当前位置:网站首页>Analysis report on market demand and investment strategy of China's re guarantee industry 2022-2028

Analysis report on market demand and investment strategy of China's re guarantee industry 2022-2028

2022-06-12 18:58:00 【LL587】

Analysis report on market demand and investment strategy of China's re guarantee industry 2022-2028 year

For details, please consult Hongsheng Xinhe Research Institute !

【 New revision 】:2022 year 2 month

【 Author 】: Hongsheng Xinhe Research Institute

The first 1 Chapter : Overview of the development of re guarantee industry

1.1 Definition and characteristics of re guarantee industry

1.1.1 Definition of re guarantee industry

1.1.2 Characteristics of the re guarantee industry

(1) Characteristics of the re guarantee industry

(2) And guarantee 、 The difference between counter guarantee

1.1.3 Re guarantee industry classification

(1) Classified according to different main guarantees

(2) Classified by way of re guarantee

1.1.4 The subject of the secured transaction

1.2 Conditions for the establishment of re guarantee

1.2.1 Conditions established at the national level

1.2.2 Conditions for establishment at the provincial level

The first 2 Chapter : Analysis on the development environment of the re guarantee industry

2.1 Industry economic environment analysis

2.1.1 Analysis of domestic economic environment

(1) At home GDP Growth rate

(2) The growth rate of industrial production

(3) Investment in fixed assets

(4) Domestic economic environment forecast

2.1.2 Economic and environmental impact analysis

2.2 Industrial environment analysis

2.2.1 Analysis of domestic financial environment

(1) Analysis of bank asset scale

(2) Bank loan investment analysis

(3) Bank risk capability analysis

2.2.2 Analysis of regional financial innovation

(1) Analysis of regional financial competitiveness

(2) Analysis on the development of regional science, technology and finance

(3) Analysis of regional rural financial development

2.2.3 The development trend of financial innovation

(1) Internet Finance formed by financial networking .

(2) Big finance formed by financial integration .

(3) The entity finance formed by the low virtualization of finance .

2.3 Industry policy environment analysis

2.3.1 The regulatory system of China's re guarantee industry

2.3.2 Overview of policies and regulations in the re guarantee industry

2.3.3 Applicability and value analysis of re guarantee

(1) Re guarantee enterprise value analysis

(2) Legal applicability of the re guarantee

2.4 Industry social environment analysis

2.4.1 Construction of social credit system

2.4.2 Talent construction in the credit field

The first 3 Chapter : Development status of international re guarantee industry

3.1 Development status of re guarantee industry in Japan

3.1.1 The financing model of small and medium-sized enterprises in Japan

(1) Financial institutions for small and medium-sized enterprises established by the government

(2) Joint contribution system

(3) Credit supplement system for small and medium-sized enterprises

(4) The system of mutual financial assistance among enterprises

(5) Equipment leasing system

3.1.2 Operation mode of Japan's re guarantee system

(1) System development process

(2) System operation mechanism

(3) How to raise funds

(4) Credit guarantee structure

(5) Risk aversion mode

3.1.3 Japan's re Guarantee Industry Cooperation Agency

3.1.4 Product analysis of Japan's re guarantee industry

3.1.5 Analysis on the characteristics of Japan's re guarantee industry

(1) The procedure of credit re guarantee for small and medium-sized enterprises is simple 、 Efficient operation

(2) risk sharing 、 The rate design is reasonable

3.1.6 Successful experience of Japan's re guarantee industry

(1) The legal system guarantees the credit re guarantee of small and medium-sized enterprises

(2) Advanced technology supports the credit re guarantee of small and medium-sized enterprises

3.2 Development status of Korean re guarantee industry

3.2.1 Financing model of small and medium-sized enterprises in Korea

(1) Small and medium-sized enterprise venture fund

(2)KASDAQ( Gosdak ) market

(3)“MOU” plan

3.2.2 Operation mode of Korean re guarantee system

(1) How to raise funds

(2) Credit guarantee structure

(3) Risk aversion mode

3.2.3 Korean re Guarantee Industry Cooperation Agency

3.2.4 Analysis on the characteristics of Korean re guarantee industry

(1) Diversified sources of funds

(2) The rights and obligations are reasonably set

3.2.5 Successful experience of Korean re guarantee industry

(1) The government strongly promotes the credit re guarantee of small and medium-sized enterprises

(2) Diversification of credit re guarantee functions of small and medium-sized enterprises

(3) The varieties of credit re guarantee for small and medium-sized enterprises have been continuously innovated

3.3 Development status of American re guarantee industry

3.3.1 The financing model of small and medium-sized enterprises in the United States

(1) National guarantee system

(2) Regional guarantee system

(3) Social guarantee system

(4) Commercial guarantee mode

3.3.2 Operation mode of American re guarantee system

(1) How to raise funds

(2) Credit guarantee structure

(3) Risk aversion mode

3.3.3 American re Guarantee Industry Cooperation Agency

3.3.4 Product analysis of American re guarantee industry

3.3.5 Analysis on the characteristics of American re guarantee industry

(1) The government directly operates the credit re guarantee of small and medium-sized enterprises

(2) The supervision and review work is strict

(3) Small and medium-sized enterprises' credit guarantee projects cover a wide range

3.3.6 Successful experience of American re guarantee industry

(1) The strong support of the government

(2) The bank has to bear a certain proportion of the risk

(3) There are many kinds of products , Both short and long term

3.4 Development status of German re guarantee industry

3.4.1 German SME financing model

3.4.2 Operation mode of German re guarantee system

3.4.3 German re Guarantee Industry Cooperation Agency

3.4.4 Analysis on the characteristics of German re guarantee industry

(1) The distribution of credit guarantee institutions for small and medium-sized enterprises is reticular

(2) Small and medium-sized enterprises' credit re guarantee risk sharing is reasonable

(3) Small and medium-sized enterprise credit guarantee loan projects are mainly medium and long-term

3.4.5 Successful experience of German re guarantee industry

(1) All departments should cooperate closely , Increase of efficiency

(2) The loan bank shall share the guarantee risk

(3) We need to give full play to the mutual assistance role of the economic community

The first 4 Chapter : Analysis on the development of China's re guarantee industry

4.1 Demand analysis of the re guarantee industry

4.1.1 Analysis on the development of small and medium-sized enterprises

(1) Analysis on the development scale of small and medium-sized enterprises

(2) Analysis on the regional distribution of small and medium-sized enterprises

(3) Industry distribution analysis of small and medium-sized enterprises

4.1.2 Analysis on financing guarantee of small and medium-sized enterprises

(1) Analysis of the current situation of enterprise financing in China

(2) Analysis on the financing environment of small and medium-sized enterprises

(3) Analysis of financing channels of small and medium-sized enterprises

(4) Investigation on financing cost of small and medium-sized enterprises

(5) Analysis on financing guarantee of small and medium-sized enterprises

4.1.3 Analysis on the demand for re guarantee of high-tech enterprises

(1) Analysis on the necessity of the development of re guarantee system

(2) Basic process analysis of re guarantee business

4.2 Analysis on the development of guarantee system in China

4.2.1 Overview of the development of guarantee system

4.2.2 Development scale of guarantee system

(1) Number and scale of guarantee industry

(2) Registered capital of guarantee industry

(3) The source of funds for the guarantee industry

(4) Net assets of the guarantee industry

(5) Guarantee industry companies' cash guarantee ability

(6) Compensation in the guarantee industry

(7) Analysis on the balance of guarantee in the guarantee industry and the balance of financing guarantee

4.2.3 There are problems in the guarantee system

(1) Single source of funds 、 Small scale 、 Low leverage

(2) Facing the double risks of credit institutions and small, medium and micro enterprises

(3) Lack of risk management and fund compensation mechanism

(4) be short of talents 、 Low credit rating

(5) Lack of institutional norms and policies

4.2.4 Development trend of guarantee industry

(1) Commercial operation trend

(2) Market segment specialization trend

(3) The development trend of integrated alliance

(4) silver 、 Protect 、 The development trend of enterprise cooperation

(5) Competitive trends

(6) Shuffle trend

4.3 Analysis on the development of China's re guarantee system

4.3.1 Development process of re guarantee system

4.3.2 Development status of re guarantee industry

(1) Re guarantee industry development system

(2) The development scale of the re guarantee industry

4.3.3 Operation mode of re guarantee system

(1) Set up analytic hierarchy process

(2) Operation mode construction

(3) Source and management of institutional funds

(4) The way of assuming responsibility

4.3.4 There are problems in the re guarantee industry

(1) Single source of funds , Insufficient compensation funds

(2) Risk sharing ratio and premium income are unreasonable

(3) The credit increase is not obvious 、 There is no standard for cooperation

(4) The location is unknown , The business is complicated

(5) Lack of innovation 、 Regulatory chaos

The first 5 Chapter : Analysis on the operation mode of China's re guarantee industry

5.1 Analysis of Jiangsu model of re guarantee industry

5.1.1 Analysis on supporting policies of guarantee industry in Jiangsu Province

5.1.2 Analysis on the operation status of guarantee industry in Jiangsu Province

5.1.3 Development model of Jiangsu Province's re guarantee industry

(1) Development strategy of re guarantee industry

(2) The establishment mode of re guarantee institution

(3) The operation mechanism of the re guarantee institution

5.1.4 Development scale of re guarantee industry in Jiangsu Province

5.1.5 Risk control mechanism of Jiangsu Province's re guarantee institutions

5.1.6 The development prospect of Jiangsu Province's re guarantee industry

(1) The production and sales of small and medium-sized enterprises grew steadily

(2) The benefits of small and medium-sized enterprises are growing at a low speed

(3) Analysis on financing demand gap of small and medium-sized enterprises

(4) Analysis on the market capacity of the re guarantee industry in Jiangsu Province

5.2 Analysis of Guangdong model of re guarantee industry

5.2.1 Analysis on supporting policies of guarantee industry in Guangdong Province

5.2.2 Analysis on the operation status of guarantee industry in Guangdong Province

(1) Analysis on the operation status of guarantee industry in Guangdong Province

(2) Analysis on the growth potential of guarantee industry in Guangdong Province

5.2.3 Development model of Guangdong Province's re guarantee industry

5.2.4 The development scale of Guangdong Province's re guarantee industry

5.2.5 Risk control mechanism of Guangdong re guarantee institution

5.2.6 The development prospect of Guangdong Province's re guarantee industry

(1) Analysis on financing demand gap of small and medium-sized enterprises

(2) Analysis on the market capacity of Guangdong re guarantee industry

5.3 Analysis of Anhui model of re guarantee industry

5.3.1 Analysis on supporting policies of guarantee industry in Anhui Province

5.3.2 Analysis on the operation status of guarantee industry in Anhui Province

5.3.3 The development model of re guarantee industry in Anhui Province

5.3.4 The development scale of re guarantee industry in Anhui Province

5.3.5 Risk control mechanism of Anhui re guarantee institution

5.3.6 The development prospect of re guarantee industry in Anhui Province

5.4 Analysis of Beijing model of re guarantee industry

5.4.1 Analysis on supporting policies of guarantee industry in Beijing

5.4.2 Analysis on the current situation of guarantee industry in Beijing

(1) The number of institutions in the financing guarantee industry in Beijing has declined as a whole

(2) The newly increased amount of guarantee in the guarantee industry in Beijing has a downward trend

5.4.3 Development model of Beijing re guarantee industry

(1) Development strategy of re guarantee industry

(2) The operation mechanism of the re guarantee institution

5.4.4 The development scale of Beijing's re guarantee industry

5.4.5 Risk control mechanism of Beijing re guarantee institution

5.4.6 The development prospect of Beijing re guarantee industry

5.5 Analysis of other models in the re guarantee industry

5.5.1 Analysis of the Northeast model of the re guarantee industry

(1) Financing status of small and medium-sized enterprises in Northeast China

(2) Development status of guarantee industry in Northeast China

(3) Re guarantee operation mode in Northeast China

5.5.2 Analysis of Jiangxi model of re guarantee industry

5.5.3 Analysis of Shenzhen model of re guarantee industry

(1) About the center

(2) Business principles

(3) Credit line and risk allocation

(4) Internal operation

5.5.4 Comparative analysis of local re guarantee modes

(1) Main business comparison

(2) Profit model comparison

(3) Credit rating comparison

The first 6 Chapter : Risk management and benefit analysis of re guarantee industry

6.1 Analysis on the current situation of income and risk of re guarantee system

6.1.1 Income analysis of re guarantee system

6.1.2 Risk analysis of re guarantee system

6.1.3 Risk control measures for re guarantee business

(1) Straighten out the government 、 Business relations

(2) Strive for the maximum support of the bank

(3) Establish a re guarantee risk control management system and standard system

(4) Fully identify the risks of enterprises and guarantee companies

(5) Timely risk management and disposal

6.2 Construction and analysis of income model of re guarantee system

6.2.1 Analysis on the influencing factors of the income of the re guarantee business entity

(1) Analysis of influencing factors of bank income

(2) Analysis of factors affecting the income of guarantee institutions

(3) Analysis of factors affecting the income of re guarantee institutions

6.2.2 Analysis on the construction of income model of re guarantee system

(1) The income model of the re guarantee system

(2) Comparative analysis of the income of the transaction subject of the re guarantee system

(3) Analysis on the income trend of trading subjects in the re guarantee system

The first 7 Chapter : Operation analysis of key enterprises in the re guarantee industry

7.1 Analysis on the overall operation of domestic re guarantee enterprises

7.2 Analysis on the operation of key domestic re guarantee enterprises

7.2.1 Northeast small and medium-sized enterprise credit re Guarantee Co., Ltd

(1) Enterprise development profile analysis

(2) Enterprise main business analysis

(3) Enterprise organizational structure analysis

(4) Business performance analysis

(5) Analysis of enterprise cooperation institutions

(6) Analysis of advantages and disadvantages of enterprise competition

(7) Analysis of the latest development trend of the enterprise

7.2.2 Beijing SME credit re Guarantee Co., Ltd

(1) Enterprise development profile analysis

(2) Enterprise main business analysis

(3) Enterprise organizational structure analysis

(4) Business performance analysis

(5) Analysis of enterprise cooperation institutions

(6) Enterprise credit capability analysis

(7) Analysis of advantages and disadvantages of enterprise competition

(8) Analysis of the latest development trend of the enterprise

7.2.3 Jiangsu credit re guarantee Group Co., Ltd

(1) Enterprise development profile analysis

(2) Enterprise main business analysis

(3) Enterprise organizational structure analysis

(4) Business performance analysis

(5) Analysis of enterprise cooperation institutions

(6) Enterprise credit capability analysis

(7) Analysis of advantages and disadvantages of enterprise competition

(8) Analysis of the latest development trend of the enterprise

7.2.4 Guangdong financing re Guarantee Co., Ltd

(1) Enterprise development profile analysis

(2) Enterprise main business analysis

(3) Enterprise organizational structure analysis

(4) Business performance analysis

(5) Analysis of enterprise cooperation institutions

(6) Enterprise credit capability analysis

(7) Analysis of advantages and disadvantages of enterprise competition

(8) Analysis of the latest development trend of the enterprise

7.2.5 Shandong re guarantee Group Co., Ltd

(1) Enterprise development profile analysis

(2) Enterprise main business analysis

(3) Enterprise organizational structure analysis

(4) Business performance analysis

(5) Analysis of enterprise cooperation institutions

(6) Enterprise credit capability analysis

(7) Analysis of advantages and disadvantages of enterprise competition

(8) Analysis of the latest development trend of the enterprise

7.2.6 Gansu re guarantee Group Co., Ltd

(1) Enterprise development profile analysis

(2) Enterprise main business analysis

(3) Enterprise organizational structure analysis

(4) Business performance analysis

(5) Analysis of enterprise cooperation institutions

(6) Enterprise risk management analysis

(7) Analysis of advantages and disadvantages of enterprise competition

(8) Analysis of the latest development trend of the enterprise

7.2.7 Shaanxi credit re Guarantee Co., Ltd

(1) Enterprise development profile analysis

(2) Enterprise main business analysis

(3) Enterprise organizational structure analysis

(4) Business performance analysis

(5) Analysis of enterprise cooperation institutions

(6) Analysis of advantages and disadvantages of enterprise competition

(7) Analysis of the latest development trend of the enterprise

7.2.8 Shanxi financing re guarantee Group Co., Ltd

(1) Enterprise development profile analysis

(2) Enterprise main business analysis

(3) Enterprise organizational structure analysis

(4) Business performance analysis

(5) Analysis of enterprise cooperation institutions

(6) Analysis of advantages and disadvantages of enterprise competition

(7) Analysis of the latest development trend of the enterprise

7.2.9 Hunan financing guarantee Group Co., Ltd

(1) Enterprise development profile analysis

(2) Enterprise main business analysis

(3) Enterprise organizational structure analysis

(4) Business performance analysis

(5) Analysis of enterprise cooperation institutions

(6) Enterprise credit capability analysis

(7) Analysis of advantages and disadvantages of enterprise competition

(8) Analysis of the latest development trend of the enterprise

7.2.10 Shenzhen SME credit re Guarantee Center

(1) Institutional development profile analysis

(2) Analysis of the main business of the institution

(3) Organization structure analysis

(4) Business performance analysis of the organization

(5) Analysis of advantages and disadvantages of institutional competition

(6) Analysis of the latest development trend of the organization

7.2.11 Shanghai re Guarantee Co., Ltd

(1) Enterprise development profile analysis

(2) Enterprise main business analysis

(3) Enterprise organizational structure analysis

(4) Business performance analysis

(5) Enterprise credit capability analysis

(6) Analysis of advantages and disadvantages of enterprise competition

(7) Analysis of the latest development trend of the enterprise

7.2.12 Suzhou credit re Guarantee Co., Ltd

(1) Enterprise development profile analysis

(2) Enterprise main business analysis

(3) Enterprise organizational structure analysis

(4) Business performance analysis

(5) Analysis of enterprise cooperation institutions

(6) Analysis of advantages and disadvantages of enterprise competition

(7) Analysis of the latest development trend of the enterprise

7.2.13 Jiangsu Jinchuang credit re Guarantee Co., Ltd

(1) Enterprise development profile analysis

(2) Enterprise main business analysis

(3) Enterprise organizational structure analysis

(4) Business performance analysis

(5) Analysis of enterprise cooperation institutions

(6) Analysis of advantages and disadvantages of enterprise competition

(7) Analysis of the latest development trend of the enterprise

The first 8 Chapter : Analysis on the development prospect and trend of re guarantee industry

8.1 Risk analysis of the development of the re guarantee industry

8.1.1 market risk

8.1.2 Credit risks

(1) Credit risk of the insured enterprise

(2) Credit risk of guarantee institution

8.1.3 Operational risk

8.1.4 Regulatory risk

8.2 Analysis on the development trend of re guarantee industry

8.2.1 Improve the cooperation mechanism between banks and banks

8.2.2 Industry regulation is more reasonable

8.2.3 The status of state-owned capital has risen

8.2.4 The guarantee industry is strong and powerful

8.3 Analysis on Development Suggestions of re guarantee industry

8.3.1 Innovative institutional cooperation model

8.3.2 Improve industry laws and regulations

8.3.3 Build a diversified capital structure

8.3.4 Improve the credit rating system

Table of figures

Chart 1: guarantee 、 The difference between counter guarantee and re guarantee industries

Chart 2: Classification of re guarantee methods

Chart 3: The way of re guarantee classified by the way of treatment

Chart 4: The subject relationship of the re guarantee transaction

Chart 5: Conditions for establishing a financing guarantee company

Chart 6:《 Regulation on supervision and administration of financing guarantee companies 》 Conditions for the establishment of branches by financing guarantee companies

Chart 7:2016-2021 In China GDP charts ( Company : One hundred million yuan ,%)

Chart 8:2016-2021 In, the industrial added value of Enterprises above designated size increased year-on-year ( Company :%)

Chart 9:2016-2021 Investment in fixed assets of the whole society and its growth rate in ( Company : One hundred million yuan ,%)

Chart 10:2021 The growth rate of China's main macroeconomic indicators in ( Company :%)

Chart 11:2016-2021 Changes in asset size of banking financial institutions in ( Company : Trillion yuan ,%)

Chart 12:2021 In, commercial bank loans were mainly invested in ( Company :%)

Chart 13:2016-2021 Changes in loan balance of small and micro enterprises in ( Company : Trillion yuan ,%)

Chart 14:2016-2021 year “ Agriculture, rural areas and farmers ” Changes in loan balance ( Company : Trillion yuan )

Chart 15:2016-2021 Anti risk capability of commercial banks in ( Company :%)

Chart 16:2021 Ranking of China's provincial financial competitiveness in

Chart 17:2016-2021 The proportion of land circulation area in the area of cultivated land under management in China ( Company :%)

Chart 18: Changes in the regulatory body

Chart 19:2016-2021 Relevant regulatory policies for the re guarantee industry in

Chart 20:2016-2021 Promotional policies for the re guarantee industry in

Chart 21:2016-2021 Normative regulations of the re guarantee industry in

Chart 22: The construction and development of China's social credit system

Chart 23: Operation mode of Japan's re guarantee system

Chart 24: Japan's financial support for the financial public treasury of small and medium-sized enterprises ( Company :%)

Chart 25: The business process of Japanese credit re guarantee system

Chart 26: Operation mode of Korean re guarantee system

Chart 27: The service scope of Korea credit guarantee fund Federation

Chart 28: The review content of the guarantee project in the United States

Chart 29: Three advantages of German guarantee banks

Chart 30:2016-2021 China's SME development index in (SMEDI) Operation of the

Chart 31: Number distribution of Chinese industrial enterprises by scale ( Company :%)

Chart 32: Distribution of assets of Chinese industrial enterprises by scale ( Company :%)

Chart 33: Distribution of main business income of Chinese industrial enterprises by scale ( Company :%)

Chart 34: Distribution of total profits of Chinese industrial enterprises by scale ( Company :%)

Chart 35:2021 year Q2 The sub regional development index of China's small and medium-sized enterprises

Chart 36: Small industrial enterprises in China TOP10 Distribution of provinces and cities ( Company :%)

Chart 37:2021 Development index of China's small and medium-sized enterprises by industry in

Chart 38: External financing mode of Chinese enterprises

Chart 39:2021 Bond issuance in ( Company : Trillion yuan )

Chart 40:2021 year 1-7 Monthly investment in mainland China by Region ( Company : home , Billion dollars ,%)

Chart 41:2021 year 1-7 Top ten countries with monthly investment amount / Regional investment in the mainland ( Company : Billion dollars )

Chart 42: An analysis of the reasons for the financing difficulties of small and medium-sized enterprises

Chart 43: Proportion of financing channels of small and medium-sized enterprises ( Company :%)

Chart 44:2021 A survey of financing costs of small and medium-sized enterprises in ( Company :%)

Chart 45:2016-2021 The balance of financing guarantee loans for small and medium-sized enterprises in China in ( Company : One hundred million yuan ,%)

Chart 46:2022-2027 Forecast of new loan demand for small and medium-sized enterprises in China in ( Company : Trillion yuan )

Chart 47:2022-2027 Forecast of financing guarantee market capacity of China's small and medium-sized enterprises in ( Company : Trillion yuan )

Chart 48: A comparative analysis of the three modes

Chart 49: The role of re guarantee in the financing of high-tech enterprises

Chart 50: The characteristics of the development of China's credit guarantee industry

Chart 51:2016-2021 Development of financing guarantee institutions in China in

Chart 52:2016-2021 The number and growth of financing guarantee institutions in China in ( Company : home ,%)

Chart 53:2016-2021 The average registered capital of China's financing guarantee institutions in ( Company : One hundred million yuan ,%)

Chart 54:《 Regulation on supervision and administration of financing guarantee companies 》 Measures and contents

Chart 55:2016-2021 Total assets of China's financing guarantee institutions in ( Company : One hundred million yuan ,%)

Chart 56:2016-2021 The net asset scale of China's financing guarantee industry in ( Company : One hundred million yuan )

Chart 57:2016-2021 Guarantee magnification of China's financing guarantee industry in ( Company : times )

Chart 58:2016-2021 Compensation rate of China's guarantee industry in ( Company :%)

Chart 59:2016-2021 The balance of China's guarantee industry in ( Company : Trillion yuan ,%)

Chart 60:2016-2021 Financing guarantee balance of China's guarantee industry in ( Company : Trillion yuan ,%)

Chart 61: China's re guarantee credit system

Chart 62:2016-2016 Development of the re guarantee industry in ( Company : One hundred million yuan )

Chart 63: By 2021 The development scale of the re guarantee industry at the end of the year

Chart 64: Analysis on supporting policies of guarantee industry in Jiangsu Province

Chart 65:2016-2021 Number of guarantee institutions in Jiangsu Province in ( Company : home )

Chart 66: end 2021 year 10 At the end of the month, the development of small and medium-sized enterprises in Jiangsu Province ( Company : One hundred million yuan ,%, individual )

Chart 67: end 2021 year 10 At the end of the month, the analysis of the operating benefits of small and medium-sized enterprises in Jiangsu Province ( Company :%, individual , One hundred million yuan )

Chart 68:2022-2027 Prediction on the demand gap of bank loans for small and medium-sized enterprises in Jiangsu Province in ( Company : Trillion yuan )

Chart 69: Analysis on supporting policies of guarantee industry in Guangdong Province

Chart 70:2021 Operation of guarantee industry in Guangdong Province ( home , One hundred million yuan , people , times ,%)

Chart 71:2021 Analysis on the growth potential of guarantee industry in Guangdong Province in ( Company : One hundred million yuan , times ,%)

Chart 72:2021 Credit risk analysis of guarantee industry in Guangdong Province in ( Company : One hundred million yuan ,%)

Chart 73:2021 Distribution of guarantee objects of guarantee business for small and medium-sized enterprises in Guangdong Province in ( Company : One hundred million yuan ,%)

Chart 74:2021 The construction and distribution of guarantee business institutions for small and medium-sized enterprises in Guangdong Province in ( Company : One hundred million yuan ,%)

Chart 75: Guarantee period of guarantee business for small and medium-sized enterprises in Guangdong Province ( Company :%)

Chart 76:2022-2027 Forecast on the demand gap of bank loans for small and medium-sized enterprises in Guangdong Province in ( Company : Trillion yuan )

Chart 77: Policies related to the guarantee industry in Anhui Province

Chart 78:2022-2027 Prediction of the demand gap of bank loans for small and medium-sized enterprises in Anhui Province in ( Company : Trillion yuan )

Chart 79: Relevant policies of Beijing Municipality on guarantee industry

Chart 80:2016-2021 year 10 Changes in the number of financing guarantee institutions in Beijing in May ( Company : home )

Chart 81:2021 The operation of the guarantee industry in Beijing in the first half of ( One hundred million yuan , times ,%)

Chart 82:2021 Credit risk analysis of Beijing guarantee industry in the first half of ( Company : One hundred million yuan ,%)

Chart 83:2022-2027 Forecast on the demand gap of bank loans for small and medium-sized enterprises in Beijing in ( Company : Trillion yuan )

Chart 84: Analysis on supporting policies of guarantee industry in Liaoning Province

Chart 85: The organizational structure of re guarantee institutions in Northeast China

Chart 86: The European Union - The organizational structure of Jiangxi credit guarantee fund

Chart 87: Comprehensive comparison chart of representative companies of local re guarantee modes

Chart 88: The strategy of dealing with the relationship between government and enterprises

Chart 89: The strategy of dealing with the relationship between government and banks

Chart 90: Establish the system strategy of re guarantee system

Chart 91: Risk management and disposal strategy

Chart 92: The factors influencing the bank's income

Chart 93: Bank cost factors

Chart 94: Factors influencing the income of guarantee institutions

Chart 95: Factors influencing the cost of the guarantee institution

Chart 96: Factors influencing the income of the re guarantee institution

Chart 97: Factors influencing the cost of the re guarantee institution

Chart 98: Comparison of income of transaction subjects in the re guarantee system ( Company : ten thousand )

Chart 99: Comparison of the change rate of return of the trading subjects in the re guarantee system ( Company :%)

Chart 100: This report analyzes the ranking of re guarantee enterprises ( Company : Ten thousand yuan )

Chart 101: Basic information of Northeast small and medium-sized enterprise credit re Guarantee Co., Ltd

Chart 102: Business and process of Northeast small and medium-sized enterprise credit re Guarantee Co., Ltd

Chart 103: Organizational structure of northeast SME credit re Guarantee Co., Ltd

Chart 104: Analysis on the competitive advantages and disadvantages of Northeast small and medium-sized enterprise credit re Guarantee Co., Ltd

Chart 105: Basic information of Beijing SME credit re Guarantee Co., Ltd

Chart 106: Organizational structure of Beijing SME credit re Guarantee Co., Ltd

Chart 107: Cooperative organization of Beijing small and medium sized enterprise credit re Guarantee Co., Ltd

Chart 108: Analysis on the competitive advantages and disadvantages of Beijing SME credit re Guarantee Co., Ltd

Chart 109: Basic information of Jiangsu credit re guarantee Group Co., Ltd

Chart 110: Organizational structure of Jiangsu credit re guarantee Group Co., Ltd

Chart 111: Cooperative organization of Jiangsu credit re guarantee Group Co., Ltd

Chart 112: Analysis of competitive advantages and disadvantages of Jiangsu credit re guarantee Group Co., Ltd

Chart 113: Basic information of Guangdong financing re Guarantee Co., Ltd

Chart 114: Organizational structure of Guangdong financing re Guarantee Co., Ltd

Chart 115: Cooperative banking institution of Guangdong financing re Guarantee Co., Ltd

Chart 116: Cooperative guarantee agency of Guangdong financing re Guarantee Co., Ltd

Chart 117: Analysis on the competitive advantages and disadvantages of Guangdong financing re Guarantee Co., Ltd

Chart 118: Basic information of Shandong re guarantee Group Co., Ltd

Chart 119: Business classification of Shandong re guarantee Group Co., Ltd

Chart 120: Organizational structure of Shandong re guarantee Group Co., Ltd

边栏推荐

- 实验10 Bezier曲线生成-实验提高-交互式生成B样条曲线

- Cookie & session & kaptcha verification code

- Leetcode 416. 分割等和子集

- 从应无所住说起

- kali局域网ARP欺骗(arpspoof)并监听(mitmproxy)局域内其它主机上网记录

- 国内如何下载Vega

- 配送交付时间轻量级预估实践-笔记

- SCI Writing - Results

- leetcode:5259. Calculate the total tax payable [simple simulation + see which range]

- Why my order by create_ Time ASC becomes order by ASC

猜你喜欢

In 2021, the global revenue of chlorinated polyvinyl chloride (CPVC) was about $1809.9 million, and it is expected to reach $3691.5 million in 2028

uniapp使用阿里图标

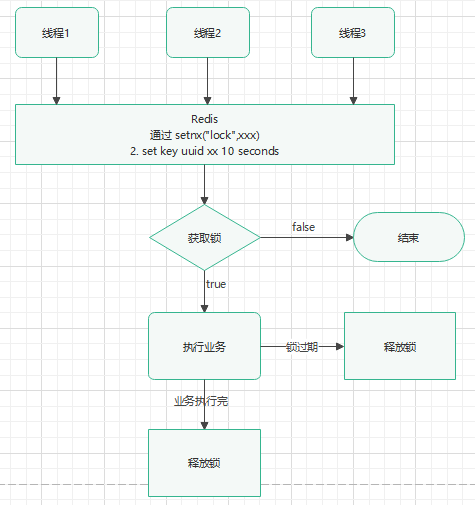

Redis (XXXII) - using redis as a distributed lock

超级重磅!Apache Hudi多模索引对查询优化高达30倍

How to download Vega in China

Redis中的事务

基于FPGA的VGA协议实现

leetcode:6097. 替换字符后匹配【set记录 + 相同长度逐一查询】

![leetcode:6095. Strong password verifier II [simple simulation + direct false]](/img/31/570ebaecdd4e6db4dede9a456741a5.png)

leetcode:6095. Strong password verifier II [simple simulation + direct false]

Kali implements port forwarding through iptables

随机推荐

A story on the cloud of the Centennial Olympic Games belonging to Alibaba cloud video cloud

Leetcode topic [string]-541- reverse string II

Leetcode 416. 分割等和子集

bilibili视频列表名字太长显示不全的解决方法

CEPH deploy offline deployment of CEPH cluster and error reporting FAQ

MySQL数据库(28):变量 variables

In 2021, the global revenue of chlorinated polyvinyl chloride (CPVC) was about $1809.9 million, and it is expected to reach $3691.5 million in 2028

What are the third-party software testing organizations in Shanghai that share knowledge about software validation testing?

Can't understand kotlin source code? Starting with the contracts function~

On how to make digital transformation after the loan of large policy banks- Yixinhuachen

攻防世界(web篇)---supersqli

I was badly hurt by the eight part essay...

Judging the quality of American advanced anti DDoS servers depends on three points!

leetcode:98. 统计得分小于 K 的子数组数目【双指针 + 计算子集个数 + 去重】

Cookie & Session & kaptcha验证码

Mysql database (28): Variables

Hugo blog building tutorial

ISCC2022

Experiment 10 Bezier curve generation - experiment improvement - interactive generation of B-spline curve

wireshark基本使用命令