当前位置:网站首页>Why did Yanjing Beer come here?

Why did Yanjing Beer come here?

2022-06-25 06:41:00 【Zhijin Finance】

Why did Yanjing Beer come here ?

author l Dazhao

when the moon is at its full , it begins to wane , When the water is full, it overflows .

Business competition is always difficult , The time shift easily , The first place in the past , Now you may be too tired .

1980 year , Yanjing Beer ( hereinafter referred to as “ Yanjing ”) Founded in Beijing , At that time, it was a beer manufacturer supported by the state . With the strong support of the Beijing government , Yanjing in the last century 90 In the mid s, it once became the largest beer producer in China , And in 1997 Listed on Shenzhen Stock Exchange in .“ Yanjing brand 12°P Special beer ” And won “ The first national light industrial products Expo ” gold prize 、 The first 31 The gold medal of the Brussels World Expo and other well-known awards at home and abroad .

Subsequently, the company vigorously promoted “ Hutong strategy ”, Rely on the channels of food and non-staple food companies , Quickly realize product sinking , It has successfully achieved brand awareness in Beijing . today ,“ Yanjing ” The two characters are still the most distinctive representatives of the beer industry in North China .

However, in the subsequent wave of mergers and acquisitions in the beer industry , Yanjing has been overtaken by Tsingtao beer and snow beer .

More serious , The nationalization of Yanjing is not progressing smoothly .

data display ,2010 In, the sales of Yanjing beer and Tsingtao beer in North China were... Respectively 44.57 One hundred million yuan 、34.28 One hundred million yuan . But then 2020 year , The sales of the two are 50.06 One hundred million yuan 、64.90 One hundred million yuan . Ten years , Yanjing beer only increased 12%, Tsingtao beer has increased by almost 90%.

All these changes should be attributed to the products of Yanjing beer .

The product portfolio is congenitally deficient ?

Puyin International Securities believes that , Although Yanjing is 2019 It launched a popular model in U8, Welcomed by consumers , But one product is not enough to change Yanjing's product portfolio .

This deficiency is mainly reflected in three aspects , Weak brand power 、 Low product positioning and lack of international brand recognition .

First , In terms of brand , Yanjing implements 3+1 strategic , In addition to Yanjing's main brands , The company also owns snow deer 、 Huiquan and Liquan are three brands . It is worth noting that , Besides Yanjing's strong influence in the North , The other three brands are all regional small brands , Lack of popularity in the country .

secondly , Most of Yanjing's products are priced at mainstream prices (3-5 element ) And the secondary high end (5-8 element ) Price band . In the high-end price band (8 Yuan of above ) Although there are some product layouts ( For example, the Eight Sights of Yanjing 、 Osmanthus fragrans, etc ), But the overall product power is relatively weak .

Why did Yanjing Beer come here ?

Picture source : Puyin International

As a contrast , Tsingtao beer and China Resources beer go far in the high-end market .

Tsingtao Beer's brand positioning is relatively high-end , Therefore, Tsingtao beer has launched more high-end products on the basis of its original brands ( For example, good luck comes first 、 Ogut et al ) It is easier to be accepted by the market .

China Resources beer is another way , At the moment of launching high-end beer products, we intend to weaken the snow brand , The product itself is highlighted through innovative packaging and active marketing strategies , Include Super X、 Create with ingenuity 、 Mars Green has also achieved great success .

Last , With the increasing diversification of domestic consumers' demand for beer , A simple product portfolio has been difficult to meet the consumers' pursuit of upgrading the consumption of beer products .

In this context :

China Resources beer and Chongqing beer merged the Chinese assets and businesses of Heineken and Carlsberg into listed companies through equity cooperation with foreign investors , To launch “ International brands ”+“ Domestic brands ” The combination of .

On the other hand , Budweiser Asia Pacific relies on the past acquisitions and mergers of the parent company Budweiser InBev , It also has a strong international brand matrix .

But Yanjing has never had any equity investment cooperation with any international brands , Therefore, there is no international brand blessing in Yanjing's brand portfolio . This makes Yanjing's brand portfolio compare with those beer enterprises with international brand recognition , Even less competitive .

The rival Tsingtao beer has no international brand blessing , However, as the No. 1 domestic beer enterprise in the high-end beer market , Its own brand has a strong position and strength . This is an advantage Yanjing does not have .

Aging product portfolio affects company performance

Aging product portfolio 、 The most direct impact of the low overall market positioning of the product on the company's finance is the low overall ton price level of the company , At the downstream of the industry .

The lower ton price leads to Yanjing's overall profit margin always in the lower reaches of the industry .

Looking back at the past seven years , Compared with the company's profit margin 2014 Not only has the year not improved , It's down . Nearly three years , Yanjing's net profit margin rebounded slightly , But the rate of rise is far less than that of competitors .

Why did Yanjing Beer come here ?

Once the problem is discovered , Yanjing Beer has carried out the reform of the majority system , Set up multiple comprehensive centers , Set up functional departments and connect with subsidiaries , And will 2022 year 6 The preliminary framework setting will be completed in January .

In accordance with the plan , A risk management center shall be set up in each comprehensive center ( There is internal audit 、 Internal control 、 Legal affairs and other departments )、 Marketing center 、 E-commerce center , Production and operation centers will be established in the future , By clarifying the functions of the headquarters , Make management more refined .

At the same time, Yanjing also optimized the personnel , Negotiate the resettlement of some senior employees , Pay dismissal compensation .2021 In, the number of employees decreased 1839 people , fell 6.6%; Personnel reduction mainly comes from subsidiaries ,2021 The number of employees in the subsidiary decreased year on year 7.2%.

In addition to the optimization of grass-roots employees , Yanjing also made high-level adjustments this year .5 month 18 Sunday night , Yanjing Beer announced , According to the announcement :

The 14th meeting of the 8th board of directors of Yanjing beer , Reviewed and adopted 《 Proposal on electing Mr. gengchao as chairman of the 8th board of directors of the company 》. The meeting elected Mr. gengchao as the chairman of the 8th board of directors , The term of office is the same as that of the 8th board of directors .

according to 《 Articles of association 》 Regulations , The chairman is the legal representative of the company , The company will go through the registration procedures for the change of the legal representative of the company according to law . Mr. xieguangjun will no longer act as chairman 、 Responsibilities of legal representative .

However, under the premise of the adjustment of the employee compensation system ,2021 In, the management and sales expense ratio of Yanjing rose year on year , Among them, the employee compensation in the management and sales expenses increased year-on-year 13.4% and 22.5%, In the sales expenses, the advertising expenses increased year on year 10.7%.

As a contrast , Tsingtao Beer's above-mentioned values are better than those of Yanjing .

First , The proportion of employee compensation in the revenue of Tsingtao Beer's management expense ratio is 6.7%, Yanjing is 2.8%;

secondly , Depreciation and amortization expenses in Yanjing management expenses account for% of the revenue 1.9%, Tsingtao beer is only 0.7%, Therefore, it can be predicted that continuously promoting the optimization of the number of employees will still be an important means for Yanjing beer to reduce the management cost rate for a long time in the future .

However, a series of measures have been taken , It doesn't seem to have helped Yanjing turn the tide .

2021 year , Yanjing Beer realized operating income 119.6 One hundred million yuan , a 2013 Year of 137.5 One hundred million yuan , falling 13.01%;

In the same period of time , Tsingtao beer is from 282.9 One hundred million yuan , Up to 301.7 One hundred million yuan .

Fall to North China “ stronghold ”

North China is the largest market in Yanjing , Accounting for% of Yanjing's total revenue 46%(2020 Annual data ).

among , Beijing contributes most of Yanjing's revenue in the North China market , As the birthplace and base market of Yanjing , Beijing is of strategic significance to Yanjing .

Yanjing once had a monopoly in Beijing , The market share in terms of sales volume was once close to 90%.

However , With the gradual consumption upgrading of local consumers and the gradual reduction of low-end beer terminals , Yanjing's market share in Beijing has declined in recent years .

According to the estimation of Puyin international securities , Yanjing's current sales market share in Beijing is 75% about .

As mentioned above , Yanjing Beer has certain defects in its brand and product line , In the face of other high-end brands continuously entering the Beijing market , Further loss of market share is likely in the future .

Why did Yanjing Beer come here ?

To solve this problem , Yanjing is stabilizing traditional catering 、 On the basis of circulation channels , Start in e-commerce 、KA( An important client , Such as large supermarkets )、 The night show channel makes efforts through various channels . In order to cooperate with it , The company is also actively laying out “ on-line + Offline ” Various marketing scenarios , Introduce Tiktok 、 Little red book, etc 、 Short video publicity , And has signed a number of front-line spokesmen .

Everbright Securities Research Report shows :

Under multiple measures , At present, the sales volume of medium and high-grade Yanjing Beer in Beijing has reached 40% about .2021 year , Its operating income in North China has reached 59.12 One hundred million yuan , Year-on-year growth 18.11%, There is a clear rebound .

However, at this stage, the company's capacity utilization is at a low level in the industry , This has led to per capita income generation 、 Net interest rate 、ROE( Return on equity ) A series of problems, such as low .

Guosheng securities statistics :

2020 year , Yanjing Beer's capacity utilization rate is only 39.2%, CR beer 、 Tsingtao Beer 、 Chongqing beer is 59%、55%、81.4%.2021 year , The number of Yanjing Beer rose slightly to 40.24%.

Besides , From the general environment of the beer industry , Its from 2014 There has been a decline in sales since , Several giants are breaking the high-end situation one after another , Market competition has become the red sea of the Red Sea , The stock fight is fierce .

The new chairman gengchao is in 《 China Food News 》 In an interview with “ In greater North China 、 Southwest China 、 Changjiang delta 、 The Pearl River Delta and the Central Plains have integrated several million tons 、 Advanced equipment 、 An intelligent large-scale production base with a wide range of radiation ”, Capacity optimization may accelerate in the future , From the perspective of the development of the beer industry , Shut down production capacity 、 The sale of plant and equipment will lead to short-term recognition of impairment, etc “ Short pain ”, However, in the next year, the depreciation and amortization expenses and personnel compensation can be reduced to open up the space for long-term profits .

Debang securities also predicted , After the management is settled , expect 2022 The year of will be the year when Yanjing beer will make the greatest efforts to reform .

Reference material :

《 What should we pay attention to when talking about Yanjing ?》, The boom securities

《 Yanjing Beer : To rebuild brilliance, we need to break down the old and establish the new 》, Puyin international securities

《 Stimulate energy , Embrace high-end —— Yanjing Beer value investment analysis report 》, Everbright securities

Statement : This article is for knowledge sharing only , Just to convey more information ! This paper does not constitute any investment proposal , Anyone makes an investment decision accordingly , Own risk .

边栏推荐

- VMware virtual machine prompt: the virtual device ide1:0 cannot be connected because there is no corresponding device on the host.

- Ht513 I2S input 2.8W mono class D audio power amplifier IC

- How do I turn off word wrap in iterm2- How to turn off word wrap in iTerm2?

- Ht81293 built in adaptive dynamic boost 20W mono class D power amplifier IC solution

- MSG_ OOB MSG_ PEEK

- What is the IP address

- DNS domain name system

- Ht8513 single lithium battery power supply with built-in Dynamic Synchronous Boost 5W mono audio power amplifier IC solution

- Query process of MySQL secondary index

- sin(a+b)=sina*cosb+sinb*cosa的推导过程

猜你喜欢

Viewing Chinese science and technology from the Winter Olympics (V): the Internet of things

![[speech discrimination] discrimination of speech signals based on MATLAB double threshold method [including Matlab source code 1720]](/img/36/ad86f403b47731670879f01299b416.jpg)

[speech discrimination] discrimination of speech signals based on MATLAB double threshold method [including Matlab source code 1720]

From file system to distributed file system

How to deploy locally developed SAP ui5 applications to ABAP servers

![[core content and derivation] the mystery of human memory system may be just like this](/img/7c/98f27bb55a1a3b74c0ed8fd7fd2cc5.jpg)

[core content and derivation] the mystery of human memory system may be just like this

Brief introduction and use of JSON

@Detailed explanation of valid annotation usage

![[200 opencv routines of youcans] 104 Motion blur degradation model](/img/a9/8841ffc8bd3c486bc4011a1a84ff45.jpg)

[200 opencv routines of youcans] 104 Motion blur degradation model

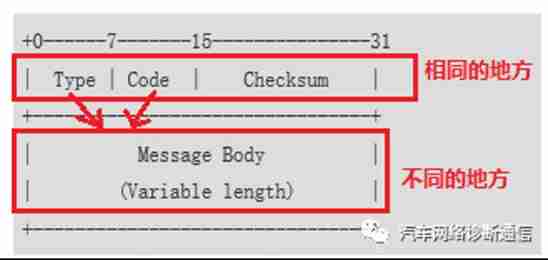

Understand what ICMP Protocol is

sin(a-b)=sina*cosb-sinb*cosa的推导过程

随机推荐

Analysis on the output, market scale and development status of China's children's furniture industry in 2020 and the competition pattern of children's furniture enterprises [figure]

cos(a-b)=cosa*cosb+sina*sinb的推导过程

Flask 的入门级使用

Bcrypt password encryption kalrry

The five minute demonstration "teaches" actors to speak foreign languages and can seamlessly switch languages. This AI dubbing company has just received a round a financing of 20million US dollars

Query process of MySQL secondary index

The Rust Programming Language

What is cloud primordial?

Acwing / 2004. Mauvaise écriture

VMware virtual machine prompt: the virtual device ide1:0 cannot be connected because there is no corresponding device on the host.

[v2.0] automatic update system based on motion step API (support disconnection reconnection and data compensation)

Analysis on the scale of China's smart airport industry in 2020: there is still a large space for competition in the market [figure]

[轻松学会shell编程]-5、计划任务

Wechat applet simply realizes chat room function

了解zbrush雕刻软件,以及游戏建模的分析

[short time average zero crossing rate] short time average zero crossing rate of speech signal based on MATLAB [including Matlab source code 1721]

Can TCP syn handshake messages transmit data

Arm register (cortex-a), coprocessor and pipeline

sin(a-b)=sina*cosb-sinb*cosa的推导过程

Zero foundation wants to learn web security, how to get started?