当前位置:网站首页>IPO can't cure Weima's complications?

IPO can't cure Weima's complications?

2022-06-10 22:57:00 【liukuang110】

The new forces qualifying is becoming more and more intense , The atmosphere of delivery competition is very tense .4 The monthly ideal delivery is less than 5000 ,5 Monthly direct translation 1.7 times , Which zha 、 Xiao peng 、 Zero run 、 Weilai still maintains stable growth , Huawei and Xiaokang AITO It's more creative 87 The fastest record of ten thousand yuan in delivery per day .

Under the excitement , The new forces ushered in the second wave IPO tide , Zero car 、 Weima automobile has successively submitted to Hong Kong IPO Prospectus . Unfortunately , Not at the moment IPO Good opportunity , Especially for Weima .

At the beginning of the year, the car was caught in the storm of spontaneous combustion ,Q1 The delivery volume is seriously lagging behind , The lawsuit with the old owner Geely has not been settled yet , The bad news from Weima never seems to stop .

In this case , Weima still wants IPO, Is it lack of money ? The prospectus shows , Weima just completed about in the first quarter of this year 6.8 One hundred million yuan D Round of funding , end 2022 year 3 End of month , There are all kinds of cash on the account 41.4 Billion , It doesn't seem so short of money .

Closer to the truth , Maybe Weima had to IPO When , Because Weima's operating data is deteriorating , The adverse factors of the external environment have increased , If it doesn't go public again , The prospect of Weima may not necessarily support a reliable IPO 了 , Behind Baidu 、 tencent 、SIG And other institutional investors believe that they will not be willing to suffer such a heavy loss .

So Weima's IPO More passive , At present, the biggest significance of listing and financing for Weima may be that the investors behind it have better exit opportunities .

The problem is , Weima's valuation cannot be too high , Because Weima is in the fierce new energy vehicle long-distance race , More and more shows a little fatigue .

Left behind

From the time of establishment , Weimahe “ Wei Xiaoli ” All belong to the earlier group of new forces that built cars independently , And Weima had its own factory from the beginning , No capacity anxiety , It can be said that the starting line is more forward . in addition , From the founder's background , Geely is a senior executive , It also injects reliable automobile genes into Weima .

Moreover, the early new forces actually had a relatively free and open competitive environment , Because we all want to avoid direct competition in product positioning , Take the differentiated route , For example, Weima focuses on mid-range pure electricity SUV, Weilai is a high-end pure electric SUV, The ideal is extended range high-end SUV, Xiao Peng is an introduction to intelligence SUV.

Go to the back and start to extend the product line , For example, Weima is moving towards the high-end SUV And the car , Xiaopeng has a smart car running , Therefore, it has stepped into more sub circuits , Usher in more positive competition .

In the past two years, , It can be said that it is the time for the new power gold to truly accept the market test of its purity , On the one hand, the pressure on the supply side is high , Various out of stock , On the other hand, the Red Sea on the demand side is heating up , It is inevitable that all kinds of strong enemies will confront each other .

But Weima's falling behind just started .

One 、 Deliveries have slipped to the third tier

2020 The annual delivery volume of Weima is 21937 car , Second only to “ Wei Xiaoli ”, At the head of the second echelon , To 2021 year , Weima's delivery volume has reached 44152 car , Although ranked fifth , But in the order of magnitude, it has been compared with “ Wei Xiaoli ” The gap is growing , Nezha succeeded in overtaking , Zero run also catches up with Weima .

Weima's performance this year is even worse ,2022Q1 deliver 7476 car , It's the delivery volume of Xiaopeng 22%, Of the desired delivery 24%, Already in the third echelon position .

Two 、 R & D growth stagnated

The prospectus shows , Goodway 2019 Year to 2021 The R & D expenditures for the three years are 8.9 Billion 、9.9 Billion 、9.8 Billion , The proportion of revenue to total revenue is respectively 50.7%、37.1%、20.7%. It can be seen that , Weima's R & D expenditure has stagnated .

More intuitive than other new forces ,2019 In, Weima's R & D expenditure barely ranked in the second echelon ,2020 Due to the influence of the epidemic situation , There is also a slight increase , but 2021 In, other new forces increased significantly in R & D , But Weima is standing still , By “ Wei Xiaoli ” The more you throw away .

3、 ... and 、 The breakthrough of revenue scale is slow

2019 year , In addition to Wei Lai, the new forces , Most of the annual revenue is less than 2billion , Ideal and Zero run even less than 3 Billion , The main reason is that the delivery time of products is long , And low production capacity , At that time, Weima's revenue scale was still relatively high .

To 2020 year , The revenue of the first batch of new car making brands has entered the explosive period , Most have more than doubled their growth , At this time, Weima's revenue growth rate has been significantly lower than that of its friends . To 2021 year ,“ Wei Xiaoli ” The scale of revenue has broken 200 Billion , And the revenue scale of Weima is still less than 50 Billion , The breakthrough speed is very slow .

Short board

As the first batch of new power brands for car making , Why did Weima fall behind , For many reasons , Does it have much to do with the external environment ?

from 2020 From the performance of the new forces since , It does matter , The epidemic affects the smoothness of the supply chain and the price of upstream parts , This will affect the profit margin and delivery speed of downstream vehicle enterprises . However, Weima's lagging behind is mostly related to its own strategic positioning and development tone .

One 、 Positioning does not match investment

Weima automobile has been positioned in since its birth “ Electric intelligent automobile ”, This is similar to Tesla 、 Xiao peng 、 The initial positioning of Zero run is similar , Emphasis on intelligence 、 electric .

But the positioning of intelligent electric needs a lot of money to support , Autopilot system 、 Car networking 、 The three electricity system is all a time-consuming technical work . Now , tesla 、 Xiaopeng's intelligent electric positioning is more recognized by the market , Although the whole stack self-study of Zero run has been questioned , However, it has also made good achievements in the intellectualization of small cars .

Weima also has many intelligent technology achievements , such as EEA、SOA、L4 Class a autopilot , It will be listed in the second half of this year M7 It even carries a lot of L5 Level hardware devices .

But now the market has a brand impression of Weima , It seems difficult to associate with intelligence , One reason may be that Weima's marketing investment is not enough .2019 In marketing 、 sales 、 Administrative expenses , Weima is still in a leading position , But to 2021 year ,“ Wei Xiaoli ” It has reached the same level or caught up with and surpassed by a large margin .

More importantly , Or Weima's R & D investment is too small compared with other manufacturers with the same positioning , According to the data mentioned above , Weima's R & D growth stagnated , The proportion of revenue has declined year after year , Intelligent ability must be positively correlated with capital investment , Weima R & D doesn't burn enough money , Naturally, it is difficult to have surprising output and technology .

Two 、 Insufficient product strength

In the past three years , Weima has sold less than 8 Thousands of cars , This quantity seems not small , Moreover, Weima currently has the most abundant vehicle types among the new forces , However, Weima has the lowest proportion of popular funds .

The data of the ride show ,2021 New energy in SUV Before sales 15 Ranking , Weima has only EX5 On the list , Wei to ES6、EC6、ES8 All of them are listed , Xiao Peng's only SUV models G3 Also successfully on the list .

It is worth noting that , last year 4 In June, Weima launched the first driverless mass production vehicle in China W6, Carrying AVP Autonomous parking system 、Living Mate The most advanced technologies such as the whole vehicle interaction system , but W6 The sales volume of has not been able to achieve the lead , stay 2021 New energy in SUV Not appearing at the top of the list , I haven't even worked at home earlier 、 Cheaper EX5.

A new car can't beat an old one , This is an awkward question , The root cause may lie in insufficient product power . First of all , Automatic driving capability of a single scene , Not enough to impress more car buyers ; second , Not up to the market for intelligence SUV Many expectations .

In addition, Weima also has a hidden danger of brand cognition , That is the spontaneous combustion that has occurred many times , It is easy for the market to form a bad potential impression . For now , Weima still hasn't been able to deal with this focus risk related to brand power .

More and more dangerous

be in IPO Weima of nodes , In fact, the situation is not optimistic . An objective fact is , After years of rallying , The new forces are a few pounds , The market already knows a lot . Especially for the first batch of new forces , Delivery volumes have proven consumer preferences .

Weima obviously fell behind , It can be said that it is the result of market selection , Product strength 、 Research and development 、 Marketing and so on , There are many things Weima has not done well , The gap with competitors is becoming more and more obvious , It is also an irrefutable fact .

From the macro data , The penetration rate of new energy vehicles is much faster than expected , Prove that the market is getting faster , But Weima seems to be still so slow , I don't seem to be aware of the rapid changes in the pace of the track .

This year is a watershed for the development of new power auto enterprises , Fast will be faster , The slow ones will be even slower , Because BYD 、 Huawei 、 Baidu these strong enemies , In actively accelerating the elimination process of the track .

The way they rob food is more cruel , Is to launch direct hard competitive products , For example, recently Jidu automobile released its first concept car ROBO-01, Locate the home 20 Ten thousand yuan SUV,AITO stay M5 On the basis of , Will be in 6 At the end of the month, a large-scale SUV Ask boundary M7. It can be seen that everyone has the same goal , I.e. household SUV market , This is Weima 、 The main area where the ideals had been deeply cultivated .

For the new forces , They are not active catfish , It's a shark that eats people at the right time . Not only Weima , Other new forces should not relax . The new energy vehicle ranking at the end of this year , There is likely to be an earth shaking change .

Of course , Weima also has the only good news , That is, the money in hand is not so nervous . But Weima is still in the stage of huge losses , The demand for external funds will start at least three to five years .

therefore , Weima resolutely chose IPO.

边栏推荐

- 【TcaplusDB知识库】TcaplusDB日常巡检介绍

- [tcapulusdb knowledge base] Introduction to the machine where the tcapulusdb viewing process is located

- 数字孪生:第三人称鼠标操作

- C language internal skill cultivation [integer stored in memory]

- Multus CNI deployment and basic use of kubernetes multi network card scheme

- I made a blind date software source code, and I can chat with those who are interested

- Opencv_ 100 questions_ Chapter II (6-10)

- 中银证券开户安全吗?它和中国银行是什么关系呢?

- UE4骨骼动画新手入门

- Keras深度学习实战(8)——使用数据增强提高神经网络性能

猜你喜欢

kubernetes多网卡方案之Multus CNI部署和基本使用

Tcapulusdb Jun · industry news collection (IV)

![[tcapulusdb knowledge base] Introduction to the machine where the tcapulusdb viewing process is located](/img/7c/d86d228bb8e9f0716e0a5511217889.png)

[tcapulusdb knowledge base] Introduction to the machine where the tcapulusdb viewing process is located

Keras deep learning practice (8) -- using data enhancement to improve neural network performance

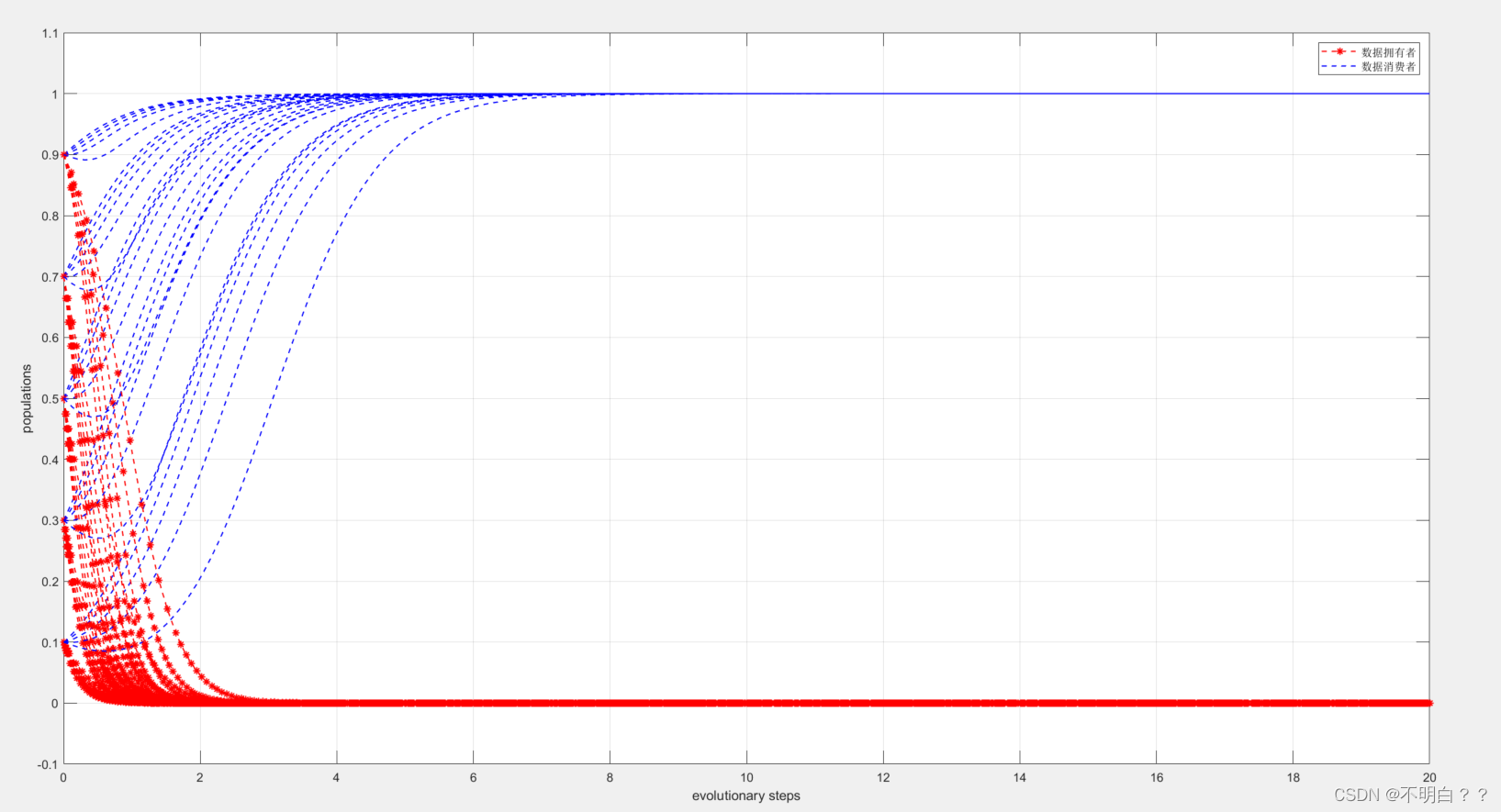

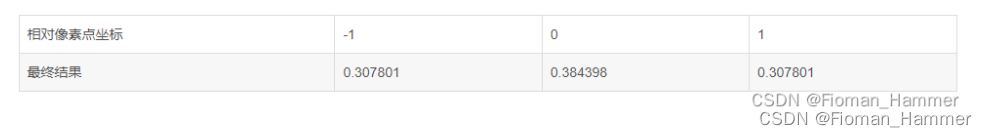

Matlab - 演化博弈论实现

【TcaplusDB知识库】TcaplusDB TcapProxy扩缩容介绍

Tcapulusdb Jun · industry news collection (V)

How Photoshop opens, edits and exports pictures in webp format

Opencv_100问_第三章 (11-15)

Opencv_ 100 questions_ Chapter II (6-10)

随机推荐

Missing heritability

[XPath] use following sibling to obtain the following peer nodes

Interpreting the registry class of mmcv

[tcapulusdb knowledge base] tcapulusdb machine initialization and launch introduction

TcaplusDB君 · 行业新闻汇编(五)

1. Introduction to tornado & introduction to tornado project in this column

存储引擎分析

kubernetes多网卡方案之Multus CNI部署和基本使用

Face recognition software based on deepface model

Tcapulusdb Jun · industry news collection (V)

[006] initial string

How can small and medium-sized conferences be upgraded digitally?

Implementation of simply untyped lambda calculus

Management solution for whale conference smart scenic spot

中银证券开户安全吗?它和中国银行是什么关系呢?

【TcaplusDB知识库】TcaplusDB TcapDB扩缩容介绍

Simply Untyped Lambda Calculus的实现

Whale conference sharing: what should we do if the conference is difficult?

The definition of the metauniverse and the seven infinite features

Basic use of mathtype7.x