Here we use two Fourier terms as external variables . Now? SARIMAX The model completes the modeling of two cyclical factors .

Model comparison

We use Mean Absolute Error Compare the three models :

TBATS: 3.8527

SARIMA:7.2249

SARIMAX + 2 Fourier term :3.9045

Advantages and disadvantages

advantage

TBATS The model can model complex cyclical factors , Such as non integer period 、 Long period, etc .

shortcoming

because TBATS The model mixes and tries many methods at the bottom , So its calculation speed is relatively slow .

TBATS The model cannot be like SARIMAX Add external variables like that .

边栏推荐

- Business visualization - make your flowchart'run'(4. Actual business scenario test)

- 软件测试与质量学习笔记1---黑盒测试

- [collection] linear algebra let me think - Summary of chapter topics

- Salted fish esp32 instance - mqtt lit LED

- Window源码解析(二):Window的添加机制

- Source code analysis of view event distribution mechanism

- Arouter source code analysis (I)

- MATLAB的实时编辑器

- Translation recommendation | debugging bookkeeper protocol - unbounded ledger

- ECCV 2022 | can be promoted without fine adjustment! Registration based anomaly detection framework for small samples

猜你喜欢

初学C#必须要掌握的基础例题

NET 3行代码实现文字转语音功能

MySQL中各类型文件详解

译文推荐 | 调试 BookKeeper 协议 - 无界 Ledger

pycharm使用conda调用远程服务器

C# 倒计时工具

MySQL master-slave architecture. After the master database is suspended and restarted, how can the slave database automatically connect to the master database

MATLAB的实时编辑器

Business visualization - make your flowchart'run'(4. Actual business scenario test)

Edge团队详解如何通过磁盘缓存压缩技术提升综合性能体验

随机推荐

Buckle 376 swing sequence greedy

ActivityRouter源码解析

Real time editor of MATLAB

Opencv installation configuration test

Arouter source code analysis (I)

数据库高级学习笔记--存储函数

SQL server, MySQL master-slave construction, EF core read-write separation code implementation

MATLAB的符号运算

PlatoFarm进展不断,接连上线正式版以及推出超级原始人NFT

Plato Farm-以柏拉图为目标的农场元宇宙游戏

Machine learning (10) -- hypothesis testing and regression analysis

MATLAB的数列与极限运算

数据库高级学习笔记--游标

Scalable search bar, imitating Huawei application market

TimeBasedRollingPolicy简介说明

Opencv4.60 installation and configuration

软件测试与质量学习笔记1---黑盒测试

NET 3行代码实现文字转语音功能

实验四 使用fdisk对硬盘进行管理

数据库那么多概念性的东西怎么学?求方法