当前位置:网站首页>Another new rule for credit cards is coming!Juphoon uses technology to boost the financial industry to improve service quality and efficiency

Another new rule for credit cards is coming!Juphoon uses technology to boost the financial industry to improve service quality and efficiency

2022-07-29 23:16:00 【Juphoon】

Recently, the China Banking and Insurance Regulatory Commission and the People's Bank of China jointly issued the Notice on Further Promoting the Standardized and Healthy Development of Credit Card Business Yinbao Jiangui [2022] No. 13 (hereinafter referred to as the "Notice").The issuance of the "Notice" aims to solve the problems in the development of credit cards that the growth rate continues to decline, the quality and effectiveness of services need to be improved; the potential financial risks are on the rise, the operation and management are excessively "indicative", and there is a lack of consumer protection.

As a leading real-time audio and video technology provider in the field of financial technology, Juphoon has been deeply involved in the financial industry for many years, and continues to focus on various regulatory policies, and is committed to providing financial institutions with solutions that are more in line with their business development direction.In response to the "Notice", Juphoon is also committed to using real-time audio and video technology to empower the banking industry to improve service quality and efficiency from credit card marketing to business operations, and to satisfy users' sense of gain in consumer gold business.

Marketing

Credit Card Application-Activation

According to the "Notice", on the one hand, in order to strictly regulate the marketing behavior of card issuance, banking financial institutions are required to actively take audio and video recording or other effective measures in key links such as credit card customer identity verification and card application willingness verification to complete and objectively record andPreserve important information such as risk disclosure and information disclosure to ensure that the recorded information is comprehensive, accurate, non-tamperable and traceable, and can meet the requirements of domestic financial management departments for inspections and judicial organs for investigation and evidence collection.

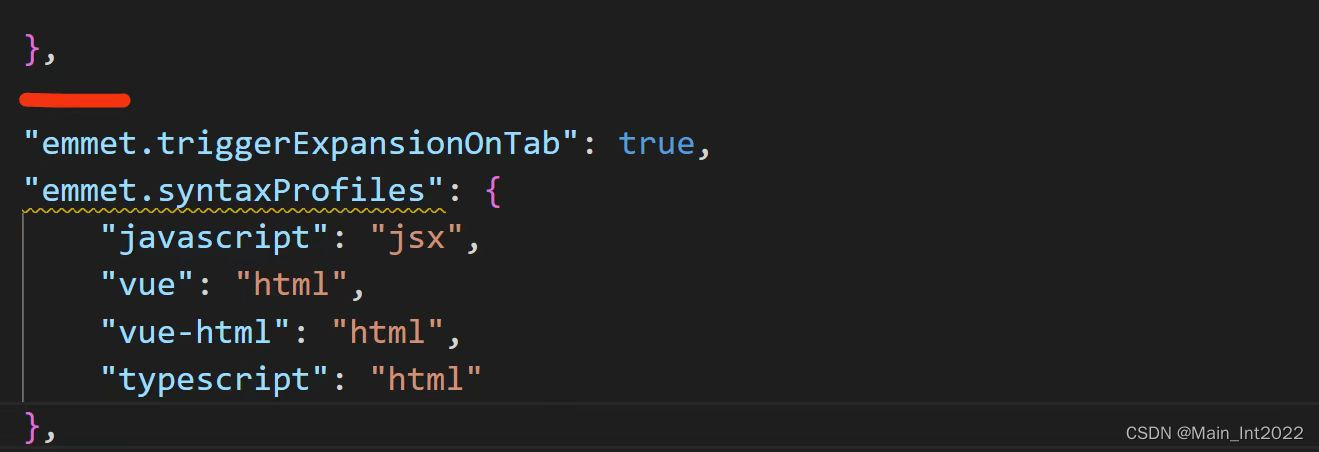

Intelligent Dual Recording Solution based on Juphoon Video Capability Platform covers offline mobile development, online self-service dual recording, remote dual recording and other scenarios, covering H5-webRTC, applet,App and other multi-channels, create an all-round customer contact model from credit card to activation, and synchronize audio and video recordings throughout the process to ensure that business can be traced back and business transactions are legal and compliant.

Take a joint-stock bank as an example, combined with Juphoon's real-time audio and video capabilities, users can directly call the bank's video customer service from the H5-WebRTC page without downloading the app or following the official account.During the activation of the credit card, the bank can directly reach the customer with only the mobile phone number, remind the user by sending a link via SMS, click to open the H5 page to connect to the video customer service, and record the credit card customer's identity verification and card application intention through the video call.Key links such as verification, etc., to complete the whole process of remote business processing of credit cards, which can not only meet the requirements of "three personal encounters" for credit cards, but also achieve the purpose of simplifying the process, improving the activation rate of credit cards, and helping the bank to greatly increase the conversion rate of credit card marketing.

Business

Credit Card Activation

On the other hand, the new credit card regulations require that the dynamic monitoring and management of sleep credit cards be strengthened, and the number of long-term sleep credit cards in the total number of cards issued by the institution shall not exceed 20% at any point in time.That is to say, banks are required not to use the number of cards issued, the number of customers, etc. as the single or main assessment indicators. A series of policies also reflect from the side that "existing customer management" is the main battlefield for financial institutions in the next stage.In the scenario of credit card promotion, Juphoon provides Internet telephony solutions for the banking industry.For example, when a bank issues a credit card installment activity, the customer service can be contacted via Internet phone on the current page of H5 or Mini Program to inquire about the activity details, optimize the customer experience with a more convenient entry and more efficient service, and increase the conversion rate of the promotion activity.This has greatly increased the use of credit cards.

In addition to the above inbound call scenarios, Juphoon provides Agent Push outbound call and VoIP solutionscan also help the party to implement outbound call scenarios.In the credit card business, the application of outbound calls also plays an important role in credit card marketing or credit card activation, making banking services more "active".Through the agent Push outbound call solution, bank customer service can actively reach out to customers directly in the form of audio or video, so that prospective users can switch to video for remote face-to-face interviews and complete credit card business processing during the call.strong>Avoid service breakpoints.In addition, the agent Push outbound call solution also supports customers to make reservations in advance, and agents can actively serve customers when they arrive at the point of call outbound.The VoIP solution can also be applied to the post-loan collection of credit cards to achieve business traces.

As far as the credit card business is concerned, in recent years, under the dual background of economic growth and strict financial supervision, the traditional corporate business of banks has faced bottlenecks. Many banks have carried out retail transformation to explore new development models.It is an important part of the retail transformation of commercial banks.Using real-time audio and video technology to improve service quality and efficiency, the banking industry has always been at the forefront of technological transformation; with the continuous encouragement of various policies, real-time audio and video have a broader space for development.The diversified solutions provided by Juphoon, such as intelligent double recording, VoIP, and outbound call by agents, will continue to help the banking industry continue to optimize credit card service functions with new technologies, new channels and new models, and continue to effectively reduce the cost of various credit card usage.Financial institutions and consumers achieve a win-win situation.

边栏推荐

猜你喜欢

随机推荐

流水线上的农民:我在工厂种蔬菜

真offer收割机 第二弹~大厂如何考察候选人?(附答案详解)

利用go通道channel实现互斥锁

JZ24 反转链表

趣味隐写术与密码术(现代密码学教程)

cached_network_image crashes with multiple images

线性表之顺序表(干货满满的分享来啦~内含顺序表全部函数代码~

Emgucv环境配置[通俗易懂]

Professor Lu Shouqun from COPU was invited to give a speech at ApacheCon Asia

【luogu P8354】多边形(容斥)(NTT优化DP)

《MySQL DBA封神打怪之路》专栏学习大纲

互联网基石:TCP/IP四层模型,由浅入深直击原理!

ah?Now the primary test recruitment requirements will be automated?

PyCharm使用教程(详细版 - 图文结合)

cv.copyMakeBorder(imwrite opencv)

我们上线了一个「开发者实验室」

A print function, very good at playing?

[leetcode] 82. Delete duplicate elements in sorted linked list II (medium)

go语言中的goroutine(协程)

MySQL Interview Questions: Detailed Explanation of User Amount Recharge Interview Questions