当前位置:网站首页>Huiyuan, 30, is going to have a new owner

Huiyuan, 30, is going to have a new owner

2022-07-05 15:02:00 【I dark horse】

source : Radar Finance App(ID:radarcj) author : Li Yihui edit : Deep sea

Silent for many years “ Juice King ” Huiyuan , Finally ushered in the dawn of turning over .

In recent days, , The first intermediate people's Court of Beijing made a ruling , Approve Beijing Huiyuan food and Beverage Co., Ltd ( Hereinafter referred to as “ Beijing Huiyuan ”) The reorganization plan . The selected investor is Shanghai Wensheng Asset Management Co., Ltd ( Hereinafter referred to as “ Wensheng assets ”), Plan to invest 16 Billion yuan became the controlling shareholder of Huiyuan .

Although Coca Cola and I wanted to 24 The amount of US $100 million holdings is far from , But Huiyuan officials still sent a thank-you letter , use “ Keep the clouds open until the moon shines ” Describe this hard won result .

according to the understanding of , Huiyuan was founded in 1992 year , Taking advantage of the east wind of reform and opening up , It soon developed into the first brand of fruit juice in China . But after the plan to commit to Coca Cola failed , Gradually go downhill , Rely on government subsidies and the sale of factories to survive .

Reorganizing fangwensheng assets is a private non-performing assets disposal company , Behind him stands Beijing trust 、 Oriental assets 、 China international capital corporation 、 CDH investment, Blackstone and other investors . In Fang Wensheng's plan , Huiyuan, which was delisted from the Hong Kong Stock Exchange last year , Will be in 3-5 During the year A Share re listing , And it is expected to realize full repayment of debts .

However , In the industry view , The adoption of the reorganization plan is only the first step . future , Whether the reorganization plan can be implemented smoothly , Can Huiyuan return “ Juice King ” Throne , There is still great uncertainty .

Huiyuan welcomes “ White Knight ”

Huiyuan juice that consumers are familiar with , Already have 30 Years of development history .

The data shows , Huiyuan juice was founded in 1992 year , Its predecessor came from a county run cannery on the verge of bankruptcy . After the founder Zhu Xinli took over , It turned losses into profits in just two years .

1996 year , Huiyuan juice is advertised on CCTV at a high price of tens of millions , rely on “ Drink Huiyuan juice , Take the road to health ” Catchy advertising words , Quickly promote sales throughout the country , The market share has ranked first in China for more than ten consecutive years .

2007 year , Huiyuan Juice successfully landed on the Hong Kong Stock Exchange , And 24 The total amount of HK $billion raised , It became the largest one of the Hong Kong Stock Exchange IPO project , The total market value also exceeds 300 Million Hong Kong dollars , The scenery is boundless .

This good time didn't last long .2008 year , Huiyuan is targeted by multinational beverage giants , Then came the turning point of my career .

That year , Coca Cola plans to buy Huiyuan juice at a high price , The purchase price is per share 12.2 The price of Hong Kong dollars , The total amount exceeds 24 Billion dollars ( About us 179.2 Million Hong Kong dollars ), Including all the issued shares of Huiyuan Juice .

Huiyuan Juice in order to cooperate with the acquisition , Do not hesitate to borrow money to expand production , At the same time, it also removed a large number of sales channels and personnel that coincided with Coca Cola , The national 21 Provincial managers in sales regions basically quit , Salesperson also from 3926 People fell to 1160 people .

But the acquisition finally failed .2009 year 3 month , The Ministry of commerce is based on 《 Antitrust 》 Stop the acquisition . The impact follows , Due to the disconnection of sales channels , Let Huiyuan Juice lose its vitality ,2009 First loss in .

Wensheng asset wrote in an article on its official website ,“ Huiyuan system ” The layout of the whole industrial chain, which has invested a huge amount of money in the above transactions, has buried hidden dangers of debt for subsequent operations . Beijing Huiyuan as “ Huiyuan system ” Core enterprise , It has undertaken more financing functions in the process of operation , Provided a huge amount of guarantee for the financing of related parties .

Although Huiyuan Juice said , In the later development, the cut channels were gradually restored . But the results show that ,2011-2017 year , Deducting government subsidies 、 financing 、 In addition to the cost of selling the plant , Huiyuan juice has been at a loss .

2018 year , Huiyuan began to suspend trading , The reason is a sum of money for the subsidiary 42.75 The loan of 100 million yuan was neither signed nor disclosed , Violated the Listing Rules of the Hong Kong Stock Exchange .

The suspension lasted as long as 3 More years , Left enough time for the Zhu Xinli family to save Huiyuan , But the effect is not obvious .

2020 year 2 month 12 Japan , Founder Zhu Xinli resigned as chairman of the board of Huiyuan Juice 、 Executive director 、 Authorized representative and chairman of the strategy and Development Committee ; Zhu Shengqin ( Zhu Xinli's daughter ) At the same time, he resigned as the executive director . Two days later , Huiyuan Juice announcement , The shares of the company are in 3 month 2 Japan 9 Officially cancel the listing status ( Delisting decision ).

2021 year 7 month 16 Japan , Upon the application of creditors , The court ruled that Beijing Huiyuan entered the reorganization procedure , As a restructuring investor, Wensheng assets combed and screened the assets and liabilities and enterprise value of Beijing Huiyuan .

The history of Beijing Huiyuan can be traced back to 1994 year , It is considered to be the starting point for Zhu Xinli to lead Huiyuan juice to impact the national market .

Tianjian accounting firm ( Special general partnership ) Issued by the 《 Special audit report on bankruptcy reorganization of Beijing Huiyuan company 》 Pointed out that , As of the benchmark date 2021 year 7 month 16 Japan , The total assets of the parent company of Beijing Huiyuan company are 10.93 One hundred million yuan , Total liabilities 124.67 One hundred million yuan , The asset liability ratio is 1140.99%, The amount of insolvency is 113.7 One hundred million yuan .

This year, 5 month 20 Japan , The second creditors' meeting of Beijing Huiyuan was successfully held , Creditors voted to approve the reorganization plan ;6 month 24 Japan , The Beijing first intermediate people's court approved the reorganization plan .

Wensheng assets said , The restructured Beijing Huiyuan will hold “ Huiyuan juice ” Core trademarks, brands and production assets , Focus on the main business , Optimize the layout , Nirvana rebirth .

however , Beijing Huiyuan is also insolvent . The data disclosed shows , The total debt scale of Beijing Huiyuan is about 80 One hundred million yuan , Under the state of bankruptcy liquidation, the repayment rate of ordinary creditor's rights is only... Under the optimistic situation 6.1%.

The plan put forward by Wensheng assets is , Employee claims and tax claims shall be fully paid off in cash at one time ; The creditor's rights secured by property shall be paid in full in the form of retention ;100 A small amount of ordinary creditor's rights less than 10000 yuan shall be paid off in a lump sum in cash , exceed 100 The ordinary creditor's rights of 10000 yuan shall be paid off in full in the form of debt to equity swap .

Wensheng assets said , Through the above payment methods , The debt repayment rate of Beijing Huiyuan is expected to be lower than that under the simulated liquidation 6.1%, Upgrade to full settlement .

Where is the way to break through ?

In addition to solving the debt problem , Wensheng assets also planned two roads for Beijing Huiyuan , Relist and import resources .

“ We will design the best securitization scheme for Huiyuan , Strive to achieve A Shares of the listed , It is expected to bring considerable returns to the convertible creditors and investors .” Wensheng assets said .

Under this goal , Wensheng assets invested as restructuring investors 16 Billion yuan became the controlling shareholder of Huiyuan , Some of the funds are used to pay Huiyuan bankruptcy expenses and repay small claims ,90% The above funds will be used to upgrade and strengthen the production and operation of Huiyuan .

actually , About listing , China's water sector that participated in the reorganization , It has been harvested 3 A harden board .

6 month 30 Sunday night , Zhongguo Water Affairs announced that it had raised the limit for two consecutive days , Focus on “ The market speculates that the company may inject Huiyuan juice through restructuring in the future ”. The company said , In the early stage, it signed with Wensheng investment on the restructuring plan of Beijing Huiyuan 《 Project cooperation agreement 》 And 《 Confidentiality agreement 》, Has been in 2022 year 4 month 22 Pay Wensheng investment performance security on the th 3 One hundred million yuan , This agreement is only the intentional investment of both parties , There is no guarantee that the company will eventually participate in this project .

Previous 5 month 17 Japan , The project cooperation agreement disclosed by China water shows , Wensheng assets is responsible for business docking , Due diligence and other asset acquisitions . If the future operation of the underlying assets meets the requirements of Party B , Zhongguo water can give priority to purchasing the equity held by Party A at the fair market value .

However , There are industry analysts think , After the continuous rise of the share price of China water , The company has lost the possibility of asset restructuring in a short time .

In addition to promoting listing , Wensheng assets said , In the future, Huiyuan will also import Industrial Synergy resources and industrial strategic resources , Consolidate enterprise production , Increase online and offline orders , Help Huiyuan tell the brand story of the new era , Expand the national market .

Xianxiaofang, executive president of Huiyuan Juice, told Beijing business daily , Huiyuan juice will focus on juice business in the future , Make efforts to build marketing channels , This is also in line with the strategy of restructuring Fang Wensheng's assets .

however , What can't be ignored , In Huiyuan fall these years , The domestic juice market has long been changing . First, the juice market shrank , Prospective industry research institute data shows ,2009 In, fruit juice beverage ranked second in the production and sales volume of the national beverage industry 、 Accounted for as 18.56%, here we are 2020 Juice has lost its top three position in 、 The market share is insufficient 15%.

secondly , A number of strong competitors have emerged in the fruit juice segment . The farmer mountain spring 、 Coca Cola 、 Uni president and Wahaha are both giant players of fruit juice drinks , It may have an impact on the market share of Huiyuan Juice .

In this case , Huiyuan may not be able to grab much market by relying on marketing alone . Baoyuezhong, a new retail expert in the FMCG industry, believes , Huiyuan has its own advantages in brand influence , But its marketing 、 Can product innovation keep up with current consumption patterns 、 The consumption environment is also crucial .

Zhu danpeng, vice president of Guangdong Food Safety Promotion Association, also said , At present, the domestic fruit juice industry and even the whole beverage industry are facing fierce competition , Pushing through the old and bringing forth the new is fast , How to rectify Huiyuan in the future , How to realize innovation and upgrading of brands and products , Need to wait and see further .

Uncover Wensheng assets of the receiving party

While the reorganization plan of Huiyuan juice is finalized , It also makes the outside world curious , What is the origin of Wensheng assets of the receiving party ?

Official website information display , Wensheng assets is a leading special opportunity investment management company in China , Now registered capital 11.42 One hundred million yuan .

2003 year , Zhouzhijie, the founder of the company, founded Zhejiang Wenhua Holding Co., Ltd , Began to get involved in the field of non-performing assets , It mainly invests in non-performing assets formed by policy stripping .

2006 year , Shanghai Wensheng Investment Management Co., Ltd. was established by Zhejiang Wenhua Holding Co., Ltd. and Zhuhai Qiaobo Investment Consulting Co., Ltd , After the share reform, it became Shanghai Wensheng Asset Management Co., Ltd .

at present , Wensheng asset business covers non-performing asset investment and services 、 Restructuring of troubled enterprises 、 Troubled real estate restructuring and default bond investment . By 2021 end of the year , Accumulated asset management scale ( Principal and interest of creditor's rights )1232 Billion .

Before entering the non-performing asset industry , There are few traces of Zhou Zhijie's past on the Internet , In public reports, he worked in auction houses .

however , Charlotte bell, which has been delisted, disclosed in an announcement ,1972 Zhou Zhijie, born in , Have a bachelor's degree , Chinese nationality , No right of permanent residence abroad .

1994 - 1998 year , Zhouzhijie works in the Shanghai Border Defense Corps ,1998 - 2001 Worked in Zhejiang World Trade auction house ,2001 - 2003 Chairman of Zhejiang Jiyang Auction Co., Ltd .

After entering the non-performing assets industry , Wensheng assets has provided investigation and evaluation from the beginning 、 Of consulting services “ Service provider ”, Become a non-performing asset manager , In recent years, they have appeared frequently A Share acquisition .

Include 2018 In, he and Nantong tycoon songxiaozhong initiated the acquisition of the controlling interest in Oriental Network .2020 From the year onwards , Wensheng assets successively took over the equity of a subsidiary of Pengxin resources 、 Jointly set up a partnership .

“ Pengxin system ” It was founded by Jiang Zhaobai, a businessman from Jiangsu Province , It owns Pengdu agriculture and animal husbandry 、 Pengxin resources 、 Junior high school water affairs 、 Runzhong International Holdings 4 Listed companies .

2020 year 12 month , Wensheng assets was hired as “ The first share of Internet jewelry ” Financial advisor of Gangtai holdings .

2021 year 3 End of month , Some shares of La Chapelle held by Xing Jiaxing, the founder of La Chapelle, were auctioned , Shanghai Wensheng assets and Shanghai Qijin, the person acting in concert, took over the offer , The latter became the largest shareholder of La Chapelle , The total shareholding ratio is close to 20%.

At that time, investors speculated , New shareholders may be interested in La Chapelle's shell resources . But this year 5 month 24 Japan , La Chapelle delisted from the Shanghai Stock Exchange .

besides , Sank into a thunderstorm, Sansheng Hongye and Oceanwide holdings , It was reported that some assets were transferred to Wensheng assets .

It is worth mentioning that , Wensheng assets also sought independent listing . The company 2017 In, I applied for listing on the new third board , But in the end, it didn't happen .

The announcement at that time showed that , Wensheng assets 2015 year 、2016 The annual operating revenues are respectively 9836.32 Ten thousand yuan 、9225.34 Ten thousand yuan ; Net profit is 9424.91 Ten thousand yuan 、1.60 One hundred million yuan .

Besides , Wensheng asset has a luxurious circle of friends . Official website display ,2021 year 7 In June, it conducted strategic cooperation with Warburg Pincus, an American private equity investment institution , Initiate the establishment of Wensheng special fund . Wenshengte plans to invest a total of 6 Billion dollars , expect 5 The scale of asset management will reach 50 Billion dollars .

6 month 29 Japan , Wensheng assets officially announced the completion of the third round of financing , blackstone group 、 Guotong Investment Co., Ltd 、 GF Securities on 2021 year 10 In June, it made equity investment in its third round of financing , And in 2022 year 6 Complete the investment in January .

Sky eye examination shows , At present, among the shareholders of Wensheng assets , And Beijing trust 、 Oriental Asset Management 、 Hangzhou industrial and Commercial Trust 、 China international capital corporation 、 CDH investment and other financial institutions .

边栏推荐

- Photoshop插件-动作相关概念-ActionList-ActionDescriptor-ActionList-动作执行加载调用删除-PS插件开发

- Implement a blog system -- using template engine technology

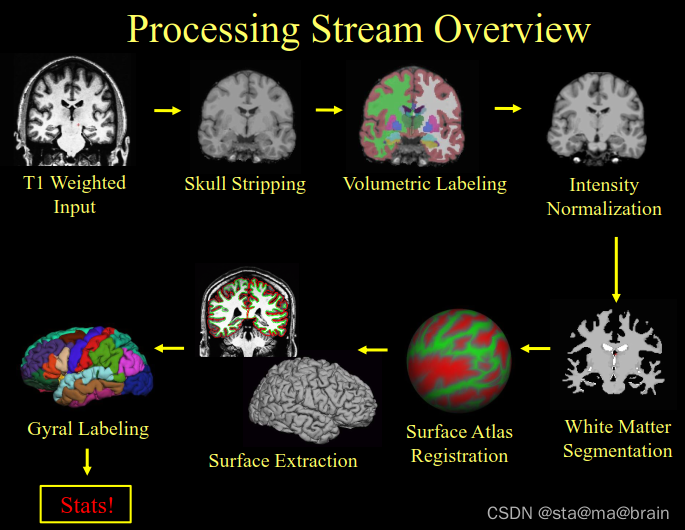

- How can I quickly check whether there is an error after FreeSurfer runs Recon all—— Core command tail redirection

- How to paste the contents copied by the computer into mobaxterm? How to copy and paste

- How to solve the problem of garbled code when installing dependency through NPM or yarn

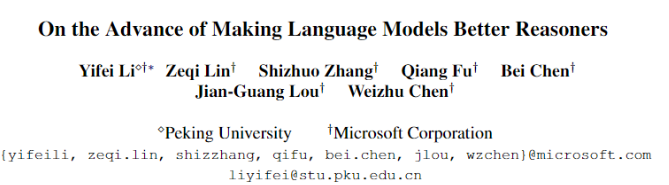

- Au - delà du PARM! La maîtrise de l'Université de Pékin propose diverse pour actualiser complètement le classement du raisonnement du NLP

- 【NVMe2.0b 14-9】NVMe SR-IOV

- Magic methods and usage in PHP (PHP interview theory questions)

- FR练习题目---简单题

- CODING DevSecOps 助力金融企业跑出数字加速度

猜你喜欢

How can I quickly check whether there is an error after FreeSurfer runs Recon all—— Core command tail redirection

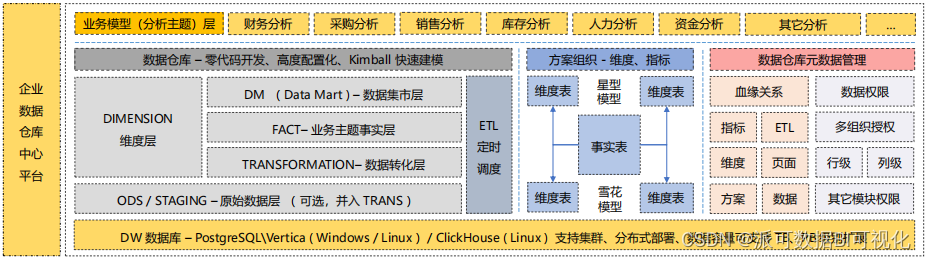

Two Bi development, more than 3000 reports? How to do it?

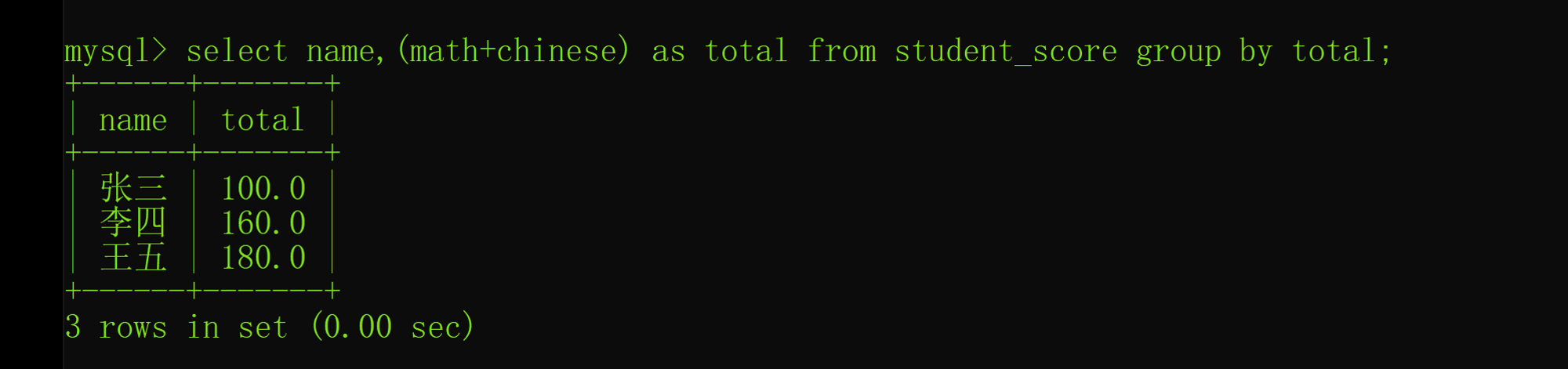

Interview shock 62: what are the precautions for group by?

超越PaLM!北大碩士提出DiVeRSe,全面刷新NLP推理排行榜

![P6183 [USACO10MAR] The Rock Game S](/img/f4/d8c8763c27385d759d117b515fbf0f.png)

P6183 [USACO10MAR] The Rock Game S

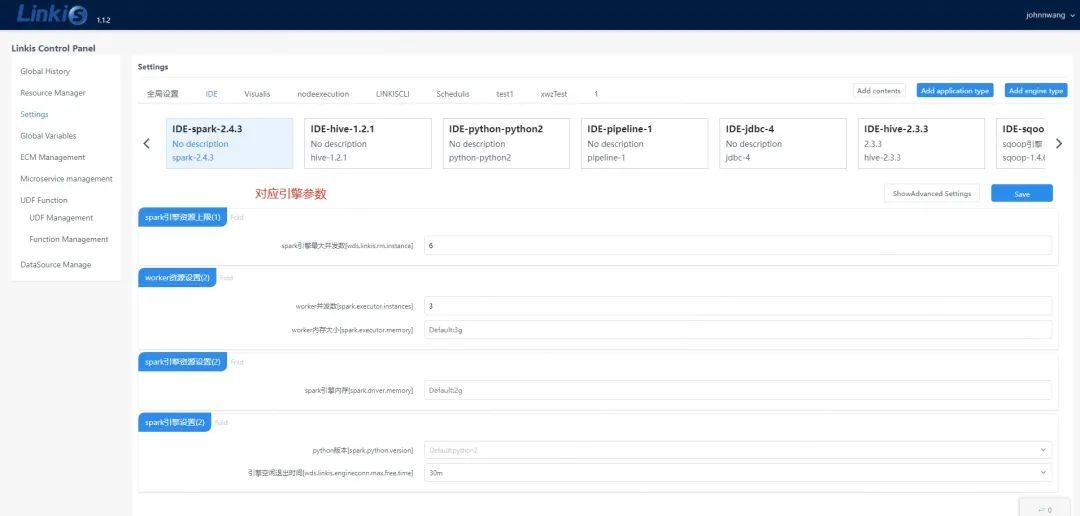

Interpretation of Apache linkage parameters in computing middleware

qt creater断点调试程序详解

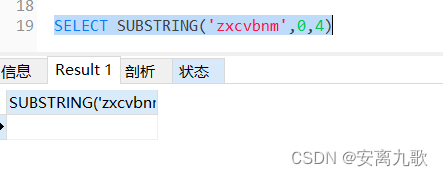

MySQL----函数

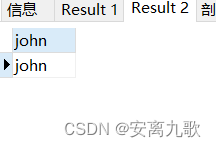

MySQL之CRUD

Mongdb learning notes

随机推荐

webRTC SDP mslabel lable

Fr exercise topic - simple question

Long list optimized virtual scrolling

Easyocr character recognition

亿咖通科技通过ISO27001与ISO21434安全管理体系认证

CPU设计相关笔记

启牛证券账户怎么开通,开户安全吗?

Two Bi development, more than 3000 reports? How to do it?

Talking about how dataset and dataloader call when loading data__ getitem__ () function

leetcode:881. lifeboat

B站做短视频,学抖音死,学YouTube生?

Mysql---- function

机器学习笔记 - 灰狼优化

Brief introduction of machine learning framework

Coding devsecops helps financial enterprises run out of digital acceleration

MySQL之CRUD

[recruitment position] infrastructure software developer

Is it OK to open the securities account on the excavation finance? Is it safe?

TS所有dom元素的类型声明

Coding devsecops helps financial enterprises run out of digital acceleration

Anonymous users

Anonymous users