当前位置:网站首页>1.4.2 Capital Market Theroy

1.4.2 Capital Market Theroy

2022-06-13 04:00:00 【Python's path to becoming a God】

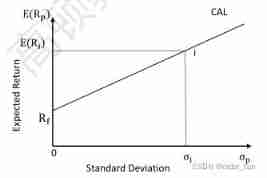

1. Capital Allocation Line(CAL)

Functions of CAL

The portfolios available to an investor through combining the risk-free asset with one risky asset.

R

p

=

w

i

R

i

+

w

r

f

R

r

f

R_p=w_iR_i+w_{rf}R_{rf}

Rp=wiRi+wrfRrf

σ

p

=

w

i

σ

i

\sigma_p = w_i\sigma_i

σp=wiσi

E

(

R

p

)

=

R

f

+

E

(

R

i

)

−

R

f

σ

i

∗

σ

p

E(R_p) = R_f+\frac{E(R_i)-R_f}{\sigma_i}*\sigma_p

E(Rp)=Rf+σiE(Ri)−Rf∗σp

Selection among CALs

The CAL with highest Sharpe ratio should be selected, it provides the highest utility among all CALs.

The optimal CAL is tangent to efficient frontier of risky assets.

Optimal portfolio along CAL

Investor should choose portfolio “m” to invest as it supplies

the most stratification(utility).

More risk-averse investor (A=4) will select portfolio “j” (less in risky asset), and less risk-averse investor (A=2) will select portfolio “k” (more in risky asset).

CAL ( C ) should be select because it provides the highest utility among these three CALs.

The Sharpe ratio of CAL ( C ) is the highest.

Optimal risky portfolio & Optimal investor portfolio.

The optimal investor portfolio is combined with the optimal risky portfolio and the risk-free asset.

2. Capital Market Line (CML)

- Assuming all investors have a homogeneous expectation.

- All investors have identical efficient frontier of risky portfolio and identical optimal risky portfilio, which is the market portfolio.

- Capital market line(CML) is a special CAL that includes all possible combinations of risk-free asset and market portfolio.

CML is tangent to the efficient frontier at a point representing market portfolio.

The equation of the CML is:

E

(

R

p

)

=

R

f

+

E

(

R

M

)

−

R

f

σ

M

∗

σ

p

E(R_p)=R_f+\frac{E(R_M)-R_f}{\sigma_M}*\sigma_p

E(Rp)=Rf+σME(RM)−Rf∗σp

- The intercept is risk-free rate.

- The slope is Sharpe Ratio of market portfolio.

S

R

m

a

r

k

e

t

−

p

o

r

t

f

o

l

i

o

=

E

(

R

M

)

−

R

f

σ

M

SR_{market -portfolio}=\frac{E(R_M)-R_f}{\sigma_M}

SRmarket−portfolio=σME(RM)−Rf

- CML is essentially the efficient frontier for all assets under the assumption that all investors have a homogeneous expectation.

Market portfolio assumes that the market achieves equilibrium and accordingly includes all of the risky assets in the economy weighted by their relative market values.

In practice, stock market indices are used to represent the market portfolio.

E.g., For the United Stated, S&P index or the wider-based Russell 2000.

E.g., For the U.K and European markets, FTSE 100 and the Euro Stoxx 50.

边栏推荐

- USB-IF BC1.2充电协议解读

- 5G China unicom AP:B SMS ASCII 转码要求

- 不卷了!团队又一位成员离职了。。

- Goframe day 4

- Real time requirements for 5g China Unicom repeater network management protocol

- Line height equals height why not center

- On the value of line height

- Single chip microcomputer: main index of a/d (analog-to-digital conversion)

- Student management system

- Precautions for stream flow

猜你喜欢

![[test development] automated test selenium (II) -- common APIs for webdriver](/img/d5/bc38f0bee98b137abc1197c6e03158.png)

[test development] automated test selenium (II) -- common APIs for webdriver

微信扫描二维码无法下载文件的解决办法

LVS four layer load balancing cluster (4) main methods of load balancing

Lightweight digital mall system based on PHP

2022春学期总结

环评图件制作-数据处理+图件制作

Difference between OKR and KPI

Promise combined with await

Et framework -22 creating serverinfo entities and events

单片机:NEC 协议红外遥控器

随机推荐

[test development] basic concepts related to testing

Difference between OKR and KPI

Sword finger offer II 022 Entry node of a link in a linked list

学生管理系统

单片机:Modbus 通信协议介绍

Lambda end operation find and match findfirst

单片机外设介绍:温度传感器 DS18B20

【测试开发】自动化测试selenium(二)——webdriver常用的API

大五人格学习记录

Jumpserver: user - system privileged user - Asset - authorization

四旋翼飞行器避障系统基础

Single chip microcomputer: infrared remote control communication principle

EGO planner论文翻译

Lambda termination operation find and match anymatch

GoFrame第五天

缓存读写--写

Unity shader learning 004 shader debugging platform difference third-party debugging tools

MCU: EEPROM multi byte read / write operation sequence

Principle, composition and functions of sensors of Dajiang UAV flight control system

How to use debounce in lodash to realize anti shake