当前位置:网站首页>Encryption market "escape": clearing, selling and running

Encryption market "escape": clearing, selling and running

2022-06-21 15:45:00 【Honeycomb Tech】

Although bitcoin is 6 month 20 It bounced back to 2 Thousands of dollars , But the crypto asset market led by it has been unable to reverse the decline ,9000 The total market value of encryption assets of US $billion has been compared with that of last year 11 The monthly high has shrunk by two-thirds .

Another panic happened in 6 month 18 Japan , The currency (BTC) Fall through 2 Million dollars , The lowest touch is 17500 dollar , Ethereum, the second largest market value (ETH) Fall through 1000 dollar , At the very lowest 880 dollar , The prices of the two major crypto assets have fallen to new annual lows . On the day , The total amount of position explosion in the crypto asset market exceeded 5.6 Billion dollars .

Unlike the last bull bear cycle , The new role of the market in this cycle DeFi( Decentralized Finance ) Also suffered heavy losses in the market crash .6 month 18 Japan , stay DeFi The total value of encrypted assets locked in the market (TVL) It also fell to a new low in the year , by 729 Billion dollars , Compared with last year 12 At the height of the month 2540 Billion dollars evaporated 71.2%.

The traceable panic is from TerraUSD(UST) The crash started , In a month , The sell-off and capital withdrawal are staged in the encryption market at the same time , Triggered a series of chain reactions : Encryption asset lending platform Celsius There is a liquidity crisis , Suspend customer transfer and withdrawal ; Crypto asset hedge fund Sanjian capital suffered a large amount of liquidation , Almost bankrupt ; Centralized encrypted asset trading platform AEX Run on , It didn't take long , Similar platforms Hoo User withdrawal has been suspended ……

Decentralized encrypted finance (DeFi) The collapse of a dollar stabilizing currency in the market , It has impacted several centralized encryption platforms , The ultimate risk spillover , To the entire encryption market . In this 「 Domino 」 In the type of market collapse , Whale speculation DeFi Your game failed , and DeFi Also with it 「 Financial democratization 」 The goals are far from each other .

Debt recovery 「 Three arrows 」

UST crash 、LUNA After zero , The storm center was transferred to the head of hedge fund Sanjian capital .

Sanjian capital probably didn't think , From the beginning DeFi To make profits from revolving credit stETH There will be breakaway anchors ETH A day of , These crypto assets as collateral are depreciating , Its position faces liquidation .

Flustered from 6 month 14 The day begins , The crypto asset hedge fund will 5 More than ten thousand stETH At a discount ETH, And take one of them 16625 ETH Convert to value 2000 A stable currency of more than ten thousand dollars DAI. Encryption analysts speculate , The purpose of Sanjian capital is to prevent it from DeFi Value in the lending platform 2.95 A $billion position was liquidated .

But the reckoning came relentlessly .6 month 15 On the afternoon of Sunday , The alarm of blockchain Security Agency paidun is constantly ringing on the social platform , The address suspected to be related to Sanjian capital is 1 It was liquidated within more than hours 14538 ETH, With ETH at that time 1027 US dollar calculation , The liquidation value exceeds 1490 Thousands of dollars .

After the news of the liquidation of Sanjian capital came out ,ETH from 1092 The dollar fell around , In a short period of time, the decline is more than 6%.

Until then, , Sanjian capital has been sold 3.3 over ETH Used to pay off debts , Value exceeding 3389 Thousands of dollars .6 month 16 Japan , The fund was sold stETH The behavior of still hasn't stopped , It is not only that their positions are liquidated Aave Such decentralization DeFi Lending platform , also FTX、Deribit and BitMEX Such a centralized trading platform , These three platforms provide financial derivatives services for encrypted assets , Including futures and options .

6 month 17 Japan ,The Block Quoting a person familiar with the matter, he said , After Sanjian capital failed to meet the margin call requirements , The three trading platforms have cleared the positions of Sanjian capital in the past week . among ,BitMEX Confirmed the liquidation information , But did not owe to Sanjian capital 600 Million dollars in debt ; and Deribit It means publicly , Its shareholder Sanjian capital does have a few accounts with net debt on the platform , But the fund security of platform users .

Among the debt collectors, there are also customers of Sanjian capital ,8 Block Capital Head of trading Danny Direct advocacy on social media , Accused Sanjian capital of misappropriating from their accounts 100 Thousands of dollars , They suspected that the money had been used for margin calls ; have other DeFi The founder of the project called , The project is deposited under the Sanjian capital OTC Trading company TPS Capital The whereabouts of the funds in the .

A series of debt crises put Sanjian capital on the verge of bankruptcy , Relating to DeFi The platform is also in crisis . Pledge income platform Finblox It is said that it has a cooperative relationship with Sanjian capital , in order to 「 Spread the risk as much as possible 」, It suspends all income distribution , It is forbidden to create a new encrypted address , And limit users' withdrawal —— Limit the maximum daily cash withdrawal value to 500 dollar , The upper limit of the month is 1500 dollar .

6 month 17 Japan , The co-founder of Sanjian capital Kyle Davies Finally broke the silence , In an interview with the Wall Street Journal , He admitted Terra The collapse of is an important reason for the company to suffer losses , The rapid decline in the crypto asset market has exacerbated the company's losses .

As Terra Behind the organization Luna Foundation Guard Investors , Sanjian capital has been to LUNA Investment contract 2 Billion dollars , These funds are to help UST Dollar linked reserves . But in 5 month UST After collapse , The investment of Sanjian capital is gone .

It is reported that , Sanjian capital has engaged legal and financial advisers to find solutions for its investors and lenders , Trying to solve the debt problem through asset sales or bailouts .

This company used to manage 100 A billion dollar crypto hedge fund is like a stranded whale , At the same time that they are in danger , It also photographed the small fish on the dry coast .

The assets of the giant whale were liquidated in large amount , Panic and selling 「 mud and sand are carried along -- there is a mingling of good and bad 」.6 month 18 Japan ,BTC Fall through 2 The decline at the time of million US dollars is 7.34%, Fall through 1000 Ethereum in the US dollar showed a greater decline , Decline is 8.47%,ETH The position was closed on the same day 1.9 Billion dollars ,BTC The position was closed on the same day 2.69 Billion dollars .

The two institutes stopped to mention

Liquidity risk is spreading to small and medium-sized platforms , Three arrow capital was liquidated on the chain 6 month 16 Japan , Encrypted asset trading platform AEX Suspended. BTC、ETH And other mainstream assets , The suspension period is 36 Hours . Although user withdrawal was restored later , but AEX Or the cash withdrawal is limited , The current ceiling is 600 dollar .

AEX Its Chinese name is anyin , It was founded on 2013 year , It was first established in Chinese Mainland , Later, after the domestic supervision became stricter, they went to sea .

AEX Call in the announcement , It is facing a super 10 A $billion Run .

「LUNA crash 」 It is also regarded as the fuse of insufficient liquidity by the trading platform ,「 since 5 Mid month LUNA Since the crash ,AEX The total market value of various asset outflows has reached 4.5 Billion USDT( Including the withdrawal of cooperative institutions ), These events quickly consumed AEX Short term liquid assets and some medium-term assets .」

AEX 's liquidity crisis is not just about runs .

Like Sanjian capital , This centralized trading platform is also DeFi Asset allocation is carried out in , In its 80% In the medium - and long-term allocation of assets , valuable 1.1 US $billion of encrypted assets are pledged on the chain 「 dig 」. The platform is stored in Curve platform 「 dig 」( Provide liquidity to get rewards ) Of USDT/USDC pool , stay UST It was exchanged after the crash , Cause loss of short-term liquidity assets .

meanwhile ,AEX Also lending crypto assets , It said that the delay in the repayment speed of customers in the pledge loan business was also one of the reasons for the cash withdrawal dilemma of the platform , The amount of loans pledged to other parties is 2.3 Billion dollars .

so ,AEX While operating the encrypted asset transaction business , Also acts as 「 Bank 」 Role , And 6 month 13 The crypto asset lending platform that suspends customer withdrawals on the th Celsius There are the same functions .Celsius Its liquidity risk is also related to its participation in DeFi of ,Terra It is also one of the root causes of the thunderstorm . At present, there is news that , This lending platform is looking for external investment or acquisition , But Reuters reports ,5 The securities regulatory authorities in regions have Celsius Launch an investigation .

These come from DeFi There are common problems in the platforms for grabbing profits and lending to foreign countries : Put in DeFi Whether the funds and loans extended to the outside world belong to the user's assets ? Whether the user's informed consent has been obtained ?AEX and Celsius Neither has made public statements on these two issues .

There are also encrypted trading platforms with cash withdrawal difficulties Hoo roller , The platform started from the encrypted asset wallet , On 2018 Founded in Chinese Mainland ,2021 Move the office to Dubai after .

Hoo Hufu generally attributes the reason for the suspension of cash withdrawal to 「 The recent market fluctuation is great 」、「 Some large structures in the industry have been liquidated 、 Liquidity dried up 」, The tiger symbol says , The liquidity of the hot wallet is affected , It takes time to transfer multiple wallets , This causes the user to withdraw cash late . The platform promises to 72 Gradually return to normal after hours .

No, AEX The disclosure is detailed , Withdrawal recovery time is longer than other companies ,Hoo The suspension of Hufu has been questioned by users , People suspect that the platform also has the ability to put assets into DeFi Market profit leads to loss , However, the user's query was not responded by Hufu .

DeFi No 「De」

The centralized crypto asset institutions have fallen into the dilemma of liquidity exhaustion , If it were not for frequent thunderstorms , The outside world may not dig deep into their chain dynamics ,「 Encrypt the participation of giant whale DeFi」 At most, it is a well-known phenomenon in the industry .

2020 year 6 month , From the decentralized lending platform on the Ethereum upstream chain Compound use 「 Liquidity mining 」 take DeFi After fire , Users' encrypted assets began to flow from the centralized trading platform into the decentralized DeFi market , A decentralized trading platform 、 Lending platform 、 The stability currency agreement provides liquidity , In order to obtain token rewards issued by these platforms . Because of the existence of liquidity exchange pool, these rewards quickly generate transaction prices , Tokens become 「 Real gold and silver 」.

The wealth effect began to brew in the early stage of the bull market in the crypto asset market , And reached a climax at the peak of the bull market , And lock up in all kinds of DeFi The total value of encrypted assets in the protocol , stay 1 It has never been enough in more than years 10 Million dollars jumped to nearly 3000 Billion dollar high .

In the process , towards DeFi Inject encrypted assets into the platform 、 Users who contribute to mobility , Upgrade from ordinary retail investors to professional players who can operate robots ( Commonly known as scientists ), But as the APY Reduction , Some scientists have also been eliminated , Only big capital with money and knowledge of smart contract technology can be invested in DeFi To make a profit , Especially with the help of the DeFi product .

With stETH For example , This was originally intended to release ETH2.0 By pledge Lido Voucher token generated by agreement , Introduced by some lending platforms as collateral for loans . pledge ETH2.0 It will produce itself 4% Revenue , And will be stETH Deposit into the lending platform , And get interest income ; What is more profitable is to stETH As a mortgage, the quality is pledged on the lending platform , Loan out stable currency , Re exchange for ETH, Then pledge into Lido Replace with stETH…… Behind the circular lending is the constant increase of leverage .

But when the collateral depreciates to a certain extent , Liquidation begins to knock on the door of risk .

6 month 14 Japan , Bank for International Settlements (BIS) stay Celsius A report on DeFi The announcement of loan .BIS Pointed out that ,DeFi Using anonymization to overcome the problem of information asymmetry in the financial market , But heavy reliance on collateral in the chain ( Encryption assets ) Characteristics , Not only does it not protect the sector from the market 「 prosperity - depression 」 The impact of the cycle , It will also fall into a liquidation spiral .

Throughout history , Financial intermediaries have been working to improve information processing , And the current DeFi Loans want to change this way , Try to substitute information collection with collateral provided by the borrower , So as to give full play to the functions of financial intermediaries .

BIS explain , To ensure that lenders are protected ,DeFi The platform sets the liquidation ratio relative to the loan amount . for example ,120% The mortgage rate may be accompanied by 110% Liquidation rate , If the collateral falls below this threshold, it will depreciate . Smart contract provisions , At this time, anyone can act as liquidator , Foreclosure , Repay the lender , And put a part of the remaining collateral into the bag . Profit driven ensures adequate supply of liquidators , Mitigate the potential credit losses of the lender .

「 Due to the anonymity of the borrower , Over mortgage in DeFi Loans are common ……」BIS Pointed out that , To avoid forced liquidation , Borrowers usually submit encrypted assets that exceed the minimum requirements , This leads to a higher effective mortgage rate . Considering the 「 prosperity - depression 」 cycle , in fact ,「 Excessive mortgage and liquidation ratios do not eliminate the risk of credit losses . In some cases , The value of collateral fell rapidly , Before they depreciate , The borrower has no time to cancel the loan , Cause the loan institution to suffer losses .」

BIS Think , Current DeFi Mainly for 「 Promote crypto asset speculation 」, Instead of 「 Lending to the real economy 」, It goes against it 「 Financial democratization 」 The goal of , Because the mortgage-based loan model only serves those who have enough assets , It doesn't include those who don't have much wealth , Not only did it not achieve Inclusive Finance , Instead, it has moved towards centralization .

In this bull bear cycle of encrypted assets ,DeFi Born in the sky , It describes a utopia that replaces traditional finance for the outside world , But it became a giant whale in the bull market 「 toy 」, Also in the bear market to play against the fireman . And that 「 Financial democratization 」 Our goal is becoming blurred in the haze of the market .

( Statement : Please strictly abide by the local laws and regulations , This article does not represent any investment advice )

Do you think the crypto asset market is in the end ?

边栏推荐

- 对Integer进行等值比较时踩到的一个坑

- MQ interview questions sorting

- Gmail:如何跟踪邮件阅读状态

- 三胎终于来了!通用智能规划平台 - APS模块

- Unity grid programming 09

- Distributed monomer brought by microservice architecture

- My debug Path 1.0

- 33岁程序员的年中总结

- Best practice | how to use Tencent cloud micro build to develop enterprise portal applications from 0 to 1

- [cicadaplayer] read and write of HLS stream

猜你喜欢

Browser evaluation: a free, simple and magical super browser - xiangtian browser

Non local network: early human attempts to tame transformer in CV | CVPR 2018

![Analysis of China's social financing scale and financing structure in 2021: RMB loans to the real economy account for more than 60%[figure]](/img/93/218ba91dc6e9866e186c004ac18e0a.jpg)

Analysis of China's social financing scale and financing structure in 2021: RMB loans to the real economy account for more than 60%[figure]

2022 latest MySQL interview questions

Perfect partner of ebpf: cilium connected to cloud native network

GO语言-type关键字

对Integer进行等值比较时踩到的一个坑

Go language - Method

Build an efficient and scalable result cache

The rising sun chart effectively shows the hierarchy and ownership of data

随机推荐

What's wrong with the if judgment of pbootcms and the direct display of labels?

Practice of geospatial data in Nepal graph

[leetcode] sum of two numbers - go language solution

Talk about MySQL's locking rule "hard hitting MySQL series 15"

5700s layer 2 interface and layer 3 interface switching

soEasyCheckin

Graph calculation on nlive:nepal's graph calculation practice

Crontab pit stepping record: manual script execution is normal, but crontab timed script execution is abnormal

Soft test intermediate network engineering test site

MySQL memory tuning

WSL 2 的安装过程(以及介绍)

Write static multi data source code and do scheduled tasks to realize database data synchronization

I don't really want to open an account online. Is it safe to open an account online

多进程的坑记录( 不定时更新)

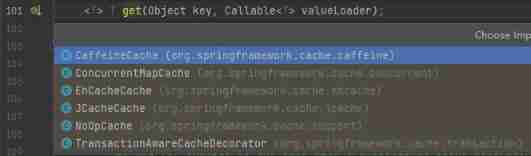

Build an efficient and scalable result cache

Analysis on the scale and market structure of China's bill financing industry in 2020 [figure]

Kitchen appliance giant employee data was leaked during the attack, and Iran's national radio was attacked by malware | February 22 global network security hotspot

Link storage structure of simulated design disk file

Merge two ordered linked lists

Not only products, FAW Toyota can give you "all-round" peace of mind