当前位置:网站首页>E-week finance | Q1 the number of active people in the insurance industry was 86.8867 million, and the licenses of 19 Payment institutions were cancelled

E-week finance | Q1 the number of active people in the insurance industry was 86.8867 million, and the licenses of 19 Payment institutions were cancelled

2022-07-04 20:40:00 【Analysys analysis】

Analysis of Yi Guan :《 Digital economy panorama white paper 》 It condenses the accumulation of experience and data of Analysys analysis for various industries of digital economy , Combined with the actual business and future challenges of enterprises in the digital age , And the innovation and breakthrough of digital technology , Finally, start with the general trend of digital economy development and cases in various fields , Help enterprises clarify the industry positioning and business development direction under the digital wave .

《 Digital economy panorama white paper 》 Continue to pay attention to the field of digital Finance , Special opening 《 Yi Zhou financial analysis 》 The column .《 Yi Zhou financial analysis 》 Compile the hot events in the financial field this week , And invite Analysys financial industry analysts to exclusively interpret and analyze the event .

Quick view of financial analysis of Yizhou

- Non bank payment institutions renew publicity ,19 The family license was cancelled

- The plan of increasing capital and shares of e-commerce bank was approved

- In the first quarter, the number of active people in the insurance industry reached 8688.67 ten thousand people

- Consumer finance in the first quarter APP Total active users 4479 ten thousand people

01

6 month 26 Japan , The people's Bank of China announces that non bank payment institutions 《 Payment business license 》 Renewal publicity information (2022 year 6 The fourth batch of the month ). Information display ,79 Among the institutions participating in the renewal Review ,52 Payment institutions successfully passed the renewal ,8 Payment institutions were suspended for renewal ,19 The payment licenses of Payment institutions were cancelled .

Analysis of Yi Guan : On the whole , Pay for the number of licenses “ shrink ” The trend continues . One side , Due to the stricter regulatory environment , No matter how difficult it is for some institutions with low compliance level to have living space ; On the other hand , As the market changes rapidly , Some institutions have encountered survival problems due to the delayed transformation of traditional payment businesses .

follow-up , The reshuffle of the payment industry will continue . At present, the market pattern of the industry's leading institutions has gradually stabilized , Some lack scenes 、 The organization of channel resources , Or small and medium-sized institutions with slow transformation in the context of the digital economy , Future or cancellation or transfer , Will gradually withdraw from the market , The Matthew effect of the industry may further intensify .

—— Su Xiaorui, senior analyst of Analysys financial industry

02

6 month 23 Japan , Issued by Zhejiang regulatory bureau of China Banking and Insurance Regulatory Commission 《 Reply on the capital and share increase plan of Zhejiang e-commerce bank 》, Agree to the capital and share increase plan of e-commerce bank . At present, the specific details of the relevant plan have not been disclosed . The relevant person in charge of e-commerce bank is right 《 Securities daily 》 The reporter said ,“ The specific plan is still in the process .”

Analysis of Yi Guan : On the one hand, the capital increase of e-commerce banks can improve the ability to resist risks , Improved compliance , On the other hand, it can also pass “ blood ” To increase investment in small and micro businesses , To support microenterprises 、 Help small and micro enterprises resume production and build a solid foundation .

At present, the supplementary capital of private banks is mainly divided into endogenous profit growth and external market-oriented means , In terms of capital replenishment in the market , Private banks have narrower channels than traditional small and medium-sized banks , It is suggested that on the premise of strengthening supervision , Support small and medium-sized banks to replenish capital through multiple channels , Improve the liquidity management ability of small and medium-sized banks .

—— Su Xiaorui, senior analyst of Analysys financial industry

03

2022 In, the activity of the insurance industry decreased significantly , to 1 Quarter end , The number of people active in the insurance industry reached 8688.67 ten thousand people , Negative growth month on month , Year on year drop to 2020 The lowest point since . The insurance service industry shows a trend of indicator differentiation , The average usage time per capita increased compared with the same period in previous years , However, the frequency of use per capita has declined .

Analysis of Yi Guan : From the perspective of the client , The epidemic has accelerated the digital transformation of the insurance industry , The head mechanism presents an ecological resultant force . The active industry is mainly affected by the repeated domestic epidemic , Superimposed on the annual festival, the conventional industry went down , Finance 、 The consumer industry is generally under pressure .APP On the active side , Traditional insurance companies follow the general trend of the industry , Generally showing negative growth month on month . User stickiness , In the first quarter, the user stickiness in the insurance industry increased slightly , However, this limited growth is likely to be swallowed up by the negative effect of active population , It is difficult to contribute to the overall growth of industry traffic .

From the liability side , The key to core competitiveness lies in channel digitalization and risk pricing . From the asset side , Implementation of the second generation of compensation , The application of insurance capital returns to the entity and main business .

—— Fang Ruixin, senior analyst of Analysys financial industry

04

2022 Consumer finance in the first quarter of APP The total number of active users reached 4479 ten thousand people . Specific to the APP level , Affected by the epidemic , Consumer finance APP User growth is under pressure , There was a slide , However, the market structure is basically stable .

Analysis of Yi Guan : Affected by the epidemic , Residents' willingness to consume gradually weakened , Short term market credit demand may continue to be weak . In the first quarter , The industrial development features focus on the reduction of industrial interest rates , The protection of financial consumers' rights and interests is still severe , The banking industry is overweight in the field of consumer finance , as well as “ New citizens ” Policy success “ New air outlet ”.

—— Chen Mingxuan, senior analyst of Analysys financial industry

* The above news sources : Securities daily 、 China bank insurance news, etc .

Notice of declaration : The third-party data and other information cited by Analysys in this article are from public sources , Analysys analysis assumes no responsibility for this . In any case , This article is for reference only , Not as any basis . The copyright of this article belongs to the publisher , Without authorization from Analysys , It is strictly prohibited to reprint 、 Reference or in any way use Analysys to analyze any content published . Any media authorized 、 When using the website or individual, the original text should be quoted and the source should be indicated , And the analysis point of view is based on the official content of Yiguan analysis , No form of deletion shall be made 、 Add 、 Splicing 、 deductive 、 Distortion, etc . Disputes over improper use , Yi Guan analysis does not assume any responsibility for this , And reserve the right to investigate the responsibility of the relevant subject .

边栏推荐

- #夏日挑战赛#带你玩转HarmonyOS多端钢琴演奏

- What is the development of block hash quiz game system? Hash quiz game system development (case mature)

- Detailed explanation of Audi EDI invoice message

- Data set division

- NetCore3.1 Json web token 中间件

- Decryption function calculates "task state and lifecycle management" of asynchronous task capability

- Employment prospects and current situation of Internet of things application technology

- 华为云云商店首页 Banner 资源位申请

- 紫光展锐完成全球首个 5G R17 IoT NTN 卫星物联网上星实测

- 太方便了,钉钉上就可完成代码发布审批啦!

猜你喜欢

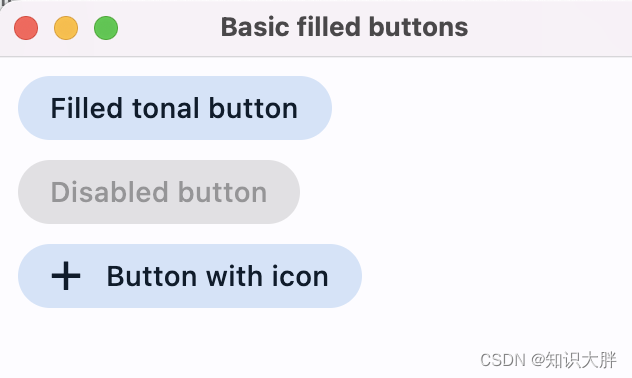

Flet教程之 04 FilledTonalButton基础入门(教程含源码)

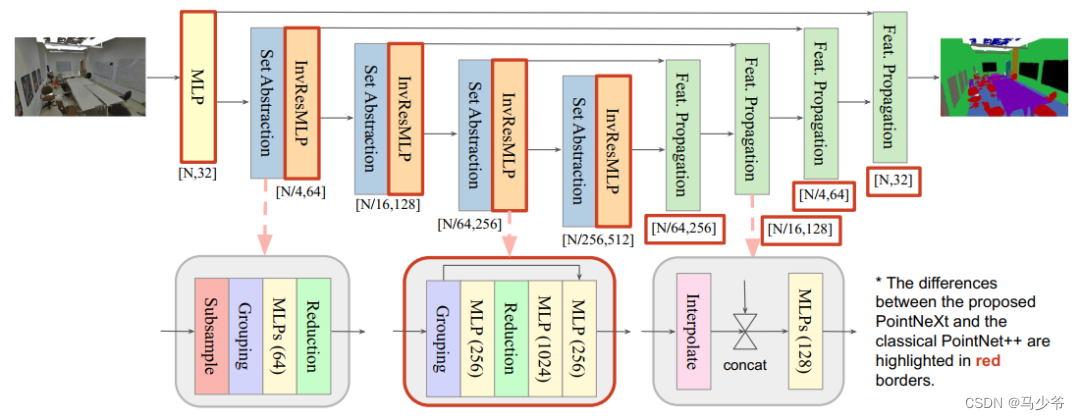

Pointnext: review pointnet through improved model training and scaling strategies++

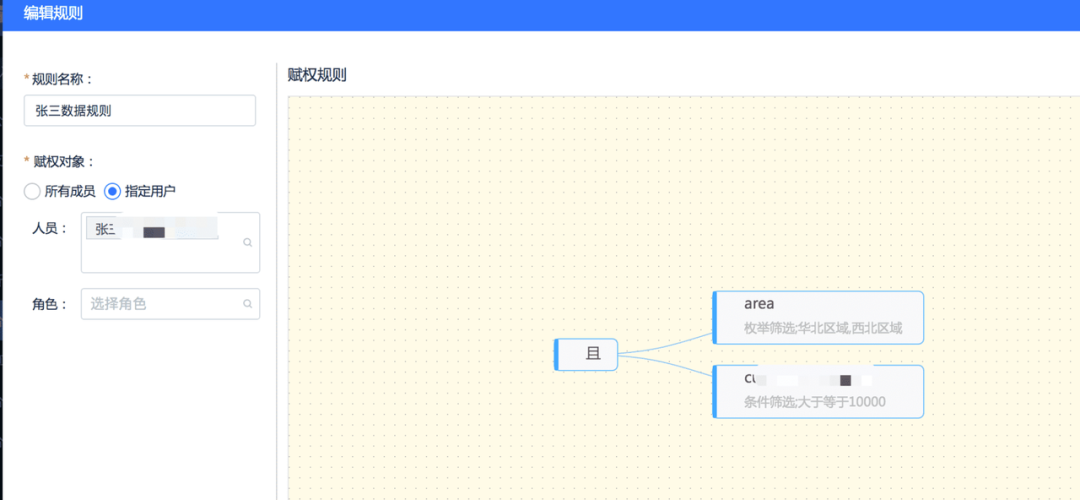

应用实践 | 蜀海供应链基于 Apache Doris 的数据中台建设

Win11系统wifi总掉线怎么办?Win11系统wifi总掉线的解决方法

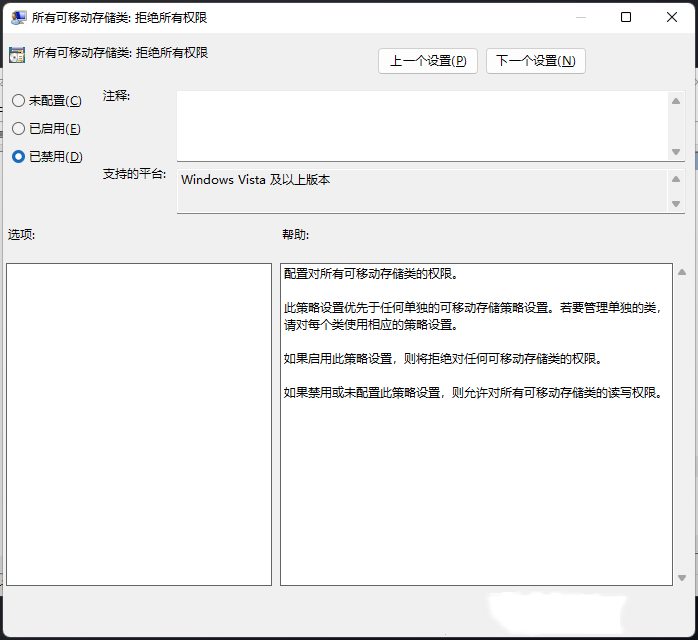

Win11U盘拒绝访问怎么办?Win11U盘拒绝访问的有效解决方法

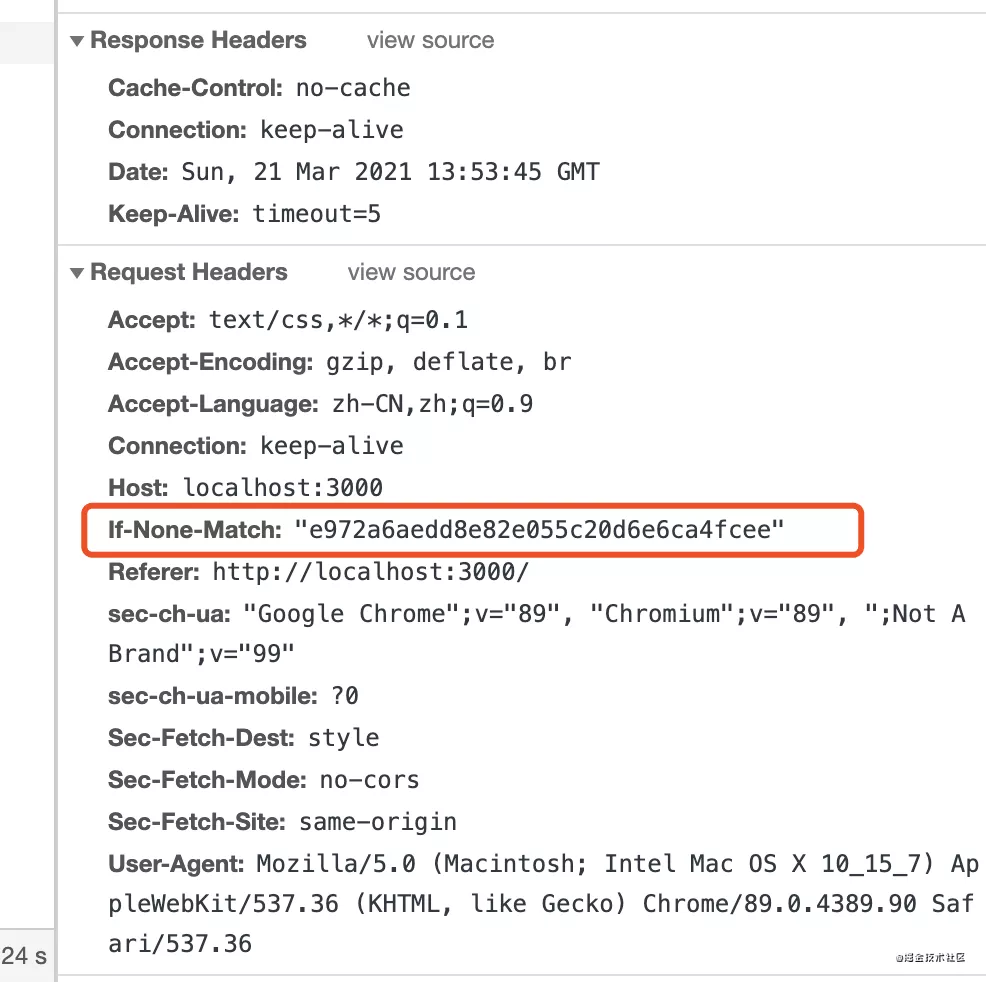

Practical examples of node strong cache and negotiation cache

精选综述 | 用于白内障分级/分类的机器学习技术

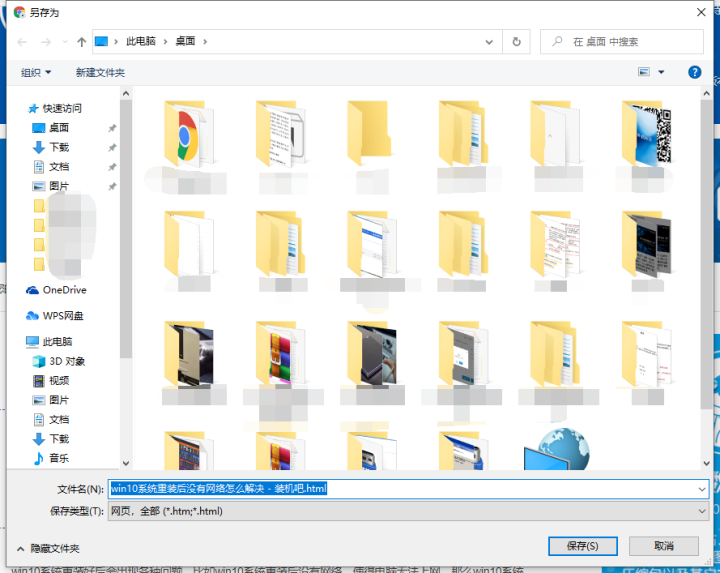

电脑怎么保存网页到桌面上使用

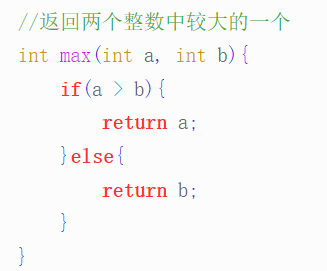

C language - Introduction - Foundation - grammar - process control (VII)

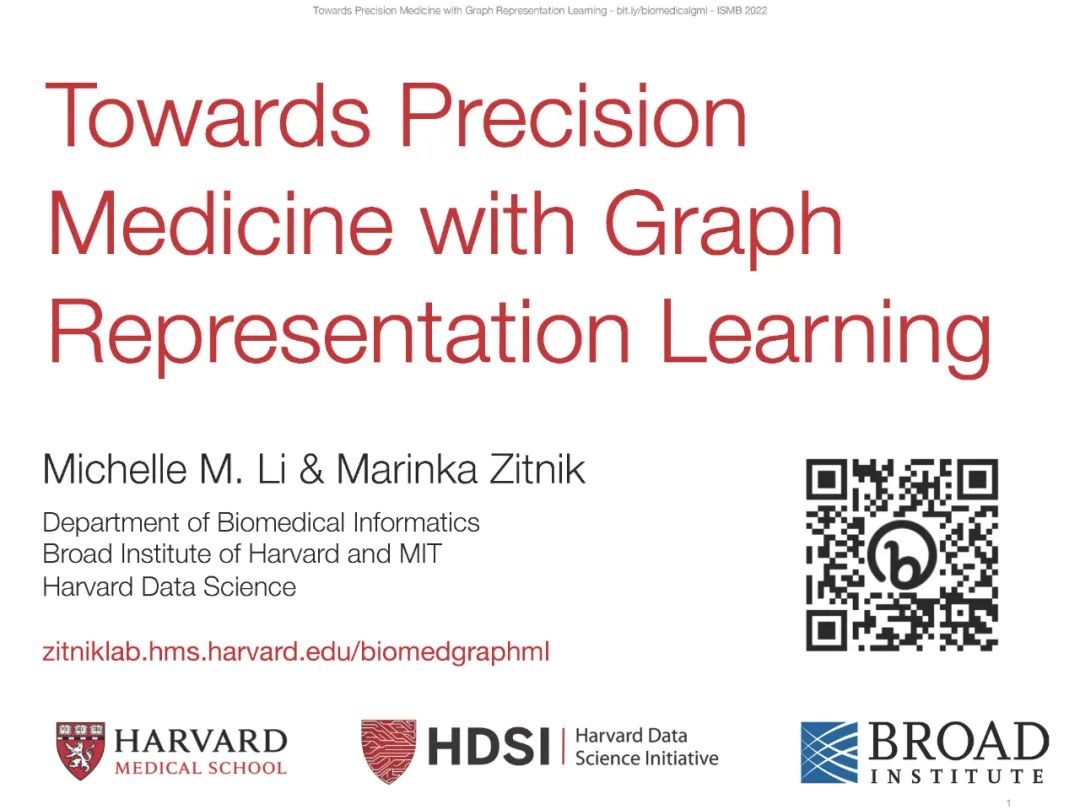

【ISMB2022教程】图表示学习的精准医疗,哈佛大学Marinka Zitnik主讲,附87页ppt

随机推荐

Process of manually encrypt the mass-producing firmware and programming ESP devices

[today in history] July 4: the first e-book came out; The inventor of magnetic stripe card was born; Palm computer pioneer was born

Installation and use of VMware Tools and open VM tools: solve the problems of incomplete screen and unable to transfer files of virtual machines

QT writing the Internet of things management platform 38- multiple database support

PHP pseudo original API docking method

Thinking on demand development

go笔记(3)Go语言fmt包的用法

NetCore3.1 Json web token 中间件

Qt编写物联网管理平台38-多种数据库支持

[ismb2022 tutorial] the picture shows the precision medicine of learning. Marinka zitnik, Harvard University, keynote speaker, with 87 ppt

Understand the reading, writing and creation of files in go language

Detailed explanation of Audi EDI invoice message

九齐单片机NY8B062D单按键控制4种LED状态

Employment prospects and current situation of Internet of things application technology

Small hair cat Internet of things platform construction and application model

SSRS筛选器的IN运算(即包含于)用法

jekins初始化密码没有或找不到

go语言笔记(2)go一些简单运用

上线首月,这家露营地游客好评率高达99.9%!他是怎么做到的?

实践示例理解js强缓存协商缓存