当前位置:网站首页>Self reflection of a small VC after two years of entrepreneurship

Self reflection of a small VC after two years of entrepreneurship

2022-07-04 17:47:00 【weixin_ thirty-eight million seven hundred and fifty-four thous】

“

This article comes from an in-depth conversation with two friends of Chunjian capital during the epidemic .

This conversation was originally purposeless , It's just a simple chat . But here's what I didn't expect , They have deep questions , It gave me the opportunity to review the entrepreneurial process of our team in the past two years .

To be frank with you , It's really not easy along the way ; But survived , Everything will get better slowly . Thank you for this conversation , Let me also have a new harvest .

” interview | Chenqingsen Haodexiu

writing | Haodexiu

0

1

Official account is the window of traffic

Investors should constantly update their circle of friends

Constant base capital 2019 Preparations began in , Through the impact of the epidemic , On 2020 year 6 Officially launched in . So far, it has invested in more than ten enterprises in the field of science and Technology , Among them are venut 、 Shanghai Boke 、 Shanghai Hengye 、 Jiepei Technology 、 And whale Technology 、 Xiaoshi technology and other projects , At present, the scale of asset management is about 3 One hundred million yuan . In any way , This is a young family “ Small fund ”. But here's the surprise , This young family “ Small fund ” But has accumulated a certain reputation in the circle , And gained tens of thousands of fans .

Fame and fans mainly come from the official account of ChangLei capital . With a series of high-quality and humorous original professional content output , ChangLei capital gains 10w+ The amount of reading , And the corresponding reputation . The signature you saw on the official account 「 Brother spear 」、「 Von ski 」 The author of , Shi Mao and Feng Bo, partners of ChangLei capital .

We are curious , Rely on building the popularity of we media to improve the popularity of the Fund , Is it the brand strategy and path of this young Fund . Regarding this , Shi Mao confessed , The popularity of ChangLei capital official account belongs to 「 Unintentional 」「 accidentally 」,“ If I can copy such a official account now , I think it's past that time . There is both chance and necessity , It's hard to repeat .”

For the popularity that official account brings to the Fund , He didn't show much surprise , Think this is just icing on the cake ,“ It's like you're wearing a nice dress , At first sight, everyone will think it's good , But the output of cognition can really help us raise money ? Or help us project well ? In fact, we can't draw an equal sign directly .”

“ Traffic is actually just a window . And you see , We won't export much in a year , Maybe it's just like sevenoreight articles , In fact, the process of each output is to summarize our experiences and thoughts , It is equivalent to a staged resumption , That's it , We don't write for the sake of writing . Besides, writing an article really wastes my time , To collect data 、 put file in order 、 Put the facts 、 Be reasonable , Otherwise it will become 「 Subjective vent 」. So we media is not our original intention .”

Although writing official account is not intentional , But more new friends pour in through this traffic window , The circle of friends of Shi Mao and ChangLei capital has been truly updated . And this is exactly what stone spear attaches great importance to . As he wrote in his article , The inherent circle of acquaintances sometimes becomes an obstacle for you to understand the real trend , Especially new things .“ My personal experience is , Investors should regularly update their circle of acquaintances , Be curious about things , So as to cover more emerging things .”

Shi Mao regards the update of the circle of friends brought by official account as an indirect 、 Passive update , Because someone else came to him , And the other is direct 、 Active circle of friends update was initiated by Shi Mao in Shanghai last year 「 Investment gangs 」 Activities . Stone spear introduction , This is an offline party about investing in black Technology , Topics include metauniverse 、 semiconductor 、 New energy 、 Industry digitalization 、 Biotechnology 、 Medical innovation and so on , At present, three phases have been done , Every issue can come 30 Many small partners for investment .“ Their level is not very high , But they are all young ,90 And after 95 After the main . I brush many items every day , A bit like ten years ago ( Just in the line ) Of me . They are very active , Not bound by some rules , I am also learning from them .”

Except for investors , Also coming to the event were technology giants 、 Industrial chain giants and other large companies are friends of Technology Management . Shi Mao added , They are not CXO This level , But I usually take a small team , You can explain their views and perceptions of the industry from the perspective of large companies .“ This is very useful for us , because ( Investing ) We still need to study the company . Many people think that listed companies are too traditional , Startups are the ones that will overturn the future , In fact, there is nothing new under the sun . You invest in a start-up , Maybe three years later , You'll find that , This enterprise is no different from those listed companies . What technology drive did the enterprise talk about in the early stage 、 Flow economy , Finally, it falls on the product 、 channel 、 Supply chain 、 Get customers and wait for these things , The nature of business has not changed .”

0

2

「 Fixed bull's-eye 」 And 「 Flowing bull's-eye 」

Contact enough companies and study great companies

Young investors and technology managers of large companies , These two groups of people appeared at a party at the same time , It almost directly reflects the methodology of ChangLei capital in daily work : Contact enough projects , Study great companies .

Since its official launch , For more than two years , ChangLei capital has invested nearly 10 companies . In the interview of Chunjian capital , We asked Stone spear , Is this speed fast or slow , He answered :“ I think it's ok .”

then , He further explained , The current investment strategy of ChangLei capital can be described as 「 Fixed bull's-eye 」( Bullseye is the project ),“ Because our first fund has not reached a particularly large scale , let me put it another way , If a single Fund 10 Billion words , Then the pressure will be great . Now we are catching up with the epidemic , Some institutions lie flat , But for us , It's called 「 Fixed bull's-eye 」, Don't worry , We have money , The amount of funds can be large or small —— Of course, it's very likely not , But there are still tens of millions of small , The investment scope is very wide for us . We need to put a map Study well , Find the winner model we think , That's what Xu Xin proposed before winner pattern. Entrepreneurship in a track , It may be like climbing a mountain , Some climb from the South , Some climb from the North , Some sit on Cableways , Finally, who can get to the top of the mountain fastest , In fact, investors need to analyze and study . If the final research finds , A company in the track is very special ; So the next question is : Can you throw it in ? If not , Then you can only give up , must miss fall .”

however , Be a family GP The size of a single fund managed has reached 10 Billion body hours , Stone spear theory , That's the entry VC Main battlefield ,「 Fixed bull's-eye 」 Immediately by 「 Flowing bull's-eye 」 replaced .“ This stage is right for VC The test of is another dimension . stay 「 Flowing bull's-eye 」 Stage , You should study every hot spot , You can't miss fall . So now for ChangLei capital , We are still in 「 Fixed bull's-eye 」 Stage , It is a static investment , Calculate the average annual investment of fourorfive 、 Fiveorsix , I think it's good . Our investment stage can be early , It can also be a growth period , On the contrary, it is quite calm .”

Whether it's 「 Fixed bull's-eye 」 still 「 Flowing bull's-eye 」, The first problem investors need to solve is to see enough good companies , Stone spear theory .“ Some investors brush every year 300 A project , Brush for three years 1000 A project , It seems busy ; But I found that : When a good project is missed , He will feel very empty himself , No sense of achievement , In the past few years, I have seen many PPT It's just a story .”

He thinks he is a lucky investor , In the past few years , Catch up with VC The golden age of , Fortunately, I participated in some good projects , Help them develop from a valuation of $100 million to $200 million into their respective industry leaders . So within the team , He asked his colleagues to get in touch with the company ,“ Maybe the investment can not be achieved in the end , But you have to touch , Track to ; Fully cover the competitive products in this track , Try to talk about everything you can , In this way, you can know yourself and your enemy .”

second , Study great companies . Such companies may already be listed , The historical data of listed companies are very detailed and perfect , And the annual report will be disclosed every year .“ By systematically studying excellent companies , Then we can slowly find what we just said winner pattern.”

Shi Mao recalled himself 2010 After entering the industry in , Experienced the explosion of Internet and mobile Internet , And I was lucky to meet a group of excellent entrepreneurs , Seized several good opportunities . He said ,2015 Around the year , China's entrepreneurial environment is full of flowers , It's like 90 Like Hong Kong films in the s , Brilliant . Wu Xiaobo also said publicly ,2014 To 2016 The year is the best time to start a business in China . Now? , The times have changed .“ you ( investors ) There are few opportunities to be lucky enough to contact the founder of a company with a future market value of more than 10 billion , Not to mention the market value of 10 billion dollars . Now this node , Invest in a ten billion dollar company , Many investors dare not think .”

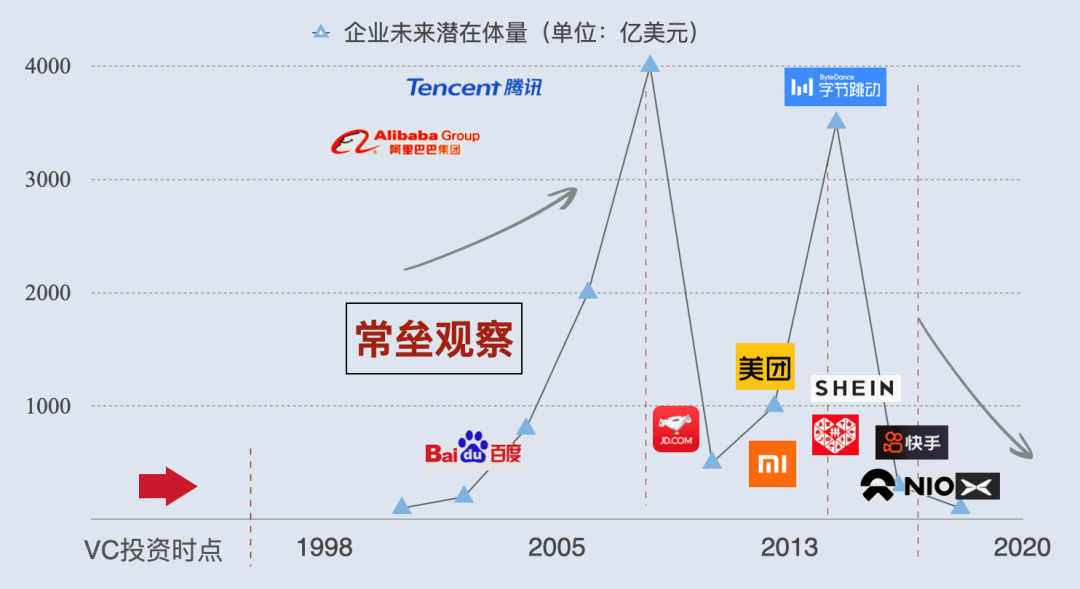

He once expounded in his article , If the investor's career is 2000-2010 year , Then you have a chance to catch two super giants , Tencent and Alibaba ; If you show up in 2010-2015 year , We can still seize enterprises at the level of hundreds of billions of dollars . But if you are 2016 Years later VC This field , So I'm sorry , You have little chance of catching top projects , It's not that you don't work hard enough , It is timing It's not right .

Today's venture capital environment , It's hard for young investors , Stone spear sighed ,“ therefore , Since you can't touch ( Potential great companies ), Then study those that have been successful , You can study Amazon , You can study Apple, You can study Google , You can study these great companies .”

Past 20 Year , As VC The opportunity to participate in a great company

( picture source : ChangLei capital official account )

Contact enough projects and research great companies , The support behind it is raised by stone spear VC Two abilities to possess : Data collection ability and research derivation ability . The two are just the combination of practice and thinking . Stone spear emphasizes , The underlying logic of investment will not change , But in the process of practice and thinking , We must consider the current industrial and social changes . He classified changes into three categories , The first is intergenerational changes , This includes China facing Lewis turning point ( Labor has shifted from surplus to shortage )、 Per capita GDP Already breakthrough 3000 Dollars and many other aspects .“ You bet , People are changing .” Stone spear emphasizes ,“ The trend of China's economy is very similar to that of Japan and the United States , I think it's more American , So many things in the United States copy to china. The road the United States has traveled , China may go again .”

The second is the breakthrough of the critical point of Technology . He cited Tesla as an example , Tesla from 2003 Established in 2003 2010 Annual listing ,“ If you vote for Tesla early, it will be very painful , Lose money every year , Close to bankruptcy , Even when listed, the market value is not high , Only a billion dollars . But it really broke out a few years after it was launched , Technology has broken through the critical point of commercialization . So the critical point of technology is very important , Before it appeared , We really have to wait , Once the time is right , There will be huge systematic opportunities .”

The third is the policy differences and changes between different countries . Stone spear then talked AI Industrial Development , He said AI Industry has a smile curve , The highest point at both ends , One end is represented by China Hikvision , The other side is represented by NVIDIA of the United States , The former is the sale of standardized hardware terminals , The latter focuses on AI The underlying technical architecture . At present, although there is Shang Tang in China 、 Ge Ling has deep pupils 、 Cloud technology has been listed AI company , but “ Earn a lot of hard money ”. He thinks that , In China, toB Entrepreneurship in this field , If only blindly copy to china, In the end, it must be impossible . meanwhile , Changes in the external relations between China and the United States in recent years , The wave of domestic software substitution is accelerating , Yes VC for , This is an important change and development trend that cannot be ignored .

0

3

to B Investment is to look for hills on the plains

As the head of a new fund that has only been established for more than two years , Shi Mao was very clear about the positioning of ChangLei capital from the beginning :“ We are a new fund , It is impossible to make a positive confrontation with major mainstream funds , So we must do screening on the subdivision circuit .”

He is one of the first investors in the field of technology in China who began to pay attention to cloud computing and other directions , And invested in cloud accounting 、 Small i Robots and many other projects . Feng Bo and panjinzhao, the other two partners of ChangLei capital, have also accumulated many years of investment experience in the field of science and Technology . so to speak , The partner team of ChangLei capital has the natural background advantage of investing in the field of science and Technology .

More specifically , ChangLei capital's investment direction is in the field of science and technology to B industry . Stone spear theory ,to C Industries tend to rise rapidly , But it fell back quickly , Especially in terms of valuation , Behind the overvaluation is investors' expectation of high growth , But many to C The company found out only after it was listed on the US stock market , The first day of listing is the peak of its market value ,“ Most companies don't have so much high growth ? Its previous valuation has already overdrawn its growth expectations for the next decade .”

but to B Our industry is different . Stone spear theory , At present, most of China to B Of enterprises choose A Share based ,“to B There is a strange phenomenon in our company , stay A Share listing and U.S. stock listing , Valuations are quite different , stay A The valuation of stocks is often higher than that of stocks in the United States .”

He analyzed that , China to C Of enterprises have absolute demographic dividends ,“ You tell a story about the demographic dividend to investors all over the world , Everyone understands , but to B But not so .to B Industry does have an invisible protective wall in China , In recent years, China has advocated to IOE, Foreign funded technology products may not be applicable in China . So Chinese to B When enterprises come to the United States to tell stories to international investors , The other party can't understand it . They think , Chinese companies listed on U.S. stocks should become high market capitalization enterprises , Then the technology must be world leading . But for now , I think there is still a gap , We must admit this .” Shi Mao emphasized , This does not mean that China to B Enterprises relying on policy protection only have advantages in China , But there are special problems in China to B The business environment has bred the growth of a number of local enterprises , Therefore, investment must follow the trend .

in addition , Stone spear raised ,to B Investment is to look for hills on the plains .“ Past 20 year , Among these domestic listed enterprises ,to C Our company belongs to 「 This principle 」, That is, the first place occupies 80% Market share , but to B The enterprise , The top three in a track can even IPO, It shows the distribution of hills .”

Hills are scattered , Shi Mao thinks , Head funds will not spend money betting on scattered targets ,“ So allow us enough time to do screening . Especially for our newly established fund , Is still in the 「 Fight street battles 」 The stage of development , This is especially important .”

and to B The subtlety of successful entrepreneurship in the field lies in , It's not like a semiconductor or a new drug development track , Only focus on the players at the top of the pyramid ; Nor is it like the pure Internet to C The track is like that , Winning is hard to copy , Completely random . This subtlety helps ChangLei capital to do screening to a certain extent .

“ for instance , In the semiconductor and pharmaceutical industries , If you are a too grassroots entrepreneur , You said you would finance to make digital chips , To do PD-1 Cancer drugs , No one dares to vote .( hypothesis ) You used to do social software or games , Suddenly kill to B field , I think it's almost impossible to succeed . in other words ,toB Entrepreneurship in this field , Rejected the completely random probability of success .”

Shi Mao's view is ,to B Entrepreneurs in the field do not have to be glittering , But not too grassroots ,“ In this direction (to B Field entrepreneurship ) It gives many experienced technology entrepreneurs a chance to succeed .”

Like many investors , He also appreciates those with auras 、 Glittering entrepreneurial team ,“ But once the light starts to shine , You'll find out , All investors will come , This is the stage of competing for funds again . Investment is too star 、 A team with too much aura , It's actually a lazy investment method for us . When Chang Lei's fund is large enough , We must also cover these Tauren . But in terms of our current fund volume , Obviously, the game of frontal battlefield is inappropriate .”

Moreover, , In the eyes of stone spear , This kind of glittering cattle man can be met but not sought .“ Projects that can really make a lot of money , Often underwater , And there are often differences in the early stage . On the contrary, the project that was held high at the beginning , It may not be a good opportunity to make money . So what ChangLei capital wants to explore is underwater projects .”

0

4

Standing on the 2022 Outlook for the year 2030 year

The tide of digitalization has just begun

In this interview , Shi Mao also shared with us four new directions that ChangLei capital is currently focusing on .

First of all , Industrial software , Including industrial control safety 、 Industrial intelligent manufacturing 、 Industrial interconnection and so on , Will be the focus of ChangLei capital's future investment layout .“ Industrial software is what we are good at , From front-end design and development to collaborative production , And then to the whole automatic manufacturing process , We will continue to layout .” Shi Mao revealed , ChangLei capital will make big moves in this field in the near future .

second ,AI2.0. Stone spear theory , Everyone mentioned AI Four Little Dragons , The first impression is loss , Because these companies are currently in the stage of expanding their territory , To a large extent, it depends on the support of capital . And now , He judged that ,AI Entered 2.0 Time .“ What is? 2.0? That is, industries should be divided .” Stone spear theory ,2.0 In the era of AI The company will be different from some companies on the market , Make a framework , And then do the algorithm , Make a model again , And make industry solutions ,“ impossible , I can't do the last part well . Therefore, the industry should be divided , Attend to each one's own duties , The division of labor in the industrial chain is perfect , In this way, the leading companies in each industry are the ones who know this industry best , At the same time, it will also form large-scale profits .”AI2.0 The era will be one in which all flowers bloom , Stone spear means , ChangLei capital will naturally continue to pay attention .

Third , Digital twins or meta cosmic infrastructure . This aspect will be related to 3D of , Include 3D modeling 、3D Design 、3D Rendering and so on ,“ What you see is what you get , Whether it's VR still AR The immersive experience of , Need to be 3D What it looks like . These can be regarded as the foundation of digital twins or meta universe .”

Fourth , Digital layout related to double carbon and new energy . It's really hot in this direction , Stone spear theory , But ChangLei capital is not to pursue the wind , Because double carbon and new energy are the general direction of national macro policy .

Stone spear theory , At present, in China's venture capital environment , Consumption and investment are cold , Technology investment is hot . He is very vigilant that , Technology investment has also reached the stage of falling back from the high point ,“ It's actually quite dangerous .” He said .“ Now let's ask you whether you want to invest in semiconductors , I think many people will answer that they should consider it . Two more years ahead , Many people say to B He who gains the world , Now? ?SaaS Investment is cold again , Everyone starts to see double carbon again , Related to new energy or automobiles .”

The development of an industry cannot be accelerated in a year or two , So the ups and downs of the cycle are normal , Investment hotspots change every other year , Stone spear theory , But investors' attention to the industry must be long-term , It will take at least ten years .“ For regular bases , Let's study digitalization and intellectualization .”

When it comes to digitization , Stone spear theory , He has just made a systematic review , Combed the development of digital industry in the United States ,“ You'll find that , The gap between China and the United States is indeed too big .”

He said , In the past 6 Months , U.S. technology stocks can be described as a stock disaster . Apple 、 Google 、 Amazon 、 Netflix 、Meta The share prices of a number of star technology companies have experienced a substantial decline , The plunge of many technology stocks “ It's no less than 2008 In the financial crisis of .” Stone spear theory , For all that , The market value is more than ten billion dollars 、 There are still many companies with hundreds of billions of dollars .“ It shows that the United States has reached a stage of rapid development , And China hasn't arrived yet . Will China come to ? This is the first question . When will China arrive ? This is the second question . Since we are focused on this track , I firmly believe that China will reach this stage of development . In the past two years, we talked about science and Technology 「 thetime 」 problem , At the bottom CPU And the operating system , Upward applications will certainly flourish like the United States , So the final competition is digitalization 、 Soft power . And with 80 After this group of people who have grown up with digitalization or come into contact with digitalization very early have gradually become the mainstay of every industry , People's habits of using digital processes will slowly come into being .to B Industries often say PLG, Products lead the market , Or is it Go To Market, Once this wave appears , Is a huge opportunity . But you can't wait for the chance to see , Opportunities are always given to those who are prepared . therefore , Standing on the 2022 I have been seeing 2030 year , I think the tide of digitalization has just begun .”

In the short term , it ( Digitization ) It's a voting machine , Everyone voted when they felt good , Stone spear theory ,“ But in the long run , It's a weighing machine , Players in this industry will become giants when they really get up . As an early investor in the primary market , We should take a long view .”

0

5

The founder has much to offer

No, core It is difficult for enterprises to have great development

Shi Mao once shared in detail in an article about 「 What kind of entrepreneurs cannot invest 」, Part of it is 「 As soon as I came up, I asked investors foolishly : Except for money , What other resources ? In the face of this problem , I usually tell him , We have no resources but , No money 」.

And the reality is , In helping entrepreneurs provide resources , ChangLei capital is focused by the track , Everyone in the team will serve the enterprise from different perspectives , Connect resources . Stone spear theory , Even if the start-up company obtains the investment of some large funds , But the real post investment service for it may only be an investment manager .“ The boss of big funds has a voice , But he can't devote all his energy to every project . Because large funds have to invest in dozens of projects a year , But only 52 Zhou , The boss is even too busy helping an enterprise every week . So big funds invest in a project , It's equivalent to a chapter ( Brand Endorsement ), Really do post investment empowerment , Maybe it's just the investment manager of this project . What empowerment can an investment manager provide ? I think there is almost no . And we are the whole team of the fund to empower the project , Dig people from 、 Customer 、 Industry strategy 、 Supply chain resources and other aspects can really help enterprises , Comprehensive grafting resources . Track focus allows us to concentrate our forces to make key breakthroughs . Why did the Red Army succeed in breaking through the encirclement and suppression three times ? It must have found the weakest link of the enemy to break through . We are the same .”

And the process of post investment service is also the process of continuous verification of enterprises , At the same time, we can have a deeper understanding of the upstream and downstream industries ,“ It is possible to find upstream or downstream worthy of investment in this process ” New business “, So as to form an industry investment ecosystem . Therefore, post investment itself is also a process of continuous research and research .”

Such a thick post investment service , Obviously, it's not what Shi Mao said 「 We have no resources but , No money 」. He explained. , The reason for this answer , Because the founders asked such questions when they first met , It is the performance of low comprehensive EQ .“ There are always bad times for founders , At every stage, there is a obstacle to overcome , He needs help , If the conversation is immature , You may set up some invisible enemies for yourself without knowing it . This shows that this person is not a very qualified CEO, EQ is flawed . Then he is at a certain point in the future , Maybe when financing , Maybe when negotiating with suppliers , Maybe when making a decision , wait , One of his personal flaws will be amplified , And this defect may be fatal .”

He has met many successful founders , Patient and modest ,“ It's a character that everyone likes very much ”. Facing such entrepreneurs , Stone spear theory , Even if you don't vote for him , Will also give him docking resources .“ Help those who get the way . You become friends with more people , There will be more people to help you .”

In the past April and may , Affected by the epidemic , Shi Mao and his colleagues in Shanghai started telecommuting . Stone spear was accidentally found , Video conferencing can help him screen entrepreneurs more efficiently .“ Help us screen out people who don't want to see each other again . If you like entrepreneurs after the video conference , Then we will definitely arrange to meet offline .”

His observation is , Many investment institutions begin to contact entrepreneurs and end up making investments , The number of meetings between the two parties generally does not exceed 3 Time .“ First meeting , Come to the roadshow , Several people in the organization asked some questions ; The second time , Drag partners to chat , Not bad , I began to make adjustments ; third time , All adjustments are finished , Okay , Get ready SPA, Sign up for payment .”

A few sides below , Investors don't really know entrepreneurs .“ In fact, most of them come out to finance CEO Not suitable for entrepreneurship , Many people should not start a business .” Stone spear sighs . In order to better understand entrepreneurs , ChangLei capital will 「 From first meeting to investment 」 The timeline of is appropriately lengthened , This is also the reason why ChangLei capital investment is not fast . Stone spear theory , ChangLei capital often observes entrepreneurs for half a year or even a year .“ We just met him ( Entrepreneur ) When , Maybe he is not in the financing window , We really vote for him , It may be half a year or a year later . But during this time , We constantly observe him , Even connect some resources for him for free , See if he can catch , It's also a test . And have dinner together , Basically like our age , Eating three meals will show a person , For example, whether to drink alcohol , What do you talk about , Where is he going after dinner , Go home or go back to the office , Or go to the gym ? Judging from many details, what he is doing all day .”

You can't take care of your family too much , Shi Mao said half jokingly , Because work energy will be scattered .“ There are also founders , The reaction was slow , What did you send him , He will also answer you , Say research . But three months later , When this thing really becomes a trend , He still has nothing action. But many young and even single founders , Tell him something , They will use various efficiency tools such as flying books to improve quickly , You will see something different in a week . This is iterative capability . So , As an investor , If you don't know the founder well , How do you know if he can ?”

Yes, of course , Don't overdo the role of the founder of myth . Stone spear theory , An enterprise starts from 0 To 1, from 1 To 10, from 10 To 100, On the surface, it is the evolution of the founder , Because the founder of a successful enterprise must have strong learning and iteration ability .“ But it's not at all ( Rely on the founder ). Enterprises from 0 To 100 In the process of , The essence is that the enterprise is in different stages of development , With the continuous integration of fresh blood , Several key figures constantly push the enterprise to new heights . So every time you invest in an enterprise , I will tell the founder , Your next thing must be hiring , Otherwise, we can only rely on the current team to learn and evolve , There will be no progress . Because everyone has his fixed cognition , It's hard to break through yourself .”

He pointed out that , If an enterprise does not recruit new people for a period of time , Or the person you recruited stayed for a while and left ,“ Take it easy. , This enterprise must still be the same , No essential change . When an enterprise develops to a certain stage , If your core( Core talent structure ) There is no form , There will be no great progress . Many companies are valued at $5.6 billion , But the development cannot go up or down , That's why core Never established . This core Each of the core characters in CEO、 The corporate culture must be highly recognized , If the core personnel disagree with each other , Then the whole enterprise has no soul ; The core backbone of the enterprise will leave at any time , Once talents leave one after another , The company's 「 Arm 」 It's gone , You will lose your strength . Employees at the bottom can leave , but core Once it collapses , Then the whole organization basically no longer exists .”

0

6

a VC Self innovation

The inheritance of mechanism and culture

Since the founding of ChangLei capital , Shi Mao likes to say that he is also an entrepreneur ,“ Although we invest in supporting technology entrepreneurs , But we are also entrepreneurs .”

that , From the perspective of entrepreneurship , What is ChangLei capital's entrepreneurial ideal ? Stone spear theory , Just like many LP Ask him , Tell me what height you want to reach in the next ten years ? Which fund are you targeting ?“ Are we going to be the next Hillhouse and Sequoia ? Definitely not , Hillhouse caught Tencent , Sequoia has seized the whole new economy , They are hehuaxing 、 Noah grew up together , This is a triangular relationship . But in today's regular base does not have any conditions ; So if I blindly say constant base capital benchmarking XX capital , Will only appear to be very ignorant .”

He does not deny that the scale of asset management is a measure of a VC The standard of success , In fact, he very much agrees with this view ,“ You're big and you haven't had a thunderstorm , That's what you're capable of , It's really powerful .” For all that , He still insists , Constant base capital is not regulated Mold wins .“VC Only want to invest in innovative enterprises , But in the past 20 year VC There is no innovation in this industry , So I want to create a new way of working , We are also learning from it DAO Thought , A decentralized and open organization ; But we don't engage in chain , No money , We are still classical investors .”

He praised the famous funds in Silicon Valley Benchmark Capital,“ There are not many people ,7 To 10 personal , But all are partners , Small and beautiful —— It's not too small , Each fund 5 About US $100 million . If calculated by RMB Fund , For me, , Each fund 5 To 10 RMB , Such a scale is ideal , It doesn't need a lot of people , It's easy to manage . I want to build a small structure in ChangLei , At the same time, it can reach more young people . These young people may come from industry , Maybe do it yourself FA, Or from LP recommend ; They will provide us with information 、 Recommended projects . So that's one DAO Flat organization , ChangLei itself has something like CPU Same information processing ability —— We have license plates , Can raise funds independently , There is also a powerful risk control kernel . Rely on the information they provide , We have established the most extensive information network . When the project really exits the settlement , They can also get carry, Because they are equivalent to our non staff personnel .” Stone spear theory , This is what ChangLei capital is practicing VC innovation .

In his detailed plan , When these 「 Non staff 」 After joining the regular base , The fund of ChangLei capital is still divided into one period and one period ,“ This pool is still very clear . When they come in , If you invest in a project , In fact, it takes up the money of this Fund . When new projects come in for investment , They will have some voting rights for new projects , Because if the new project sucks , That rotten project is to share everyone's costs , The final share will affect everyone's income . meanwhile , Different outsiders may come in each issue .” such , According to the assumption of stone spear , Every fund of ChangLei capital will become an automated 、 Mechanized 、 A long-term fund that is not transferred by human will .

Looking back at China in the past 20 years VC The history of development and changes , Stone spear theory , The founders of many established funds have made money , The talents in the middle echelon have left , The brand of this fund finally disappeared .“ So I want to be more objective , Even more digitally , Establish a flat and automatic investment platform . The size of each fund may not be very large ,5 To 10 RMB , If it can continue , In the future, it can also be made into a fund with a volume of 10 billion . This is what we want to do in the next ten or twenty years , I may spend more time making friends in the future 、 Train more young people , Let the regular base 「VC innovation 」 It really works , Create something different for the industry .”

Shi Mao thinks , The ultimate winner of an enterprise , It is the inheritance of mechanism , It's also the inheritance of culture , The same is true of funds . therefore , When Chang Lei capital 「VC innovation 」 After the mechanism gradually matures and operates , The inheritance of culture is particularly important . Before , In a dialogue with Lang Ping, Shen NANPENG mentioned how to better practice the partner culture , He proposed three words , Namely : listen 、 trust 、 brace . Shi Mao is deeply convinced of this .

He explained one by one ,「 listen 」 It's not just partners who need to listen to the views of partners , Partners should also be good at listening to the views of entrepreneurs ,“ Listening is important , Investment is not a subjective thing , Data speaks .”

then , He said 「 trust 」,“ Great projects are often anti consensus , In an organization, only oneortwo people are sure . If your first step of listening is not done well , The data is not objective , Then there will be no trust inside the Fund , You will question . Once you lose trust , Then investment becomes a fraud .”

The third is 「 brace 」. The advantages of each partner are different , Stone spear theory , Some people are research driven , Someone is a data collector , Some people are particularly good at socializing ,“ Versatile talents are scarce , So partners should fill each other's seats , Verify the reliability of investment from all dimensions .”

0

7

The current crisis is a kind of psychological crisis

Read more , But don't pretend to be diligent

When Shi Mao described to us the future blueprint of ChangLei capital , We can strongly feel this investor's high spirits and complacency , There is no sign of the depression that may have been brought about by being kept at home for two months due to the Shanghai epidemic . He even said that he was used to working at home ,“ I can't go out now without going out ”, Because it can save a lot of transportation costs .

He did not deliberately emphasize his optimism , But his optimism is beyond words .“ When you read too much , I've read too much about history , Will understand , When there is a crisis , There will inevitably be opportunities .” He believes that the current downturn in China's venture capital market , More of a psychological crisis ,“ Why is there such a psychological crisis ?2020 After the epidemic in , actually 2021 A lot of investment in is 2020 Squeezed out in , in other words ,2020 The pace of investment in has slowed down , All squeezed to 2021 Years. . therefore 2021 Year is an explosive financing , Including consumption 、SaaS All walks of life including , There have been great foam . But the epidemic continues to recur , After the tide recedes , Have you found , More financing will not save an enterprise . therefore VC Start to rethink , last year (2021 year ) It's too blind , Then this year will naturally become cautious when shooting .”

This caution is psychological caution , Shi Mao continued , Just like children make mistakes , He will be unhappy the next day , But time will slowly fade this mood , On the third day, he was alive again —— Of course, mistakes will be made , That's human nature .“ Next year, ( Venture capital market ) It will be hot again .” Stone spear predicts .

VC Invest in innovative industries , And the innovative industry is the country every year GDP The layer of cheese on it , Stone spear theory , China is GDP More than 100 One trillion , Even if the growth rate drops to 3%, And every year 3 Trillion growth ,“ this 3 In a trillion , Some are taken away by traditional enterprises , Even stay 1000 Yigei innovation ( industry ), Does that affect our investors ? Every year, 1000 Billion innovative industries are waiting for us , I don't think it has any effect . There is no need to be pessimistic . Not to mention the proposal of the state GDP The growth target is not 3%, It is 5%. So there is nothing to worry about ?”

He attributed his confidence to 「 Read more 」,“ After reading too many books , You will find that people's minds will slowly open , It is interesting to .1997 The financial crisis of 、2008 The financial crisis of , There are many crises , And there are crises every year , But doesn't it still have a chance every year ? Many excellent enterprises are slowly emerging from the crisis 「 kill 」 Coming out . So I think ( The crisis ) Normal .”

then , This book loving investor shared his recent private book list with us in detail :《 Galileo's finger 》、《 Japanese economic history after the war 》、《 The mystery of Silicon Valley 》、《 What is life 》, And often read 《 Mao's Selected Works 》.

《 Galileo's finger 》 The writer is Peter, Professor of chemistry at Oxford University • Atkins . Stone spear theory , After reading the book , He has a lot of enlightenment ,“ The essence of human is that countless particles rotate in the body , That's it , So what do you say people have to worry about ? This is how the future of the world turns . Look at quantum mechanics , Look at these macro and micro things , That's interesting .”

《 Japanese economic history after the war 》 It is also a very interesting book . Shi Mao reflected on the three trends of China's current economic development with Japan's economic development history , The first is the tide of domestic substitution caused by the competition between China and the United States . The second is digital domestic demand ,“ When GDP When the growth rate drops , Efficiency tools will become particularly important . It used to develop too fast , They are running horses and enclosure , What kind of refined management ? But when the industry is full of carrots and pits , Everyone is going to carry out efficiency management , Then digitalization will become more and more important , This is domestic demand .” The third is capital overflow ,“ Domestic demand cannot be pulled , The relationship between external demand is not good now , Export trade is blocked , What do I do ? Now another group of people are talking about going to sea , But this going to sea is not a APP Sea , Or play a game and go to sea , It's not that simple , Instead, let China's excess capacity go to sea .”

《 The mystery of Silicon Valley 》 Let Shi Mao restore the entrepreneurial spirit of Silicon Valley . And Schrodinger wrote 《 What is life 》 This book , Stone spear theory , It's too obscure , Not recommended .

Every night 9 Point to 12 spot , It's his work review and reading and writing time —— Those on ChangLei capital official account 10w+ The article , It comes from these nights . Too busy during the day , Sometimes one day 7 Meetings , There is no time to eat , Tired and hungry . At such a fast pace , Stone spear still insists on every week 「 deliberately 」 Set aside a day , To meet new friends ,“ There is no destination to chat .” He said , Some investors are either on business trips or on the way , Make yourself busy , In fact, there is no time to think ,“ Busy year after year , The actual lack of harvest is not much . Don't make yourself look busy and diligent , make a fuss about nothing , Have no meaning , We must combine work with rest ; Hard work at the same time , Be sure to set aside time to think .”

边栏推荐

- What if Kaili can't input Chinese???

- MVC mode and three-tier architecture

- 完美融入 Win11 风格,微软全新 OneDrive 客户端抢先看

- To sort out messy header files, I use include what you use

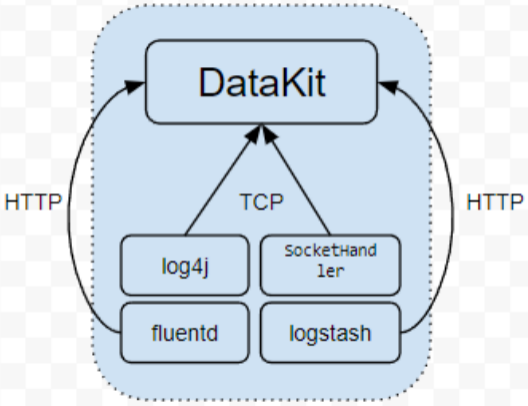

- Datakit -- the real unified observability agent

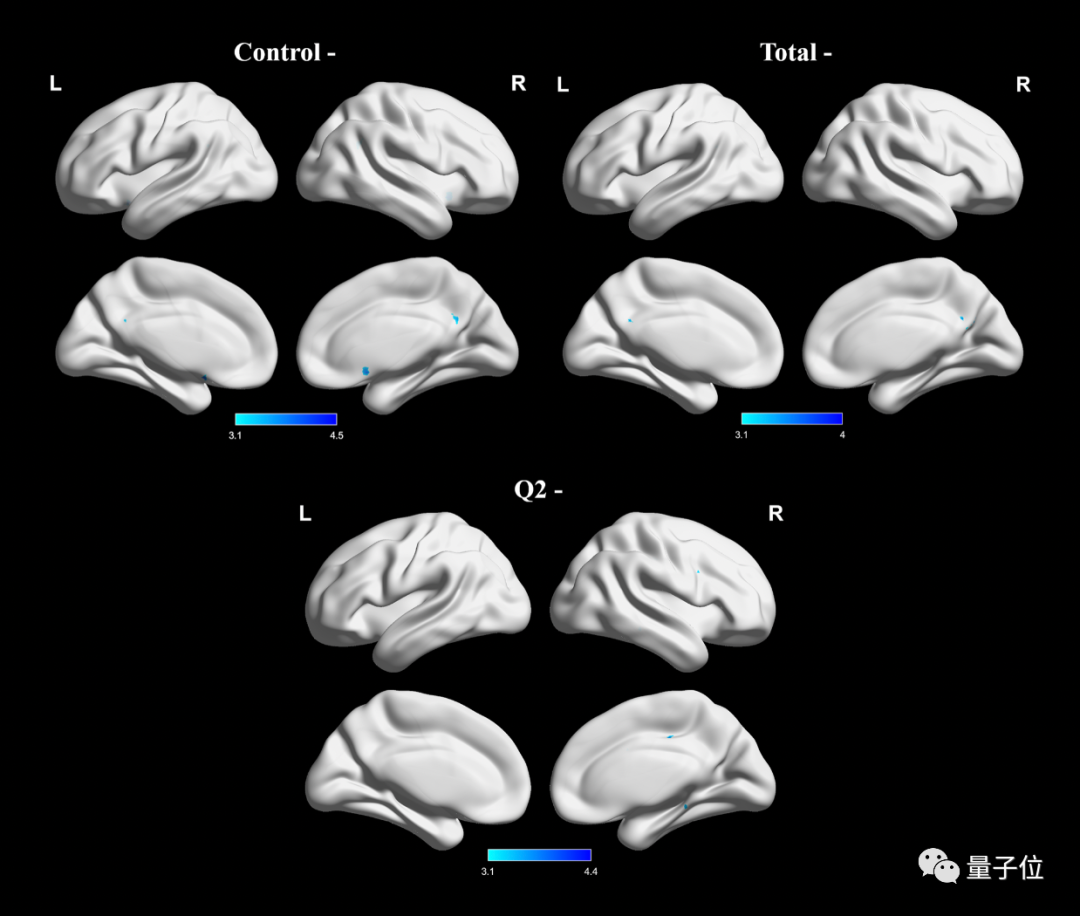

- Internet addiction changes brain structure: language function is affected, making people unable to speak neatly

- 【Hot100】32. 最长有效括号

- What is low code development?

- Ble HCI flow control mechanism

- 内核中时间相关的知识介绍

猜你喜欢

要上市的威马,依然给不了百度信心

【HCIA持续更新】广域网技术

就在今天丨汇丰4位专家齐聚,共讨银行核心系统改造、迁移、重构难题

电子宠物小狗-内部结构是什么?

上网成瘾改变大脑结构:语言功能受影响,让人话都说不利索

Developers, MySQL column finish, help you easily from installation to entry

NFT liquidity market security issues occur frequently - Analysis of the black incident of NFT trading platform quixotic

Datakit -- the real unified observability agent

![[Huawei HCIA continuous update] SDN and FVC](/img/02/f86b509fdc515f14a4497090f0d070.png)

[Huawei HCIA continuous update] SDN and FVC

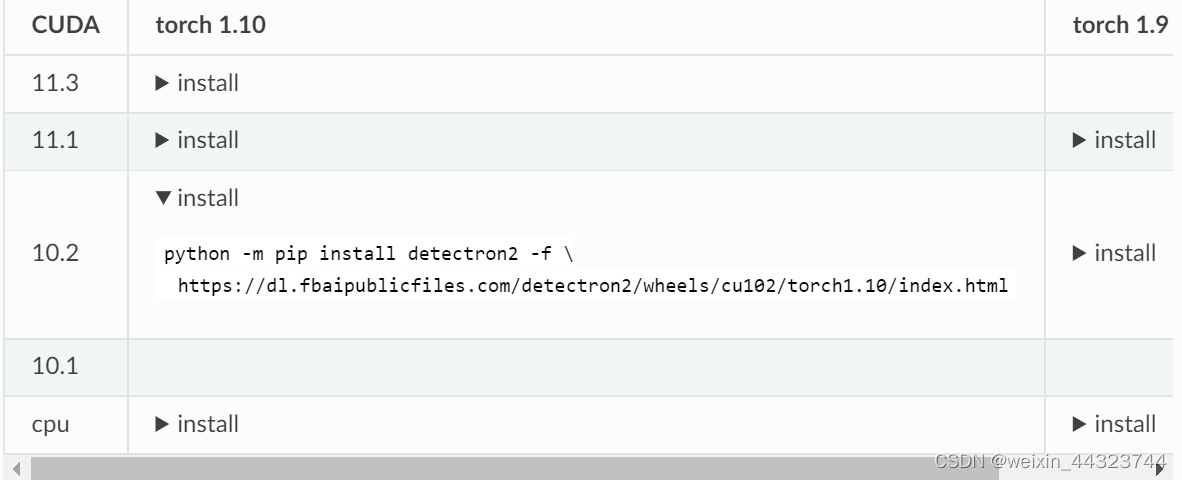

Detectron2 installation method

随机推荐

缓存穿透、缓存击穿、缓存雪崩分别是什么

如何进行MDM的产品测试

Flask 轻量web框架

【华为HCIA持续更新】SDN与FVC

完美融入 Win11 风格,微软全新 OneDrive 客户端抢先看

新享科技发布小程序UniPro小优 满足客户移动办公场景

The top half and bottom half of the interrupt are introduced and the implementation method (tasklet and work queue)

Rainfall warning broadcast automatic data platform bwii broadcast warning monitor

就在今天丨汇丰4位专家齐聚,共讨银行核心系统改造、迁移、重构难题

Set the transparent hidden taskbar and full screen display of the form

公司要上监控,Zabbix 和 Prometheus 怎么选?这么选准没错!

CANN算子:利用迭代器高效实现Tensor数据切割分块处理

With an annual income of more than 8 million, he has five full-time jobs. He still has time to play games

Developers, MySQL column finish, help you easily from installation to entry

VB cannot access database stocks

tx.origin安全问题总结

【测试开发】软件测试——基础篇

解读数据安全治理能力评估框架2.0,第四批DSG评估征集中

离线、开源版的 Notion—— 笔记软件Anytype 综合评测

解决el-input输入框.number数字输入问题,去掉type=“number“后面箭头问题也可以用这种方法代替