当前位置:网站首页>Zhishang technology IPO meeting: annual revenue of 600million, book value of accounts receivable of 270Million

Zhishang technology IPO meeting: annual revenue of 600million, book value of accounts receivable of 270Million

2022-07-27 13:58:00 【leijianping_ ce】

RedI network Lei Jianping 7 month 25 Reported Wednesday

Shenzhen Zhishang Technology Co., Ltd ( abbreviation :“ Zhishang Technology ”) Recently, on the Shenzhen Stock Exchange gem IPO Past meeting . Zhishang technology plan fundraising 13 One hundred million yuan .

among ,4 Billion yuan is used for the expansion project of core parts of game consoles ,2.55 Billion yuan for the expansion project of electronic connectors ,2.17 Hundred million yuan is used for 5G Parts expansion project ,1.59 100 million yuan for R & D center construction projects ,2.7 Billion yuan is used to supplement working capital projects .

Annual revenue 6.15 Billion

The end customers of Zhishang technology are mainly well-known Japanese enterprises N company 、 SONY 、Facebook And so on , Direct customers are mainly Foxconn 、 Goethe Co., Ltd. and other manufacturing service enterprises , The precision parts produced by the company are integrated with other functional parts such as Foxconn and goer to form complete machine products , And finally supply end customers with supporting equipment .

The prospectus shows , Zhishang Technology 2019 year 、2020 year 、2021 The annual revenue is 4.62 One hundred million yuan 、5 One hundred million yuan 、6.15 One hundred million yuan ; The net profit is respectively 3550.28 Ten thousand yuan 、6552.44 Ten thousand yuan 、9184.92 Ten thousand yuan ; The net profit after deducting non profits is 3405.3 Ten thousand yuan 、6046.93 Ten thousand yuan 、7671.92 Ten thousand yuan .

During the reporting period , The proportion of the total sales of the company's top five customers in the operating revenue is 82%、78.38% and 82.48%, Among them, the proportion of Foxconn's sales revenue to its operating revenue is 42.18%、67.52% and 64.40%.

During the reporting period , The proportion of the total sales of the company's top five customers in the operating revenue is 82%、78.38% and 82.48%, Among them, the proportion of Foxconn's sales revenue to its operating revenue is 42.18%、67.52% and 64.40%.

At the end of each reporting period , The book value of the company's accounts receivable is 1.26 One hundred million yuan 、1.64 Million dollars 2.7 One hundred million yuan , The proportion of current assets is respectively 50.46%、32.65% and 45.06%.

Zhishang Technology 2022 year 1-3 Monthly revenue is 1.13 One hundred million yuan , That's up from a year ago 29.75%, Realize the net profit attributable to the shareholders of the parent company 2158.06 Ten thousand yuan , That's up from a year ago 546.79%.

Zhishang Technology 2022 year 1-3 In June, we continued to focus on game console components with high gross profit margin , The proportion of revenue from game console parts with strong profitability increased to 71.26%, The gross profit margin of the main business in this period increased to 36.41%.

Chenchaoxian control 34.83% equity

IPO front , The controlling shareholder of Zhishang Technology 、 The actual controller is Chen Chaoxian , It directly owns the company 31.92% equity , Indirectly hold the company through xinzhishang 2.91% equity , Hold together 34.83% equity .

Chen Chaoxian ,1979 year 10 born ,2002 year 8 Month to 2007 year 4 In June, he worked in Hongfujin precision industry, a subsidiary of Foxconn Group ( Shenzhen ) Co., LTD. , Engaged in planning ;2008 year 2 In June, he started a business with others to establish Shenzhen hongfuhan Technology Co., Ltd , Successive executive directors 、 The general manager ,2010 year 7 Withdraw from operation after transferring equity in January ;2009 year 12 Month co founded Zhishang technology with others , The current chairman and general manager of the company .

Shenzhen xinzhishang investment enterprise ( Limited partnership ) The shareholding is 11.14%, Liu Dongsheng holds 8.13%, Ji Leyu 、 Ji leqiang 、 Ji Lexian holds shares of 7.16%, Shenzhen Yuanfang enterprise management partnership ( Limited partnership ) The shareholding is 4.46%, Chen Hexian holds 3.51%;

Juying Xianning equity investment fund partnership ( Limited partnership ) The shareholding is 3.01%, Li Yongliang holds 2.77%, Ji Xianhui holds 2.39%;

Shenzhen Meiling Jushi investment enterprise ( Limited partnership ) The shareholding is 1.81%, Shenzhen Zhisheng enterprise management partnership ( Limited partnership ) The shareholding is 1.69%, Shenzhen xingzhishang investment enterprise ( Limited partnership )、 Shenzhen xingchunsheng investment enterprise ( Limited partnership ) Their respective shareholdings are 1.66%, Shenzhen Zhilian innovation enterprise management partnership ( Limited partnership ) The shareholding is 1.2%, Chongqing shengyiou Technology Co., Ltd. holds 1%.

IPO after , Chen Chaoxian holds 23.94%, Shenzhen xinzhishang investment enterprise ( Limited partnership ) The shareholding is 8.36%, Liu Dongsheng holds 6.1%, Ji Leyu 、 Ji leqiang 、 Ji Lexian holds shares of 5.37%, Shenzhen Yuanfang enterprise management partnership ( Limited partnership ) The shareholding is 3.34%;

Chen Hexian holds 2.63%, Juying Xianning equity investment fund partnership ( Limited partnership ) The shareholding is 2.26%, Li Yongliang holds 2.08%, Ji Xianhui holds 1.79%;

Shenzhen Meiling Jushi investment enterprise ( Limited partnership ) The shareholding is 1.62%, Shenzhen Zhisheng enterprise management partnership ( Limited partnership ) The shareholding is 1.36%, Shenzhen Zhisheng enterprise management partnership ( Limited partnership ) The shareholding is 1.27%, Shenzhen xingzhishang investment enterprise ( Limited partnership );

Shenzhen xingchunsheng investment enterprise ( Limited partnership ) Share holding 1.24%, Shenzhen Zhilian innovation enterprise management partnership ( Limited partnership ) holding 0.9%, Chongqing shengyiou Technology Co., Ltd. holds 0.75%.

———————————————

Lei Di was founded by Lei Jianping, a senior media person , If reproduced, please indicate the source .

边栏推荐

- Meshlab farthest point sampling (FPS)

- Wechat campus laundry applet graduation design finished product (5) assignment

- Charles tutorial

- What are the benefits of taking NPDP

- 2022ACM夏季集训周报(四)

- 西测测试深交所上市:年营收2.4亿募资9亿 市值47亿

- Redis implements the browsing history module

- Software system architecture designer concise tutorial | software system modeling

- Leetcode error reporting and its solution

- 在灯塔工厂点亮5G,宁德时代抢先探路中国智造

猜你喜欢

Fifth, download the PC terminal of personality and solve the problem of being unable to open it

纯c手写线程池

MySQL startup options and configuration files

redis集群搭建-使用docker快速搭建一个测试redis集群

特征工程中的缩放和编码的方法总结

Product manager experience 100 (XI) - Strategic Product Manager: model and methodology

Summary of scaling and coding methods in Feature Engineering

小程序毕设作品之微信校园洗衣小程序毕业设计成品(2)小程序功能

使用RecyclerView,实现列表左滑菜单

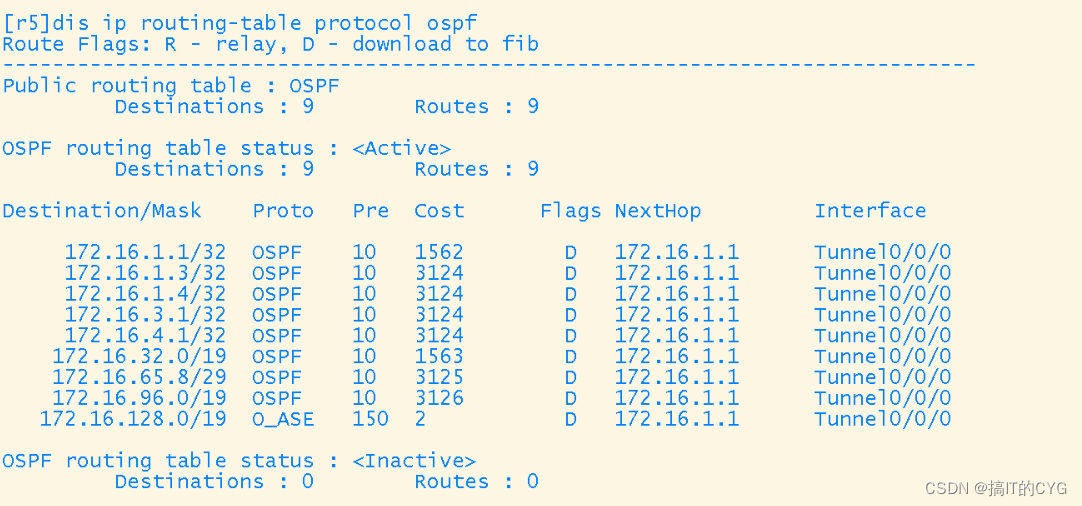

Hcip - OSPF comprehensive experiment

随机推荐

[introduction to C language] zzulioj 1021-1025

小程序毕设作品之微信校园洗衣小程序毕业设计成品(8)毕业设计论文模板

使用RecyclerView,实现列表左滑菜单

redis集群搭建-使用docker快速搭建一个测试redis集群

Cesium region clipping, local rendering

致尚科技IPO过会:年营收6亿 应收账款账面价值2.7亿

SQL教程之 SQL 聚合函数入门教程

Redis cluster setup - use docker to quickly build a test redis cluster

Add index to the field of existing data (Damon database version)

期货开户的条件和流程

2. Citrix virtual apps and desktops 2203 clipboard redirection policy

Hcip - OSPF comprehensive experiment

new的多种使用方法

A Keypoint-based Global Association Network for Lane Detection

GoPro接入 - 根据GoPro官方文档/Demo,实现对GoPro的控制和预览

The universe has no end. Can utonmos shine the meta universe into reality?

【LeetCode】592. 分数加减运算

2022acm summer training weekly report (IV)

[C Advanced] pointer array vs array pointer

Download address of each version of libtorch