当前位置:网站首页>Barbell strategy -- extreme stability and extreme waves

Barbell strategy -- extreme stability and extreme waves

2022-06-21 21:59:00 【zhanyd】

List of articles

Barbell strategy

The barbell strategy is that Taleb is 《 Anti frailty 》 The one mentioned in , It's a way to fight uncertainty .

The shape of the barbell is big at both ends 、 The middle is small , The weight is concentrated on both sides , But it has strong stability . You can think of both ends as important parts , The middle is the negligible part .

Apply it to the field of investment , It is an asset with low risk and low return at one end , At the other end are high-risk and high-yield assets , In the middle are assets with medium risk and return , The barbell strategy suggests investing in assets at both ends , Instead of participating in the investment of intermediate assets .

If the portfolio is configured according to the barbell strategy , One side is high-risk assets , Such as the stock 、 fund 、 Futures and so on , On the other side are low-risk assets , Like savings 、 national debt 、 Money funds and so on .

On the distribution of funds , High risk assets can be allocated 20% Capital of , Low risk asset allocation 80% Capital of , The advantage of doing this is that extremely safe assets build a safety cushion for you , Make sure you are on a break even basis , There are still opportunities for high returns .

Since the future trend of asset prices is uncertain , The best way is to embrace it , Instead of pursuing uncertain medium income , It's better to pursue uncertain high returns , Barbell strategy helps you find a balance between uncertainty and certainty .

The 28 law tells us a truth ,80% The benefits are always derived from 20% Brought by assets , These assets are often very risky , But we can never give them up , This confidence comes from the construction of extremely safe assets .

When high-risk assets bring more and more benefits , This part of the income can be extracted , Invest in extremely safe assets , So your safety mat gets thicker and thicker , Your ability to resist risks is getting stronger .

Many successful people are masters of barbell strategy , Before successfully building passive revenue , Have a stable job , And purchased assets with high income certainty for themselves .

The advantage of doing so is that you won't be able to live when you encounter a loss . therefore , We can't just pursue stability , You can't put all your eggs in one basket , Use the barbell strategy , Find the balance between uncertainty and certainty , Is the best way to get a return on assets .

Investment advice from ordinary people

For the average person , Buying stocks directly is too risky , A better strategy is to invest in index funds . Mr. Wu Jun is in 《 Google letter 》 In this column, I put forward several investment suggestions for ordinary people , There are mainly the following points :

One 、 Choose an index fund that has performed well in history . Although all investors will say that past performance does not reflect future earnings , But in the past, the performance was not good for a long time , There is little chance of doing well in the future .

Two 、 Every one of us , It should be based on your income 、 Risk tolerance and time to spend money , Allocate assets proportionally to stocks and bonds . If it's young people , You can put... Of your income 80% All invested in index funds , The rest 20%, Except to set aside 5% In addition to cash , The rest can buy treasury bonds .

If you are going to get married or buy a house in a few years , Or the elderly , You can't do that , Investment needs to be more secure , Reduce the proportion of investment funds as needed , Raise the bond ( And cash ) The proportion of .

3、 ... and 、 If you are lucky enough to invest in the stock market , The stock portion of your portfolio will yield far more than the bond portion ( And cash ) The proportion of , For example, you initially set 7:3 The proportion of , Now it may become 8:2 了 , At this time, you need to get back part of the stock income , Instead of following everyone on the stock market .

I need to remind you , When we have good luck , Be sure to thank God , Don't thank ourselves . contrary , When the stock market plummeted , It's not the time for you to cut meat , Now , Your original bonds or cash will work , You should buy stocks , Maintain the proportion of stocks in the investment portfolio as originally set , Rebalance the funds .

At this time , You actually invest at a cheaper price . Of course , Every transaction has a cost , This fine-tuning of the portfolio is enough once a year . Your fine-tuning approach , In fact, he is practicing what Buffett said “ I fear when others are greedy , I'm greedy when others are afraid ”.

Anyone who can do the simple ones above , Don't worry about getting rich long-term returns .

Here are index funds and bonds ( cash ) It's both ends of the barbell , Index funds correspond to the high-risk side , bond ( cash ) Corresponding to the low-risk end ,7:3 The ratio of is the specific gravity at both ends .

Barbell strategy in work life

If the barbell strategy is applied to life and work , Namely “ Extreme stability and extreme waves do not roll inside ”.

“ Extreme stability and extreme waves do not roll inside ” It's what the classical teacher said , He means to say , We must first have a stable job , This is the end of the barbell , Then we use our spare time to develop our hobbies , Try all kinds of high-risk but high-yield things , For example, we media 、 live broadcast 、 Writing, etc .

No, it means , Let's not waste time doing things that waste our energy but do not return , For example, flattering the leaders 、 Drinking and socializing 、 Intrigue, etc .

The most important thing is to seize the time to improve your ability .

Take two. “ Extreme stability and extreme waves do not roll inside ” Example :

such as , Kafka, an Austrian Hungarian writer , Work in an insurance agency , Usually I leave work at two o'clock in the afternoon , This is extremely stable , Then he spent his spare time on his literary works which were loyal to his firm stand , This is extreme wave , And writing can bring great rewards , This is not involute .

such as , Liucixin is a computer engineer in a power plant , This is his very stable end , Then he used his spare time to write science fiction , This is the end of the polar wave , Writing science fiction is not a success , There are no worries about being an engineer .

Extremely stable work plus extremely long literary creation , Even the typical barbell strategy , Stable work gives us inner peace , No longer worry about making a living , And then we can devote ourselves to the other end of the barbell , Completely stimulate our creativity .

summary

Barbell strategy is a good way to deal with risks and uncertainties , Configure both ends of the barbell , It allows us to balance safety and benefits , That's what a portfolio is all about .

We use barbell strategy in our work and life , It can prevent us from selling houses and starting businesses 、 Borrow money to invest 、 Resignation, stock speculation and other high-risk things , Life never ALL IN, And learn to play barbells .

For the average of us , The more feasible approach is : Work hard , Do a good job in asset allocation , Fixed investment index fund , Then use your spare time to develop hobbies and sidelines , Wait for the flowers to bloom .

边栏推荐

- Yanyu saltalk obtained USD 8million round a financing: continue to expand team and market coverage

- Abbkine细胞周期染色试剂盒特色和实验建议

- GAMES101作业7-多线程提速实现步骤详解

- 从随便到无聊到有病

- Yb5212a charging IC chip sop8

- ACM. Hj35 serpentine matrix ●

- Worthington胰蛋白酶解决方案

- Can I open an account for online stock trading? Is it safe

- 搭建Eureka-Server集群

- 杠铃策略--极稳极浪不内卷

猜你喜欢

![When Jerry made Bluetooth transmission, when he modified stereo to mono differential output, there was a jam sound at the receiving end [chapter]](/img/ef/35a74fe3b1a8035afb6c50e6880860.png)

When Jerry made Bluetooth transmission, when he modified stereo to mono differential output, there was a jam sound at the receiving end [chapter]

Do280openshift command and troubleshooting -- accessing resources and resource types

广东疾控提醒:暑期将至,返粤大学生这样安全“归巢”

phpmailer 通过smtp发送邮件,相同发送内容有的成功有的失败

杰理之开启四声道打开 EQ 后播歌卡顿问题【篇】

![There is no sound solution to the loopback when jerryzhi launches Bluetooth [chapter]](/img/ba/377ec19ca22c2c106f227e864f1e9e.png)

There is no sound solution to the loopback when jerryzhi launches Bluetooth [chapter]

Summary of intelligence problems

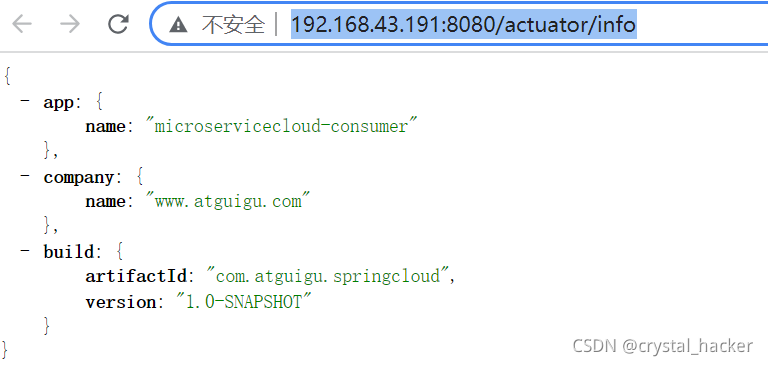

Eureka console accesses the info endpoint exposed by the microservice

Introduction to security encryption

JS object operation (much simpler than C object)

随机推荐

Tutorial on the implementation of smart contracts by solidity (4) -erc1155 contracts

Qx2308 high efficiency PFM Synchronous Boost dc/dc converter

Which iPad apps can read English literature well?

matplotlib plt. Details of subplots()

In the anchoring stage of retail digitalization, more attention is paid to how to mine and transform traffic by means of Digitalization

潮流媒体Hypebeast拟曲线上市:作价5.3亿美元 拟第三季完成

Ln2220 2A overcurrent 5v1a High Efficiency Boost IC chip dc/dc voltage regulator

三维度八视图

P6758 [BalticOI2013] Vim

Excuse me, which website is better for college students to check literature?

全屋智能家居品牌“智汀科技”有体验中心?

phpmailer 通过smtp发送邮件,相同发送内容有的成功有的失败

Eureka console accesses the info endpoint exposed by the microservice

When Jerry made Bluetooth transmission, when he modified stereo to mono differential output, there was a jam sound at the receiving end [chapter]

电子招标采购商城系统:优化传统采购业务,提速企业数字化升级

在AD中安装元件和封装库

Build Eureka server cluster

Synchronous Boost dc/dc converter fs3400 synchronous SOT23-6 small current 500mA boost IC

面了十多家实习岗位失败的实习面试经历总结

M3608 boost IC chip high efficiency 2.6a boost dc/dc converter