当前位置:网站首页>A possible investment strategy and a possible fuzzy fast stock valuation method

A possible investment strategy and a possible fuzzy fast stock valuation method

2022-07-05 12:44:00 【Guangqijun】

This article is suitable for non professional investors , This article does not constitute investment advice , The stock market is risky , Be careful when entering the market .

It's hard to make money from stocks .

Bloggers analyzed the investment strategies of various stock market winners , Including social security fund 、 Typical niusan ( Such as chenfashu 、 Conch Cement 、 High allocations )、 Typical hot money ( Such as happy coast 、 Zhang Mengzhu )、 Typical foreign investors ( Like sister Mu 、 buffett 、 Norwegian sovereign investment fund 、 Abu Dhabi Investment Authority ), A possible investment strategy is given :

1. The ideal asset allocation ratio should be that the ratio of venture capital to fixed income does not exceed 1. This point refers to the Social Security Fund , The ratio of bank deposits of social security fund to national debt shall not be less than 50%, securities investment funds 、 The proportion of stock investment is no higher than 40%, For personal investment enthusiasts ,“ Greedy ” and “ poor ” In some cases, it is interconnected , stay “ Greedy ” and “ poor ” Find the appropriate dynamic balance point , It is very important for part-time investors .

2. Find a long-term good 、 Market capitalization 100 Billion -1000 A company between 100 million yuan . The larger the share of the company in the industry, the better , The higher the barrier in the industry, the better , The more stable the revenue and profit growth, the better , State owned enterprises are the best , Super brands are better . As a whole , Such a long-term good “ Small and beautiful ” Enterprises generally have high valuation , Under the influence of some non fatal factor ( Such as macroeconomic impact 、 Raw materials rose in the short term 、 The stock market is in a bear market as a whole ) fall , When the P / E ratio is lower than 5 year 30 Quantile value p / E ratio is a better time to buy , Buy separately , Cooperate with the cabinet phase band , Increase positions as you fall , Wait patiently , Wait until the stock price because of some unsustainable factor ( If you are in a bull market 、 Emotional hype and so on ) When it is pushed up to significantly deviate from the reasonable valuation, it will be sold , Note that the overall position holding process may last for many years , For example, Xie Renguo sticks to Tuobang shares 6 Make a lot of money every year 2 Billion .

Some things are the world of the slow one , Some are against the clock , Institutions usually buy the stock price first to the expected price of the next stage , Meet expectations or sell or increase positions , All sold below expectations , Overweight , For individual investors , Due to the lack of field research 、 Detailed analysis of industry and business 、 Quantified investment 、 Major news gathering and other high threshold capabilities , So imagine institutional investors 、 It is impossible to estimate as accurately as hot money , Therefore, the stock valuation can only be used to judge whether the stock price deviates significantly from the actual value , Here is a possible fuzzy fast stock valuation method , Take real stocks as an example :

1. Dong'e Ejiao is not obviously bad in the short term , And there are potential benefits such as equity incentives , Using history 50 Quantile P / E ratio 20,2022 Expected annual profit 12 One hundred million yuan , Corresponding market value 240 Billion , Corresponding to the stock price 36.69 element , Compared with the current stock price, it is basically flat .

2. Shandong Pharmaceutical glass was affected by the overall decline of the pharmaceutical industry in the short term 、 Fund closing and redemption 、 The price of raw glass is from 2022 It has been rising since the beginning of the year 、 It may depress the stock price, issue additional shares and so on , Give to history 30 Quantile P / E ratio 28,2022 Expected annual profit 8.5 One hundred million yuan , Corresponding market value 238 Billion , Corresponding to the stock price 40 element , Compared with the current stock price 31 Yuan undervaluation , There are buying opportunities .

边栏推荐

- Introduction to relational model theory

- Redis highly available sentinel cluster

- Instance + source code = see through 128 traps

- Get the variable address of structure member in C language

- VoneDAO破解组织发展效能难题

- UNIX socket advanced learning diary - advanced i/o functions

- Compilation principle reading notes (1/12)

- View and terminate the executing thread in MySQL

- Flume common commands and basic operations

- Pytoch through datasets Imagefolder loads datasets directly from files

猜你喜欢

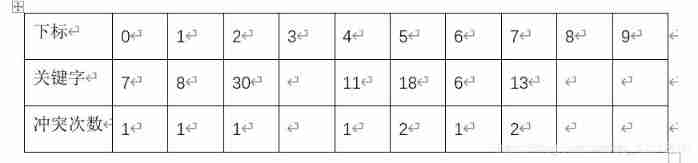

Average lookup length when hash table lookup fails

Take you hand in hand to develop a service monitoring component

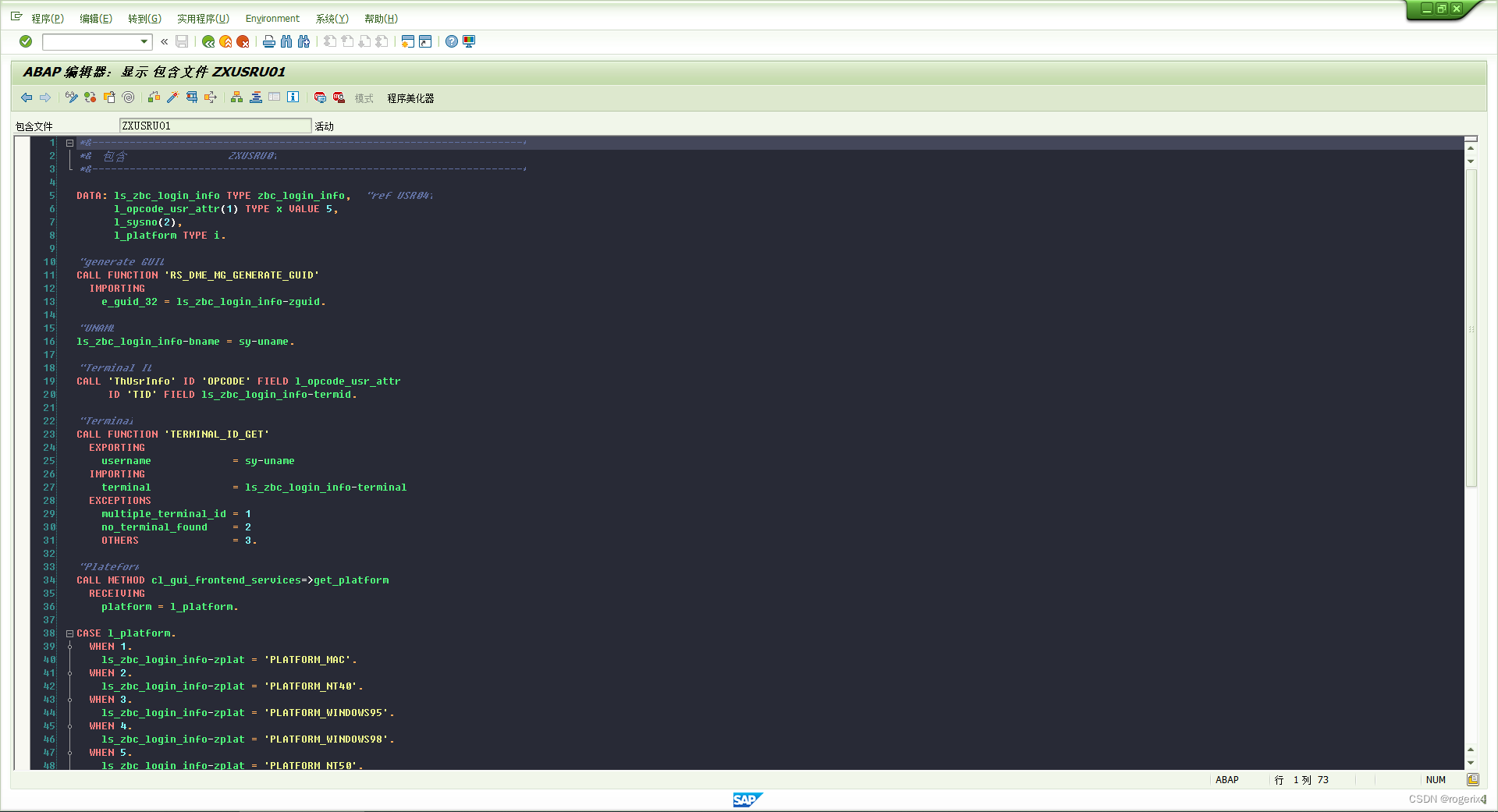

SAP self-development records user login logs and other information

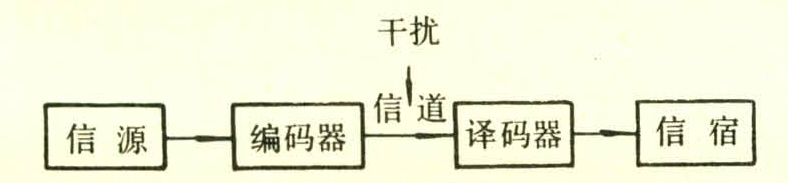

《信息系统项目管理师》备考笔记---信息化知识

Redis highly available sentinel mechanism

MySQL index - extended data

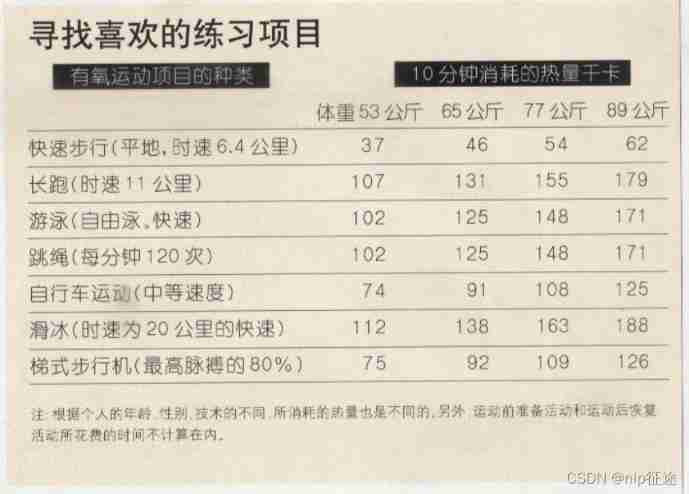

10 minute fitness method reading notes (3/5)

Flutter2 heavy release supports web and desktop applications

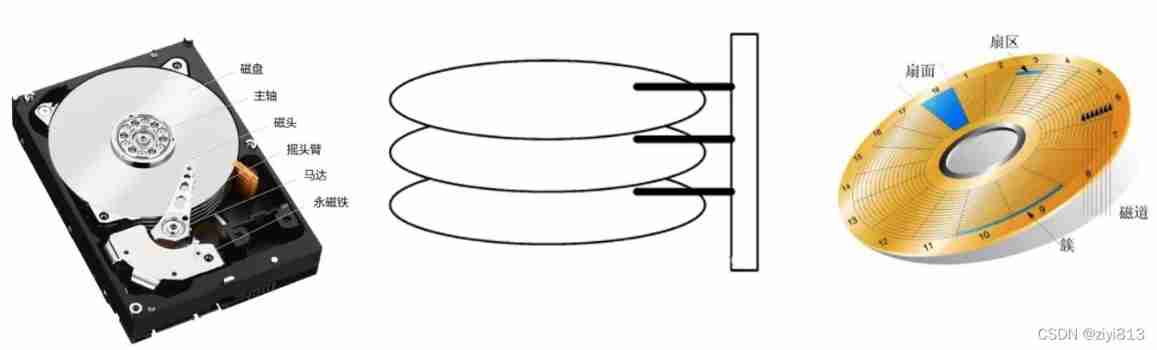

Storage Basics

Ecplise development environment configuration and simple web project construction

随机推荐

Kotlin变量

MySQL index - extended data

Conversion du format de données GPS [facile à comprendre]

How to recover the information server and how to recover the server data [easy to understand]

Understand redis persistence mechanism in one article

VoneDAO破解组织发展效能难题

Correct opening method of redis distributed lock

ActiveMQ installation and deployment simple configuration (personal test)

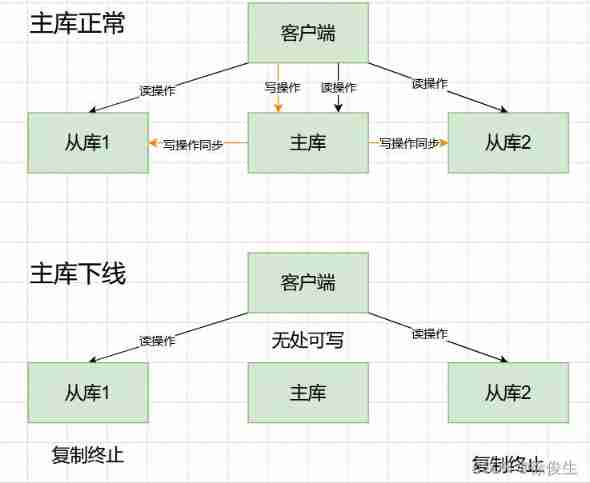

Master-slave mode of redis cluster

Average lookup length when hash table lookup fails

JSON parsing error special character processing (really speechless... Troubleshooting for a long time)

View and modify the MySQL data storage directory under centos7

Principle of universal gbase high availability synchronization tool in Nanjing University

PIP command reports an error pip is configured with locations that requires tls/ssl problems

Kotlin流程控制、循环

Resnet+attention project complete code learning

UNIX socket advanced learning diary - advanced i/o functions

前几年外包干了四年,秋招感觉人生就这样了..

激动人心!2022开放原子全球开源峰会报名火热开启!

Redis clean cache