当前位置:网站首页>Uncover the "intelligence tax" of mousse: spend 4billion on marketing, and only 7 invention patents

Uncover the "intelligence tax" of mousse: spend 4billion on marketing, and only 7 invention patents

2022-07-01 16:01:00 【Intelligent relativity】

Recently, the stock market has been quite “ Magic realism ” The smell of .6 month 27 Japan ,#26 Chinese retail investors were fined by the US Securities Regulatory Commission for exceeding 5 Billion # Rush to hot search , Shandong retail investors ran to the United States to manipulate U.S. stocks , Stealing chickens doesn't eat rice , By the United States SEC to punish severely . On the other side , It was exposed by an inquiry letter from the CSRC “ Fake foreign brand ” Essential Muse shares , On 6 month 23 It was listed on the main board of Shenzhen Stock Exchange on the th , Cause a sigh .

as everyone knows , all A All listed companies should bear their own social responsibilities . And self admiration “ Fake foreign brand ” Events ferment to this day , The real identity of the foreign elderly in its advertisement , And whether there are false publicity and other related problems in the product publicity , Muse has never given a satisfactory explanation to the public .

Now it is listed in the sound of frequent doubts , More questions also follow .

3 Annual smash 40 Billion marketing , Where does the money come from ?

In the past two years, there has been an impact IPO, Muse's financial report data looks particularly “ beautiful ”. data display , Muse's revenue in recent three years 38.62 Billion 、44.52 Billion 、64.81 Billion , Year-on-year growth 21.16%、15.29%、45.56%. The glossiness of the surface can't hide the fact that this enterprise likes to go “ shortcut ” Fact , A comparison of gross profit margin shows . According to the prospectus of Muse shares , The gross profit margin of Muse in recent three years is 53.49%、49.14%、44.45%, Higher than the average of peers 10 to 15 percentage .

Ultra high gross profit margin depends on low-cost investment . Take the category of mattresses , As the most profitable product line of mousse , The average unit cost of mattresses in the past three years is about 900 yuan , However, most mattress products in Muse stores sell for about 10000 yuan , One can imagine the huge profits .

Why dare you sell such a high price at such a low cost ? I have to say that mousse is very clever , Know how to set up for yourself with marketing “ persona ”, Do not hesitate to spend a lot of money to build a “ On the tall ” The brand image of . According to the prospectus of Muse shares ,2019 year -2021 year , The selling expenses of mousse shares are 12.1 One hundred million yuan 、11.1 One hundred million yuan 、 and 16 One hundred million yuan , The total cost of three years is close to terrible 40 Billion , And a peer listed company 3 The annual selling expense is only 28 One hundred million yuan , Be inferior by comparison .

Infamous OST , Actually difficult. . What comes out of a sheep comes out of a sheep , Marketing without product power is ultimately a castle in the air . When more and more people begin to understand the truth , When “ Foreign leather coat ” The marketing method of has been thoroughly exposed , What is the high-end mattress of muse that costs ten thousand yuan 、 A symbol of luxury , Or cut leeks 、 IQ tax is synonymous with ? Believe that the answer is self-evident .

But compared with consumers' hindsight , Dealers are more “ The world is sober ”. last year 8 month , Musk Hubei dealers reported that musk deducted its taxes , Received a response from a number of dealers . Regarding this , Muse except oral excuses , So far, no effective solution has been put forward , This can not help but make people guess that Muse's internal management is not done and the business mode is chaotic .

Unfaithful to consumers , Unjust to partners , When such enterprises enter A After the stock market , How can we be honest with investors , Win their trust ?

7 Invention patents ,“ Sleep leader ” Can the image stand ?

Muse has always been “ Global sleep brand leader ” Our corporate image shows people , Not only deeply ploughed into the field of sleep for more than ten years , And emphasize the importance of research and development , Strive to pass the design 、 Material and intelligent technology innovation realize the iterative upgrading of product matrix , Improve people's sleep quality .

So is this really the case ?

According to the prospectus , Compared with the investment on the marketing side , Muse's investment in R & D is only a drop in the bucket . data display , Muse from 2019 Year to 2021 The total annual R & D expenses are 3.19 One hundred million yuan , Accounting for about% of the operating revenue 2%, Less than one twelfth of the marketing expenses .

R & D investment is stingy , It also leads to scientific research patents “ There's shyness in the bag ”. In terms of proprietary patents , By 2021 year 12 month 31 Japan , The company and its subsidiaries have 940 Patent rights , Including design patent 730 individual , Utility model patent 203 individual , Invention patents only 7 individual .

I believe everyone in the industry knows , The gold content of patented technology , Usually invention > Utility model > Design . If an enterprise has a scientific research patent 70% The above are all exterior designs , The R & D level of this enterprise is actually stretched .

Even if “ dried food ” Insufficient , Muse still regards itself as a technology driven enterprise , And make a full article on the application of new materials , Introduce Japanese imports “ Space resin ball ” New material mattress , It is said to be the only , Toyota's exclusive authorized agent .

The prospectus of Comus shows ,“ Space resin ball ” Materials are purchased from Dongguan Sino Japanese home furnishing Co., Ltd , Not imported . And the material is not a natural product , It's a chemical compound , The relevant trademark application status also shows invalid and awaits substantive examination . Can this mattress quality really improve sleep ?

so to speak , Investment in R & D 、 When the output is not brilliant , Muse's own strength is still difficult to join the ranks of scientific and technological innovation enterprises , Its image as a leader in the sleep industry is also difficult to stand on .

The truth may be buried , But it won't disappear out of thin air . Consumers and investors are the most important part of the market circulation , We should also rationally view the listing of Muse shares , Only understand the operation logic and product strength behind it , To know the truth , Master the initiative of investment and consumption .

边栏推荐

- She is the "HR of others" | ones character

- Photoshop plug-in HDR (II) - script development PS plug-in

- [target tracking] |stark

- [每日一氵]Latex 的通讯作者怎么搞

- The newly born robot dog can walk by himself after rolling for an hour. The latest achievement of Wu Enda's eldest disciple

- Introduction to RT thread env tool (learning notes)

- Go language learning notes - Gorm use - table addition, deletion, modification and query | web framework gin (VIII)

- 二叉树的前序,中序,后续(非递归版本)

- Automatic, intelligent and visual! Deeply convinced of the eight designs behind sslo scheme

- Please, stop painting star! This has nothing to do with patriotism!

猜你喜欢

Tensorflow team: we haven't been abandoned

![[target tracking] |stark](/img/e2/83e9d97cfb8c49cfb8d912cfe2f858.png)

[target tracking] |stark

基于PHP的轻量企业销售管理系统

Photoshop plug-in HDR (II) - script development PS plug-in

2022 Moonriver全球黑客松优胜项目名单

How does win11 set user permissions? Win11 method of setting user permissions

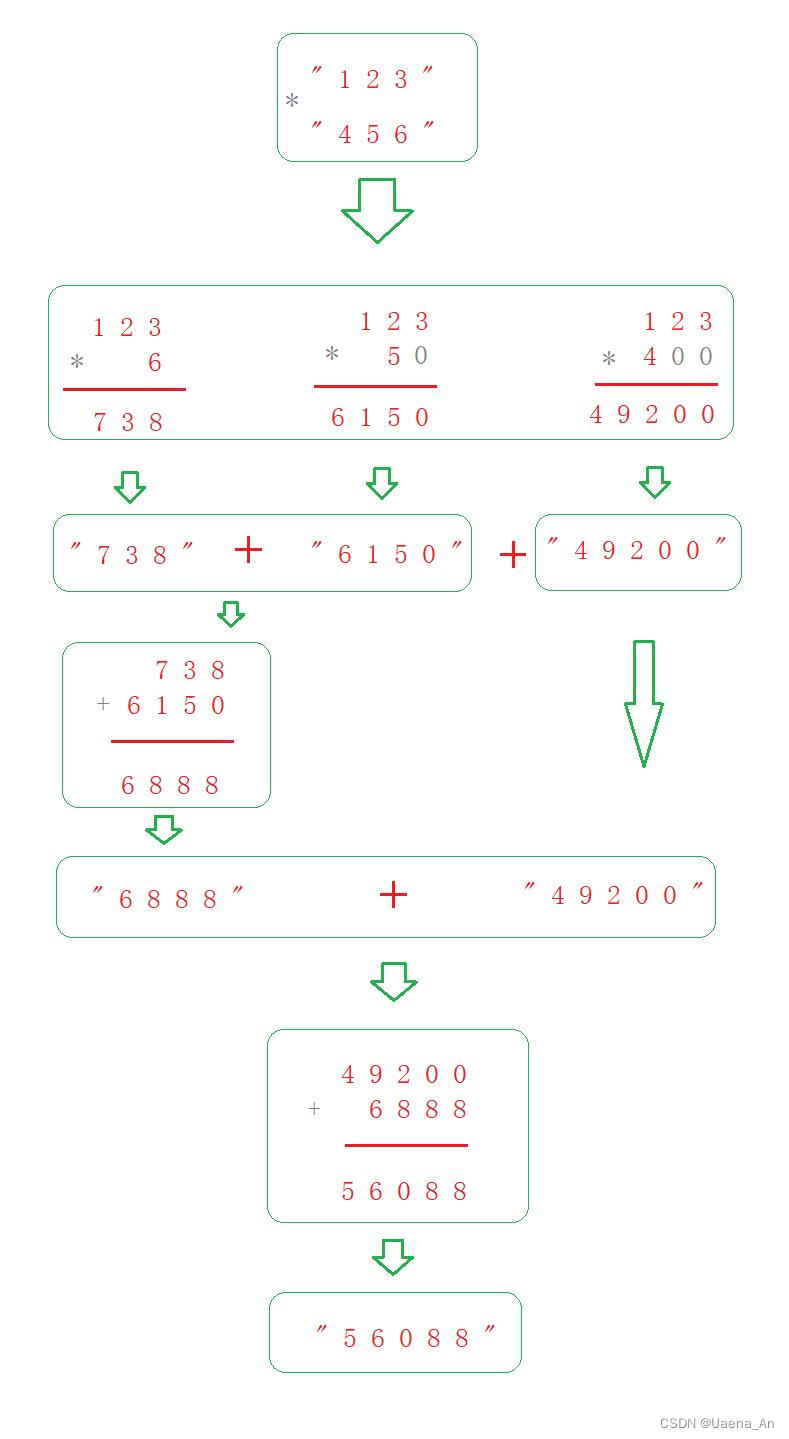

【LeetCode】43. String multiplication

Share the daily work and welfare of DJI (Shenzhen headquarters) in Dajiang

Programming examples of stm32f1 and stm32subeide - production melody of PWM driven buzzer

idea启动Command line is too long问题处理

随机推荐

Factory high-precision positioning management system, digital safety production management

[200 opencv routines] 216 Draw polylines and polygons

Malaysia's Star: Sun Yuchen is still adhering to the dream of digital economy in WTO MC12

【LeetCode】43. String multiplication

MySQL的零拷贝技术

Task.Run(), Task.Factory.StartNew() 和 New Task() 的行为不一致分析

[PHP graduation design] design and implementation of textbook management system based on php+mysql+apache (graduation thesis + program source code) -- textbook management system

Pocket Network为Moonbeam和Moonriver RPC层提供支持

MySQL backup and restore single database and single table

自動、智能、可視!深信服SSLO方案背後的八大設計

Preorder, inorder, follow-up of binary tree (non recursive version)

近半年内连获5家“巨头”投资,这家智能驾驶“黑马”受资本追捧

自动、智能、可视!深信服SSLO方案背后的八大设计

表格存储中tablestore 目前支持mysql哪些函数呢?

Huawei issued hcsp-solution-5g security talent certification to help build 5g security talent ecosystem

电脑照片尺寸如何调整成自己想要的

HR interview: the most common interview questions and technical answers

Detailed explanation of stm32adc analog / digital conversion

七夕表白攻略:教你用自己的专业说情话,成功率100%,我只能帮你们到这里了啊~(程序员系列)

Programming examples of stm32f1 and stm32subeide - production melody of PWM driven buzzer