当前位置:网站首页>Longkou united chemical registration: through 550 million revenue xiu-mei li control 92.5% stake

Longkou united chemical registration: through 550 million revenue xiu-mei li control 92.5% stake

2022-08-01 14:03:00 【leijianping_ce】

Reported by Lei Jianping on July 31

Longkou United Chemical Co., Ltd. (referred to as "Longkou United Chemical") has recently been registered on the Growth Enterprise Market and is expected to be listed on the Shenzhen Stock Exchange in the near future.

Longkou United Chemical plans to raise 398 million yuan, of which 311 million yuan will be used for the production of organic pigments with an annual output of 8,000 tons, 36.82 million yuan will be used for the R&D center construction project, and 50 million yuan will be used to supplement working capital.

Annual revenue of $552 million

Longkou United Chemical was established in 2007. The company's main business is the research and development, production and sales of azo organic pigments and water-based inks.

Longkou United Chemical's main products are yellow, red and orange azo organic pigments and water-based inks.Pigments are mainly used in the field of ink, and a small amount can also be used in other fields such as coatings and plastics.

Yellow and red azo organic pigments are the most commonly used organic pigments in the field of inks. Compared with organic pigments in other fields, organic pigments for inks have higher requirements for transparency, color vividness and tinting strength.

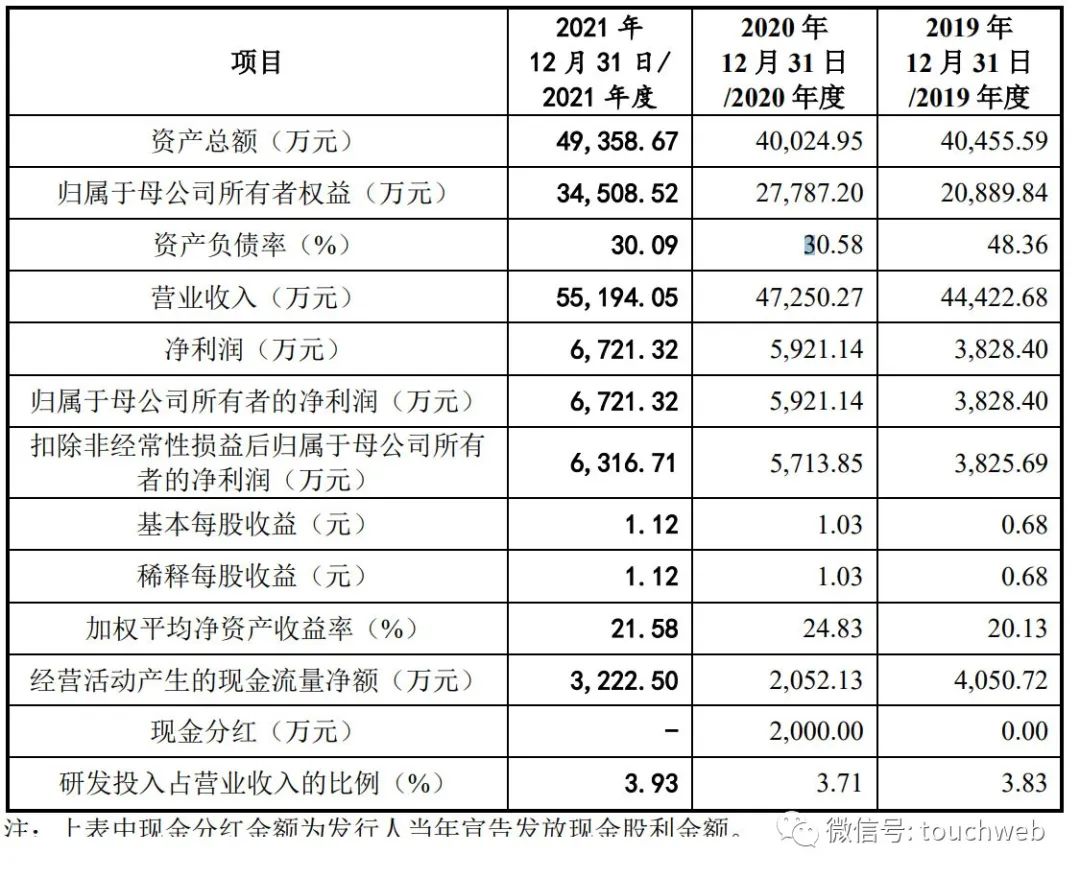

The prospectus shows that the revenue of Longkou United Chemical in 2019, 2020 and 2021 is 444 million yuan, 473 million yuan and 552 million yuan respectively; the net profit is 38.284 million yuan, 59.21 million yuan and 67.2132 million yuan respectively;The non-post net profits were 38.2569 million yuan, 57.1385 million yuan and 63.167 million yuan respectively.

During the reporting period, DIC Co., Ltd. was the largest customer, and the company's sales revenue to DIC Co., Ltd. was 201 million, 207 million, and 247 million, accounting for 45.27%, 43.73%, and 44.82% of revenue, respectively.;DIC Corporation contributed 52.16%, 48.59% and 51.91% to the company's gross profit;

The company's accounts receivable balances to DIC Co., Ltd. were 45.2044 million yuan, 35.7177 million yuan and 73.98 million yuan respectively, accounting for 49.85%, 38.25% and 62.38% of the current accounts receivable balance.

Li Xiumei is the actual controller

The actual controller of Longkou United Chemical is Li Xiumei.

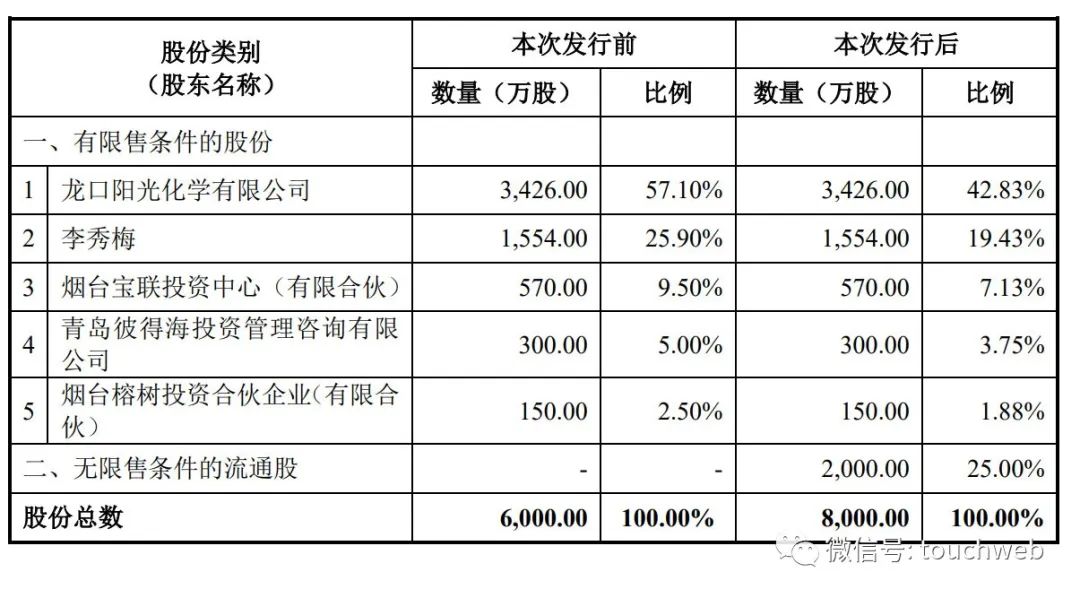

Before this issuance, Li Xiumei directly held 25.9% of the shares, controlled 57.1% of the shares by holding 52% of the shares of Sunshine Chemical, and held 71.74% of the capital contribution of Yantai Baolian Investment Center (Limited Partnership) andAs a managing partner, he controls 9.50% of the shares, directly and indirectly controls 92.5% of the total shares of United Chemical, and is in a controlling position;

Qingdao Peterhai Investment Management Consulting Co., Ltd. holds 5% of the shares, and Yantai Rongshu Investment Partnership (Limited Partnership) holds 2.5% of the shares.

Ms. Li Xiumei: born in 1968, served as the experimenter and director of the R&D Center of Longkou Taihang Pigment Co., Ltd. from August 1990 to December 1996, and served as the technical manager of Longkou Taihang Pigment Co., Ltd. from January 1997 to December 2000, Deputy General Manager, General Manager of Longkou Taihang Pigment Co., Ltd. from January 2001 to April 2003, General Manager of Shandong Taihang Chemical Co., Ltd. from May 2003 to February 2007, General Manager of United Chemical Co., Ltd. since March 2007Manager, director and chairman of the board, currently the chairman and general manager of United Chemical.

Li Xitian: born in 1995, Li Xiumei's nephew, graduated from the City University of Hong Kong in October 2020 with a master's degree in applied sociology, and has worked as an analyst in the investment banking department of Essence Securities Co., Ltd. since January 2021.Since March 2017, he has served as the director of United Chemical.

After this issuance, Ms. Li Xiumei is still the actual controller.

After the IPO, Longkou Sunshine Chemical Co., Ltd. holds 42.83%, Li Xiumei holds 19.43%, Yantai Baolian Investment Center (Limited Partnership) holds 7.13%, and Qingdao Peterhai Investment Management Consulting Co., Ltd. holds 19.43%.3.75%, Yantai Rongshu Investment Partnership (Limited Partnership) holds 1.88%.

———————————————

Lei Di was founded by senior media person Lei Jianping. If you reprint, please indicate the source.

边栏推荐

猜你喜欢

随机推荐

嵌入式开发:创建和使用可移植类型的7个技巧

Programmer's Romantic Tanabata

六石编程学:问题要面对,办法要技巧,做不好的功能要想办法

软件测试之发现和解决bug

分布式中的CAP原理

sql中常用到的正则表达

2022-07-29 网工进阶(二十二)BGP-其他特性(路由过滤、团体属性、认证、AS欺骗、对等体组、子路由器、路由最大接收数量)

Qt实战案例(55)——利用QDir删除选定文件目录下的空文件夹

魔众短链接系统 v3.9.0

PAT 1163 Dijkstra Sequence(30)

数据挖掘-04

The basic knowledge of scripting language Lua summary

又拿三个大奖?!多力就是要让你吃的更营养更健康

为什么最大值加一等于最小值

【二叉树】路径总和II

DDL和DML的含义与区别「建议收藏」

性能测试入门指南

重磅!国内首个开放式在线绘图平台Figdraw突破10万用户!发布《奖学金激励计划》:最高5000元!...

搭建LNMT架构

Data Mining-04