当前位置:网站首页>How to choose coins and determine the corresponding strategy research

How to choose coins and determine the corresponding strategy research

2022-08-05 10:18:00 【squirrel quant】

Research on Duck Duck 02丨Preliminary Exploration on Selection of Breeds and Determining Corresponding Strategies

After the recent establishment of the Duck Duck community, many small partners privately messaged me and asked a lot of questions about strategies and combinations, as well as MC backtesting and real platform settings.I screened some valuable topics for preliminary research.In the first article, we shared our research and analysis on the Fed rate cut and the event-driven strategy of the BTC price cycle.Today, let's take a look at the problem of selecting varieties and corresponding strategies

In the domestic futures market, the black line is the source of profit for many CTA quantifications. One of the most important things is that this sector is both rising and falling, and the correlation is extremely high.The strategy developed in this sector also has a high degree of universality.The reason is that mathematically, the price trend is highly correlated, and basically it is the same industry chain.

From the background of the above viewpoints, today we will study the correlation of each currency to determine the corresponding strategy type.Without further ado, let's start~

The preparation process is as follows:

1. Data and processing data

2. Correlation matrix diagram

3. Further testing of high frequency cycle

4. CTA strategy backtest verification

Data and processing data

We read in the daily data of each currency. Of course, you can also write this piece into the for loop of os.walk to read it. Here is the method of reading one by one and then merging, as shown in the following figure:

Afterwards, we use the above method to process and merge BTC, BNB, ETH, ETC, EOS, XRP, BCH, LTC, BNB, DOGE and other currencies.It should be noted here that the On in the merge parameter I used is based on candle_begin_time, so it will start with the shortest time according to the currency.

Correlation Matrix

I resampled and merged the following currency data, and then visualized the data as a correlation matrix heatmap, as shown in the following figure:

Because some currencies, such as: OP, FIL, SOL, etc., are too short, I will not take screenshots here.Through correlation visualization, we can see that most of the varieties (both mainstream and non-mainstream) are highly correlated, except for EOS.

Let's make a small inference first:

1. Through the daily correlation matrix, we can see the correlation between EOS and various mainstream currencies, and the overall performance is low in correlation.The average correlation of other varieties is the lowest at 0.77+.

2. We can initially infer from the correlation:

(1) EOS is not suitable for the strategy types of most mainstream coins (you can try it if you don’t believe it, and you don’t have to go to great lengths to write strategy backtests)

(2) EOS has the effect of hedging portfolio

(3) Other similar varieties and logic can also be tentatively inferred

3. You can change the N-hour period, repeat the above data result changes, and strengthen the daily data conclusion.

4. The above calculation can be performed on all tradable varieties in the market, which is similar to the combination and selection of varieties.

As there are more and more varieties mentioned above, we simplify the variety correlation matrix and obtain the average correlation between each variety and other varieties.As shown below:

We get the corresponding average correlation, although this method is not rigorous, but it can be regarded as an efficient estimation mode.

High frequency cycle further test

First, merge the data, as shown in the following figure:

In the second step, we visualize the correlation coefficient matrix of the 1-hour high-frequency period, as shown in the following figure:

It can be seen from the qualitative graph that EOS is still a currency with low overall correlation.Second, we found that BCH is much less correlated with BTC and ETH.From the daily line of 0.71, 0.6 to the hour line of 0.65, 0.57.

Let's take a look at the simplification of the variety correlation matrix, and find the average correlation between each variety and other varieties.As shown below:

From the point of view of the hourly period, the corresponding average correlation is obtained, which coincides with the result of the daily line, that is to say, whether it is an hourly or a daily line, their average correlation is the same.

Summary:

1. Any variety with a correlation above 0.7 has a high probability and is more suitable for a universal CTA strategy to a certain extent.It's just the quality of the details and stages, and the general trend is the same.

2. Don't waste your time. I have passed the test of KD00 and KD01 strategies and found that it is consistent with the appeal result. Only EOS is a loss, and the others are profitable.

3. This method can be extended to all small currencies, so that you can directly know which varieties are compatible with the inventory strategy.For direct and targeted backtesting and parameter adjustment, you can load the actual strategy.

4. Predictability, correlation is not causality, and it cannot be concluded that a certain coin will rise or fall, which will cause which coin to rise or fall.However, with the difference in the duration of the currency, through the correlation data, we can predict the volatility and trend of the short-listed and highly correlated varieties with a certain probability.Because the correlation is there, this high correlation naturally also has a certain correlation in the distribution characteristics, which is natural.(everyone knows it)

边栏推荐

- uniapp connect ibeacon

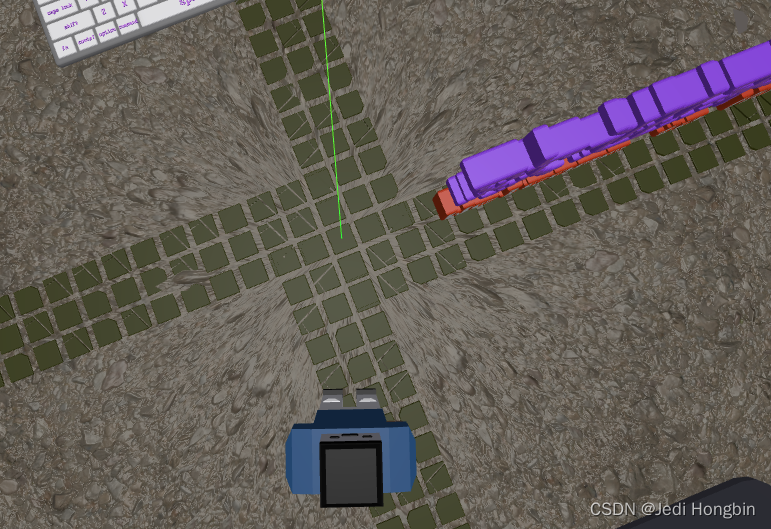

- three物体围绕一周呈球形排列

- 登录功能和退出功能(瑞吉外卖)

- 华为轻量级神经网络架构GhostNet再升级,GPU上大显身手的G-GhostNet(IJCV22)

- 告白数字化转型时代:麦聪软件以最简单的方式让企业把数据用起来

- Analysis and practice of antjian webshell dynamic encrypted connection

- 仿SBUS与串口数据固定转换

- 2022 Huashu Cup Mathematical Modeling Question A Optimization Design Ideas for Ring Oscillators Code Sharing

- The query that the user's test score is greater than the average score of a single subject

- 上位机开发C#语言:模拟STC串口助手接收单片机发送数据

猜你喜欢

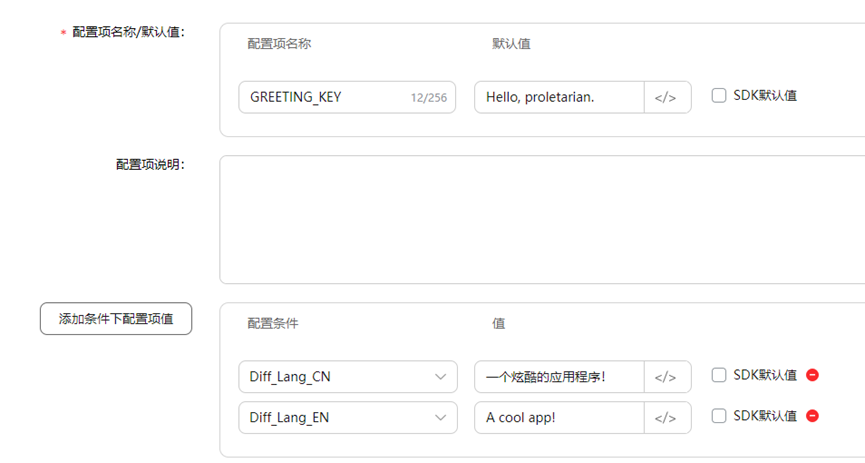

【AGC】增长服务1-远程配置示例

three物体围绕一周呈球形排列

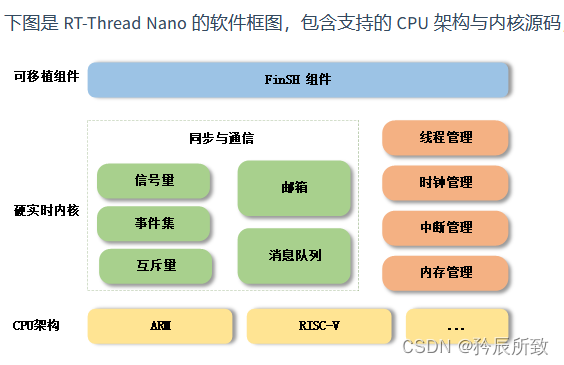

RT-Thread记录(一、RT-Thread 版本、RT-Thread Studio开发环境 及 配合CubeMX开发快速上手)

一文道清什么是SPL

The century-old Nordic luxury home appliance brand ASKO smart wine cabinet in the three-temperature area presents the Chinese Valentine’s Day, and tastes the love of the delicacy

入门 Polkadot 平行链开发,看这一篇就够了

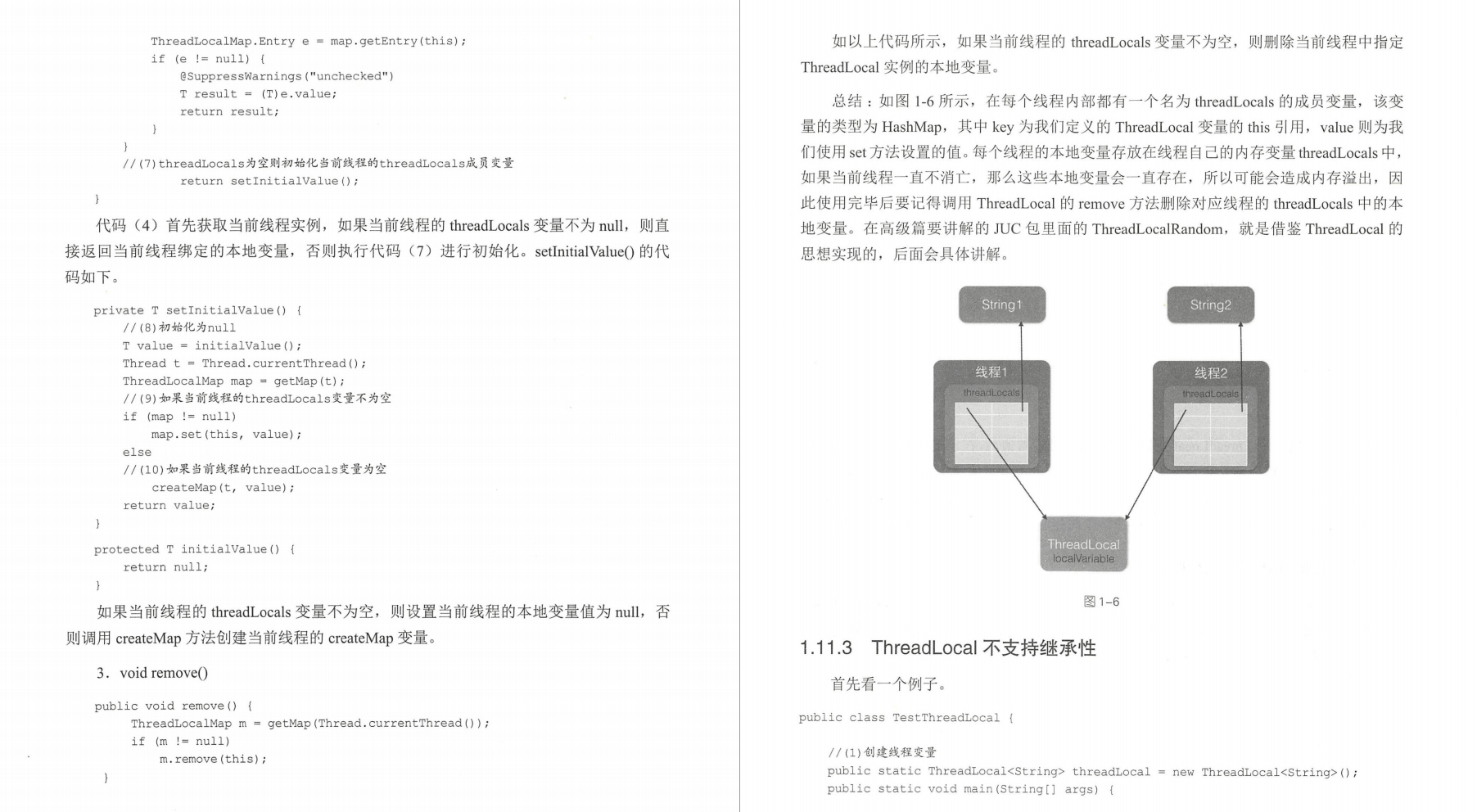

这份阿里强推的并发编程知识点笔记,将是你拿大厂offer的突破口

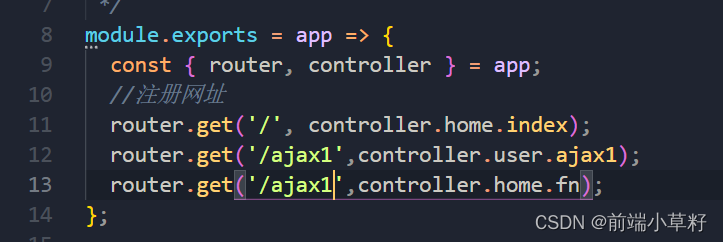

Egg framework usage (2)

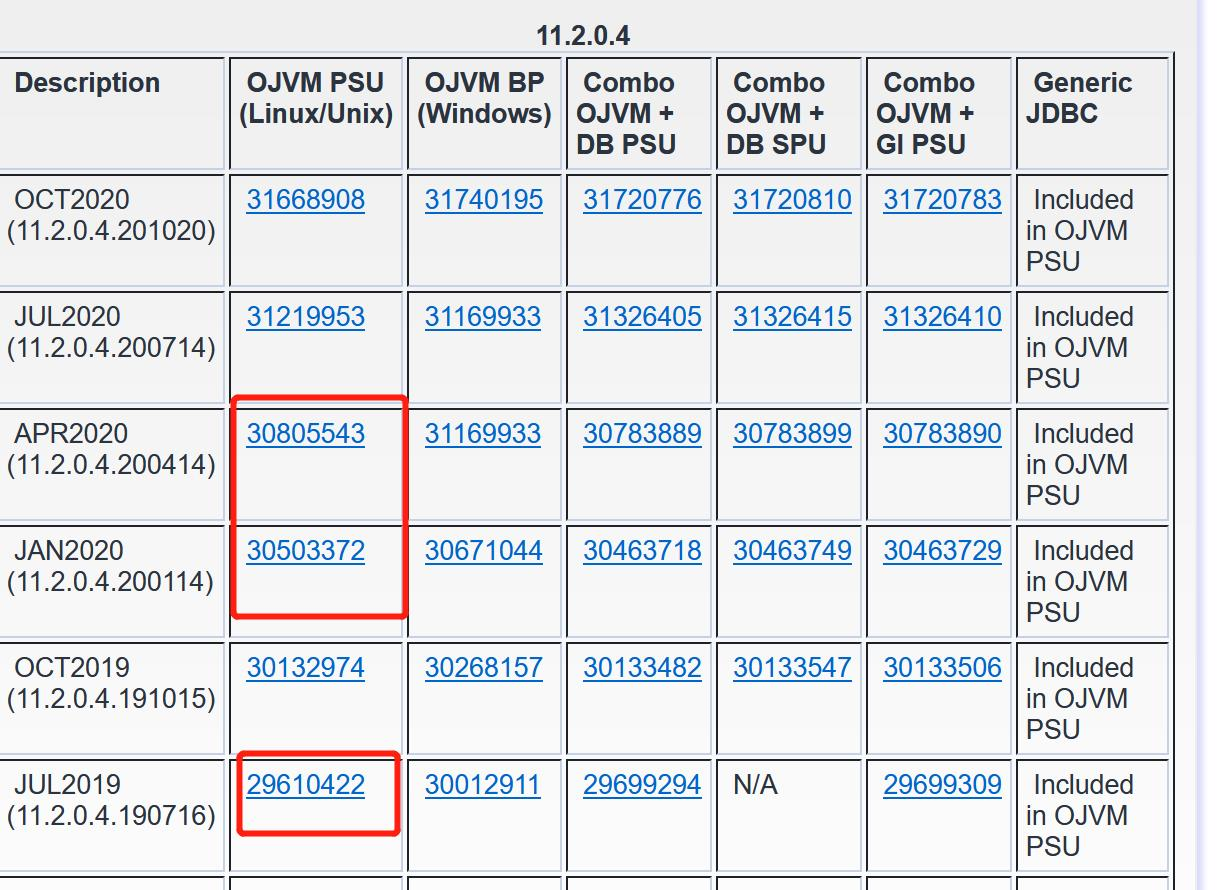

哪位大佬有20年4月或者1月的11G GI和ojvm补丁呀,帮忙发下?

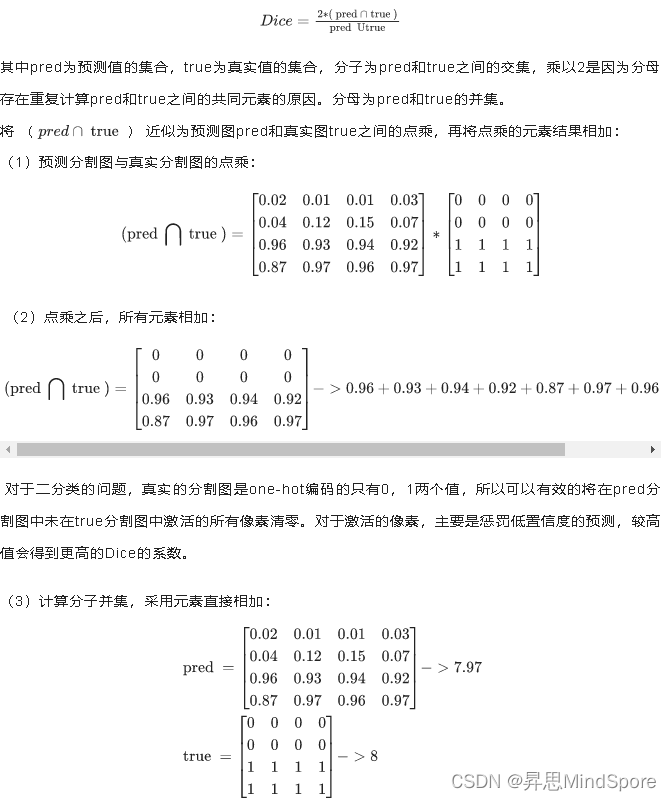

Complete image segmentation efficiently based on MindSpore and realize Dice!

随机推荐

PHP 操作mangoDb

GCC编译的时候头文件搜索规则

哪位大佬有20年4月或者1月的11G GI和ojvm补丁呀,帮忙发下?

JS introduction to reverse the recycling business network of learning, simple encryption mobile phone number

Go编译原理系列6(类型检查)

【翻译】混沌网+SkyWalking:为混沌工程提供更好的可观察性

egg框架使用(一)

IO stream articles -- based on io stream to realize folder copy (copy subfolders and files in subfolders) full of dry goods

气象数据数据处理实例——matlab字符串切割匹配与R语言日期匹配(数据拼接)

Confessing in the era of digital transformation: Mai Cong Software allows enterprises to use data in the easiest way

【AGC】增长服务1-远程配置示例

FPGA: Basic Getting Started LED Lights Blinking

QSS 选择器

js hijacks the array push method

Pytorch Deep Learning Quick Start Tutorial -- Mound Tutorial Notes (3)

uniapp connect ibeacon

一个栈的输入序列为1 2 3 4 5 的出站顺序的理解

教你本地编译运行一个IDEA插件,在IDEA里聊天、下棋、斗地主!

linux下oracle常见操作以及日常积累知识点(函数、定时任务)

FPGA: Basic Getting Started Button Controlling LED Lights