当前位置:网站首页>Some impressions of the 519 plummet 2021-05-21

Some impressions of the 519 plummet 2021-05-21

2022-08-02 14:01:00 【Make friends with time BTC】

The slump on May 19 was undoubtedly the focus of many media attention in the past two days.Many media, including many of our readers, have talked about the reasons for the slump. One of them is that the slump may be caused by the expectation of the Federal Reserve to raise interest rates ahead of schedule.

The expectation that the Fed will raise interest rates ahead of schedule comes from the recently released minutes of a Fed meeting.In this minutes, Fed officials mentioned that it will be necessary to discuss raising interest rates at some point in the future. After the minutes were made public, U.S. stocks and commodities fell sharply, and we ushered in more than 40% of May 19th.'s plunge.

If the Fed really raises interest rates, then all dollar-linked investment markets (including digital currencies) in the world have a very high possibility of ushering inA correction or even a bear market, but the key point here is when will the Fed raise rates?

According to public information, the Fed now has two reference criteria for deciding whether to raise interest rates: one is to see whether inflation has exceeded 2% for a period of time; twoIt is to see whether the unemployment rate in the United States is under control (that is, whether the economy is improving).

Only when these two criteria are met, the Fed has a high possibility of raising interest rates.

And according to the current data, although there are signs of rising inflation, the unemployment rate has not improved much, so I still think that even if the interest rate is raised, it won't come so fast.

Take a step back and say that if the Fed does raise interest rates unexpectedly for various reasons, it will take some time for the effect of interest rate hikes to be transmitted to the investment market..

So comprehensively, regardless of whether the Fed raises interest rates this year or not, I think there is a high possibility that the liquidity in the market before the end of this year will not be relatively stable.The big change is that the market is still well-funded.

Under such circumstances, abundant funds will definitely not lie in banks with close to 0 interest rate, but will definitely look for investment targets everywhere.The market-visible investment targets are still only: stock markets, commodities, precious metals and digital currencies.And these markets are not cheap right now.Even if money briefly exits a market, where does it go?I reckon it will come back to the market eventually.

This is my basic idea of judging the trend of the entire market.

Of course, the trend of the market is definitely not 100% predictable, so in the process of moving forward, we still have to keep an eye on variousChanges in factors, adjust your strategy at any time according to the situation.

But so far, I think our strategy remains the same.Because the fundamental factors have not changed so far, we still have to try our best to look at the volatility of the market, including this crash.

In the message, a reader said that based on his years of experience and experience in the financial market, he has an intuition that the bull market is not over.I also have this kind of intuition, so when we encounter a sudden situation like 519, we should calmly analyze various objective factors, and then ask our intuition. If the basic judgments from the two perspectives are consistent, then there is no need to be too nervous..

This intuition of financial markets is not some mysterious inspiration, but accumulated over the course of the market.After a long time, I have experienced many accidents, and learned a lot of lessons. Slowly, painful memories will arise in my mind, and the torture and destruction I have experienced can be endured again.

I read Bao Erye's thoughts on the 519 crash today, and talked about the five bulls and bears he experienced and the moments of despair.He is glad that he gritted his teeth and survived those moments when life was better than death, and he was grateful that it was because of those hardships that he had today's wealth.

I think this should be the hardship that every digital currency investor must go through before harvesting wealth.

This is not our end, the second half of the situation is still ahead of us.

边栏推荐

猜你喜欢

矩阵中的路径

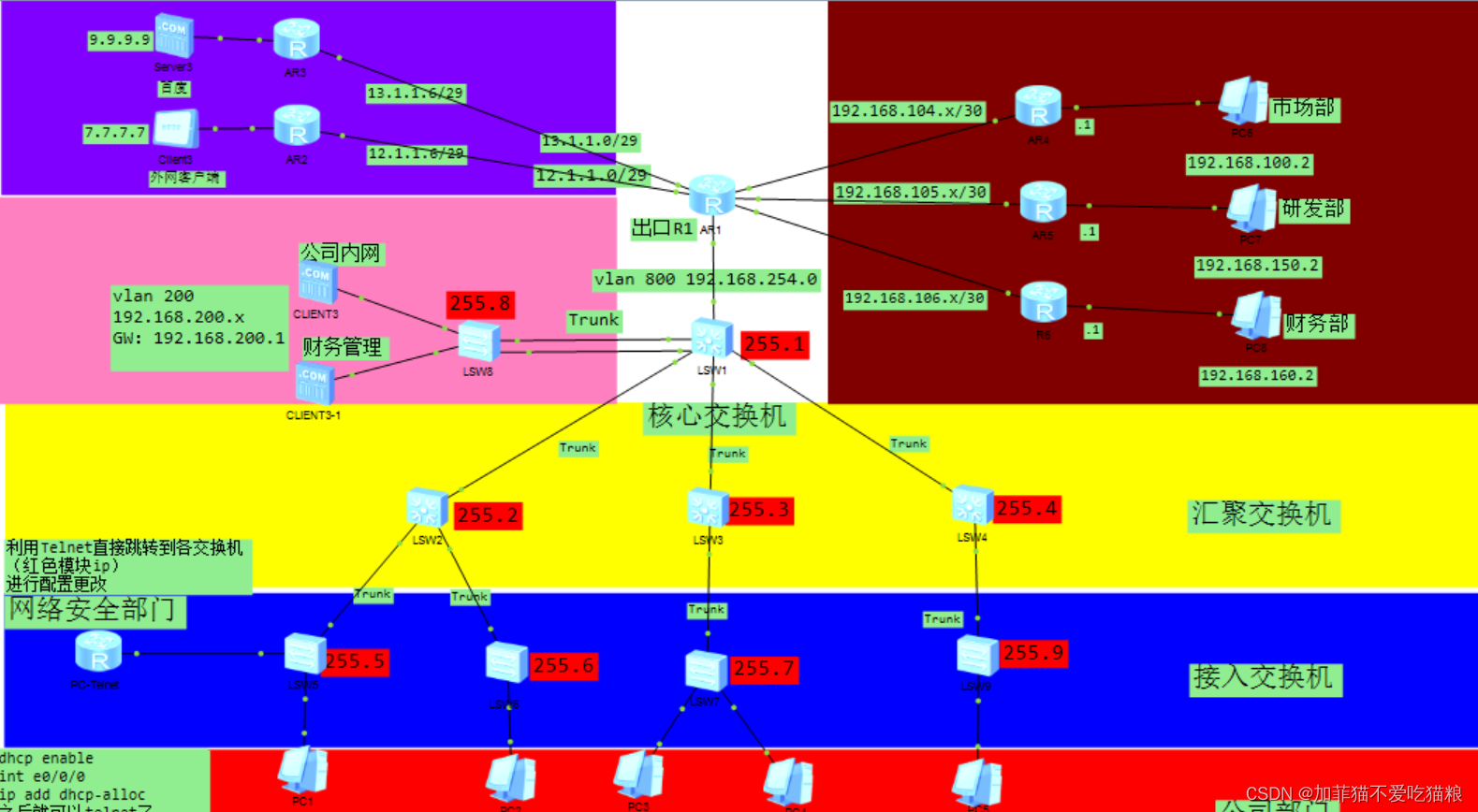

Enterprise Network Planning Based on Huawei eNSP

供应磷脂-聚乙二醇-羧基,DSPE-PEG-COOH,DSPE-PEG-Acid,MW:5000

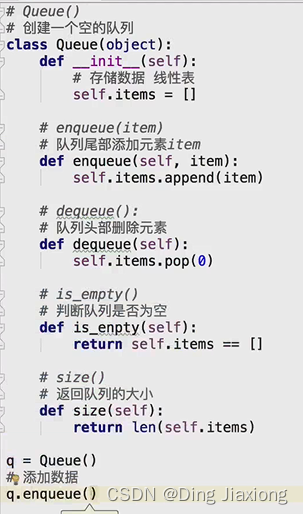

栈 && 队列

专访|带着问题去学习,Apache DolphinScheduler 王福政

攻防世界----unfinish

此次519暴跌的几点感触 2021-05-21

智能指针-使用、避坑和实现

How to create short images and short videos from the media?How to make the click volume reach 10W?

你接受不了60%的暴跌,就没有资格获得6000%的涨幅 2021-05-27

随机推荐

Diodes and their applications

目标检测场景SSD-Mobilenetv1-FPN

好用的php空间,推荐国内三个优质的免费PHP空间[通俗易懂]

【C语言】手撕循环结构 —— for语句

OpenMMLab简介

网络安全第二次作业

MySQL - ERROR 1045 (28000): Access denied for user ‘root’@‘localhost’ (using password: YES)

【ONE·Data || Getting Started with Sorting】

[C language] Analysis of function recursion (2)

WiFi Association&Omnipeek抓包分析

如何解决mysql服务无法启动1069

多个驻外使领馆发提醒 事关赴华出行、人身财产安全

static修饰的函数有什么特点(static可以修饰所有的变量吗)

Embedded system driver primary [2] - based on character device driver _ basic framework

Summer training camp-week2 graph theory

GTK:Gdk-CRITICAL **: IA__gdk_draw_pixbuf: assertion ‘GDK_IS_DRAWABLE (drawable)‘ failed

Mysql 基本操作指南之mysql查询语句

关于C#使用DateTime数据的细节

CVE-2020-27986(Sonarqube敏感信息泄漏) 漏洞修复

矩阵中的路径