当前位置:网站首页>Shanghai Pudong Development Bank, which frequently receives penalty tickets, has been cheated by hundreds of millions of yuan in loans, and lacks of internal control?

Shanghai Pudong Development Bank, which frequently receives penalty tickets, has been cheated by hundreds of millions of yuan in loans, and lacks of internal control?

2020-11-06 22:43:00 【BEDO Finance】

In recent days, , Shanghai Pudong Development Bank ( Hereinafter referred to as “ Pudong Development Bank ”) To be punished by supervision again . according to the understanding of , Shijiazhuang Central Branch of the people's Bank of China disclosed a number of anti money laundering administrative punishment information , The bank of China, 、 Shanghai Pudong Development Bank and others were fined and confiscated 1400 Ten thousand yuan .

among , Bank of China Hebei Branch 、 Shijiazhuang Management Department of Bank of China 、 Bank of China Xinji branch and other branches were fined respectively 310 Ten thousand yuan 、290 Ten thousand yuan 、180 Ten thousand yuan , Several responsible persons were punished . According to the calculation , The total amount of fines imposed by the Bank of China exceeds 1000 Ten thousand yuan .

Besides the Bank of China , Shanghai Pudong Development Bank Shijiazhuang Branch failed to fulfill the customer identification obligations in accordance with the provisions 100 Ten thousand yuan . meanwhile , Two responsible persons of Shijiazhuang branch of Shanghai Pudong Development Bank were fined respectively 5 Ten thousand yuan , The date on which the penalty decision was made is 2020 year 10 month 29 Japan .

On the same day , Xiangyang banking and insurance regulatory bureau announced the administrative penalty information disclosure table shows , Xiangyang Branch of Shanghai Pudong Development Bank (SPDB) has illegal and illegal behaviors of returning loan funds to borrowers for issuing deposit of bank acceptance bills , Be fined 25 Ten thousand yuan .

Increasing income does not increase profit

Bedouin learned that , Shanghai Pudong Development Bank received a huge fine issued by Shanghai Banking and Insurance Regulatory Bureau earlier this year , The total penalty is 2100 Ten thousand yuan . According to the report ,2013 - 2019 year , Pudong Bank has delayed payment of interbank investment funds to absorb deposits 、 Personal consumption loan post loan management is not due “12 sin ”.

Shanghai Pudong Development Bank said , The relevant responsible personnel have been seriously held accountable . Shanghai Pudong Development Bank pointed out that , The bank carried out rectification work from many aspects , At present, the relevant rectification work has been basically completed . But there's no denying it , Shanghai Pudong Development Bank has been violating the rules for a long time .

The data shows , Shanghai Pudong Development Bank was established 1992 year , The registered capital 293.52080397 One hundred million yuan , The legal representative is Zheng Yang ,1999 Listed on the Shanghai Stock Exchange in , Ticker 600000. At present , Shanghai Pudong Development Bank's executives include Zheng Yang, chairman of the board 、 President pan Weidong and vice president Wang Xinhao 、 Cui Bingwen 、 Xie Wei 、 Liu Yiyan et al .

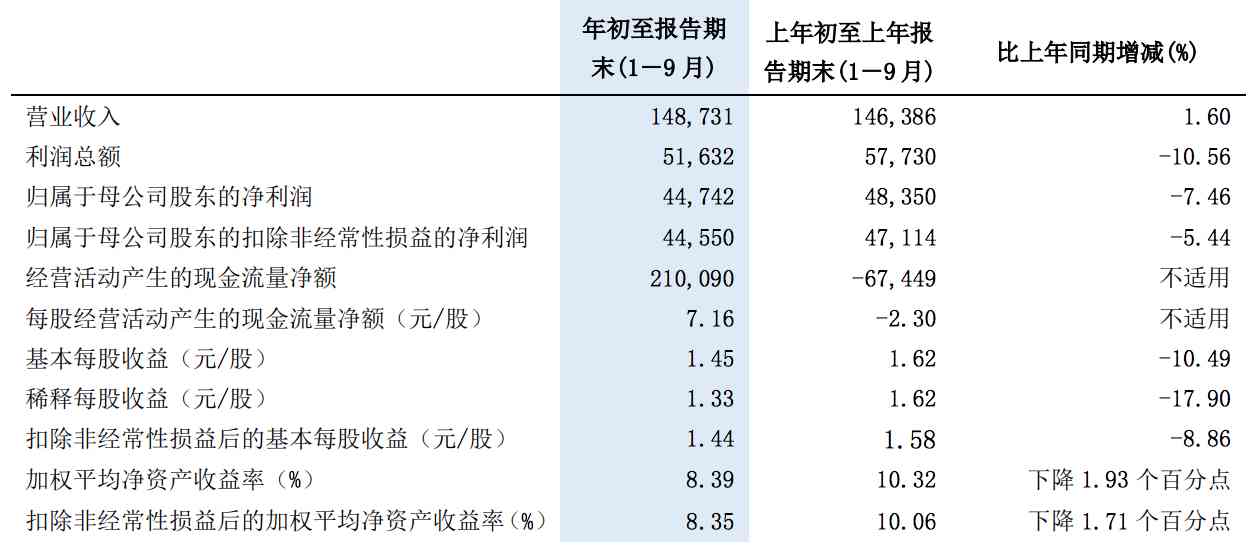

performance ,2020 First three quarters , Shanghai Pudong Development Bank realized its business income 1487.31 One hundred million yuan , Year on year 2019 Increase in 23.45 One hundred million yuan , A mild increase year-on-year 1.6%; Net profit 447.42 One hundred million yuan , fell 7.46%; The net profit after deduction is 445.5 One hundred million yuan , fell 5.44%.

According to the Shanghai Pudong Development Bank's previous announcement 2020 First half results , The bank realized operating revenue during the reporting period 1014.1 One hundred million yuan , Year-on-year growth 3.9%; Net profit 289.6 One hundred million yuan , Year-on-year decline in 9.8%. According to the calculation , Pudong Development Bank 2020 Third quarter revenue 473.2 One hundred million yuan , Net profit 155.9 One hundred million yuan .

In terms of asset quality , By 2020 year 9 end of the month , Shanghai Pudong Development Bank's non-performing loan ratio 1.85%, a 2019 Year end decline 0.2 percentage ; The provision coverage rate is 149.38%, a 2019 Year end rise 15.65 percentage .

And by the 2019 end of the year , The balance of non-performing loans of Shanghai Pudong Development Bank is 813.53 One hundred million yuan , The non-performing loan rate is 2.05%, Chain ratio 2019 In the third quarter of 1.76%, Added 0.29 percentage , Year on year increase 0.13 percentage .

before , Shanghai Pudong Development Bank is in 2018 It is mentioned in the annual report that 2019 It was said in the annual business plan that ,2019 At the end of the year, the non-performing loan ratio was controlled at 1.8% about . But apparently , Shanghai Pudong Development Bank has not completed the set value , until 2020 It's only a year before it gets better .

There are a lot of regulatory fines

It is worth mentioning that , This year, 11 month 2 Japan , The Shanghai Commission for Discipline Inspection announced that , Mu ya, former vice president of Shanghai Pudong Development Bank , At present, it is undergoing discipline examination and investigation by Shanghai Commission for Discipline Inspection and supervision . according to the understanding of , Mu Yayu 2017 year 6 He resigned from Shanghai Pudong Development Bank in June , The reason for leaving the company is “ Job changes ”.

according to 2017 year 7 In January, the media reported , After Mu Ya resigned from Shanghai Pudong Development Bank , Joined Wanda financial group of Wanda Group , As vice president of Wanda financial group . This year, 9 month 1 Japan , Mu Ya also took over the position of legal representative and chairman of Wanda Group .

Information display , Mu Ya worked in Shanghai Pudong Development Bank , Chengdu Branch of Shanghai Pudong Development Bank once issued loans in violation of regulations , The total penalty is 4.62 One hundred million yuan , At the same time, the former president of Pudong Development Bank Chengdu Branch 、2 Vice presidents are accountable , Including banning business 、 Tickets, etc , The time for making a penalty decision is 2018 year 1 month .

The reason for being punished is that , Shanghai Pudong Development Bank Chengdu Branch made up false use of 、 The spin off facility 、 Ultra vires examination and approval etc , Illegal handling of credit 、 Industry 、 conduct financial transactions 、 L / C and factoring , towards 1493 Credit to shell companies 775 One hundred million yuan , In exchange for the investment of relevant enterprises to undertake the non-performing loans of Shanghai Pudong Development Bank Chengdu Branch .

2019 year 10 month 12 Japan , The penalties disclosed by the CIRC show that , because “ Shanghai Pudong Development Bank has seriously overlooked the credit business and rectification of Chengdu Branch , The party concerned shall be responsible for the violation ”, Mu ya, then vice president of Shanghai Pudong Development Bank, was fined 30 Ten thousand yuan .

It is also understood that , Shanghai Pudong Development Bank has also infringed on the rights and interests of consumers , Be informed by the Consumer Protection Bureau of CBRC . This year, 4 month 16 Japan , The Bureau issued 《 About Shanghai Pudong Development Bank 、 Notice of cases of China Property Insurance Company infringing on the rights and interests of consumers 》, Name Shanghai Pudong Development Bank 、 China property insurance has infringed on the rights and interests of consumers .

Report shows ,2018 year 9 month , Shanghai Pudong Development Bank agency sales of private products appear to be delayed payment problem , It has caused many consumer complaints . After the check , Shanghai Pudong Development Bank has a number of violations of consumer rights and interests , Including inadequate due diligence 、 Incomplete risk warning, etc .

Hundreds of millions of yuan were defrauded

Besides , Shanghai Pudong Development Bank (SPDB) has also made frequent loans “ Step on thunder ”. In the near future , A civil ruling issued by the Chengdu Intermediate People's court in Sichuan Province shows that , Sichuan Zhonghuan Mining Co., Ltd 2016 year 1 The month and 6 month , We have successively obtained two loans from Kehua sub branch of Chengdu Branch of Shanghai Pudong Development Bank , total 6500 Ten thousand yuan .

When the two loans mature respectively , Shanghai Pudong Development Bank Chengdu Kehua branch has not received the principal , No interest was received .2019 year , Shanghai Pudong Development Bank filed a lawsuit against Sichuan Zhonghuan Mining Co., Ltd , But the defendant did not appear in court , And has been listed in the list of abnormal operation by Sichuan market supervision and Administration Bureau .

however , This is not the first time Shanghai Pudong Development Bank has “ Step on thunder ” To lend or be defrauded of a loan . before , Wang Yibin, former customer manager of Shijiazhuang branch of Shanghai Pudong Development Bank , Take advantage of authority , Collude with outsiders to defraud your own bank 6000 Ten thousand acceptance draft . As of the date of the crime , Still close 3000 Ten thousand yuan has not been returned .

stay 《 Yan learned to commit the crime of contract fraud 、 Loan fraud 、 Credit card fraud 、 Retrial of state functionary's verdict on non criminal bribery 》 in , Yan learned to use the two companies he controlled , Bribe Wang Mou Jue, general manager of small and medium Customer Department of Shanghai Pudong Development Bank Guangzhou Branch 256.1 Ten thousand yuan, etc , The total amount of loans approved from Shanghai Pudong Development Bank is 7800 Ten thousand yuan .

in fact , The most serious case is the case of loan fraud directed by Shanghai Pudong Development Bank Chengdu Branch . The former CBRC pointed out that , This is an organized fraud case led by Pudong Development Bank Chengdu Branch , The amount involved is huge , The means are hidden , Poor quality , have a profound lesson .

版权声明

本文为[BEDO Finance]所创,转载请带上原文链接,感谢

边栏推荐

- Exclusive interview with Alibaba cloud database for 2020 PostgreSQL Asia Conference: Zeng Wenjing

- 2020-08-19: what mechanism does TCP ensure reliability?

- How to start the hidden preferences in coda 2 on the terminal?

- Stm32f030c6t6 compatible to replace mm32spin05pf

- Test the necessary skill points of siege lion! This article takes you to interpret the testing technology under Devops

- FreeSWITCH视频会议“标准”解决方案

- Stm32f030f4p6 compatible with smart micro mm32f031f4p6

- 插件Bilibili新版0.5.5

- QT audio and video development 46 video transmission UDP version

- confd

猜你喜欢

Interviewer: how about shardingsphere

confd

Git SSH bad permissions

Experiment one

pc端与移动端适配解决方案之rem

Epu360: all the H5 templates you want are here, e-book, big turntable, red envelope rain, questionnaire survey

August 30, 2020: naked write algorithm: the nearest common ancestor of two nodes in a binary tree.

Stm32f030c6t6 compatible to replace mm32spin05pf

“非洲用户的付费意愿并不低”——专访四达时代研发总监张亮

Detailed software engineering -- the necessary graphs in each stage

随机推荐

How does LeadTools detect, read and write barcodes

Stm32f030c6t6 compatible to replace mm32spin05pf

条形码识别性能低,如何优化Dynamsoft Barcode Reader解码性能

Zhou Jie: database system of East China Normal University

ado.net and asp.net The relationship between

Idea activation to 2089 failure

Plug in bilibilibili new version 0.5.5

image operating system windows cannot be used on this platform

JS array the usage of array is all here (array method reconstruction, array traversal, array de duplication, array judgment and conversion)

大佬们如何在nginx镜像里面增加模块?

The memorandum model of behavior model

Common mathematical basic formulas of recursive and backtracking algorithms

汽车维修app开发的好处与功能

idea 激活到 2089 失效

Stm32f030k6t6 compatible replacement smart mm32f031k6t6

confd

Exclusive interview with Alibaba cloud database for 2020 PostgreSQL Asia Conference: Zeng Wenjing

Image processing toolkit imagexpresshow to view events

Mobile pixel adaptation scheme

vue3 新特性