当前位置:网站首页>Making nearly $90billion, Buffett's latest heavy stock exposure

Making nearly $90billion, Buffett's latest heavy stock exposure

2022-06-12 16:56:00 【caijing365】

2 month 26 Sunday night ,“ warren ” warren · Buffett's company Berkshire · Hathaway released 2021 Fourth quarter and full year performance report . This year's 《 Buffett's letter to shareholders 》 It will also be made public .

2021 In, Berkshire realized operating profit of 274.55 Billion dollars ,2020 The year is 219.22 Billion dollars , Year-on-year growth 25.24%. The net profit attributable to the parent is 897.95 Billion dollars , Compared with the same period 425.21 Billion dollars , growth 111.18%.2021 Operating profit in the fourth quarter of 72.85 Billion dollars , Compared with the same period 50.21 Billion dollars , growth 45.09%. The net profit attributable to the parent is 396.5 Billion dollars , Compared with the same period 358.4 Billion dollars , growth 10.63%.

Buffett said in his letter , We hold shares based on our expectations of their long-term operating performance , Instead of speculating on short-term market movements .

Chief economist of Chuancai securities 、 Chen Li, director of the Research Institute, is right 《 Securities daily 》 The reporter said ,“ warren ” The way to invest , First, it depends on the strong analytical ability of investment research , In particular, the mining capacity of the bottom companies is very outstanding . Second, the holding period of some stocks is very long , Be able to patiently and fully enjoy the high dividends of the company from the initial stage to unicorn .

Yangdelong, chief economist of Qianhai open source fund, is accepting 《 Securities daily 》 The reporter said in an interview , from 1965 Year to 2021 year , Berkshire · The compound annual growth rate of Hathaway's market value per share is 20.1%, Significantly better than S & P 500 Exponential 10.5%. Because of the power of compound interest , Berkshire · The growth rate of Hathaway's market value is amazing 36416 times , And S & P 500 The index is 302 times , That means Berkshire · Hathaway's market value has grown in the past 50 Over the years, it has outperformed S & P 500 The index is as high as 100 Many times , This fully reflects the charm of value investment .

Shareholding , By 2021 By the end of year , Berkshire · Hathaway holds apples separately ( Market value 1611.55 Billion dollars )、 Bank of America ( Market value 459.52 Billion dollars )、 American Express ( Market value 248.04 Billion dollars )、 Coca Cola ( Market value 236.84 Billion dollars )、 Moodie ( Market value 96.36 Billion dollars )、 Verizon ( Market value 82.53 Billion dollars )、 United Bank of America ( Market value 80.58 Billion dollars )、 BYD (247.840, 2.98, 1.22%)( Market value 76.93 Billion dollars )、 Chevron ( Market value 44.88 Billion dollars )、 Bank of New York Mellon ( Market value 38.82 Billion dollars ) etc. .

Yang Delong said , The largest heavy stock is still apple , exceed 1611 Billion dollars , Of the total stock position 46% about . It can be seen that , Buffett has always maintained a habit of heavy positions for promising companies , Apple is undoubtedly the most profitable company for him , Also for Berkshire · Hathaway contributed nearly 1000 About $billion in profits .

Besides , BYD, the eighth largest position , Also for the “ warren ” It brings rich rewards .2008 year 9 month , Buffett with 8 The Hong Kong dollar / Price of shares , Jiancang 2.3 Billion dollars . Annual report , Buffett has made money on BYD's investment 32 times .

Yangdelong reminded me , Berkshire · Hathaway has 3500 $billion in equity assets , But there are still a lot of cash positions on the balance sheet , Include 1440 US $billion in cash and cash equivalents, etc . in other words , keep 20% To 30% Cash positions around , There is no full allocation of equity assets .

“ In terms of investment proportion , Technology 、 Financial and consumer stocks account for a relatively high proportion , And pay special attention to growing leading enterprises .” Chen Li analyzed ,A The stock market also pays special attention to value investment and scientific and technological attributes . Combined with the current market , Energy industry and commodities 、 Precious metals in a specific market environment , Investors can focus on . more Stocks information , Focus on finance and Economics 365!

边栏推荐

- About component value transfer

- 博士申請 | 新加坡國立大學Xinchao Wang老師招收圖神經網絡方向博士/博後

- su直接切换到超级管理员模式,这样很多报错都可以避免了

- Sudo of uabntu

- Leetcode 2194. Cellules dans une plage dans un tableau Excel (OK, résolu)

- Latex table online generation

- \Begin{algorithm} notes

- 【树莓派】:(四)Camera 进阶

- \Begin{algorithm} notes

- Unit sshd.service could not be found

猜你喜欢

Preprocessing command section 3

Male god goddess voting source code v5.5.21 voting source code

Information outline recording tool: omnioutliner 5 Pro Chinese version

Gerrit+2触发Jenkins任务

![[research] reading English papers -- the welfare of researchers in English poor](/img/8a/671e6cb6a3f4e3b84ea0795dc5a365.png)

[research] reading English papers -- the welfare of researchers in English poor

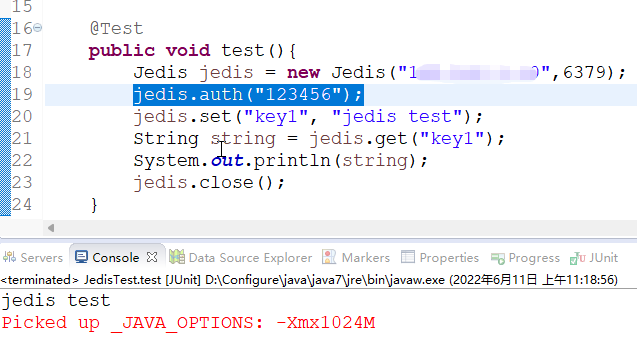

redis. clients. jedis. exceptions. JedisDataException: NOAUTH Authentication required

Cloud development kunkun chicken music box wechat applet source code

快速入门scrapy爬虫框架

有哪些特容易考上的院校?

使用ubantu时,遇见的一些小毛病和解决方法

随机推荐

QCustomplot笔记(一)之QCustomplot添加数据以及曲线

Play kubernetes every 5 minutes summary

程序的动态加载和执行

有趣的 LD_PRELOAD

Schrodinger's Japanese learning applet source code

Latex table online generation

\begin{algorithm} 笔记

Gerrit触发Jenkins SonarQube扫描

IDEA在控制台显示出services,统一管理所有的jetty服务,

Leetcode 2194. Cells within a range in Excel table (yes, solved)

CVPR 2022 | 元学习在图像回归任务的表现

并发三色标记法

Canvas advanced functions (Part 2)

【树莓派】:(四)Camera 进阶

Download PHP source code of leaf sharing station

Swin transformer code explanation

canvas 高级功能(下)

Possible problems of long jump in gaussdb

Anyone who watches "Meng Hua Lu" should try this Tiktok effect

Object. Keys traverses an object