当前位置:网站首页>How to choose stocks? Which indicator strategy is reliable? Quantitative analysis and comparison of strategic benefits of ASI, VR, arbr, DPO and trix indicators

How to choose stocks? Which indicator strategy is reliable? Quantitative analysis and comparison of strategic benefits of ASI, VR, arbr, DPO and trix indicators

2022-06-13 00:55:00 【Your name is Yu yuezheng】

Preface

From the stock market to the present , Many indicators have been developed , But when you use it, you will find , Due to the unknown fluctuation of the share price the next day , The indicators are not always accurate , There will always be miscalculations . For this inevitable situation , We can only try to quantify it 、 Calculate the yield after operation according to the strategy 、 Estimate the probability of misjudgment, etc

This article first selects ASI、VR、ARBR、DPO、TRIX Five indicators to quantify ( A total of More than 30 indicators , Due to the space problem, five kinds of ), Then use ten stocks to test the effectiveness of these five strategies ( The actual situation is that 3600+ Stock to calculate the effect of strategy , It is not convenient to display the results at present )

disclaimer

Nothing in this vision and analysis should be interpreted as investment advice , Past performance does not necessarily indicate future results .

Quantitative analysis of index strategy

Data preparation

I chose 600519 Guizhou Moutai 、600031 Sany heavy industry 、002594 BYD 、601633 Great Wall motor 、002074 GuoXuan high tech 、300750 Ningde era 、300014 Yiwei lithium energy 、000591 The solar energy 、002475 State - precision 、600862 China Aviation hi tech These ten stocks 2020 year 1 month 1 Japan ~ 2021 year 1 month 15 Japan To test

Part of the code fragment

import pandas_datareader.data as web

import datetime

start = datetime.datetime(2020, 1, 1)

end = datetime.datetime(2021, 1, 15)

df = web.DataReader(ticker, "yahoo", start, end)

Index Introduction

sma It is the calculation function of smooth moving index

_ma Is a function of the moving average

_md Is a function of the standard deviation

_ema Is a function of the exponential moving average

ASI indicators

def asi(df, n=5):

_asi = pd.DataFrame()

_asi['date'] = df.date

_m = pd.DataFrame()

_m['a'] = (df.high - df.close.shift()).abs()

_m['b'] = (df.low - df.close.shift()).abs()

_m['c'] = (df.high - df.low.shift()).abs()

_m['d'] = (df.close.shift() - df.open.shift()).abs()

_m['r'] = _m.apply(lambda x: x.a + 0.5 * x.b + 0.25 * x.d if max(x.a, x.b, x.c) == x.a else (

x.b + 0.5 * x.a + 0.25 * x.d if max(x.a, x.b, x.c) == x.b else x.c + 0.25 * x.d

), axis=1)

_m['x'] = df.close - df.close.shift() + 0.5 * (df.close - df.open) + df.close.shift() - df.open.shift()

_m['k'] = np.maximum(_m.a, _m.b)

_asi['si'] = 16 * (_m.x / _m.r) * _m.k

_asi["asi"] = _ma(_asi.si, n)

return _asi

VR indicators

def vr(df, n=5):

_vr = pd.DataFrame()

_vr['date'] = df.date

_vr['vr_'] = df.volume / _ma(df.volume, n).shift(1)

_vr['rr_'] = (df.close - df.close.shift(1)) / df.close.shift(1) * 100

return _vr

ARBR indicators

def arbr(df, n=26):

_arbr = pd.DataFrame()

_arbr['date'] = df.date

_arbr['ar'] = (df.high - df.open).rolling(n).sum() / (df.open - df.low).rolling(n).sum() * 100

_arbr['br'] = (df.high - df.close.shift(1)).rolling(n).sum() / (df.close.shift() - df.low).rolling(n).sum() * 100

return _arbr

DPO indicators

def dpo(df, n=20, m=6):

_dpo = pd.DataFrame()

_dpo['date'] = df['date']

_dpo['dpo'] = df.close - _ma(df.close, int(n / 2 + 1))

_dpo['madpo'] = _ma(_dpo.dpo, m)

return _dpo

TRIX indicators

def trix(df, n=12, m=20):

_trix = pd.DataFrame()

_trix['date'] = df.date

tr = _ema(_ema(_ema(df.close, n), n), n)

_trix['trix'] = (tr - tr.shift()) / tr.shift() * 100

_trix['trma'] = _ma(_trix.trix, m)

return _trix

The final quantitative results

Due to the inconvenience of space and display , Do not show the visual buying and selling points and the fund change curve in the article

In order to understand the effect of the strategy most succinctly , The initial capital is set to 10000 element , And for the sake of simplicity, we don't consider the restriction that we must buy the whole hand , Every time 10000 Yuan to buy all , Test the effect of five index strategies at the same time 2020.1.1 Buy and hold until 2021.1.15 The strategy of , Compare the final funds to measure the effectiveness of the strategy

HOLD Line is a representation 2020.1.1 Buy and hold until 2021.1.15 The final fund of the strategy

Data visualization is not shown here , After having data, you can draw and tabulate according to your habits ; More evaluation data are not shown

In the chart we notice

ARBR indicators Excellent performance , stay 600031、002564、000591 The performance of these stocks is better than the holding strategy , And the performance of the other seven stocks is not bad . But it is necessary to study this indicator in the whole A The performance of the stock market needs to consider thousands of stocks and data of more than ten years

Although in most cases, the effect of operating according to indicators is not as good as that of long-term holding strategy , But when the strategy does not hold shares, as a trader, of course, he will look for new opportunities , Generate revenue !

边栏推荐

- Mysql database password modification

- 牌好不好无法预料

- Oceanbase is the leader in the magic quadrant of China's database in 2021

- Why is there always a space (63 or 2048 sectors) in front of the first partition when partitioning a disk

- .net core 抛异常对性能影响的求证之路

- Unity calls alertdialog

- Leetcode weekly -- April to May

- Hard (magnetic) disk (II)

- Druid reports an error connection holder is null

- MCU serial port interrupt and message receiving and sending processing -- judge and control the received information

猜你喜欢

Comparison of disk partition modes (MBR and GPT)

![[JS component] simulation framework](/img/f2/8d5bb7e0db55a87ce76c09fae03694.jpg)

[JS component] simulation framework

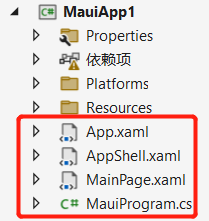

(01). Net Maui actual construction project

.net core 抛异常对性能影响的求证之路

Canvas game 2048 free map size

Programming training 1

Common skills for quantitative investment - drawing 2: drawing the moving average

![[sca-cnn interpretation] spatial and channel wise attention](/img/4b/bdcdab17d531481bf0222a96ace065.png)

[sca-cnn interpretation] spatial and channel wise attention

![[003] embedded learning: creating project templates - using stm32cubemx](/img/18/43dfa98f1711e8e544828453e36812.jpg)

[003] embedded learning: creating project templates - using stm32cubemx

Undirected graph -- computing the degree of a node in compressed storage

随机推荐

Win10 home vs pro vs enterprise vs enterprise LTSC

The grass is bearing seeds

gpu加速pytorch能用吗?

Canvas game 2048 free map size

Mongodb array operation

[JS component] calendar

通过抓包下载钉钉直播回放

Biological unlocking - Fingerprint entry process

Can GPU acceleration pytorch work?

Arduino interrupt

[JS component] floating text

Mysql批量插入数据时如何解决重复问题?

pytorch是什么?解释pytorch的基本概念

Kotlin collaboration, the life cycle of a job

[003] embedded learning: creating project templates - using stm32cubemx

With a market value of more than trillion yuan and a sales volume of more than 100000 yuan for three consecutive months, will BYD become the strongest domestic brand?

Pipeline pipeline project construction

Druid reports an error connection holder is null

The scope builder coroutinescope, runblocking and supervisorscope of kotlin collaboration processes run synchronously. How can other collaboration processes not be suspended when the collaboration pro

Aunt learning code sequel: ability to sling a large number of programmers