当前位置:网站首页>Third party payment in the second half: scuffle to symbiosis

Third party payment in the second half: scuffle to symbiosis

2022-06-23 08:25:00 【Financial external participation】

The picture comes from Canva Paintable

Alipay arrival ×× element 、 Wechat to account ×× element ......

It's not hard to find out , Third party payment is common in daily life . stay 2019 year , Lizhenhua, executive director of ant Financial Research Institute, said , The economic penetration rate of third-party payment has exceeded 60%, China has become the global mobile payment penetration rate 、 The countries with the highest coverage .

so far , The penetration rate of third-party payment is still gradually increasing , The market scale is also increasing . AI media consulting data display , stay 2020 year , The total scale of third-party mobile payment and third-party Internet payment has reached 271 Trillion yuan payment transaction scale .

In general , China's third-party payment industry has a strong momentum of development , Keep moving forward steadily . But specifically , The industry situation is changeable , Unpredictable pattern . In recent years , Two private payment giants, Alipay and TenPay, have made frequent innovations , In addition, the introduction of relevant policies has stimulated the fighting will of other payment institutions , The third-party payment industry seems calm , In fact, the tide is surging .

fight like kilkenny cats

Prospective industry research institute data shows ,2020 Second quarter , Alipay on the third party payment comprehensive trading market in China 、 TenPay and UnionPay respectively 49.16%、33.74% and 6.93% Market share in the top three . so , At present, the domestic third-party payment market is dominated by Alipay and TenPay “ Double oligarchs ” pattern , The industry concentration is relatively high .

in fact , The leading position of Alipay has been maintained for many years , TenPay has been following closely, hoping to catch up , Both have their own laws in the third-party payment industry . Alipay first broke through the encirclement from the merchant side , TenPay is a huge enterprise that relies on social platforms such as wechat C End flow , As well as the introduction of the red envelope function to achieve rapid exit .

in addition , The development of Alipay and TenPay has entered a mature stage , It is relatively stable in terms of scale expansion and operation .2020 year 8 month , The prospectus issued by ant group disclosed , Alipay has more than active users in the year 10 Billion , Monthly active users reached 7.11 Billion , Monthly active merchants exceed 8000 ten thousand .

In terms of payment business , TenPay is also maintaining healthy growth . Tencent Financial report shows ,2021 The revenue of fintech and enterprise services business increased in the third quarter of 30% RMB to RMB 433 One hundred million yuan , This is mainly driven by the growth of commercial payments .

Beyond all doubt , On the account side , Both Alipay and TenPay have “ The moat ”, In the face of catching up with other similar products, we really can not panic at all , Relatively speaking , What Alipay and TenPay care more about is the game between them .

As a third-party payment institution that obtains payment licenses in earlier batches , Alipay and TenPay have similar application scenarios , It has become a pair of payment circles “ enemy ”, The two have been competing with each other , Strive to be the industry leader . In recent years , Alipay and TenPay are in B End sum C Each of them has his own unique moves , Both sides are full of gunpowder .

Strive to dig deep into the stock C End

Alipay and TenPay rely on code scanning 、 Face brushing and other payment methods are basically divided up C Mid-market , Both sides have formed a deep user base , The third party C End payment tends to be stock . But with the development of network technology , As well as the continuous upgrading of user needs ,C The end market still has room to sink . Whether it's Alipay or TenPay , The two C The end of the cultivation has never stopped .

It is reported that ,2020 Since then , Tencent Financial technology continues to focus on video numbers 、 Small programs and other aspects , Expand the user payment scenario of wechat . Users' satisfaction with wechat 、QQ And other social platforms have developed strong usage habits , There is a huge traffic import from wechat and other social platforms , TenPay attached to it will be easier to reach users .

The main reason is the influence of platform attributes , TenPay with social attributes sinks C The end payment market is more flexible than Alipay, which is the essence of life service tools , The main reason has a lot to do with user habits .

Activity is a great evidence of users' dependence on the platform , Prospective research data show that , end 2020 year 12 China App Activity ranking , The active penetration rates of wechat and Alipay are 86.9% and 56.9%, rank first 、 second . so , Users will use social software more frequently than non social software such as life services .

In order to alleviate the problem of activity, Alipay , stay C A lot of efforts have been made to update the end functions , It has launched social networking in succession “ circle ”、 Ant forest 、 Chicken farm and other social interaction functions , And yu'e Bao 、 Hua Bai and other applications , Try to keep C End flow . But various measures , It's hard to change C The end is gradually paid by TenPay “ Gaudy pressure ” Destiny .

The incremental B End operation race

contrast C End , The third party B The end payment market is still scattered , More importantly, under the influence of the digital trend ,B The end has gradually become the driving force of industry growth , It has also become a new battlefield for all third-party payment institutions .

however B The end payment covers a wide range of industries , Compared with C More complex for the end , Alipay and TenPay enter the Bureau B The end needs to constantly improve the business end service chain , It is a big test for the operation ability of both parties .

Alipay has always attached commercial payment to the platform B End , alipay B Terminal and payment business have always been complementary , Create a B It is self-evident that the platform ecology of the end is important to its payment business . stay 2021 year 11 month , Alipay released the ecological opening principle , Promote the construction of operational links , By strengthening the platform's digital life service capability , Let more businesses profit from it , So as to feed the ecological benign operation of the platform .

at present , Alipay has successively opened search in the mobile terminal 、 Applet 、 Recommend pages and other positions to support businesses' self operation , in addition , For the different needs of the head and small and medium-sized service providers , Alipay also plans to launch a corresponding growth plan . Similarly, ,2020 TenPay business enterprise pay went online in , The purpose is to help enterprises realize the digital upgrading of industrial finance , Provide e-commerce platform for small and medium-sized enterprises 、 Core enterprises provide account management 、 Combined payment 、 Payment by installments and other professional services .

The positioning adjustment of Alipay from a payment tool to an open platform for digital life , TenPay launched enterprise end services , Of the two B The wild prospect of the end ecology has already been made public .

To sum up, we can see , Alipay and TenPay, the two major third-party payment giants, are ready to take all B、C Calculation at both ends , Each step by step . It is worth noting that , Although Alipay and TenPay are C The position of the end has been difficult to shake , But in B The end is not the case .

Dark horse counter attack ?

The current third-party payment market except C In addition to Alipay and TenPay, players of high rank , also B End of the lacala 、 Strong players with first mover advantage, such as UnionPay .

As a result, overseas businesses are blooming everywhere . Lucia Lacarra 2021 The financial report of the first half of , At present, the cross-border payment service merchants in lakala are nearly 1 Thousands of families , The business covers the United States 、 The European 、 Japan and other countries and regions . besides , UnionPay overseas business development Also very strong . It is reported that ,2021 year , UnionPay overseas mobile payment acceptance merchants reached 1000 ten thousand , Online acceptance merchants exceed 2200 ten thousand .

Second, China has taken the lead in digital RMB . The characteristic of digital RMB is that transaction means settlement , From the perspective of underlying technical logic , Digital RMB can eliminate some trading links , Reduce transaction costs . The most important thing is that the digital RMB is endorsed by the state , High security .

Lakala and UnionPay are making efforts to enter... Through digital RMB B、C End business , On the one hand, it can take the lead in providing more efficient inter enterprise payment 、 Convenient payment solutions ; On the other hand, we can get involved in undeveloped fields with the help of digital RMB , To gain more market share in the payment market .

It seems , Lakala and UnionPay also have a large share in the third-party payment industry “ Dark horse ” potential . The main thing is , At present, under the axe of antitrust , Alipay and TenPay have performed somewhat in the industry “ convergence ”, A counter attack by lakala and UnionPay is very likely .

Coexistence and common prosperity

in general , Alipay and TenPay “ Iron throne ” The dispute is getting fiercer , Lakala and UnionPay then stepped up their pursuit , All parties in the third-party payment industry engage in close combat .

however , The third-party payment institutions should realize that the anti-monopoly awareness of various industries has been strengthened , Mutual ecology is gradually opening up , The current third-party payment institutions have been in a state of coexistence .

stay C End , Objectively, Alipay and TenPay have occupied the vast majority of users' minds , Even the hot Tiktok sound 、B standing 、 Meituan and other platforms have built their own payment ecology , But we can't abandon our dependence on old third-party payment institutions such as Alipay and TenPay .

in addition , Although digital RMB has incomparable advantages compared with third-party payment institutions , However, the scope of current application scenarios is limited , It will not have too much impact on other platforms . And for now , Digital RMB and third-party payment are more “ money ” and “ wallet ” The relationship between , It may be more appropriate to say that the two complement each other .

meanwhile , stay B End , Alipay 、 TenPay 、 Lucia Lacarra 、 Third party payment giants such as UnionPay have also realized interconnection .

so , In the environment of gradual opening of platform Ecology , Account side of the third-party payment industry 、 Unilateral adduction 、 Institutions such as the settlement side have been linked together . Perhaps the third-party payment industry can jump out of the stage of scuffle between all parties , Hold each other together , Win win cooperation is the positive solution for the sustainable development of all third-party payment institutions .

边栏推荐

猜你喜欢

点云库pcl从入门到精通 第十章

值得反复回味的81句高人高语

Use of tensorboard

Create an orderly sequence table and perform the following operations: 1 Insert element x into the table and keep it in order; 2. find the element with the value of X, and delete it if found; 3. outpu

![Vulnhub | dc: 4 | [actual combat]](/img/33/b7422bdb18f39e9eb55855dbf1d584.png)

Vulnhub | dc: 4 | [actual combat]

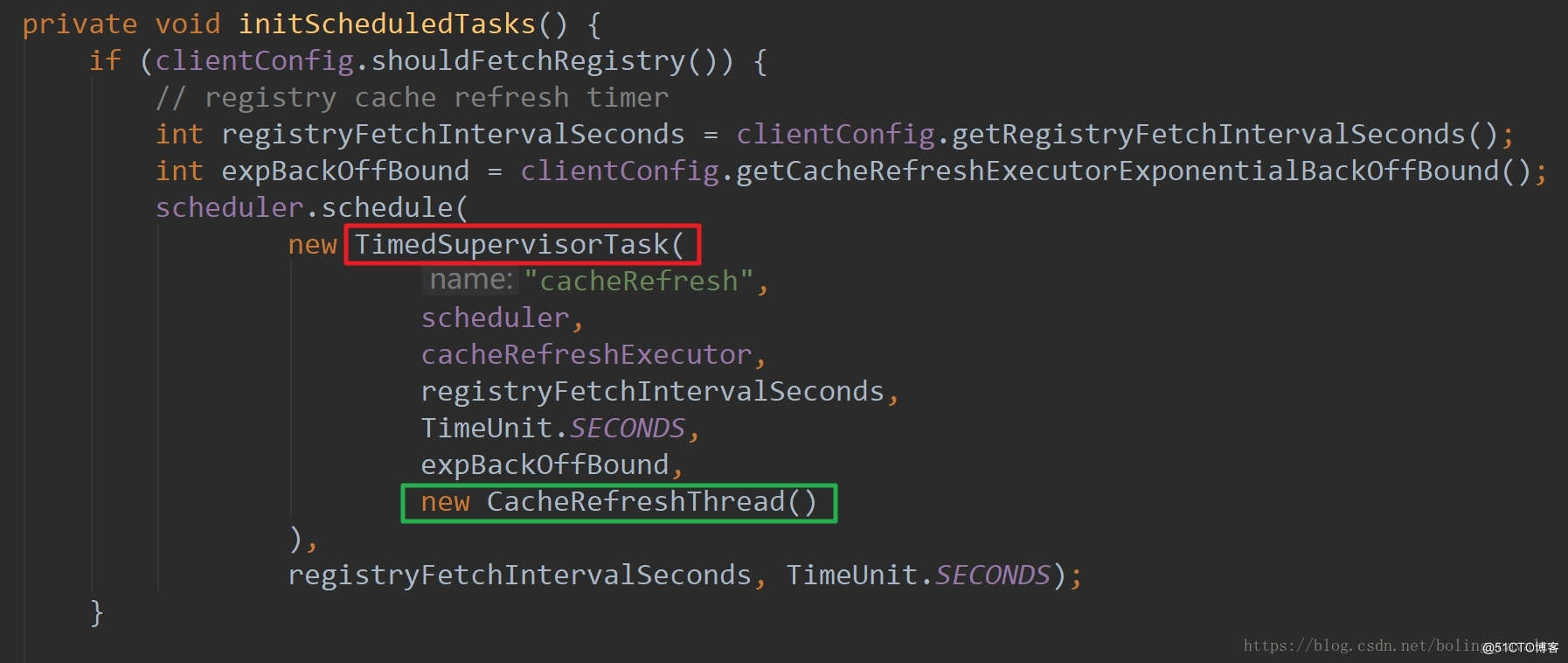

实战监听Eureka client的缓存更新

最常用的5中流ETL模式

Install a WGet for your win10

![[paper notes] catching both gray and black swans: open set supervised analog detection*](/img/52/787b25a9818cfc6a1897af81d41ab2.png)

[paper notes] catching both gray and black swans: open set supervised analog detection*

RTSP/ONVIF协议视频平台EasyNVR启动服务报错“service not found”,该如何解决?

随机推荐

Idea true permanent activation method and permanent activation code tutorial

5本财富自由好书的精华

Huawei ECS EIP cannot be pinged

“方脸老师”董宇辉再回应热度下降:把农产品直播做好让农民受益 考虑去支教

C restart application

Tensorboard的使用

Self organizing map neural network (SOM)

Does huangrong really exist?

Google common syntax

List接口三个子实现类

生产环境服务器环境搭建+项目发布流程

Code quality level 3 - readable code

Check the file through the port

Multi Chain and cross chain are the future

自组织映射神经网络(SOM)

图像分割-改进网络结构

View the file once a second and send the result of the last line of the file to the syslog server

Commonly used bypass methods for SQL injection -ctf

Leetcode 173 Binary search tree iterator (2022.06.22)

开源技术交流丨批流一体数据同步引擎ChunJun数据还原-DDL功能模块解析