当前位置:网站首页>Financial management [6]

Financial management [6]

2022-06-24 23:08:00 【Star drawing question bank】

1. An enterprise owns a piece of land , Its original cost is 250 Ten thousand yuan , The book value is 180 Ten thousand yuan . Now we are going to build factories on this land , But if you sell this land now , Available income 220 Ten thousand yuan , Then the opportunity cost of building the plant is ()

A.250 Ten thousand yuan

B.70 Ten thousand yuan

C.180 Ten thousand yuan

D.220 Ten thousand yuan

2. Of the following , What can be used as an auxiliary indicator of short-term solvency is ()

A. Turnover rate of accounts receivable

B. Inventory turnover

C. Working capital turnover

D. Turnover rate of current assets

3. DuPont analysis system does not involve ()

A. Solvency analysis

B. Asset management capability analysis

C. Profitability analysis

D. Development capability analysis

4. What changes in direct proportion to the comprehensive leverage coefficient is (). Please select the following (1)-(4) All the options that match the meaning of the question :(1) Rate of change in sales ;(2) Change rate of profit per share ;(3) Operating leverage ;(4) Financial leverage

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(3)、(4)

D.(2)、(3)、(4)

5. In accordance with the requirements of capital preservation constraints , The sources of funds required by the enterprise to distribute dividends include (). Please below (1)-(4) Choose all the options that match the meaning of the question :(1) Current profit ;(2) Retained earnings ;(3) Original investment ;(4) equity .

A.(1)、(2)

B.(1)、(2)、(3)

C.(3)、(4)

D.(1)、(2)、(3)、(4)

6. Relative to ordinary shareholders , The preference of preferred shareholders is (). Please select the following (1)-(4) All the options that match the meaning of the question :(1) Priority management ;(2) Priority voting rights ;(3) Priority to distribute dividends ;(4) Give priority to the distribution of remaining property rights

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(3)、(4)

D.(2)、(3)、(4)

7. The financial relationship between the owners of a company and its managers reflects ()

A. The financial relationship between the company and its shareholders

B. The financial relationship between the company and its creditors

C. The financial relationship between the company and the government

D. The financial relationship between the company and its employees

8.ABC The company plans to buy a shares , The dividend of the stock in the next three years is expected to be 1.5 element ,1.8 element ,2 element , The market price of the stock is expected to be 25 element , The necessary rate of return for the company's investment is 10%, What is the value of the stock ( element )?()

A. The value of the stock is 23.14 element .

B. The value of the stock is 23 element .

C. The value of the stock is 25.14 element .

D. The value of the stock is 23.54 element .

9. The enterprise sells product a to customers on credit 100 Ten thousand yuan , In order that customers can pay as soon as possible , The credit conditions given to customers by enterprises are “10/10,5/30,n/60”, Then the following description is correct ()

A. In the credit terms 10,30,60 Is the credit term

B.n Represents the discount rate , It shall be determined by the buyer and the seller through negotiation

C. As long as the customer is 60 You can enjoy a cash discount if you pay within days

D. As long as the customer is 10 Pay within days and enjoy 10% Cash discount on

10. A company plans to purchase a batch of materials , The supplier's quotation is as follows :30 Pay within days , The price for 97500 element ;31 Day to 60 Pay within days , The price for 98700 element ;61 Day to 90 Pay within days , The price for 100000 element . Suppose the enterprise is short of funds , You can borrow short-term loans from banks , The interest rate of short-term bank loans is 10%, By year 360 Day count . requirement : Calculate the cost of giving up cash discounts , And make the most favorable decision for the company .()

A. give up 2.5% The cost of a cash discount is 15.38%, give up 1.3% The cost of a cash discount is 15.81%; Companies should borrow short-term funds from banks , Advance payment for material purchase . In the 60 Daily payment is in the best interest of the company .

B. give up 2.5% The cost of a cash discount is 16.38%, give up 1.3% The cost of a cash discount is 18.81%; Companies should borrow short-term funds from banks , Advance payment for material purchase . In the 60 Daily payment is in the best interest of the company .

C. give up 2.5% The cost of a cash discount is 15.38%, give up 1.3% The cost of a cash discount is 20.81%; Companies should borrow short-term funds from banks , Advance payment for material purchase . In the 60 Daily payment is in the best interest of the company .

D. give up 2.5% The cost of a cash discount is 15.38%, give up 1.3% The cost of a cash discount is 18.81%; Companies should borrow short-term funds from banks , Advance payment for material purchase . In the 90 Daily payment is in the best interest of the company .

11. The items related to the calculation of IRR are (). Please proceed from the following (1)-(4) Choose the complete choice that matches the meaning of the question :(1) Original investment ;(2) discount rate ;(3) From year to year NCF;(4) Project calculation period .

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(1)、(3)、(4)

D.(1)、(2)、(3)、(4)

12. Assume that the risk coefficient of an investment is 1, The risk-free rate of return is 10%, The average market rate of return is 20%, The necessary rate of return is ().

A.15%

B.25%

C.30%

D.20%

13. Bad debt losses and collection expenses are () Key considerations .

A. Make a collection policy

B. Make credit policy

C. Set credit standards

D. Determine credit terms

14. The daily management of monetary funds should pay attention to (). Please below (1)-(4) Choose all the options that match the meaning of the question :(1) Shorten collection time ;(2) Postpone payment date ;(3) Use idle funds ;(4) Try not to use monetary funds .

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(3)、(4)

D.(1)、(2)、(3)、(4)

15. Financial risk is caused by () Risks .

A. Inflation

B. High interest rates

C. Financing decisions

D. Sales decision

16. The reason for holding monetary funds is to meet (). Please below (1)-(4) Choose all the options that match the meaning of the question :(1) National policy needs ;(2) Transactional needs ;(3) Preventive needs ;(4) Speculative needs .

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(3)、(4)

D.(2)、(3)、(4)

17. Only in () Shareholders registered on this day , To be eligible for the current dividend .

A. Dividend declaration date

B. Equity registration date

C. Ex dividend day

D. Dividend payment date

18. The current laws and regulations have restrictions on the company's dividend distribution (). Please below (1)-(4) Choose all the options that match the meaning of the question :(1) Capital preservation ;(2) Equity dilution is not allowed ;(3) Maintain the liquidity of assets ;(4) Draw statutory surplus reserve in proportion .

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(1)、(4)

D.(1)、(2)、(3)、(4)

19. Of the following () It does not belong to the advantages of absorbing direct investment .

A. Help to enhance the company's reputation

B. It is conducive to the formation of production capacity as soon as possible

C. The cost of capital is low

D. Conducive to reducing financial risks

20. If investors focus on investment benefits , Then the main basis for making multi project portfolio decision of long-term investment should be : On the premise of making full use of funds , As far as possible ()

A. Early recovery of investment

B. Get the most profit and pay the most tax

C. Extended operating period

D. The total net present value of the largest profit

21. The following items do not constitute retained earnings are ()

A. Net profit

B. Withdraw statutory reserve fund

C. Withdraw discretionary provident fund

D. Undistributed profit

22. The net assets per share of common stock reflect the value of common stock ().

A. Face value

B. Market value

C. Investment value

D. Book value

23. The existing outstanding ordinary shares of a company 1000000 stocks , Par value per share 1 element , Capital reserve 300 Ten thousand yuan , Undistributed profit 800 Ten thousand yuan , Stock market price 20 element , If pressed 10% Pay stock dividends in proportion to , And converted at market price , The statement of the company's capital reserve is shown as ()

A.1000000 element

B.2900000 element

C.4900000 element

D.3000000 element

24. In securities investment , The risk of inflation is ().

A. default risk

B. Interest rate risk

C. Purchasing power risk

D. Operational risk

25. The way of raising relative equity funds , The disadvantage of long-term loan financing is (). Please select the following (1)-(4) All the options that match the meaning of the question :(1) High financial risk ;(2) High financing costs ;(3) The amount of financing is limited ;(4) Slow fund raising

A.(1)、(3)

B.(1)、(2)、(3)

C.(2)、(4)

D.(2)、(3)、(4)

26.ABC The company has a fund , Plan to invest in Securities for profit , At present, the company has three investment opportunities :(1) Invest in treasury bills , Annual interest rate 4%.(2) investment 10 The beta coefficient of the year is 0.5 The bond , The face value of each bond 1000 element , The coupon rate 10%, The current market price of each bond is 1180 element ,(3) The investment beta coefficient is 1.5 Shares , The dividend of the stock in the first year is... Per share 2 element , Annual growth in the next three years 5%, Then it turned to normal growth and maintained 3% The level of , The current market price of the stock is 13.5 element . If the current treasury bill interest rate 4%, Market risk premium 8%. requirement :(1) Calculate the necessary rate of return on investment in bonds and stocks .(2) Calculate the value of bonds and stocks .(3) Please make reasonable investment decisions for the enterprise .()

A.(1) The necessary rate of return on bond investment 16%; The necessary rate of return on stock investment 13%.(2) The value of the bond 1134.21 element ; The value of the stock 16.11 element .(3) You should invest in stocks .

B.(1) The necessary rate of return on bond investment 12%; The necessary rate of return on stock investment 16%.(2) The value of the bond 1130.21 element ; The value of the stock 16.11 element .(3) You should invest in stocks .

C.(1) The necessary rate of return on bond investment 8%; The necessary rate of return on stock investment 16%.(2) The value of the bond 1134.21 element ; The value of the stock 16.11 element .(3) You should invest in stocks .

D.(1) The necessary rate of return on bond investment 10%; The necessary rate of return on stock investment 16%.(2) The value of the bond 1134.21 element ; The value of the stock 19.11 element .(3) You should invest in stocks .

27. Cash outflow refers to the increase of enterprise cash expenditure caused by investment projects , Include (). Please proceed from the following (1)-(4) Choose the complete choice that matches the meaning of the question :(1) Construction investment ;(2) Cash cost ;(3) Annual depreciation ;(4) Income tax .

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(2)、(3)、(4)

D.(1)、(2)、(3)、(4)

28. The change rate of earnings per share of common stock is equivalent to the multiple of the change rate of EBIT , It means ().

A. Operating leverage

B. Financial leverage

C. Total leverage factor

D. Marginal cost of capital

29. An enterprise pays an annual interest rate 5.8% Borrow money from a bank 1000 Ten thousand yuan , The bank asked to keep 15% The compensatory balance of , Then the effective interest rate of the loan is ().

A.5.8%

B.6.4%

C.6.8%

D.7.3%

30. The way of financing without financial leverage is ().

A. Issue of ordinary shares

B. Issuance of preferred shares

C. Issue bonds

D. Borrow money from banks

31. The standard deviation of scheme a is 1.5, The standard deviation of scheme B is 1.35, If the expectations of scheme a and scheme B are the same , Then the risk relationship between the two schemes is ().

A. A is greater than B

B. A is less than B

C. A and B are equal

D. Undetermined

32. The application fields of time value of capital in financial management include (). Please proceed from the following (1)-(4) Choose the complete options that match the meaning of the question :(1) financing ;(2) investment ;(3) Capital operation ;(4) Distribute .

A.(1)、(2)、(3)

B.(1)、(2)、(4)

C.(1)、(2)、(3)、(4)

D.(2)、(3)、(4)

33. Among the following options, matters that will not affect the stability of cash flow may include ()

A. Centralized payment of investment funds

B. One time repayment of principal and interest when due

C. Both purchase and sales are booming

D. Payment for goods in peak season

34.() It refers to the enterprise for better development in the future , A capital expenditure plan for greater remuneration , Comprehensively reflect the capital source and application of the investment project

A. The capital budget

B. Financial forecast

C. Financial decisions

D. Financial control

35. At present, the annual credit sales revenue of a company is 3000 Ten thousand yuan , Variable cost rate 70%, The cost of capital 12%, The credit terms are “n/30”, Bad debt loss rate 2%, Collection expenses 65000 element , In order to increase the income from credit sales 10%, Yes A、B The two schemes can be selected together .A programme : The credit terms are “n/60”, Bad debt loss rate 3%, Collection expenses 70.2 Ten thousand yuan .B programme : The credit terms are “2/10,1/20,n/60”, Use... In customers 2% The cash discount is expected to be 60%, utilize 1% The cash discount is expected to be 15%, Cash discounts are expected to be waived 25%. The estimated bad debt loss rate is 2%, The collection fee is 58.78 Ten thousand yuan . requirement : By calculation , Evaluate whether the company should change its current credit conditions . Such as change , Which option should be chosen to be more advantageous ?()

A. The current credit conditions should not be changed ; Choose B programme .

B. The current credit conditions should be changed ; Choose B programme .

C. The current credit conditions should be changed ; Choose A programme .

D. The current credit conditions should not be changed ; Choose A programme .

36. The existence of compensatory balance makes the borrowing enterprise suffer (). Please below (1)-(4) Choose all the options that match the meaning of the question :(1) Increased interest payable ;(2) Reduced available funds ;(3) Increased funding costs ;(4) Reduced interest payable .

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(2)、(3)

D.(2)、(3)、(4)

37. Unit variable cost of a product 5 element , The unit price 8 element , fixed cost 2000 element , sales 600 Pieces of , To make a profit 400 element , The measures that can be taken are ()

A. Increase sales 100 Pieces of

B. Reduce fixed costs 400 element

C. Reduce unit variable costs 0.5 element

D. Raise the price 1 element

38. Annual operating income of an investment scheme 140 Ten thousand yuan , Annual operating cost 70 Ten thousand yuan , Annual depreciation 30 Ten thousand yuan , Income tax rate 40%, Then the annual net operating cash flow of the scheme is () Ten thousand yuan .

A.54

B.58

C.72

D.46

39. The legal surplus reserve withdrawn by a listed company reaches the of the registered capital () when , The statutory surplus reserve may no longer be withdrawn .

A.15%

B.25%

C.40%

D.50%

40. The following dividend policies are conducive to stabilizing the stock price , So as to establish a good image of the company , However, the dividend policy that the payment of dividends is divorced from the company's earnings is ().

A. Fixed dividend policy

B. Residual dividend policy

C. Fixed rate dividend policy

D. Ladder dividend policy

41. The financial activities of an enterprise refer to the ()

A. Monetary fund revenue and expenditure activities

B. Fund allocation activities

C. Investment and recovery of capital

D. Fund raising 、 Application 、 Recovery and distribution

42. Only applicable to joint stock limited companies , And the financing mode that must take stocks as the carrier is ().

A. Absorb direct investment

B. Issue bonds

C. Issue of shares

D. finance lease

43. The credit standard is () Important content of .

A. Credit terms

B. Cash discount policy

C. Collection policy

D. Credit term

44. A company obtains a loan 2000 Ten thousand yuan , Annual interest rate 12%, requirement 5 Repay in equal amount at the end of each year during the year , Then the annual repayment is about ().

A.400 Ten thousand yuan

B.520 Ten thousand yuan

C.545 Ten thousand yuan

D.555 Ten thousand yuan

45. It is conducive to stabilizing the stock price , So as to establish a good image of the company , But what separates the payment of dividends from the surplus is ().

A. Residual dividend policy

B. Fixed dividend policy

C. Ladder dividend policy

D. Fixed rate dividend policy

46. The cash discount cost is the following items () The product of the . Please below (1)-(4) Choose all the options that match the meaning of the question :(1) Net sales on credit ;(2) Cash discount rate ;(3) Proportion of sales paid during the discount period ;(4) Average collection period .

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(3)、(4)

D.(1)、(2)、(3)、(4)

47. It is known that a project has no construction period , The capital is invested at one time at the starting point of construction , Available after the project is completed 8 year , The net cash flow of each year is equal . If the static payback period of the project is 6 year , Then the present value coefficient of annuity determined according to the internal rate of return is ().

A.14

B.8

C.6

D.2

48.ABC The company plans 5 Purchase of equipment after , Need money 5000 Ten thousand yuan , If the interest rate 8%.(1) If you make a one-time deposit now , How much money to deposit ( Ten thousand yuan )?(2) If the same amount is deposited at the end of each year , How much money do you want to deposit at the end of each year ( Ten thousand yuan )?()

A.(1)3403 Ten thousand yuan ;(2)852.29 Ten thousand yuan

B.(1)3406 Ten thousand yuan ;(2)852 Ten thousand yuan

C.(1)2450 Ten thousand yuan ;(2)853 Ten thousand yuan

D.(1)3340 Ten thousand yuan ;(2)820 Ten thousand yuan

49. If a 、 B. the net present value of the two investment schemes is different , be ().

A. Scheme a is superior to scheme B

B. Scheme B is superior to scheme a

C. Both scheme a and scheme B meet the necessary conditions for the feasibility of the project

D. Unable to evaluate a 、 B. the economic benefits of the two schemes

50. The net profit of the enterprise this year 100 Ten thousand yuan , The target capital structure of the enterprise is that liabilities account for 60%, Equity accounts for 40%, In order to expand the scale of production and operation , It is expected that new investment will be needed next year 200 Ten thousand yuan , Calculate the remaining dividends available for distribution .()

A. The remaining dividends available for distribution are 20 Ten thousand yuan

B. The remaining dividends available for distribution are 30 Ten thousand yuan

C. The remaining dividends available for distribution are 40 Ten thousand yuan

D. The remaining dividends available for distribution are 50 Ten thousand yuan

51. Analysis through cash flow statement , The main purpose that users of accounting statements can achieve is ()

A. Analyze the profitability of enterprises

B. Evaluate the profit quality of enterprises

C. Analyze business risks

D. Predict the future investment retention rate of the enterprise

52.ABC The company plans to invest in stocks , The company found two investment targets through research , Company a's current price per share 11 element , First year dividend 0.6 element , The annual growth rate in the future is 5%; The current price of company B is... Per share 11 element , First year dividend 1 element , It will be fixed every year in the future , The necessary rate of return on the company's investment 10%.(1) Excuse me, a 、 What is the value of company B's shares ?(2)ABC What is the company's reasonable stock investment strategy now ?()

A.(1) The stock value of company a is 12 element ; The value of company B's shares 10 element .(2)ABC The company's reasonable stock investment strategy should be : Buy a stock , sell ( Short ) B shares .

B.(1) The stock value of company a is 10 element ; The value of company B's shares 12 element .(2)ABC The company's reasonable stock investment strategy should be : Buy a stock , sell ( Short ) B shares .

C.(1) The stock value of company a is 12 element ; The value of company B's shares 10 element .(2)ABC The company's reasonable stock investment strategy should be : Buy B shares , sell ( Short ) A shares .

D.(1) The stock value of company a is 10 element ; The value of company B's shares 12 element .(2)ABC The company's reasonable stock investment strategy should be : Buy B shares , sell ( Short ) A shares .

53. The most common way to repay bonds is ().

A. Prepayment

B. Repay on a monthly basis

C. Quarterly repayment

D. A lump sum repayment when due

54. A company intends to issue 600 Ten thousand yuan of corporate bonds , The annual interest rate of the bond is 10%, Time limit 4 year , If the market interest rate at the time of bond issuance is 12%, Then the issuance method of this bond shall be ()

A. Issue at a premium

B. Discount issue

C. Equivalent issue

D. At current prices

55. Among the following items that will affect the discount of interest bearing bills is (). Please below (1)-(4) Choose all the options that match the meaning of the question :(1) Date of issue ;(2) due date ;(3) Discount date ;(4) discount rate .

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(3)、(4)

D.(1)、(2)、(3)、(4)

56. In order to dilute the stock price of the company in circulation , The form of dividend payment to shareholders is ().

A. Cash dividends

B. Property dividends

C. Debt dividends

D. Stock dividends

57. Under the compound interest method , The factors affecting the size of compound interest mainly include (). Please proceed from the following (1)-(4) Choose the complete options that match the meaning of the question :(1) Interest bearing frequency ;(2) Amount of funds ;(3) Time limit ;(4) The interest rate

A.(1)、(2)、(3)

B.(1)、(2)、(4)

C.(1)、(2)、(3)、(4)

D.(2)、(3)、(4)

58. The main factors affecting the cost of preferred stock are (). Please select the following (1)-(4) All the options that match the meaning of the question :(1) Preferred stock dividends ;(2) Total preferred shares ;(3) Preferred stock raising rate ;(4) Corporate income tax rate

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(3)、(4)

D.(2)、(3)、(4)

59. Of the following , The calculation result is equal to the dividend payout rate ().

A. Dividend per share divided by earnings per share

B. Earnings per share divided by dividends per share

C. Dividend per share divided by market price per share

D. Earnings per share divided by market price per share

60. A company 2009 Year and 2010 Some of the data in the financial report for the year are as follows :( Company : Ten thousand yuan )2010 year ,2009 Annual payroll payable 3422,4059 Long term loan 4359,5293 Other debts 6867,7742 Owner's equity 4389,4038 Total liabilities and owner's equity 19037,21132 requirement : Calculate the company 2010 Annual equity multiplier , Explain the meaning of this indicator ;( On an average basis )()

A. The equity multiplier is 4.77, Show every 4.77 Our assets include 1 Rights and interests of yuan ; The bigger the indicator , The more fully utilized the debt operation , But it reflects that the weaker the solvency of the enterprise .

B. The equity multiplier is 5.77, Show every 5.77 Our assets include 1 Rights and interests of yuan ; The bigger the indicator , The more fully utilized the debt operation , But it reflects that the stronger the solvency of the enterprise .

C. The equity multiplier is 4.77, Show every 4.77 Our assets include 1 Rights and interests of yuan ; The smaller the index is , The more fully utilized the debt operation , But it reflects that the weaker the solvency of the enterprise .

D. The equity multiplier is 5.27, Show every 5.27 Our assets include 1 Rights and interests of yuan ; The smaller the index is , The more fully utilized the debt operation , But it reflects that the weaker the solvency of the enterprise .

61. The source and core indicators of DuPont analysis system are ()

A. Return on equity

B. Net interest rate on assets

C. Equity multiplier

D. Return on total assets

62. The significance of issuing stock dividends by enterprises lies in (). Please below (1)-(4) Choose all the options that match the meaning of the question :(1) Capitalization of corporate profits ;(2) It can save the cash of the enterprise ;(3) The stock price is not too high ;(4) It will increase the value of enterprise property .

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(3)、(4)

D.(1)、(2)、(3)、(4)

63. The total capital of an enterprise is 2000 Ten thousand yuan , The ratio of debt to equity financing is 2:3, The interest rate on the debt is 12%, Current sales 1000 Ten thousand yuan , The EBIT is 200 ten thousand , Then the current financial leverage coefficient is ().

A.1.15

B.1.24

C.1.92

D.2

64. An enterprise produces A product , Unit selling price 80 element , Unit variable cost 60 element , Unit fixed cost 20 element , Annual sales 3000 Pieces of . Sales are expected to increase next year 10%. Calculation required : The principal guaranteed sales volume and principal guaranteed sales volume of the enterprise ;② Calculate the expected profit for the next year .()

A. Breakeven sales 3000 Pieces of , Breakeven sales 240000 element ; Estimated annual profit 6000 element .

B. Breakeven sales 3000 Pieces of , Breakeven sales 240000 element ; Estimated annual profit 5000 element .

C. Breakeven sales 4000 Pieces of , Breakeven sales 240000 element ; Estimated annual profit 6000 element .

D. Breakeven sales 3000 Pieces of , Breakeven sales 250000 element ; Estimated annual profit 6000 element .

65. In general , The enterprise's financial situation is relatively stable and reliable, and the current ratio should be maintained at ()

A.4∶1

B.3∶1

C.2∶1

D.1∶1

66. Production cost budget , yes () A summary of . Please below (1)-(4) Choose all the options that match the meaning of the question :(1) Sales and administrative expenses budget ;(2) Direct material budget ;(3) Direct labor budget ;(4) Manufacturing cost budget .

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(3)、(4)

D.(2)、(3)、(4)

67.ABC The company plans to purchase office buildings , There are three payment methods to choose from ,(1) Payment at the end of each year 900 Ten thousand yuan , continuity 10 year .(2) Pay now 3000 Ten thousand yuan , in the future 10 Payment at the end of each year 446 Ten thousand yuan .(3) Payment at the end of each year 2500 Ten thousand yuan , continuity 3 year . If the interest rate 8%, What kind of payment method should the enterprise adopt ?()

A.(1)、(2)

B.(2)、(3)

C.(1)、(3)

D.(2)

68. The capital cost of common stock is higher than that of debt , The main reason is (). Please below (1)-(4) Choose all the options that match the meaning of the question :(1) Dividends are paid out of after tax profits ;(2) The number of shareholders is large ;(3) Higher issuance costs ;(4) The dividend payment rate is high .

A.(1)、(3)

B.(1)、(2)、(3)

C.(3)、(4)

D.(2)、(3)、(4)

69. From the perspective of enterprises , The factors restricting dividend distribution are (). Please below (1)-(4) Choose all the options that match the meaning of the question :(1) Control dilution ;(2) Financing capacity ;(3) Profit changes ;(4) Future investment opportunities .

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(2)、(3)、(4)

D.(1)、(2)、(3)、(4)

70. The impact of debt capital on capital structure is (). Please select the following (1)-(4) All the options that match the meaning of the question :(1) Reduce the cost of enterprise capital ;(2) Increase the financial risk of enterprises ;(3) With financial leverage ;(4) Decentralize shareholder control

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(3)、(4)

D.(2)、(3)、(4)

71. The following () You can raise your own funds for the company .

A. Internal accumulation

B. finance lease

C. Issue bonds

D. Borrow money from a bank

72. In all cases , The indicators that can measure the size of risk are ().

A. Standard deviation

B. Standard deviation coefficient

C. Expectations

D. probability

73. Of the following , What is not directly reflected in the cash budget is ().

A. Cash balance at the beginning and end of the period

B. Cash raising and utilization

C. Production and sales volume in the budget period

D. Cash balance and shortage in the budget period

74. Financial valuation refers to the estimation of assets ().

A. Book value

B. Market value

C. Liquidation value

D. Intrinsic value

75.() It refers to when the company arranges the amount of current assets , On the basis of normal operating requirements and normal insurance reserves , Plus some extra reserves , In order to reduce the risk of the company .

A. adventure ( radical ) Our investment policy

B. loose ( steady ) Our investment policy

C. Radical ( Adventurous ) Financing policy

D. Robust ( Conservative type ) Financing policy

76. The accounts receivable turnover period of an enterprise is 80 God , The average payment period of accounts payable is 40 God , The average inventory turnover period is 70 God , Then the cash turnover period of the enterprise is () God .

A.190

B.110

C.50

D.30

77. The total denomination issued by a company 1000 Ten thousand yuan , The coupon rate is 12%, Repayment period 5 year , Issue rate 3% The bond ( The income tax rate is 33%), The bond issue price is 1200 Ten thousand yuan , Then the capital cost of the bond is ().

A.8.29%

B.9.7%

C.6.91%

D.9.97%

78. The advantages of borrowing money from banks are (). Please select the following (1)-(4) All the options that match the meaning of the question :(1) The amount of financing is large ;(2) Fast fund raising ;(3) Great financing flexibility ;(4) Low financing cost

A.(1)、(2)、(4)

B.(1)、(2)、

C.(2)、(3)、(4)

D.(2)、(4)

79. The similarities between preferred shares and bonds are ().

A. There is no expiration date

B. The company is required to pay fixed remuneration to investors

C. There is no need to repay the principal

D. Dividends are paid after tax

80. The consecutive years for which the profit before tax makes up for the losses of previous years shall not exceed ().

A.1 year

B.3 year

C.5 year

D.10 year

81.A company 2008 year 、2009 The year and 2010 Some data of the annual income statement are as follows : Company : Ten thousand yuan 2010 year ,2009 year ,2008 Annual sales revenue 32168,30498,29248 Selling cost 20281,18531,17463 Net profit 2669,338,53305 requirement : Calculate the company 2010 Annual net profit margin on sales ,2010 Gross profit margin of annual sales ()

A.2010 Annual net profit margin on sales 8.30%,2010 Gross profit margin of annual sales 36.95%

B.2010 Annual net profit margin on sales 9.30%,2010 Gross profit margin of annual sales 36.95%

C.2010 Annual net profit margin on sales 8.26%,2010 Gross profit margin of annual sales 37.95%

D.2010 Annual net profit margin on sales 8.30%,2010 Gross profit margin of annual sales 38.95%

82. After paying stock dividends , The following situations will not be caused by (). Please below (1)-(4) Choose all the options that match the meaning of the question :(1) Change the shareholding ratio of shareholders ;(2) Increase the assets of the enterprise ;(3) Cause changes in earnings per share and market price per share ;(4) Cause changes in the structure of various items of shareholders' equity .

A.(1)、(2)

B.(1)、(2)、(3)

C.(3)、(4)

D.(1)、(2)、(3)、(4)

83. Of the following , The advantages of absorbing direct investment compared with debt financing are ().

A. Low cost of capital

B. Concentration of corporate control

C. Low financial risk

D. It is conducive to giving full play to the role of financial leverage

84. An enterprise obtains a loan from a bank 100 Ten thousand yuan , Time limit 1 year , Contract interest rate 9%, Interest is paid by the discount method , Then the effective interest rate is ()

A.9%

B.9.11%

C.9.89%

D.11.11%

85. The construction period of a project is 1 year , Construction investment 200 Ten thousand yuan was invested in the construction at the beginning , The operating period is 10 year , The annual net cash flow is 50 Ten thousand yuan , If the discount rate is 12%, Then the present value index of the project is ().

A.1.4841

B.1.4126

C.1.2613

D.1.4246

86. According to different sources of funds, financing can be divided into ().

A. Internal financing and external financing

B. Direct financing and indirect financing

C. Equity financing and debt financing

D. On balance sheet financing and off balance sheet financing

87. The reason for operating leverage effect is ().

A. Constant debt interest

B. Constant production and sales

C. Constant fixed costs

D. Constant sales unit price

88. The factors affecting the financial leverage coefficient are (). Please select the following (1)-(4) All the options that match the meaning of the question :(1) Profit before interest and tax ;(2) fixed cost ;(3) Preferred stock dividends ;(4) Income tax rate

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(3)、(4)

D.(1)、(3)、(4)

89. When a joint-stock company is liquidated due to bankruptcy , The right of claim for preferred shares shall be located in () Before the holder of .

A. bond

B. Commercial draft

C. Promissory note

D. common stock

90. The wage payment policy of workers in a garment factory is : Fixed monthly salary 600 element , Pay for each piece of clothing processed 10 element . This month, a worker processed 200 Clothes , How much salary should the garment factory pay ?()

A.2600 element

B.3600 element

C.4500 element

D.2800 element

91. Of the following annuities , The final value and present value can be calculated (). Please proceed from the following (1)-(4) Choose the complete options that match the meaning of the question :(1) Ordinary annuity ;(2) Prepaid annuity ;(3) Deferred annuity ;(4) Perpetual annuity

A.(1)、(2)、(3)

B.(1)、(2)、(4)

C.(1)、(2)、(3)、(4)

D.(2)、(3)、(4)

92. The net interest rate of a company's assets is 10%, If the equity ratio is 1.5, Then the net interest rate of equity is ()

A.6.67%

B.10%

C.15%

D.25%

93. The error in the following expression is ()

A. profits = Marginal contribution — fixed cost

B. profits = Sales volume X Unit marginal contribution — fixed cost

C. profits = Sales revenue — Variable cost — fixed cost

D. profits = Marginal contribution — Variable cost — fixed cost

94. If the listed company adopts a reasonable income distribution policy , The effects that can be obtained are (). Please below (1)-(4) Choose all the options that match the meaning of the question :(1) It can create good conditions for enterprise financing ;(2) Can handle the relationship with investors ;(3) Improve business management ;(4) Can enhance investor confidence .

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(3)、(4)

D.(1)、(2)、(3)、(4)

95. The board of directors of the company refers to the deadline for the registration of shareholders entitled to receive dividends as ()

A. Dividend declaration date

B. Equity registration date

C. Ex dividend day

D. Date of Payment

96. An enterprise is prepared to “2/20,N/40” Buy a batch of materials under the credit conditions of , The opportunity cost for enterprises to give up cash discounts is ().

A.2%

B.36.73%

C.18%

D.36%

97. When calculating the net cash flow during the operation period , following () The project is relevant . Please proceed from the following (1)-(4) Choose the complete choice that matches the meaning of the question :(1) profits ;(2) Expenditure on intangible assets ;(3) Depreciation amount ;(4) Recovery amount .

A.(1)、(2)、(4)

B.(1)、(2)、(3)

C.(1)、(3)、(4)

D.(1)、(2)、(3)、(4)

98. The expected return on a stock is 10%, The standard deviation is 0.04, The risk reward coefficient is 30%, Then the risk return rate of the stock is ().

A.40%

B.12%

C.6%

D.3%

99. Compared with equity financing , The disadvantage of long-term bank loan financing is ().

A. High financial risk

B. Fast financing

C. Stabilize control of the company

D. Low cost of capital

100. In the following items, the relationship between creditor's rights and debts is ()

A. The financial relationship between the enterprise and its creditors

B. The financial relationship between the enterprise and the recipient

C. The financial relationship between the enterprise and the debtor # feedback

D. The financial relationship between enterprises and the government

边栏推荐

- 【nvm】

- Docker installation MySQL simple without pit

- Memory alignment of structures

- Selection (025) - what is the output of the following code?

- [laravel series 7.9] test

- C language operators and expressions

- 【nvm】

- 双亲委派机制

- Research and investment strategy report on China's building steel structure anticorrosive coating industry (2022 Edition)

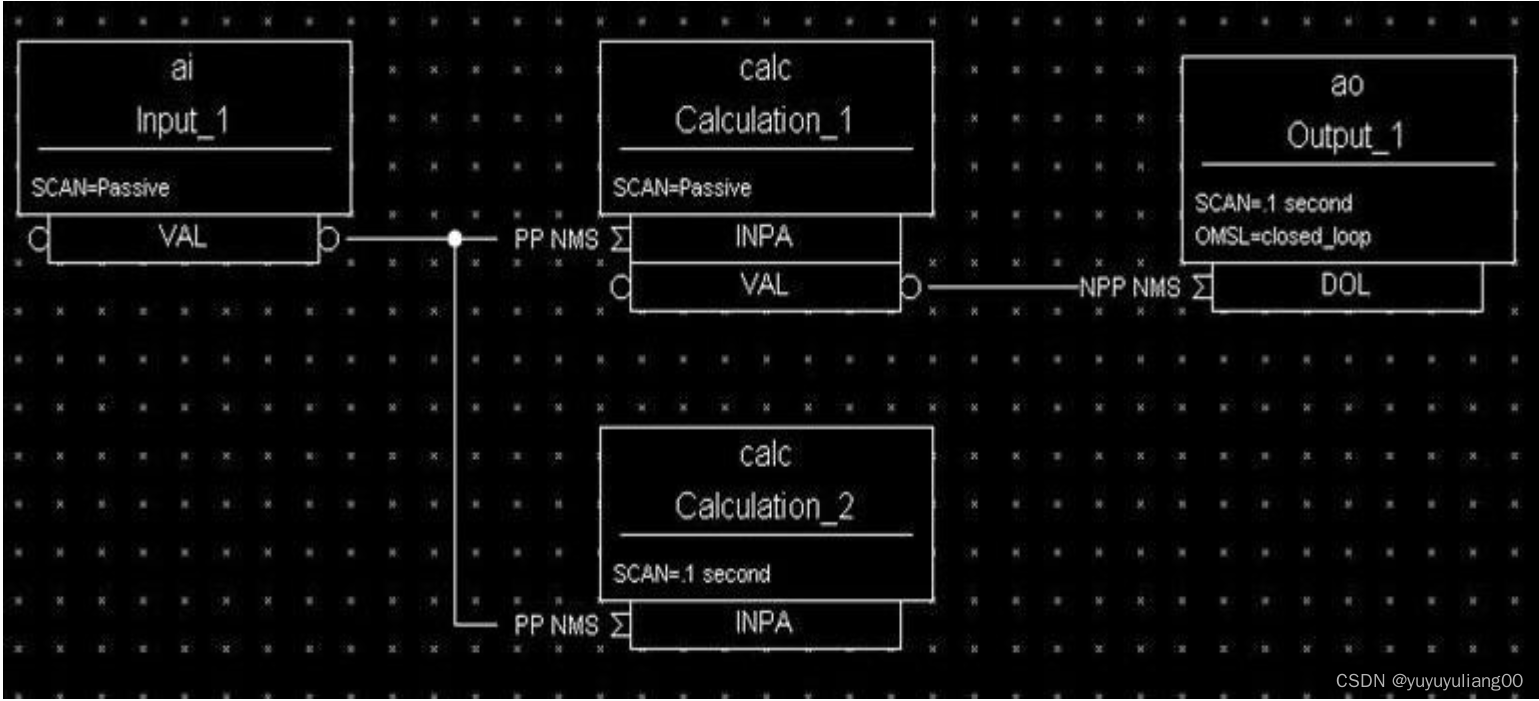

- EPICS记录参考4--所有输入记录都有的字段和所有输出记录都有的字段

猜你喜欢

Stop using it indiscriminately. This is the real difference between @validated and @valid!!!

JWT(Json Web Token)

![[postgraduate entrance examination English] prepare for 2023, learn list8 words](/img/25/d1f2c2b4c0958d381db87e5ef96df9.jpg)

[postgraduate entrance examination English] prepare for 2023, learn list8 words

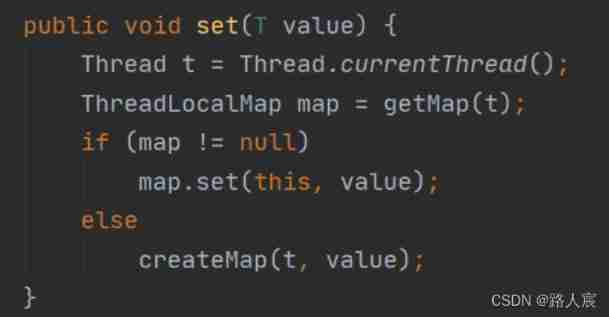

ThreadLocal local thread

win10或win11打印机无法打印

docker安装mysql-简单无坑

01_ Getting started with the spingboot framework

![[untitled]](/img/ed/847e678e5a652da74d04722bbd99ff.jpg)

[untitled]

Epics record reference 2 -- epics process database concept

推送Markdown格式信息到钉钉机器人

随机推荐

laravel用户授权

2022 safety officer-b certificate examination question bank and answers

China smallpox vaccine market trend report, technical innovation and market forecast

【Mongodb】READ_ ME_ TO_ RECOVER_ YOUR_ Data, the database is deleted maliciously

Research Report on solar battery charger industry - market status analysis and development prospect forecast

laravel model 注意事项

Research Report on market evaluation and investment direction of Chinese dermatology drugs (2022 Edition)

vulnhub DC: 2

Combine pod identity in aks and secret in CSI driver mount key vault

China solar window market trend report, technical dynamic innovation and market forecast

Tech talk activity review kubernetes skills of cloud native Devops

go Cobra命令行工具入门

shopee开店入驻流水如何提交?

canvas 实现图片新增水印

Research Report on terahertz imaging system industry - market status analysis and development prospect forecast

02_SpingBoot 入门案例

Attackg: constructing technical knowledge graph from cyber thread intelligence reports

别再乱用了,这才是 @Validated 和 @Valid 的真正区别!!!

机器学习编译入门课程学习笔记第一讲 机器学习编译概述

Talk about GC mechanism often asked in interview