当前位置:网站首页>There is a difference between u-standard contract and currency standard contract. Will u-standard contract explode

There is a difference between u-standard contract and currency standard contract. Will u-standard contract explode

2022-07-01 15:56:00 【New observation of science and technology】

u What is the difference between standard contract and currency standard contract ,u Will the standard contract explode

Today, I will take you to have a deep understanding u What is the difference between standard contract and currency standard contract .

First of all, we need to know what is U Standard contract and currency standard .

1. Currency standard

Currency standard ”, It refers to position building and final delivery , All the products used are the corresponding target products , For example, you need to be long or short BTC, You need to fill in the contract account BTC, Ultimate loss or gain , They all use BTC Settlement .

2.U Standard

“U Standard ”, It refers to position building and final delivery , It's all used USDT As a negotiable document , Whether long or short BTC perhaps ETH And other currencies , All need to be charged into the contract account USDT, Ultimate loss or gain , Are subject to USDT Settlement .

So what is the difference between the two ?

1、 Different pricing units .USDT The standard perpetual contract is based on USDT Is the unit of valuation ; Currency standard perpetual contracts are denominated in US dollars . Therefore, the index price between the two will also be different , such as BTC/USDT The index price of is taken from each exchange BTC Spot exchange USDT The price of ; and BTC/USD The index price of currency standard perpetual contract is taken from each exchange BTC The price of spot against US dollar .

2、 The contract value is different .USDT Standard perpetual contract the value of each contract is the corresponding target currency , such as BTC/USDT The face value of is 0.001BTC; Currency based perpetual contracts the value of each contract is USD, such as BTC/USD The face value of the contract is 100 dollar .

3、 The currencies used as collateral assets are different .USDT Standard perpetual contract all kinds of contracts use the pricing currency USDT As collateral assets , Users only need to hold USDT You can participate in the transaction of various kinds of contracts ; Currency standard perpetual contracts are secured assets in the underlying currency , Users need to hold the corresponding target currency to participate in the transaction of this kind of contract , such as BTC/USD Currency based perpetual contract , The user needs to transfer in BTC Act as an encumbered asset .

Due to the different currencies used as collateral assets , When prices fall , The risk of depreciation of the collateral assets of the two contracts is also different . Suppose that BTC/USD When the perpetual price of the currency standard falls , The higher the requirements for the collateral assets required by the user's position , Required for holding secured assets BTC The more ; but USDT Standard perpetual contracts because the collateral assets required are USDT,BTC Falling currency prices will not affect USDT The value of the encumbered assets .

The currencies for calculating profit and loss are different .USDT Standard perpetual contract all kinds of contracts use the pricing currency USDT Calculate profit and loss ; Currency standard perpetual contracts calculate profits and losses in the underlying currency , For example, user transactions BTC/USD Currency based perpetual contract , The currency of profit and loss is BTC.

边栏推荐

- vscode 查找 替换 一个文件夹下所有文件的数据

- 三星率先投产3nm芯片,上海应届硕士生可直接落户,南开成立芯片科学中心,今日更多大新闻在此...

- Tanabata confession introduction: teach you to use your own profession to say love words, the success rate is 100%, I can only help you here ~ (programmer Series)

- Nuxt. JS data prefetching

- u本位合约和币本位合约有区别,u本位合约会爆仓吗

- ThinkPHP advanced

- ABAP-屏幕切换时,刷新上一个屏幕

- Stm32f4-tft-spi timing logic analyzer commissioning record

- Pocket Network为Moonbeam和Moonriver RPC层提供支持

- Preorder, inorder, follow-up of binary tree (non recursive version)

猜你喜欢

Some abilities can't be learned from work. Look at this article, more than 90% of peers

![[open source data] open source data set for cross modal (MRI, Meg, eye movement) human spatial memory research based on virtual reality scenes](/img/73/98e4847783be26d86d147425ce3ecd.jpg)

[open source data] open source data set for cross modal (MRI, Meg, eye movement) human spatial memory research based on virtual reality scenes

Don't ask me again why MySQL hasn't left the index? For these reasons, I'll tell you all

![[PHP graduation design] design and implementation of textbook management system based on php+mysql+apache (graduation thesis + program source code) -- textbook management system](/img/04/11f24f12c52fb1f69e3d6f513d896b.png)

[PHP graduation design] design and implementation of textbook management system based on php+mysql+apache (graduation thesis + program source code) -- textbook management system

![[STM32 learning] w25qxx automatic judgment capacity detection based on STM32 USB storage device](/img/41/be7a295d869727e16528041ad08cd4.png)

[STM32 learning] w25qxx automatic judgment capacity detection based on STM32 USB storage device

Go语学习笔记 - gorm使用 - 表增删改查 | Web框架Gin(八)

你TM到底几点下班?!!!

近半年内连获5家“巨头”投资,这家智能驾驶“黑马”受资本追捧

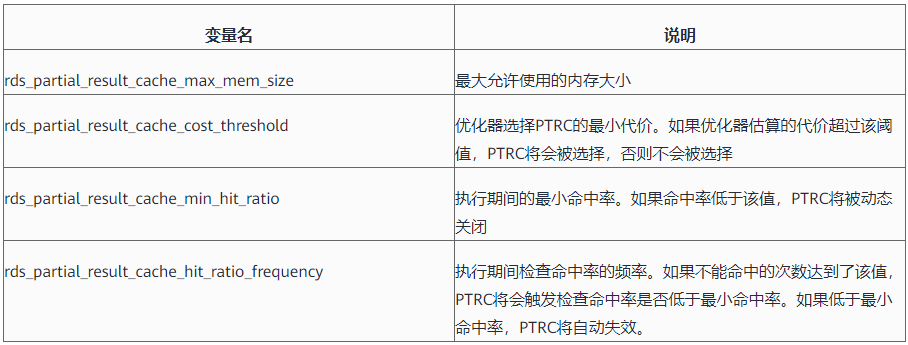

Gaussdb (for MySQL):partial result cache, which accelerates the operator by caching intermediate results

Comment win11 définit - il les permissions de l'utilisateur? Win11 comment définir les permissions de l'utilisateur

随机推荐

TensorFlow團隊:我們沒被拋弃

Photoshop插件-HDR(二)-脚本开发-PS插件

关于用 ABAP 代码手动触发 SAP CRM organization Model 自动决定的研究

[stm32-usb-msc problem help] stm32f411ceu6 (Weact) +w25q64+usb-msc flash uses SPI2 to read out only 520kb

七夕表白攻略:教你用自己的专业说情话,成功率100%,我只能帮你们到这里了啊~(程序员系列)

SAP CRM organization Model(组织架构模型)自动决定的逻辑分析

6.2 normalization 6.2.6 BC normal form (BCNF) 6.2.9 normalization summary

Crypto Daily:孙宇晨在MC12上倡议用数字化技术解决全球问题

ABAP-屏幕切换时,刷新上一个屏幕

[IDM] IDM downloader installation

Automatic, intelligent and visual! Deeply convinced of the eight designs behind sslo scheme

ABAP-调用Restful API

Gaussdb (for MySQL):partial result cache, which accelerates the operator by caching intermediate results

Trace the source of drugs and tamp the safety dike

自動、智能、可視!深信服SSLO方案背後的八大設計

[one day learning awk] function and user-defined function

【LeetCode】43. 字符串相乘

Summer Challenge harmonyos canvas realize clock

ADS算力芯片的多模型架构研究

[200 opencv routines] 216 Draw polylines and polygons