当前位置:网站首页>RPA: Bank digitalization, business process automation "a small step", and loan review efficiency "a big step"

RPA: Bank digitalization, business process automation "a small step", and loan review efficiency "a big step"

2022-07-01 23:08:00 【It observation】

Digital age , With 5G、 Cloud computing 、 New technologies such as big data and artificial intelligence continue to innovate and apply , Digital transformation is also the general trend . among , The digitalization of banking industry is at the forefront , Focus on the construction of digital general core competence system . Now , automation 、 Intelligent tools are widely used in demand touch 、 Risk management 、 Fund pricing and other business services and decision management ,RPA、 natural language processing 、 machine learning 、 Computer vision 、 Knowledge atlas and other text intelligent processing technologies are becoming an important way of bank digital transformation , Constantly expand the existing capacity boundary of the bank , Run out of transformation acceleration .

One 、 Build a solid bottom line for bank digitalization , Grasp the risk of loan business “ Pain points ”

In banking business , Loan business is one of the core businesses of banks , It is also the main source of bank profits , But it is also the main risk of the bank .

Security is the bottom line and red line to promote digital transformation , Improve digital risk management and control capabilities , The bank needs to 、 During and after the loan , Every link should be done to effectively avoid risks : Before loan , The bank needs to carry out an effective due diligence on the borrower ; In credit , Strictly review the data ; After the loan , Need to track and follow up in time .

such as , The pre loan investigation was not detailed enough , Lack of solvency to customers 、 Comprehensive grasp of operating cash flow and credit status , It may cause risks in granting loans to customers who do not meet the borrowing conditions or are unable to repay .

To avoid the risk of bank loans , The most important step for banks is to conduct comprehensive and effective due diligence on borrowers . However, there are often some pain points in the audit of traditional bank loan business :

1、 Electronic collection of customer data is time-consuming and laborious . The formats and sources of various materials collected by the account manager are diverse , It is difficult to unify information , Traditional offline collection and online information entry require a lot of time for customer managers .

2、 There are various types of data . There are more than ten kinds of materials that need to be checked in loan business , Including loan receipt 、 Letter of commitment 、 Loan application 、 Repayment commitment, etc .

3、 Cross checking between data is complex . Data cross checking poses a great challenge to manual audit , The customer manager is required to be clear about the verification relationship between more than ten kinds of documents , Therefore, offline manual loan review is inefficient , Long audit cycle , These problems seriously restrict the healthy development of bank loan business .

Two 、 Business Process Automation “ A small step ”, Loan review efficiency “ A big step ”

Data capabilities and intelligent capabilities have gradually become the key competition points of the banking industry , Replace experience with data , It is the core of the digitalization stage of the banking industry .

In recent days, , Really intelligent AI product “supertext Smart text ” The new version was successfully released , Further enrich the real intelligent document review product matrix , Help the banking industry realize the differentiation of management and services 、 Individualization 、 Intelligent .

Real intelligence supertext Smart text with RPA、NLP、OCR And other cutting-edge technologies , Applied to the electronization of information 、 Business areas such as risk early warning , Digital upgrading of enabling loan review business , Bring more scenario solutions for the digital transformation of the banking industry :

1、 Supports multiple file types , Extract all kinds of document information . Through real intelligence, all self-study AI Ability ,supertext Smart text can automatically recognize and extract paper information , And synchronize to the system , Information can be automatically entered 、 External credit inquiry and information integration . Such as table information extraction 、 Identity document information extraction 、 Automatic capture of system information . At the same time, support the guarantee contract 、 Id card 、 The business license 、 Letter of commitment 、 Information filtering of documents required in loan approval such as loan receipt , Get key information more efficiently .

2、 Realize the automation of information audit and verification .supertext Smart text can extract important information from various documents , Assist the approver in judging the authenticity of the loan information 、 Uniformity 、 Compliance, etc , Automatically complete information review and verification . Such as financial report analysis 、 Contract subject name and other compliance audits 、 Verification of image data and system information .

3、 Provide personalization . Loan business involves credit loan 、 A mortgage on a house 、 Vehicle mortgage and other ways , Different loan methods have different audit rules , Therefore, we provide independent setting of audit rules , Banks can set and adjust rules according to actual personalized needs .

3、 ... and 、 Activate digital workforce , Promote the digital transformation of banks

Besides ,supertext Smart text is also related to reality RPA Get through , built-in 500 Multiple components , The building block construction process is easy to start , adopt AI+RPA Ability , Realize automatic file acquisition 、 Key information extraction 、 Review and automatically enter into the system .

Now ,supertext Smart text has helped a rural commercial bank get through the complete link of bank loan audit , Realize resource integration 、 Ability precipitation , Achieve business efficiency 、 Risk control capability 、 Improve the customer experience more :

1、 Early warning risk information .supertext Smart text , Be able to strictly follow the audit requirements , Information extraction and approval of various documents , Help the account manager find out the risks in time , Pinpoint risks , Avoid loan risks caused by risk neglect .

2、 Improve audit efficiency . When the information is complete , The traditional approval process also needs 24 Hours , stay supertext In smart text , Help through the intelligent audit system , The overall process can be reduced to 20 minute , Just click to upload the review materials , Second response , Get audit results quickly .

3、 Get rid of boring and repetitive work . The account manager uses the traditional manual entry method , Enter the information into the system , Boring and time-consuming ,1 Hours of input , adopt supertext Smart text ,AI With ability blessing, you only need 5 minute , It can automatically realize the identification of paper documents and the acquisition of system information , Improvement of input efficiency , Help account managers to devote themselves to higher value work .

As a platform and professional service provider of automated, intelligent and situational solutions trusted by customers , Always adhere to the customer first 、 The real spirit of mission , Constantly innovate financial technology , take AI Technology as a foundation for strengthening digital transformation services 、 A strong foundation for continuously releasing the value of digital connection , Activate the vitality of bank digital labor , Contribute to the digital transformation of banks .

边栏推荐

- [MySQL] index creation, viewing and deletion

- Congratulations on the release of friends' new book (send welfare)

- Timer和ScheduledThreadPoolExecutor的区别

- “信任机器”为发展赋能

- 马赛克后挡板是什么?

- Armbain系统根分区空间不足处理

- 【Swoole系列1】在Swoole的世界中,你将学习到什么?

- The principle, testing and Countermeasures of malicious software reverse closing EDR

- 使用 EMQX Cloud 实现物联网设备一机一密验证

- YOGA27多维一体电脑,兼具出色外观与高端配置

猜你喜欢

flutter Unable to load asset: assets/images/888.png

tcpdump命令使用详解

Multi picture alert ~ comparison of Huawei ECs and Alibaba cloud ECS

Daily question brushing record (10)

![Jielizhi Bluetooth headset quality control and production skills [chapter]](/img/ad/28e7461f8c5dc5c54a3f4da0c111ac.png)

Jielizhi Bluetooth headset quality control and production skills [chapter]

vSphere+、vSAN+来了!VMware 混合云聚焦:原生、快速迁移、混合负载

数字化转型道阻且长,如何迈好关键的第一步

Use 3DMAX to make a chess piece

Demo program implementation of QT version Huarui camera

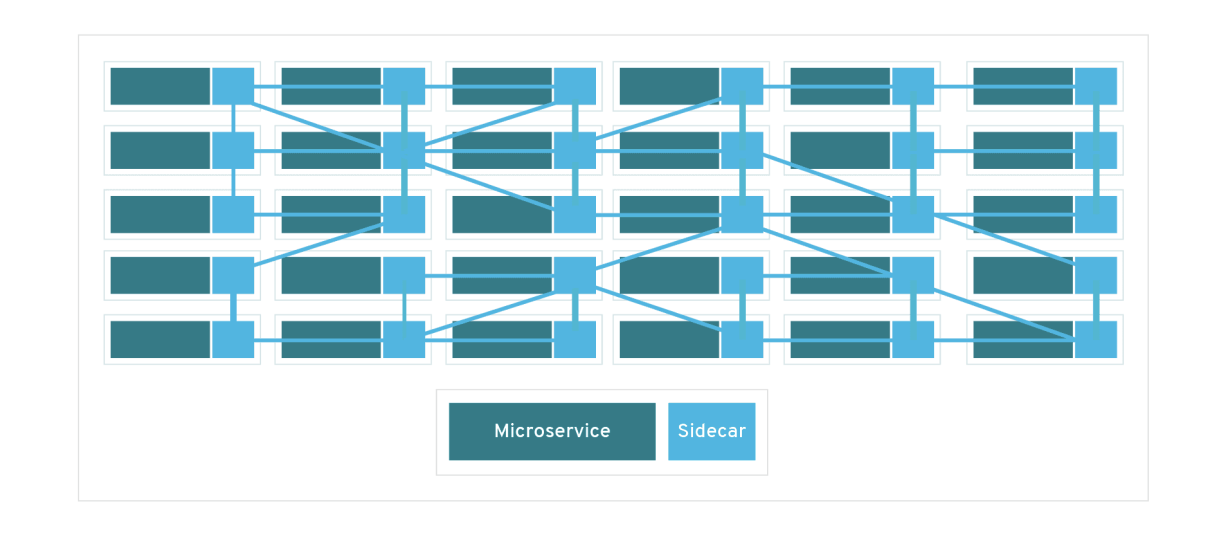

Istio、eBPF 和 RSocket Broker:深入研究服务网格

随机推荐

实在RPA:银行数字化,业务流程自动化“一小步”,贷款审核效率“一大步”

Where can the courses purchased by CSDN be accessed

Congratulations on the release of friends' new book (send welfare)

用JpaTransactionManager操作数据库事务

Use and function of spark analyze command map join broadcast join

MySQL -- index of InnoDB storage engine

Summary of "performance testing" of software testing, novice will know the knowledge points on the road

Treatment of insufficient space in the root partition of armbain system

Cisco test -- the concept and configuration test of routing

毕业季,既是告别,也是新的开始

[daily training] 66 add one-tenth

Unable to climb hill sort, directly insert sort

每日刷题记录 (十)

Appium automation test foundation - appium installation (I)

MySQL -- index of MyISAM storage engine

vim给目录加颜色

ESP自动下载电路设计

Preparation of functional test report

[image segmentation] 2021 segformer neurips

ECMAScript 2022 正式发布,有你了解过的吗?