当前位置:网站首页>Future banks need to think about today's structure with tomorrow's thinking

Future banks need to think about today's structure with tomorrow's thinking

2022-06-24 16:49:00 【It Chronicle】

“ Banking needs very sensitive processes and appropriate expertise . at present , The basic structure of many banks faces the risk of a three-tier structure , The future bank should be a two-tier structure .”Alain Benichou ( Bao zhuolan ) It's an engineer , The current IBM President of Greater China .

Not for the sake of selling ,Alain Benichou I hope to share my understanding of the industry with the banking industry .

At the “2019 year IBM Conference of financial innovators ” in ,Alain Benichou This sharing is subversive , What it subverts is that after cloud computing becomes a necessity , A three-tier structure formed in some banks —— This is a risk for the banking industry .

In most banks around the world , Relatively traditional finance IT The architecture is divided into two layers . The first layer is the core business , It is usually deployed on the central server represented by the host ; The second floor , In China's banking industry, it is usually x86 The server , E-banking business represented by Internet business is deployed on it .

Before the migration of banking business to cloud computing , This architecture can achieve the consistency of application data ; But after everything started to cloud , This consistency is threatened .Alain Benichou Think of it as a financial industry IT Architectural risks .

Due to regulatory and bank's own requirements for business sustainability and data security , And the limited market space of the industry's financial cloud , The financial industry is bound to be unable to put all its businesses on the cloud , This has led to the emergence of a third tier architecture beyond the traditional two tier architecture —— On the mainframe 、x86 Outside the server , Add another layer of public cloud .

And that's what Alain Benichou Worried about , Because in the three-tier architecture , It is difficult to fully synchronize data . Even if it can be realized by technology , But not perfect , And it's very difficult .

If the data cannot be synchronized, it will limit the innovation of the business , The question is 5G And artificial intelligence is in the ascendant . Some companies are trying to meet this challenge , For example, subdivide the business , Put part of the content under control ……

The risk is here , But look to the future , This risk is underestimated . With the segmentation of the business ,IT The system as a whole will become fragile , with “ Great risk of failure and collapse ”. Although when some companies encounter technical problems , Some of them rely on virtualization and other technologies to explore , But it did not produce substantial value .

Just like Einstein gave us advice —— We can't solve problems with the way of thinking that we raised problems in the past —— The financial industry should use tomorrow's thinking to think about today's structure .

This is a very persuasive point of view , Especially for the future , This is especially true of bankers who are actively engaged in digital transformation .

IBM Provides a choice . When the three-tier architecture encounters 5G、 Artificial intelligence and other cross era challenges , People should try to solve it with a new two-tier architecture , Instead of continuing to check and fill gaps in the three-tier architecture .

IBM Vice President, 、 Guorensheng, general manager of China's financial industry, regards it as the banking industry “ A strong and agile body ” Component part . This body cooperates with financial enterprises “ The brain ” The transformation of the , In the financial industry , It has covered the open financial service platform 、 Open banking platform 、 Open insurance platform 、 And blockchain platforms .

stay Alain Benichou In the eyes of , A two-tier structure of China's banks and financial institutions in the future should be like this :

The core banking business is deployed on the mainframe or high-end POWER On the processor , Satisfy 7*24 Hourly transaction service demand ; Connect to the public cloud that provides financial services —— Its construction depends on the requirements of the regulatory authorities , in any case , It won't be consumer grade .

Some banks have begun to try to provide export-oriented services , For example, Zhaoyin yunchuang, etc .

This two-tier architecture combines “ A hybrid cloud ”、“ Data and AI” Together, they constitute the three pillars of the digital financial service platform , And finally support the goal of financial enterprises' transformation to cognitive financial enterprises .

It's important to point out that , there “ A hybrid cloud ” To refer to , It contains IBM Cloud platform 、IBM The cloud service 、RedHat Products and services , as well as IBM Hybrid cloud management, etc .

IBM The Institute of business value has visited a number of leading figures in the financial industry , Which about 30% It means that the platform construction has been started , At the same time, more managers also focus on improving the customer experience —— This is obviously because of the challenge of the Internet .

“ We put forward four strategies for the innovation of China's banking industry .” Guorensheng said that these strategies will help banks or financial institutions to reshape digitalization . It involves rethinking the banking organization 、 The importance of rediscovering customer relationships 、 Highly Digital , And reinvigorate innovation .

These are not empty slogans . Take digitalization as an example , A large domestic bank and IBM We have jointly developed risk control systems for tens of thousands of enterprise customers , This allows banks to pass more than... In almost real time 300 A risk control model is used to analyze the risks of enterprise customers .

Under the two-tier architecture , The synchronization of all these data will become more secure and faster —— Around this , There will be more challenges in the future 、 Wider scope —— Let the landing of technologies including more artificial intelligence come naturally .

The two-tier architecture provides the financial industry with a path for digital transformation . A background that cannot be ignored here is , At the birth of the host 40 Many years later , More than 90% of the world's large banks are using mainframe to build the core of infrastructure . therefore , Innovation of the mainframe , About the future .

Support for open banking is one of the key points . The so-called open bank , By using API, Allow third parties to access bank information , And finally achieve the bank as “ market ” Model innovation . In this mode , Banks connect producers and consumers of products and services ,

DBS and IBM Cooperate with these API, Therefore, it can go deep into the automobile market 、 The electricity market , And numerous consumer markets . The bank got customers , And consumers ultimately benefit .

Banks and financial institutions to steady-state 、 Sensitive and intelligent business requirements , It is an indispensable component of the banking industry in the process of digital transformation . according to IBM The cognitive —— These capabilities depend on the transformation of the infrastructure layer to a two-tier infrastructure , Will allow financial enterprises “ Get insight quickly ” Make it possible .

It's not hard to imagine , If the support “ Insight ” The data of cannot be synchronized with the local high-speed security in the cloud , For innovative 、 forthcoming AI for , All data resources will be meaningless , In this way AI Will also become like chicken ribs .

5G Ready for it ,IBM It's the same thing . Remove the two-tier infrastructure , Some applications of artificial intelligence have been implemented .

In France , A bank application IBM Our AI technology automatically replies to customers' emails ,1 The number of email replies in has reached 100 ten thousand G.

Banks using artificial intelligence like technologies are growing rapidly .Alain Benichou Mentioned Hang Seng Bank, Hong Kong, China , It uses robots to help customers complete a series of businesses such as living payment on the phone , The voice is sweet .

Remember the movie 《HER》 Do you ? A sweet voice that can make you fall in love , It already exists in your life .

Different from the sad ending in the movie , To make a “ people ”“ service ” For thousands of customers , This is a result that people are delighted with .

【IT Chuang Ji Ji 】 Creating the future of Technology . Founder Qi Meng , For senior technology we media people , Previous appointment 《 Business partners 》 Deputy editor-in-chief 、《 Computer business newspaper 》 Editor in chief 、 Urban media reporters , More than 14 year . The column with the same name has been settled on various mainstream media platforms .

边栏推荐

- 区块哈希游戏竞猜系统开发(成熟代码)

- How to perform concurrent stress testing on RTSP video streams distributed by audio and video streaming servers?

- 未来银行需要用明天的思维,来思考今天架构

- Introduction to koa (IV) koa operation database

- During JMeter pressure measurement, time_ The number of requests does not go up due to many waits. The problem is solved

- How important is it to document the project? I was chosen by the top 100 up leaders and stood up again

- In those years, I insisted on learning the motivation of programming

- [the activity is over, and the list of winners is announced] in March, techo youth university open class demo practice

- One Minute! No code! Add [statistical analysis] to the website

- How to customize the log output format of zap?

猜你喜欢

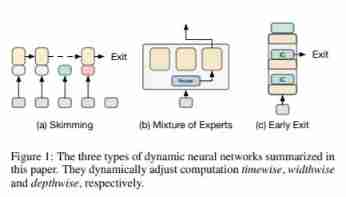

A survey on model compression for natural language processing (NLP model compression overview)

A survey on dynamic neural networks for natural language processing, University of California

Applet wxss

Ps\ai and other design software pondering notes

Problems encountered in the work of product manager

MySQL learning -- table structure of SQL test questions

Daily algorithm & interview questions, 28 days of special training in large factories - the 15th day (string)

Applet - use of template

A survey of training on graphs: taxonomy, methods, and Applications

![[leetcode108] convert an ordered array into a binary search tree (medium order traversal)](/img/e1/0fac59a531040d74fd7531e2840eb5.jpg)

[leetcode108] convert an ordered array into a binary search tree (medium order traversal)

随机推荐

In those years, I insisted on learning the motivation of programming

主链系统发展解析

实现TypeScript运行时类型检查

Complete the log service CLS questionnaire in 1 minute and receive the Tencent cloud 30 yuan threshold free voucher ~

proxy pattern

Popular explanation [redirection] and its practice

zblog系统如何根据用户ID获取用户相关信息的教程

06. Tencent cloud IOT device side learning - Introduction to basic functions

How to pop up an alarm through the national standard gb28181 protocol video platform easygbs for mobile detection / perimeter intrusion detection video recording

Modern finite element analysis can easily achieve accurate results

What is browser fingerprint recognition?

Web page live broadcast on demand RTMP streaming platform easydss newly added virtual live broadcast support dash streaming function

[the activity is over, and the list of winners is announced] in March, techo youth university open class demo practice

AI video structured intelligent security platform easycvr realizes intelligent security monitoring scheme for procuratorate building

[idea] dynamic planning (DP)

Tencent blue whale container management platform was officially released!

Pagoda activities, team members can enjoy a lightweight server 1 core 2g5m 28 yuan for two years

Use Google search like a professional

Introduction to koa (III) koa routing

Tencent released "warehouse express" and issued "ID card" for each commodity!