当前位置:网站首页>35 year old programmer fired Luna millions of assets and returned to zero in three days. Netizen: it's the same as gambling

35 year old programmer fired Luna millions of assets and returned to zero in three days. Netizen: it's the same as gambling

2022-06-26 04:15:00 【_ findyi】

Today, I almost saw a “ Miserable ” 's post :

Read the report carefully : This guy is Luna stay 2 dollar -20 Bought during the period of USD , The total cost is less than 30 ten thousand .

In fact, this is the end of the loss 30 Ten thousand , Not at the highest point 1000 ten thousand . But people are greedy , When it goes up, I think it's my own , I thought I had lost so much when I lost .

It's funny , Originally, no one is a speculator , To put it bluntly, it is all hindsight 、 Like a pig in advance .

If you are lucky, you will say that you have unique vision , The market is to blame for bad luck . I dare to put so many air coins in it , This programmer must have a lot of money .

If you have money, make it , Just buying this kind of currency is not called investment 、 It's called gambling ! Since it's gambling , Then it's good to admit defeat .

Recently, many friends asked me how to invest and manage money 、Web3.0 It's not reliable 、 Whether to buy a house or not , To tell you the truth, the environment is really bad now , If you are not sure, the best thing is that cash is king .

I also talked about investment and financial management , But more from 「 Avenue 」 From the angle of , I haven't talked about specific practical operation , Talk to you today :

1. investment Web3.0 It depends on it or not

Let me tell you the truth first : It is not allowed in China Web3.0( Coin making 、 Engage in digital finance ) Of , At present, it seems that this thing is essentially cutting leeks .

Current stage Web3.0 The frightening landing of the concept is actually all kinds of air coins , Like this Luna, In the end, the probability is that the publisher is making money , Leeks are crying .

If you think you can be a sickle instead of a leek , Consider going abroad to be a publisher , After all, in order to control systemic risks in China , Basically, this thing will not be opened .

In addition, the recent digital collections are quite hot , The prices of many collections have soared hundreds of times , There is no essential difference between personal views and air money , Of course, a thing can't be seen through when it is covered with art , If you want to invest, pay attention to risks , Don't think about making a fortune .

In a word : Investing in these things is gambling , Gambling is risky , It's not impossible to lose everything .

2. About to buy a house

Recently, the state has issued many policies to encourage people to buy houses , For example, the loan interest rate has dropped , The interest rate of the house loan has been approaching in just two months 6% drop to 4.25%、 Another example is the support for real estate companies .

But the students who buy houses must be cautious , I wonder if you have noticed a small detail recently , Big cities are trying to liberalize their purchase restrictions , Without exception, they were quickly stopped .

Let's think about the reasons for this , For the sake of safety, I won't say so thoroughly .

There is another set of data :2021 The birth population in China was only 1062 ten thousand , But the real estate was sold 1000 More than a .

The inflection point of real estate has undoubtedly come , Chinese houses used to be 20 The myth staged in will certainly be broken in the future .

Unless you just need ( Don't buy a house, the kind your mother-in-law doesn't agree with ), Unless it is the core area of Beijing, Shanghai, Guangzhou and Shenzhen , Don't buy anything else if you can .

In addition, we must pay attention to the loan ratio , Don't let yourself carry high debts for decades , Once the future is not up , FA can't be merciful .

3. About stock speculation

This question has also been asked by many students , Like fried A stocks 、 Hong Kong stocks or US stocks ? What kind of stock is better to buy ?

First of all, I suggest that US stocks ,A Gu Taiyao doesn't say much here , Anyway, I am hold I can't live , The liquidity of Hong Kong stocks is relatively poor .

Secondly, I suggest that as a retail investor , Be sure to make value investments , It depends on the company's track 、 Growth rate and CEO Vision .

What do retail investors see in the short term K The line diagram is basically green leeks , But retail investors can really make money if they choose to hold a growth stock for a long time .

4. Fund management and insurance

Funds and insurance are actually low-risk investments , For example, the essence of yu'e Bao is also a fund .

As long as it is a fund, there are risks , Basically, the higher the interest rate, the greater the risk , In order to get a higher interest rate, many friends will directly choose the popular products recommended by the government on platforms such as Alipay , In fact, this is not quite right . The official hot spot only represents the yield in the past , Once officially recommended , The interest rate will come down when the fund plate is large .

To pursue high interest rates, we must learn to choose by ourselves , Funds can be divided into the following three categories according to different classification standards : Growth funds 、 Income fund and Balanced Fund .

The interest and bonus of income funds will be distributed , Low risk , But the interest rate is lower, and the bank is about the same , But it can be used to dilute the risk .

A growth fund is equivalent to a trader helping you speculate in stocks , Risk volatility fluctuates with the stock market , The risk is great but the benefit is also great , Novices do not recommend .

I suggest you buy a balanced fund , Pursuing the preservation and appreciation of assets , Also pursue risk reduction .

Insurance , It's no big problem not to buy when the economy is good , Recently, I suggest you configure some , Especially the major disease insurance and accident insurance , It can prevent a rainy day .

Write it at the end :

There are also some conservative investments , Such as gold 、 National debt and so on will not be introduced one by one . The core of investment and financial management is still to pay attention to distribution : Low risk 、 Medium risk 、 High risk compliance 6:3:1 Or other fixed proportion , Make sure there is not too much risk .

Sometimes be patient , Especially when it comes to getting rich , Getting rich slowly may be a better situation .

Blindly pursuing sudden wealth leads to various traps for honor , Finally, it becomes the fattest big leek .

So much for today , See you next time ~

边栏推荐

- 线程同步之互斥量(互斥锁)

- China air compressor manufacturing market demand analysis and investment prospect research report 2022-2028

- Custom parameter QR code picture combined with background picture to generate new picture node environment

- Mutex of thread synchronization (mutex)

- [QT] resource file import

- Knowledge of functions

- mysql自带的性能测试工具mysqlslap执行压力测试

- Conditional variables for thread synchronization

- 微软禁止俄用户下载安装Win10/11

- Go time package: second, millisecond, nanosecond timestamp output

猜你喜欢

線程同步之讀寫鎖

After four years of outsourcing, people are directly abandoned...

![[Flink] Flink source code analysis - creation of jobgraph in batch mode](/img/8e/1190eec23169a4d2a06e1b03154d4f.jpg)

[Flink] Flink source code analysis - creation of jobgraph in batch mode

Nailing open platform - applet development practice (nailing applet server side)

Sorting out the examination sites of the 13th Blue Bridge Cup single chip microcomputer objective questions

matplotlib多条折线图,点散图

【QT】对话框dialog

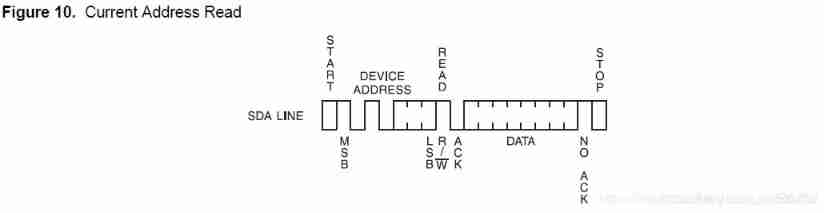

How to use EEPROM in 51 Single Chip Microcomputer?

Matplotlib multi line chart, dot scatter chart

What preparation should I make before learning SCM?

随机推荐

Lua grammar explanation

Use soapUI to access the corresponding ESB project

六、项目实战---识别猫和狗

Webrtc series - 7-ice supplement of network transmission preference and priority

Sorting out the knowledge points of the renderview renderobject parentdata of the shuttle

[Nuggets' operation routine disclosure] the routine of being truly Nuggets

Nailing open platform - applet development practice (nailing applet server side)

R language and machine learning

How much do you make by writing a technical book? To tell you the truth, 2million is easy!

I/o virtualization technology - UIO framework

Double buffer technology asynchronous log system

How do wechat applets delay? Timing? Execute a piece of code after? (kengji)

Analysis report on the development trend and operation status of China's environmental monitoring instrument industry from 2022 to 2028

In the matter of getting customers at sea, how can advertisers play besides digital advertising?

[MySQL] MySQL export database

力扣 515. 在每个树行中找最大值

asp. Net web page, ASP connects to the database, and uses asp:panel and asp:dropdownlist controls

(15) Blender source code analysis flash window display menu function

[Flink] Flink source code analysis - creation of jobgraph in batch mode

WPF 值转换