当前位置:网站首页>Under the high debt of Red Star Macalline, is it eyeing new energy?

Under the high debt of Red Star Macalline, is it eyeing new energy?

2022-07-26 04:11:00 【Blueberry finance V】

This year, 5 month , S & P global rating changed the long-term main credit rating of Red Star Macalline from “BB” Down to “B+”, Look negative , At the same time, the long-term debt rating of its unexpired secured senior unsecured bonds was upgraded from “BB-” Down to “B”.

This exposed the huge debt of Red Star Macalline , It can no longer be covered , As the home decoration and furniture shopping mall sector, it belongs to the downstream industry of the real estate value chain , Red Star Macalline is impacted by the contagion effect of the weak domestic real estate market , Superimposed on the epidemic, the national economy is waiting to recover , It will be more difficult to achieve cash collection and leverage improvement , S & P rating's confidence in red star Macalline's repayment naturally declined .

Until the beginning of this month, a family named “ Shanghai Red Star Macalline Xingyuan Technology ” The company quietly appeared , Its business scope includes the sales of new energy prime mover equipment , It makes people suddenly realize , Does red star Macalline want to enter the field of new energy , Let's take a look at this debt ridden “ Devastate ” The body of ?

But exactly how much debt has red star Macalline borne ? How should I pay it back ?

01 “ Stressed out ” Huge debts

In recent years, it is obvious that the asset liability ratio of Red Star Macalline has gradually increased , from 2015 - 2021 During the year , Its total liabilities from 356.14 100 million yuan increase to 776.56 One hundred million yuan , The overall asset liability ratio is from 48.25% Up to 57.44%,2021 The annual interest expense is as high as 26.95 One hundred million yuan , Even higher than net profit .

Turn to profitability , According to its financial report ,2021 In, the operating income of Red Star Macalline reached 155.1 One hundred million yuan , Year-on-year growth 9.0%; The net profit reached 21.89 One hundred million yuan , Year-on-year growth 6.05%%. The scale of revenue is equivalent to 2019 Annual level , The scale of profits is far less than 2013 In the year .

Entering this year, the performance growth is more sluggish ,2022 First quarter of 2009 , Macalline achieved revenue 33.75 One hundred million yuan , A mild increase year-on-year 1.01%, Net income of 6.32 One hundred million yuan , fell 12.69%.

In the case that the growth of revenue and net profit is less than expected or even gradually declines “ Bleak ” Under the circumstances , Red Star Macalline's high debt of nearly 100 billion has become more and more shocking in the eyes of the market .

What about the solvency of Red Star Macalline ? Will there be insolvency ?

The answer is unknown , But it is certain that red star Macalline is already facing liquidity risk under huge debt .

By 2021 end of the year , The cash balance of Red Star Macalline is 69 RMB 100 million . Its short-term debt is 130 One hundred million yuan , Including expiring 60 Billion yuan equivalent preferred bonds 、 Can be found in 2022 Corporate bonds and commercial real estate mortgage-backed securities sold back in . say concretely , Red Star Macalline needs to be in 2022 Years and 2023 Annual repayment 100 Billion yuan of corporate bonds .

02 The hard way to repay the debt

Due to the operation of Red Star Macalline 、 There are still risks in combination with the business model and the position of the industrial chain , It is very likely that it will restrict its ability to deleverage in the next two years .

Red Star Macalline benefits from continuous financing to expand its business , You must also assume the obligation to repay the debt , although “ Demolish the east wall , Buxiqiang ” Not the best policy , But facing the shortage of cash flow, we have to continue financing .

At the beginning of the year , Red Star Macalline disclosed in Shanghai clearing house 2020 The first issue of medium-term notes of the year , The prospectus shows the registered amount of this medium-term note 20 One hundred million yuan . Of which, the current issue amount 5 One hundred million yuan , It is planned to repay the bank borrowings of the issuer that are about to expire , And said that the remaining amount will also be used to repay bank loans in interest bearing liabilities of the consolidated caliber .

besides , In order to raise funds as much as possible, Macalline also moved the idea of its own equity , Maybe because since last year , The share price of Red Star Macalline fell sharply , So far, there is no obvious sign of inflection point .

According to statistics , The unexpired equity pledge of Red Star Macalline exceeds 12 pen , among 7 The pen has reached the warning line and closing line , Its shareholding 62% Has pledged .

At the same time, the continuous decline of the stock price will force Macalline to continue to supplement the pledge of shares , To avoid the serious risk of being liquidated , However, it has not yet been determined whether the stock will be liquidated , For example, once the liquidation is triggered , It will further cause the stock price to continue to fall , Form a bad negative cycle .

And the vicious circle of share price and equity pledge , It will worsen Macalline's debt problem , Making its financing in the capital market more difficult , Even default . Last , Price of stock 、 Equity pledge 、 Huge debts and other issues , Or will continue to deteriorate in a negative cycle .

03 Torrent bravely set foot in new energy ?

Will the new energy field that tries to step into the market be the Savior of Red Star Macalline ?

The result is not known , At present, according to the sky eye survey , Shanghai Red Star Macalline Xingyuan Technology Group Co., Ltd. was established this year 7 month , The registered capital 2000 Ten thousand yuan , The business scope includes the sales of new energy prime mover equipment 、 Wholesale of auto parts 、 Oil and gas technology services 、 Real estate brokerage, etc .

And after equity penetration , Xingyuan technology is held by red star Macalline 70%, Jiangsu Xingyuan Green Decoration Engineering Co., Ltd. holds shares 30%, It is worth mentioning that , The current name of Jiangsu Xingyuan Green Decoration Engineering Co., Ltd. is this year 3 Month by month “ Jiangsu Xingyuan Design Decoration Engineering Co., Ltd ” Change and come , One “ green ” word , Perhaps the Red Star Macalline has long been moving “ New energy ” Signs of mind .

Macalline, a red star mainly engaged in the downstream industry of real estate , In recent years, limited by the transformation of consumption scenarios , Factors such as the decline of the real estate cycle , Weak development and huge debt , Various activities carried out before “ Light assets 、 Heavy operation 、 Lower the lever ” The effect of strategic transformation is average , At this time, red star Macalline, which is struggling under high debt, wants to seek new business growth points , It can be explained , but “ New energy ” Three words , For Red Star Macalline, who has no experience in energy and automobile , It's still just a concept .

A suit of “ hole ” But the volume and assets are huge ,“ A noble son from a poor family ” Can the adverse development of appear on Macalline, the red star who wants to set foot in the field of new energy , Perhaps for Red Star Macalline to choose to turn to the high boom track is also mixed , The outcome is yet to be announced by time as a witness to the market .

边栏推荐

- Wechat applet to realize music player (4) (use pubsubjs to realize inter page communication)

- Basic line chart: the most intuitive presentation of data trends and changes

- How mantium uses deepspeed to implement low latency gpt-j reasoning on Amazon sagemaker

- Implementation of distributed lock

- Firewall command simple operation

- 在 Istio 服务网格内连接外部 MySQL 数据库

- STM32状态机编程实例——全自动洗衣机(下)

- 电商运营小白,如何快速入门学习数据分析?

- This article takes you to graph transformers

- 加班一周开发了报表系统,这个低代码免费IT报表神器太好用了

猜你喜欢

Go Plus Security:一款Build Web3不可或缺的安全生态基础设施

Worked overtime for a week to develop a reporting system. This low code free it reporting artifact is very easy to use

荐书 |《学者的术与道》:写论文是门手艺

Wechat applet to realize music player (4) (use pubsubjs to realize inter page communication)

基于移位寄存器的同步FIFO

Opencv learning notes -- Hough transform

STM32状态机编程实例——全自动洗衣机(下)

Analysis on the infectious problem of open source license

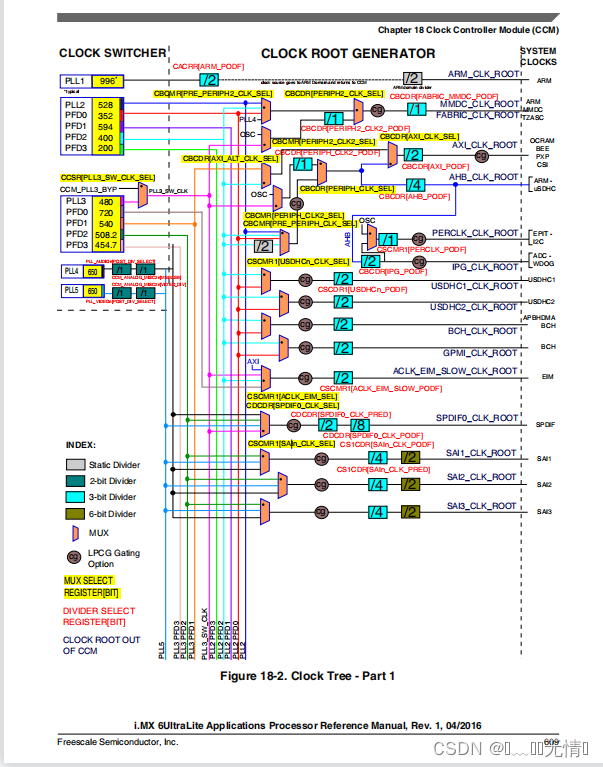

I.MX6U-ALPHA开发板(主频和时钟配置实验)

dijango学习

随机推荐

Luoda Development -- the context of sidetone configuration

Connect external MySQL databases in istio Service Grid

dijango学习

Write a paper for help, how to write the discussion part?

Helloworld案例分析

Basic line chart: the most intuitive presentation of data trends and changes

How engineers treat open source -- the heartfelt words of an old engineer

1. Mx6u-alpha development board (GPIO interrupt experiment)

Firewall command simple operation

Educational Codeforces Round 132 (Rated for Div. 2) E. XOR Tree

[深入研究4G/5G/6G专题-42]: URLLC-13-《3GPP URLLC相关协议、规范、技术原理深度解读》-7-低延时技术-1-子载波间隔扩展

智装时代已来,智哪儿邀您一同羊城论剑,8月4日,光亚展恭候

软考 系统架构设计师 简明教程 | 案例分析解题技巧

座椅/安全配置升级 新款沃尔沃S90行政体验到位了吗

I.MX6U-ALPHA开发板(主频和时钟配置实验)

Share | 2022 big data white paper of digital security industry (PDF attached)

Web Test Method Encyclopedia

【读书笔记->数据分析】01 数据分析导论

雅迪高端之后开始变慢

PHP object conversion array