当前位置:网站首页>Is it difficult for small and micro enterprises to make accounts? Smart accounting gadget quick to use

Is it difficult for small and micro enterprises to make accounts? Smart accounting gadget quick to use

2022-07-06 20:06:00 【Hua Weiyun】

Recently, another famous actress was named and criticized by the people's daily for tax evasion , Think back to the news in the past two years , star 、 Anchor tax evasion is often hundreds of millions , The chaos caused by the huge profits in the industry is really sad .

The live broadcasting industry has developed rapidly in a few years , The head anchors of all platforms have received huge income , And the high pay in the entertainment industry has long been nothing new , But after becoming famous , Some practitioners quickly disappeared in the industry due to tax problems , It's not very sad at the same time , It also makes the tax issue more and more attract the attention of ordinary people .

picture source : Sina weibo

In fact, in addition to these high-yield enterprises, we should pay more attention to taxation , There are also many tax demands in the life of ordinary people : Office workers have to pay personal income tax , Individual businesses 、 Small and micro enterprises such as family workshops also need to be taxed ……

Office workers don't need to worry about paying taxes by themselves , But the tax recording and declaration of small and micro enterprises is not so easy , How to deal with tax matters easily while starting a business is puzzling many start-ups .

The funds are tight in the initial stage , The cost burden of setting up special accounting posts is heavy

According to the statistics of the Ministry of industry and information technology , By 2021 end of the year , Small, medium and micro enterprises have exceeded 4400 Thousands of families , Contributed to 50% The above taxes ,60% The above GDP,70% The above innovative achievements ,80% The above labor force employment and 90% New jobs .

In order to further promote mass entrepreneurship , Support small, medium and micro enterprises , A series of supporting measures and policies have been issued . Small, medium-sized and micro enterprises enjoy the preferential policies of the state at the same time , according to 《 Detailed rules for the implementation of the law of the people's Republic of China on the administration of tax collection 》 Article 17 :“ Engage in production 、 Taxpayers engaged in business shall open basic deposit accounts or other deposit accounts from the date 15 Intraday , Report all account numbers to the competent tax authority in writing .”

Small, medium-sized and micro enterprises are short of funds at the initial stage of entrepreneurship , Setting up accounting posts will undoubtedly increase the burden of operating costs for small, medium-sized and micro enterprises , So most small, medium and micro enterprises will choose accounting companies , Carry out bookkeeping and tax declaration services .

But in this case , Small, medium and micro enterprises have to face “ If you have no money, you will be unpopular ” The circumstances of .

The accounting industry is mixed , Perfunctory attitude has become the norm of the industry

Usually, the basic account agency business is one year 2000 A lot of money , In the case of small business of start-ups , It is a relatively reasonable expenditure .

But from the perspective of accounting for accounts , But it is a rather meager income , There is fierce competition in the accounting industry , One accounting agent serves multiple companies , There are many docking matters , You can't avoid perfunctory service attitude 、 Not dealt with in time 、 Bookkeeping is sloppy 、 The professional level is worrying 、 The emergence of arbitrary charges and other problems .

Although it is “ Pay for services ”, But sometimes business owners have to admit : Not enough money , May not be able to enjoy the desired service .

however , With the advent of intelligent independent accounting and tax declaration era , There is an opportunity for small and micro enterprises to get rid of the differential treatment in the accounting industry .

Open a new era of self-service accounting and tax declaration for small and micro enterprises ,6 Minutes to complete online one click tax declaration

In response to the national promotion 「 Don't meet 」 office 、「 Contactless 」 Tax and other policy requirements , Solve the high service cost of small, medium and micro enterprises using traditional accounting companies 、 Low service quality 、 Tax hidden dangers and other pain points , Quick tax declaration Launched enterprise independent tax filing black Technology , There is no need for professional financial personnel , Only... Is needed every month 3 Bookkeeping and tax declaration can be completed in one step , Realization AI Bookkeeping 、 Automatic tax declaration and more tax services .

01 Save accounting fees , Easy to operate

No need to pay for accounting , As long as the business owner can scan 、 I can take pictures , You can easily handle tax recording and declaration matters on your mobile phone , It takes no time or effort .

And compared with the traditional accounting agency 2000-4000/ The agency fee for the year , Quick tax declaration Every year, only 800 Yuan Qi !

02 Whole process online operation , Smart tax filing is very simple

Invoice and bank flow support one click access , Realize automatic voucher generation : Quick tax declaration The system is directly connected to the whole country 36 Electronic tax area , The electronic invoice of an enterprise does not need to be entered manually , The system automatically collects , Business owners just need to check whether it is complete , If there are photos that need to be added, just upload them .

In the bookkeeping 、 Tax calculation , Quick tax declaration The system can also automatically generate vouchers 、 Financial and tax statements , And calculate the tax automatically according to the tax report , Avoid miscalculation .

In terms of declaration , Quick tax declaration It has achieved nationwide 36 Tax area coverage , Therefore, after confirming the tax, you can declare with one click and obtain the tax payment certificate in time .

In terms of invoicing , Quick tax declaration You can make an invoice in the cloud with one click anytime and anywhere without a computer .

Business owners don't have to send bills 、 Sign the contract 、 Offline docking tax , It greatly reduces the time cost and communication cost , Truly realize intelligent and efficient tax declaration .

03 Price transparency , The progress is clear at a glance

Quick tax declaration Price transparency , The price of the service is clearly marked , There will be no hidden consumption . meanwhile , The service progress can be checked in real time , The historical accounts are clear at a glance , Business owners can know the monthly funds in real time 、 tax 、 profits , According to the financial situation of the company , Plan ahead for the development of the company .

When we witnessed too many disadvantages of traditional accounting agency in the initial stage of the enterprise , Such as : Personnel turnover causes the omission of enterprise account information 、 High error rate ; The professionalism and service quality of accounting agency are mixed ; Single service items 、 After hiding many consumption items and other problems , Quick tax declaration The emergence of has opened the door to the world of intelligent self-service accounting and tax declaration .

As Cloud store Partners of , Express tax declaration will work with Huawei cloud , Bring you a new experience of intelligent self-service bookkeeping and tax declaration !

Product links mentioned in the article : Quick tax declaration

【 Huawei cloud store —— innovation , So let's start here 】

Write a big moon

Editor: a big moon

边栏推荐

- Social recruitment interview experience, 2022 latest Android high-frequency selected interview questions sharing

- Database specific interpretation of paradigm

- Crawler (14) - scrape redis distributed crawler (1) | detailed explanation

- OceanBase社区版之OBD方式部署方式单机安装

- logstash高速入口

- 语音识别(ASR)论文优选:全球最大的中英混合开源数据TALCS: An Open-Source Mandarin-English Code-Switching Corpus and a Speech

- 腾讯安卓开发面试,android开发的基础知识

- Tencent T2 Daniel explained in person and doubled his job hopping salary

- Node. Js: express + MySQL realizes registration, login and identity authentication

- 深度学习分类网络 -- ZFNet

猜你喜欢

深度剖析原理,看完这一篇就够了

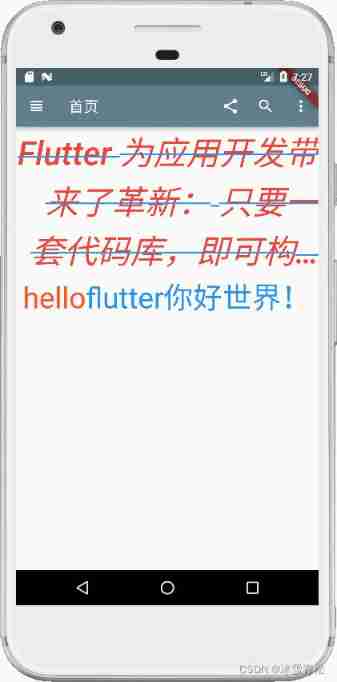

Example of shutter text component

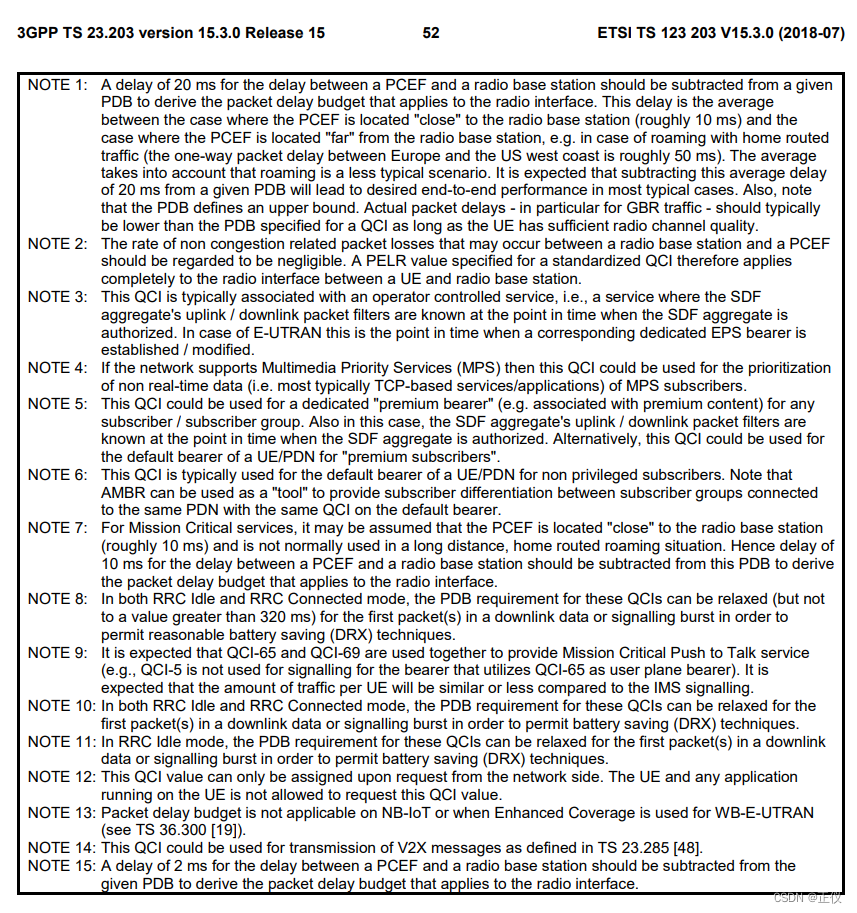

Standardized QCI characteristics

【GET-4】

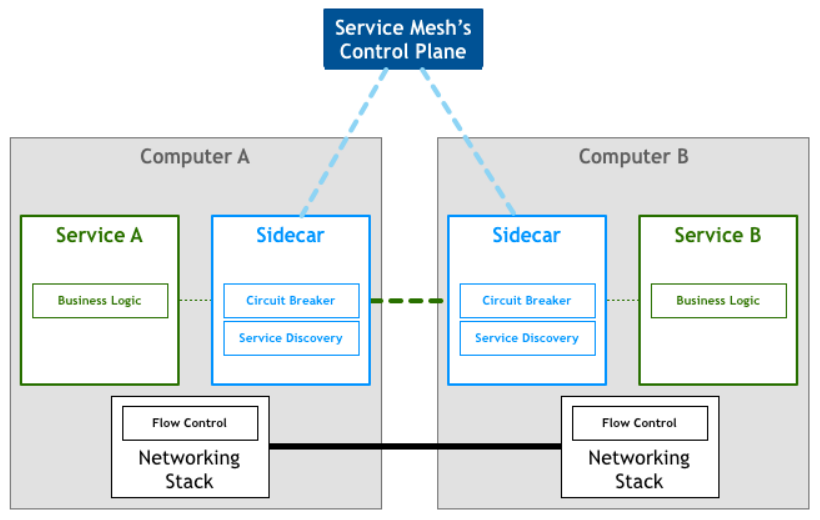

激进技术派 vs 项目保守派的微服务架构之争

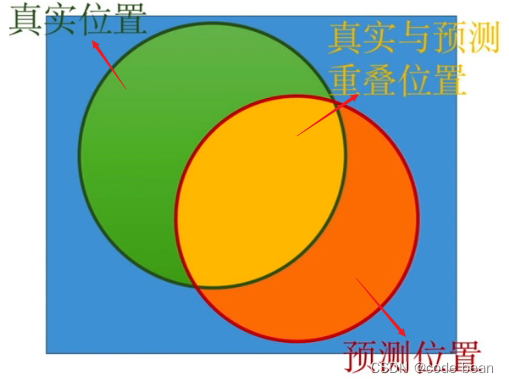

Understand yolov1 Part II non maximum suppression (NMS) in prediction stage

数字三角形模型 AcWing 1018. 最低通行费

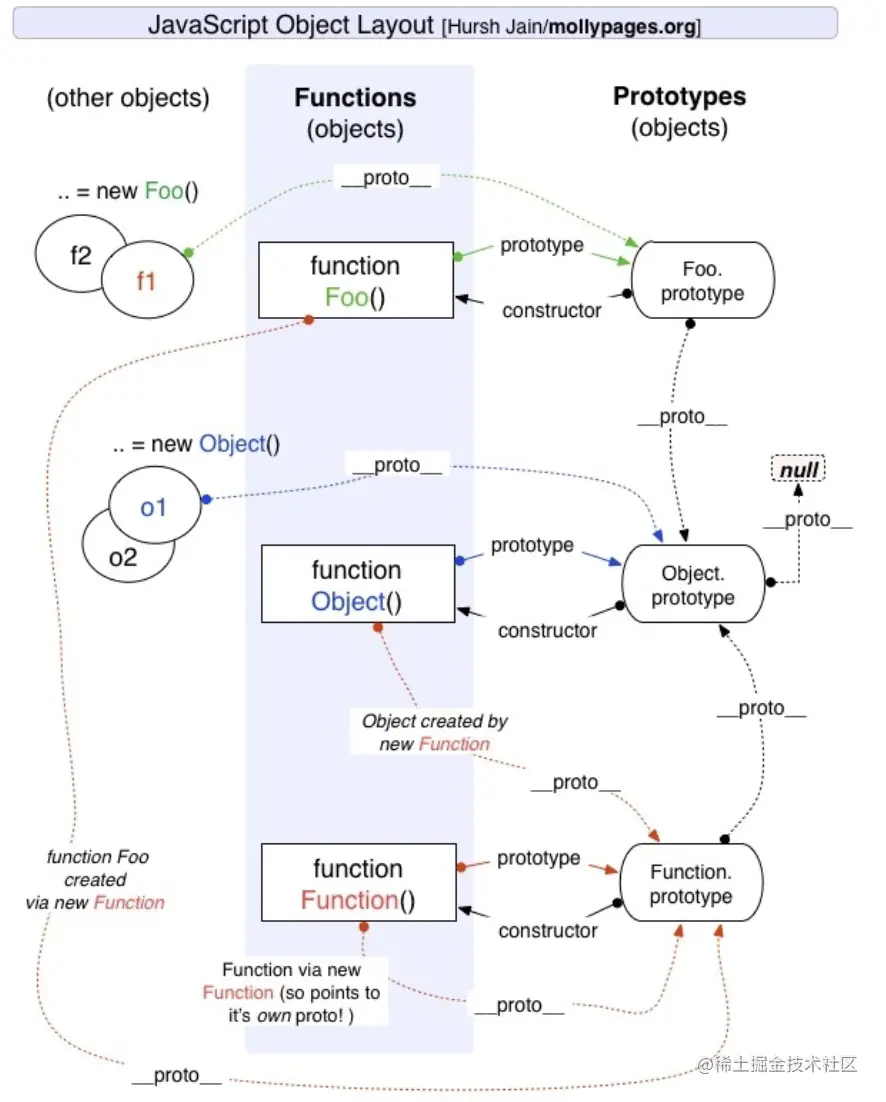

Teach you to learn JS prototype and prototype chain hand in hand, a tutorial that monkeys can understand

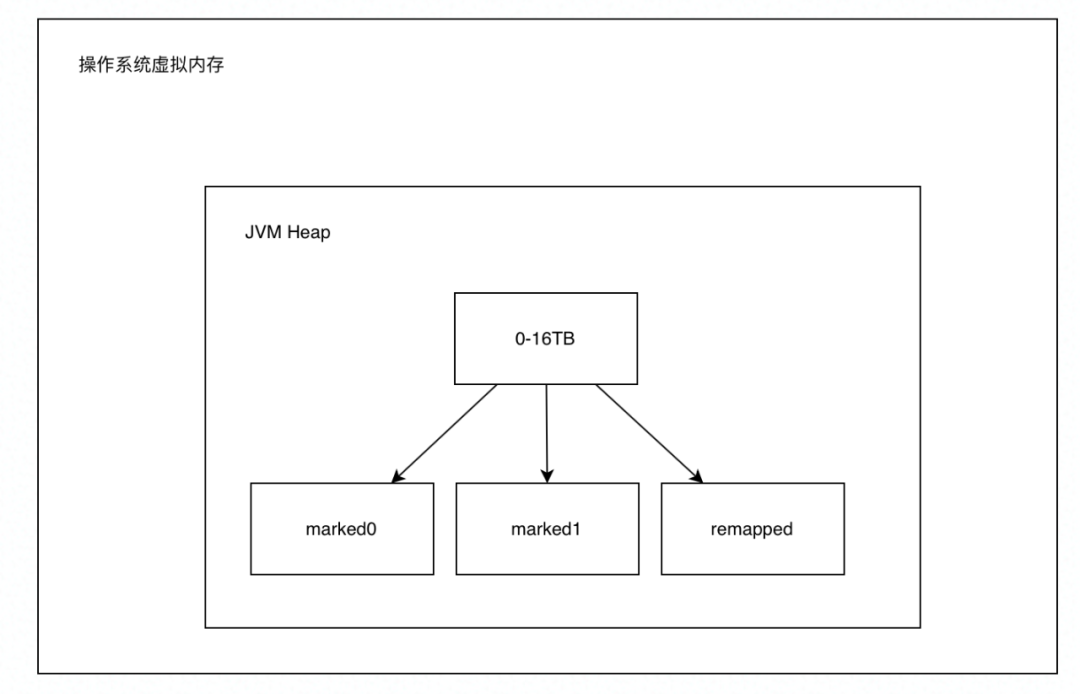

新一代垃圾回收器—ZGC

腾讯字节等大厂面试真题汇总,网易架构师深入讲解Android开发

随机推荐

In simple terms, interview surprise Edition

系统与应用监控的思路和方法

句号压缩过滤器

Li Kou 101: symmetric binary tree

Oceanbase Community Edition OBD mode deployment mode stand-alone installation

golang的超时处理使用技巧

[Yann Lecun likes the red stone neural network made by minecraft]

Recursive implementation of department tree

微信小程序常用集合

范式的数据库具体解释

After solving 2961 user feedback, I made such a change

腾讯T3大牛手把手教你,大厂内部资料

What happened to the kernel after malloc() was transferred? Attached malloc () and free () implementation source

Crawler (14) - scrape redis distributed crawler (1) | detailed explanation

【云原生与5G】微服务加持5G核心网

The "white paper on the panorama of the digital economy" has been released with great emphasis on the digitalization of insurance

精彩编码 【进制转换】

Monthly report of speech synthesis (TTS) and speech recognition (ASR) papers in June 2022

Logstash expressway entrance

HMS Core 机器学习服务打造同传翻译新“声”态,AI让国际交流更顺畅