当前位置:网站首页>The strategy of convertible bonds -- - (cake sharing, premium, forced redemption, downward revision, double low)

The strategy of convertible bonds -- - (cake sharing, premium, forced redemption, downward revision, double low)

2022-06-29 18:40:00 【Xiao Li 314】

What is a convertible bond

The bond and conversion characteristics of convertible bonds correspond to the dual characteristics of creditor's rights and options , That is, the value of convertible bonds = Bond value + Stock call option . I use the vernacular to say , A convertible bond is an IOU that the company lends you money , The interest rate shall not be lower than the current monetary interest rate , That is to say, it must be higher than the monetary fund you buy on Alipay . Here are five ways to introduce other properties of convertible bonds .

Cake spreading playing method

The initial issue price of the convertible bond is 100 element . The core of the cake spreading method is when the batch of convertible bonds is lower than 100 Yuan time , You buy all in batches 100 Convertible bonds less than yuan ( Of course, the lower the better ).

What you might encounter at this time :

Prices continue to fall , For example, I fell down 90 element , But the current period ends , He has to be 110 I will pay you the principal plus interest at the price of yuan . Your earnings are 10%+

Rise in price , here we are 130 Yuan of above , Or there is 20%+ Make price poly when earning , For example, you can set as long as the price is not lower than 120, Then you always have , The price fell below 120 sell . As prices rise , You constantly improve your profit position . Until finally poly was out . At this time, your income must be 20%+

Forced redemption play

On the basis of cake spreading playing method , There can be strong redemption methods , When the price is at 130 Above yuan , There may be forced redemptions , Sell in time at this time . Because this forced redemption will redeem your bonds at a very low price , For example, the current price is 130, Then his redemption price is likely to be 101, If you don't sell it, you will have to bear a great loss .

The strong redemption strategy actually has a strong logic . First , The conditions for issuing convertible bonds are very strict . Basically, only very good companies can issue ,4000+ Company only 300 Many companies can issue convertible bonds . Another is that all companies want to issue convertible bonds , because , You can borrow this money without changing it , So why not change it ? Because you can convert debt into equity , After he wants to borrow money from you , Current price 130 More , You can exchange it all for stock , You've earned 30%+ 了 , Don't force me to redeem , If you force me to redeem, I will give you money in real gold and platinum , But I won't have to pay back the money after you change it into stock .

Practice the playing method

Then we can easily be quite , If the price is always low , For example, the value of share conversion is 80 many , Did I lose money soon after I changed shares , At this time, who would be so stupid as to change shares by himself ?

So there is the next amendment clause . The next amendment is to allow you to convert into stocks at a lower price. Are you happy . Would be more willing to convert shares . Generally, the conversion value will rise after the lower revision . Once the stock goes up , But you can choose to buy at a lower price , For example, now the stock is 7 element , But you can 6 I'm going to buy... At the price of RMB ,( This reflects the attributes of options ), But you can also choose not to change , Get the principal and interest of the bond at that time , The choice lies in you . From the point of view of the company, I must hope you can change into stock , Because you don't have to pay cash .

Double low play

There are two important references for convertible bonds. One is the face value , One is the premium rate . The nominal value is well understood , It's the current price , The premium rate is the value of your convertible bonds after conversion into shares , If you encounter a small premium rate and a small par value, or even only 100 element , We can call it the money boy . It's good to meet this opportunity once a year .

This double low strategy can be directly used in jisilu , Convertible bond sector , see

Pictured :

The top ones 100 Yuan is because it is a new debt , It has not been released yet , We don't care ( Let me mention , The new operation of new debt is also very profitable .)

Actually this zhengbang Convertible bonds were a good place to buy yesterday , Yesterday's price was 100 Head start , Today, the daily limit was raised . Of course, at the moment hongtao Convertible bonds are also very good .

other 130 We will not consider the above , There is a risk of foreclosure .

Premium play

In the above introduction, we can also find that when the premium rate is negative , You are sure to make a profit when you buy and exchange shares . you 're right , So this kind of almost once it exists, it will be bought soon , So there are not many opportunities .

summary

The main concern is the risk , in general , Convertible bond is basically a zero risk operation . The premise must be that you are 100 Buy below yuan , And the lower the better .

So let's simulate what you can encounter :

1. This bond is very stable , Finally, I will give you regular interest , You put your money in the bank . But this one can be used at any time . The probability of this 5% about .

2. The bond was forcibly redeemed , Then your profits are likely to 40% about , This probability 95% about .

3. The bond is in default , The company was delisted , At this time, the convertible bonds you hold will still be repaid to you , Even if the company goes bankrupt , Convertible bonds are still the priority to obtain compensation , This probability 0%, Because at present, convertible bonds have been used since the last century 90 Since the generation existed , No breach of contract . None of them broke the contract . And spread the cake ( Buy a lot ) This kind of loss is also limited .

The difficulty lies in waiting , Most of the time waiting in the empty position , Because many opportunities are once-in-a-year . When you encounter it, you should seize it !

official account : Xiao Li 314

You know : Xiao Li

CSDN: Xiao Li 314

Blog Garden : Xiao Li 314

If you invest in quantification , Data analysis , Interested in scientific progress , Pay attention to me , We have the opportunity to share !

边栏推荐

- Anfulai embedded weekly report no. 271: June 20, 2022 to June 26, 2022

- JWT login authentication

- Error [warning] neural network information was performed on socket 'RGB', depth frame is aligned to socket

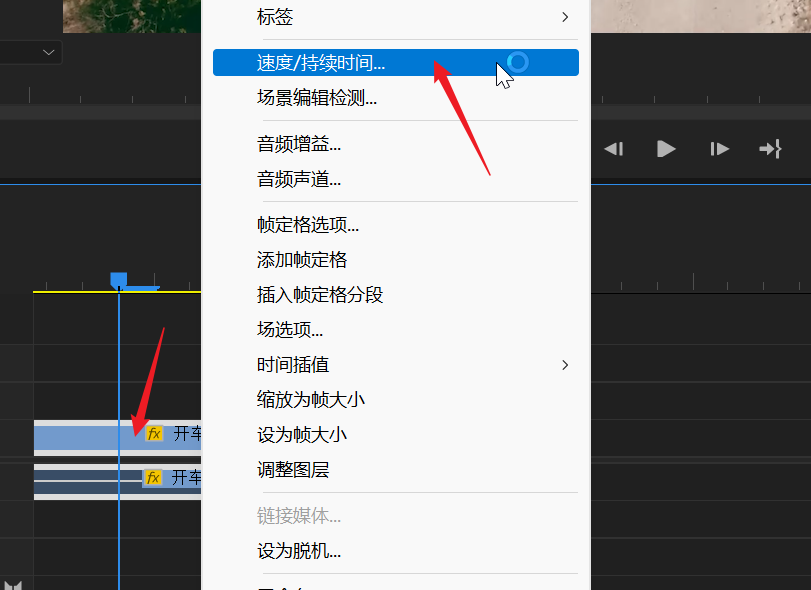

- Adobe Premiere基础-时间重映射(十)

- 第02章_MySQL的数据目录

- [tcapulusdb knowledge base] tcapulusdb doc acceptance - transaction execution introduction

- 数据分析--时间序列预测

- Adobe Premiere Basics - general operations for editing material files (offline files, replacing materials, material labels and grouping, material enabling, convenient adjustment of opacity, project pa

- Sd6.22 summary of intensive training

- How to use idea?

猜你喜欢

Apache Doris 基本使用总结

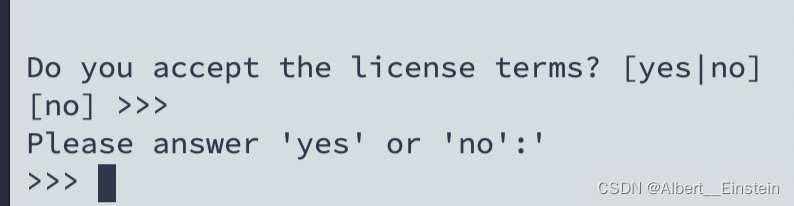

Anaconda installs and configures jupyter notebook remote

idea怎么使用?

MySQL -connector/j driver download

JDBC knowledge

对强缓存和协商缓存的理解

JWT登录验证

Adobe Premiere foundation - batch material import sequence - variable speed and rewind (recall) - continuous action shot switching - subtitle requirements (13)

Data warehouse model layered ODS, DWD, DWM practice

数据仓库模型分层ODS、DWD、DWM实战

随机推荐

Fluent's MSH grid learning

Leetcode 984. String without AAA or BBB (thought of netizens)

Data analysis time series prediction

面试题 10.10. 数字流的秩

Adobe Premiere基礎-聲音調整(音量矯正,降噪,電話音,音高換擋器,參數均衡器)(十八)

剑指 Offer 34. 二叉树中和为某一值的路径-dfs法

Apache Doris basic usage summary

mysql — 清空表中数据

If the evaluation conclusion of waiting insurance is poor, does it mean that waiting insurance has been done in vain?

【TcaplusDB知识库】TcaplusDB运维单据介绍

Anaconda安装并配置jupyter notebook远程

Sister Juan takes you to learn database -- 5-day dash day4

PostgreSQL database system table

Adobe Premiere Basics - general operations for editing material files (offline files, replacing materials, material labels and grouping, material enabling, convenient adjustment of opacity, project pa

JWT login authentication

jdbc_ Related codes

JS converts seconds to "2h30min50s" format

AMAZING PANDAVERSE:META”无国界,来2.0新征程激活时髦属性

Goldfish rhca memoirs: do447 building advanced job workflow -- using fact cache to improve performance

Stepping on the pit: json Parse and json stringify