当前位置:网站首页>What is the investment value of iFLYTEK, which does not make money?

What is the investment value of iFLYTEK, which does not make money?

2022-07-06 02:46:00 【Technology Pro】

2021 year , IFLYTEK's operating income has reached 183 Billion , growth 40.61%; Net profit 15.56 Billion , growth 14.13%; Deduct non net profit 9.79 Billion , growth 27.54%. The book looks very bright , Is a highly profitable company , But from the perspective of financial statements over the years to carefully analyze , IFLYTEK has a lot of profit .

One 、 The main business has weak hematopoietic capacity

IFLYTEK's revenue continues to rise , But the gap between revenue growth and net profit growth is growing . Compare the operating revenue and net profit trend of iFLYTEK over the years , An obvious trend is : The income growth rate is getting higher and higher , The growth rate of net profit cannot keep up .

source : The company's financial statements over the years

It can be seen from the picture that , IFLYTEK fell into “ Increasing income does not increase profit ” among . Under scrutiny , There are three small problems .

First , From the perspective of income composition , IFLYTEK's current revenue sources mainly include education 、 Smart city 、 Open platform and consumer business , There is a puzzling question :2016 year 8 month , The company in 2015 The annual operating revenue reaches 25 After billion , Released “ short-term 、 Mid - 、 Long term vision ”. The short-term vision is to be a leader in the voice industry and a pioneer in the AI industry , Realize ten billion income 、 Hundreds of billions of market value . Since you want to be a leader in the voice industry , Relevant business income should be clearly indicated to the person , However, iFLYTEK did not report the composition of revenue according to specific product lines , It is difficult for the outside world to see how much of iFLYTEK's revenue is due to its core competitiveness —— Voice intelligent driven products , Therefore, the outside world has no way to judge the profitability of voice intelligence driven business .

secondly , The operating results are not optimistic . According to the financial report , Net cash flow from iFLYTEK's operating activities , Less than half of the profits (2021 year ), Main business “ Hematopoiesis ” Ability is questionable . Hikvision in the same industry is completely different , Its 80% Of the profits come from operating activities .

source : The company's financial report

Besides , IFLYTEK's gross profit margin continued to decline . According to financial data ,2021 In, iFLYTEK's gross profit margin was 41.43%, Year-on-year decline in 4%, And has been declining for five consecutive years . In terms of specific business segments , Wisdom Education 、 Open platform 、 Smart city 、 The gross profit margin of smart medical and other businesses decreased . The main reason for the rise in the price of chips given by iFLYTEK is the increase in the official stock market 、 Business structure changes 2021 Factors such as investment in the layout of strategic base areas in . The author thinks , If the gross profit margin drops accidentally , It may have something to do with the environment , It has declined steadily every year , Is it necessary to reflect on your own problems ?

Third , In the annual report, iFLYTEK has repeatedly emphasized its role in the field of artificial intelligence in China “ The leader ” The role of , Ambition is good , But the future will represent China to the world , Become an industry leader , Technical strength needs to be verified in a wider range . From a regional point of view , At present, iFLYTEK's business income from overseas is very low , Account for only a 0.31%, Its products have not been widely used overseas , Naturally, we cannot say that its products and technology have reached world-class . Domestic stock markets like to talk about concepts , Especially the current hot “ Artificial intelligence ” Concept . Artificial intelligence “ Concept ” How big has been described by countless people , Enough investors to play and imagine . But the reality is , IFLYTEK has world-class technology , However, its AI products or services have not been recognized by the world , At present, it can only be called a high-tech enterprise in China .

Two 、 Squeeze out the water of profit

IFLYTEK's net profit , The first problem is the high capitalization rate of R & D expenses . Accounting treatment of R & D investment , That is, the direction of R & D investment , It is divided into research stages 、 The development phase , Usually, the research and development investment in the research stage is included in the current expenses ; And R & D in the development stage can be capitalized , Transfer to development cost or intangible assets .

source :2021 Annual financial report

Capitalization rate of iFLYTEK R & D expenses , In the past ten years or so 40% about , Far higher than peers , image 2019 reach 48.52%. This means that R & D expenses are less counted in the current period , As a result, profits have increased , There is a suspicion of whitewashing profits . After being included in intangible assets , This amount will be amortized year by year in the future , For example, iFLYTEK may press 5 Annual amortization , That is to say, such accounting treatment causes the reaction of its R & D expenses in the income statement to lag 5 year .

Another comparison is more intuitive : Now most of the Internet intelligence fields A Stock listed company , Almost all or most of the R & D investment is expensed . For example, security leader Hikvision , The annual R & D investment is fully expensed .2021 The annual R & D investment is as high as 82.52 Billion , It is also included in the R & D expenses , The capitalized amount is 0. If we squeeze the capitalized part of R & D investment out of the net profit of iFLYTEK , It can be said that in the past 5 year , IFLYTEK is not only unprofitable , Even lost money .

The second question is , IFLYTEK earned money ,“ Coming ” Too many . Looking back a few years , IFLYTEK has been in 2011、2013、2015、2016、2017、2019、2021 The annual fixed increase raised funds ( Ask shareholders for money ), add IPO The amount of funds raised reached nearly 110 Billion , This does not include applying for long-term and short-term loans from banks , Think about the net profit of the company ? It's not hard to explain , IFLYTEK's return on net assets in recent years is 10% Up and down , Hikvision is probably 30% about .

in addition , IFLYTEK's government subsidies account for the proportion of total reported profits, which has been maintained at 50% about , image 2021 Annual net profit 15.56 Billion , There are government subsidies 8 One hundred million yuan . Of course , It's a skill to ask for money , What I worry about is , IFLYTEK, supported by profits , When can you rely on your main business to achieve substantial profits , Let the waist stand up ?

The third question is , Since there is so much money to come , Not much cash . The absolute value of a company's cash may be due to investment 、 financing 、 Business decisions fluctuate , But compared with peers , The higher the cash ratio , It means strong solvency . data display , Shenwan computer - The average current ratio of the software development industry is 2.36, The average quick ratio is 2.03; IFLYTEK current ratio 1.74, Quick ratio 1.44, IFLYTEK's current ratio 、 The quick ratio is still lower than the industry average , It means that cash is not abundant , It's confusing .

3、 ... and 、 What is the investment value of iFLYTEK ?

IFLYTEK in terms of business , The scale grows rapidly, but the gold content of income is not high ; At the financial level , It is a company that is good at raising funds but not good at making money . However, from the perspective of investment , It needs to be re judged , After all, the value of an enterprise cannot be based on making money . The author thinks , Judge whether iFLYTEK has significant investment value , The key depends on its core products or application scenarios , How big is the annual sales possible , Or to put it another way , What is the ceiling of commercialization .

IFLYTEK's main products in the field of voice intelligence do not seem to be very optimistic , It's hard to sustain the current market value . But there are several positive factors that cannot be ignored :1、 According to the 《 China Internet Development Report (2021)》 Statistics ,2020 year , The scale of China's artificial intelligence industry has reached 3031 One hundred million yuan , The growth rate is slightly higher than the global growth rate . The total number of AI enterprises in China is 1454 home , Second in the world . At home AI In the field, the situation is generally good , The landing scenarios of intelligent products are gradually diversified 、 Concretion ; Various national support policies have also been introduced ;2、 IFLYTEK adopts “ platform + Track ” Strategy , Open the pattern . Artificial intelligence is a grand and long-term undertaking , It is by no means the power of one family to complete the commercialization , Industry development is the right way .

IFLYTEK is in 2010 In, the first AI open platform in China was released , It's also one of the first “ National new generation AI open innovation platform ”, The aim is to empower through technology 、 Market empowerment 、 Business model empowerment , Provide full chain services for developers and upstream and downstream resource partners of the industry , And further build iFLYTEK on this basis AI Marketing platform 、 IFLYTEK intelligent industrial platform and other capability platforms . On the track , In iFLYTEK's main revenue business , Education business 、 Consumer business 、 Medical services 、 Automobile business and operator business , There are specific playing methods ,ToB and ToC Two wheel drive , There is still room for imagination .

But imagination belongs to imagination , Improving the profitability of the business in a down-to-earth manner may be the most urgent task of iFLYTEK .

边栏推荐

- 07 单件(Singleton)模式

- [Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 21

- [Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 9

- 一个复制也能玩出花来

- Introduction to robotframework (II) app startup of appui automation

- DDoS "fire drill" service urges companies to be prepared

- 【若依(ruoyi)】启用迷你导航栏

- [Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 17

- "Hands on learning in depth" Chapter 2 - preparatory knowledge_ 2.3 linear algebra_ Learning thinking and exercise answers

- [Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 8

猜你喜欢

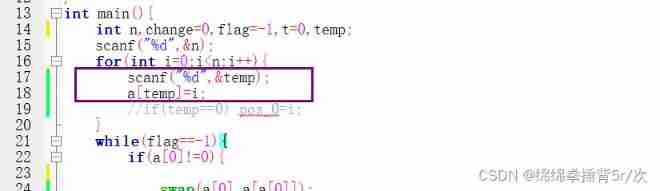

#PAT#day10

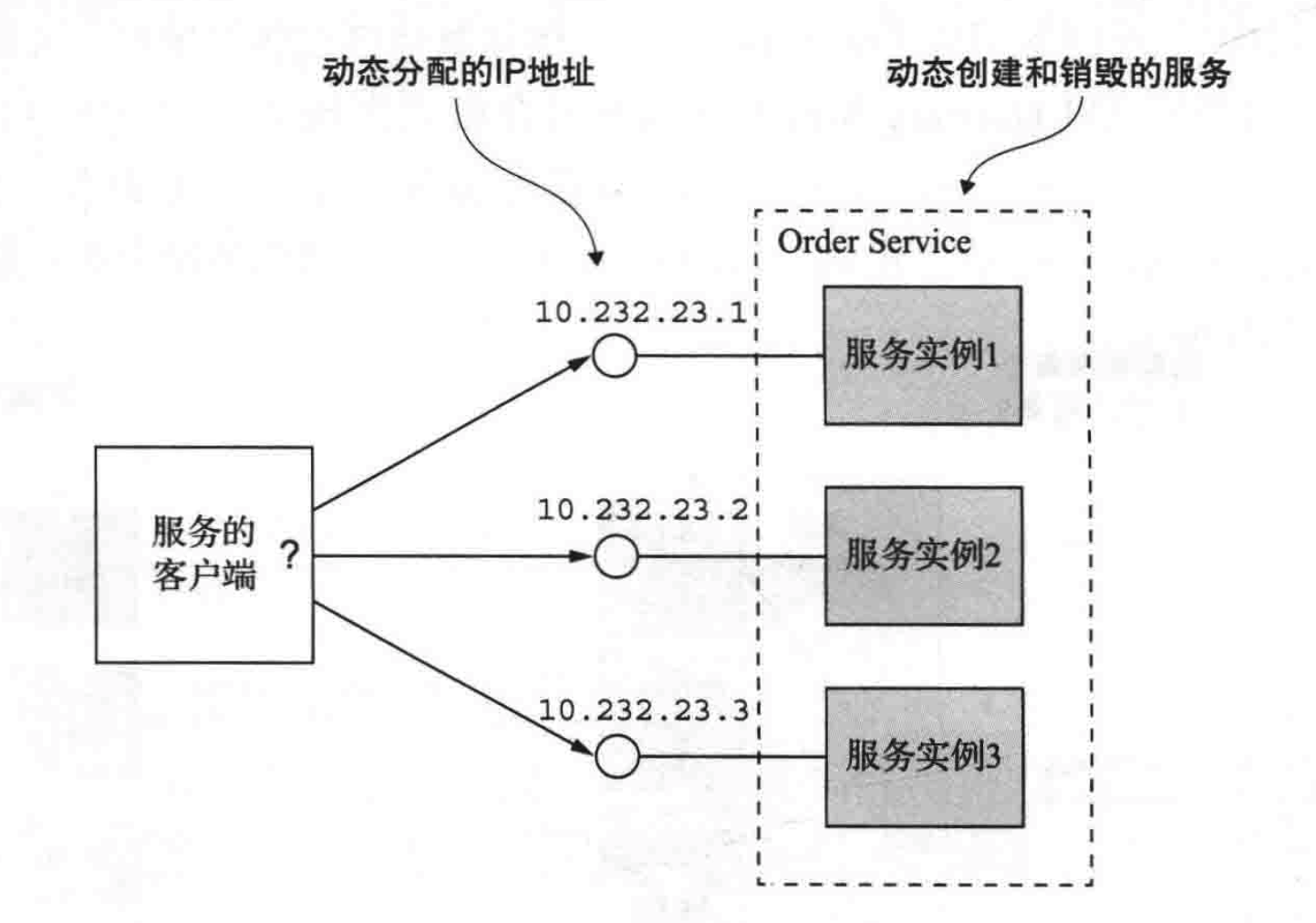

Microservice registration and discovery

![[Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 14](/img/c5/dde92f887e8e73d7db869fcddc107f.jpg)

[Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 14

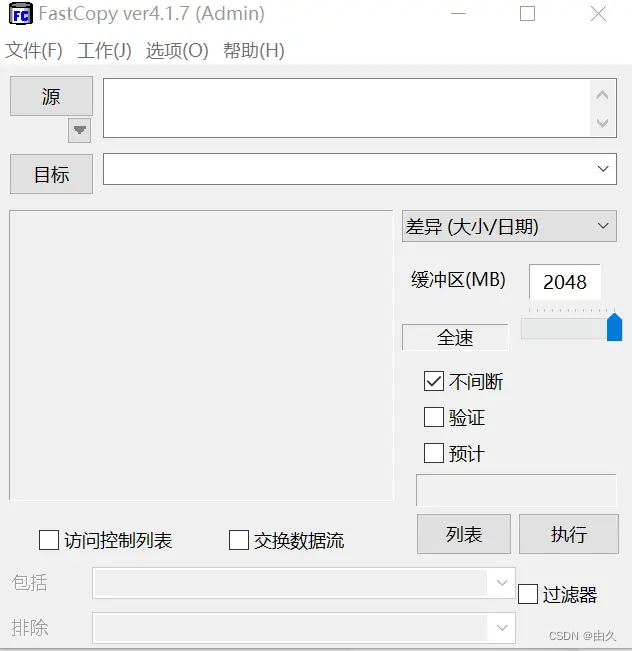

一个复制也能玩出花来

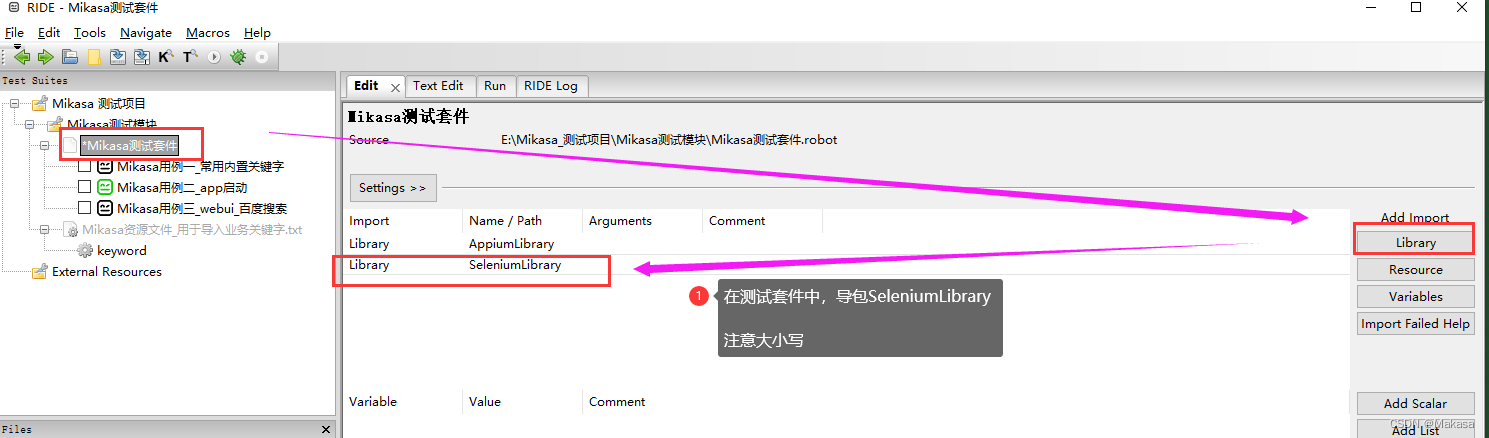

RobotFramework入门(三)WebUI自动化之百度搜索

![[Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 9](/img/ed/0edff23fbd3880bc6c9dabd31755ac.jpg)

[Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 9

如何精准识别主数据?

How to accurately identify master data?

![[Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 21](/img/73/4050a592fdd99bf06e8fd853b157b6.jpg)

[Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 21

![[Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 6](/img/38/51797fcdb57159b48d0e0a72eeb580.jpg)

[Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 6

随机推荐

Summary of Bible story reading

How to accurately identify master data?

Installation and use tutorial of cobaltstrike-4.4-k8 modified version

How does yyds dry inventory deal with repeated messages in the consumption process?

Blue Bridge Cup group B provincial preliminaries first question 2013 (Gauss Diary)

Redis delete policy

Pure QT version of Chinese chess: realize two-man, man-machine and network games

继承的构造函数

Briefly describe the implementation principle of redis cluster

Follow the mouse's angle and keyboard events

Sword finger offer 29 Print matrix clockwise

张丽俊:穿透不确定性要靠四个“不变”

Universal crud interface

[matlab] access of variables and files

Which ecology is better, such as Mi family, graffiti, hilink, zhiting, etc? Analysis of five mainstream smart brands

A copy can also produce flowers

ReferenceError: primordials is not defined错误解决

What should we pay attention to when using the built-in tool to check the health status in gbase 8C database?

CobaltStrike-4.4-K8修改版安装使用教程

RobotFramework入门(三)WebUI自动化之百度搜索