当前位置:网站首页>What is more advantageous than domestic spot silver?

What is more advantageous than domestic spot silver?

2022-06-21 20:40:00 【sino_ sound】

As the group with good investment habits continues to grow , More and more friends in China are aware of the advantages of spot silver . The two-way trading mechanism of spot silver can help investors gain profits in different market conditions , Combined with T+0 Trading system and certain capital leverage , The yield is much better than the traditional investment products .

Many domestic investors may have heard of silver T+D, It is the spot margin variety listed in Shanghai gold exchange , It belongs to silver deferred transaction , Current work 、 farmers 、 in 、 build 、 All banks have agents , After an investor opens an account at a bank outlet or through online banking , You can get involved .

As China has not directly introduced the spot silver on the international market , So silver T+D To a certain extent, it meets the demand of domestic investors for leveraged spot silver products . But the imitated products have defects after all , For example, the lever level is only about one eighth of that of the original version , Trading hours are divided into early trading (9:00—11:30)、 Afternoon plate (13:30—15:30)、 Night disk (20:30—02:30) Three paragraph , Increased the risk of market short jump . The most important thing is that it is a domestic variety , Not fully in line with international silver prices , Its trend is not fully reflected in international economic data and major events .

边栏推荐

- Excuse me, the exclusive resources in data integration can not connect to some databases normally. The following reasons do not seem to be true. Public funds

- 點雲轉深度圖:轉化,保存,可視化

- The difference between break and continue

- [wechat applet failed to change appid] wechat applet failed to modify appid all the time and reported an error. Tourist appid solution

- 机器学习之数据处理与可视化【鸢尾花数据分类|特征属性比较】

- Xcode插件管理工具Alcatraz

- 起飞,年薪40万+

- National certification -- examination requirements for software evaluators

- JMeter thread duration

- 大鱼吃小鱼小游戏完整版

猜你喜欢

Zabbix6.0+timescaledb+ enterprise wechat alarm

![[wechat applet] collaboration and publishing data binding](/img/9a/a986fe169cf9bee0bb109750590a22.png)

[wechat applet] collaboration and publishing data binding

Details, MySQL_ DATE_ FORMAT()_ Functions_ Detailed explanation (remember to collect)

LN2220 2A过流5V1A高效率升压IC芯片 DC/DC 电压调整器

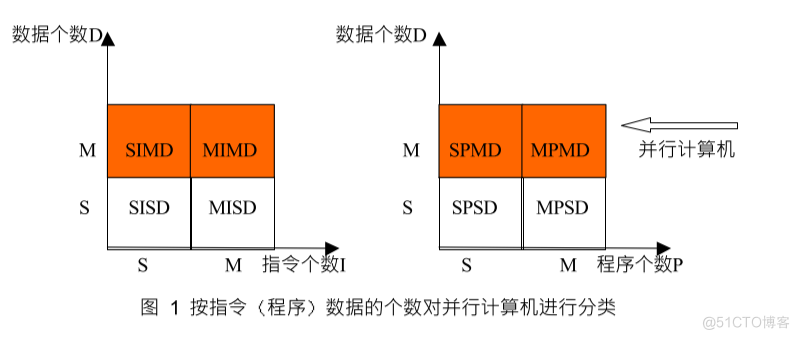

带你区分几种并行

Xcode插件管理工具Alcatraz

QX2308高效 PFM 同步升压 DC/DC 变换器

Quartus II 18.0软件安装包和安装教程

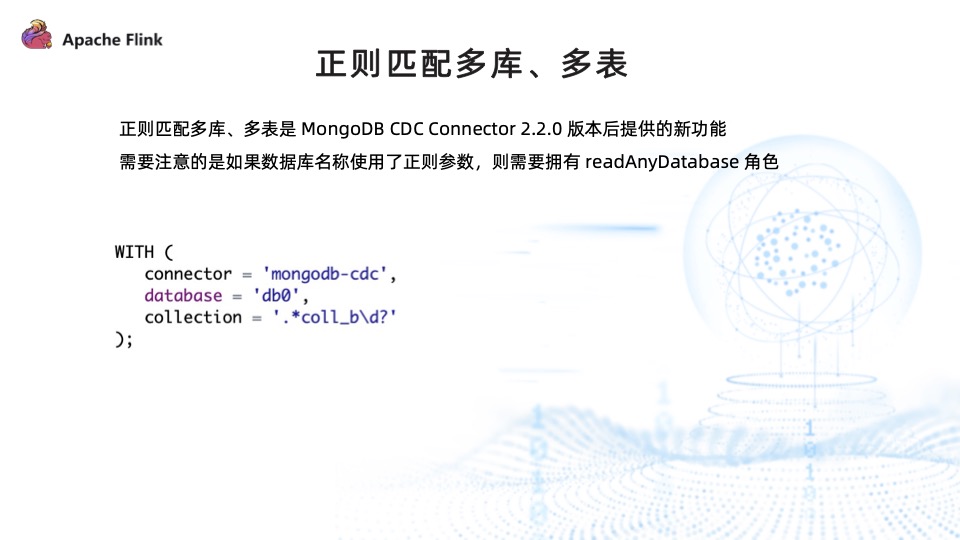

Flink CDC MongoDB Connector 的实现原理和使用实践

什么是GCaMP6f?钙离子成像技术。

随机推荐

What statements are added to MySQL

SD6.20集训总结

1156 Sexy Primes

机器学习之数据处理与可视化【鸢尾花数据分类|特征属性比较】

Envi classic annotation object how to recall modification and deletion of element legend scale added

DO280OpenShift命令及故障排查--访问资源和资源类型

Pfsense configuring tinc site to site tunneling tutorial

FS9935 高效率恒流限流 WLED 驱动IC

软件测试办公工具推荐-桌面日历

Deep learning image data enhancement

Is it possible to update some fields through flinksql?

深度学习图像数据增强

Jenkins定时构建并传递构建参数

什么是eGFP,绿色荧光蛋白

国家认证--软件评测师考试要求

5月刚刚阿里面软件测试岗回来,3+1面任职阿里P7,年薪28*15薪

The second round of layoffs in a large factory is coming, and the routine is full

Harbor高可用集群设计及部署(实操+视频),基于离线安装方式

最高月薪17K,只要心中有一片希望的田野,勤奋耕耘将迎来一片翠绿~

全局负载均衡实现原理