当前位置:网站首页>Lingyunguang of Dachen and Xiaomi investment is listed: the market value is 15.3 billion, and the machine is implanted into the eyes and brain

Lingyunguang of Dachen and Xiaomi investment is listed: the market value is 15.3 billion, and the machine is implanted into the eyes and brain

2022-07-07 12:55:00 【leijianping_ ce】

RedI network Lei Jianping 7 month 6 Reported Wednesday

Lingyunguang Technology Co., Ltd ( abbreviation :“ Ling Yunguang ”, Ticker :“688400”) Listed on the scientific innovation board today .

Lingyunguang this release 9000 Thousands of stocks , Issue price 21.93 element , The total amount raised is 19.74 One hundred million yuan .

Lingyunguang's opening price is 33.48 element , Higher than issue price 52.67%; The closing price is 34.08 element , Higher than issue price 55.4%; At the closing price , The market value of lingyunguang is 153.36 One hundred million yuan .

Chairman of lingyunguang Yaoyi said :“ Today's success lies in A Shares of the listed , It's a rite of passage organized by Ling Yunguang , It is a new starting point for lingyunguang's development . Lingyun is proud of the achievements of the company , We are full of longing and expectation for the historical opportunities brought by machine vision and artificial intelligence for our career .”

Yao Yi said , Lingyunguang started his business from scratch , Based on optical technology innovation , Implant eyes and brains into machines . Lingyunguang continues to innovate products and technologies , near 20 Over the years , Accumulate advanced optical imaging 、 Intelligent software and Algorithm 、 Intelligent automation and other technology platforms and many products , Widely serve 3C Electronics 、 Printed packaging 、 New displays 、 New energy 、 Movie Animation 、 Scientific image 、 Rail transit and many other industries .

“ Looking back , Achievements in development , More hardships and challenges . In the face of difficulties , Lingyunguang's core management team and lovely Lingyun people are not afraid of difficulties , Unite as one , Strive all the way . Difficulties and hardships make you succeed .”

Annual revenue 24.36 Billion

Ling Yunguang has been engaged in machine vision and optical communication business for a long time , Serve multiple industries , At present, the strategy focuses on the machine vision business . The company is a configurable vision system 、 Professional supplier of intelligent vision equipment and core vision devices , It is one of the enterprises that entered the field of machine vision earlier .

Ling Yunguang has been deeply engaged in the machine vision industry chain for nearly 20 years , On the one hand, the online detection of gravure printing in RMB 、 The items such as Zhang inspection are traction , Establish the ability of independent research and development of vision system ; On the other hand , Establish long-term and stable agency business relationship with machine vision manufacturers , In China, it has established a system based on foreign machine vision technology and products , The ability to build multiple solutions to serve multiple application industries .

2006 Year begins , Ling Yunguang enters the printing and packaging 、 New displays 、 Consumer electronics, intelligent transportation and other industries . Through independent research and development and cooperation with leading domestic research units , Continuous accumulation optical imaging 、 Algorithm 、 Software patent technology R & D capability , The breakthrough and accumulation of key technologies have been realized ; meanwhile , Developed a series of configurable vision systems and intelligent vision equipment products , And independently develop industrial cameras 、 Light source and other core devices , It is widely used in many industries .

In the field of optical communication , Ling Yunguang mainly serves Romania RCS&RDS、 Jiangsu cable 、 China Radio and television and other domestic and foreign radio and television network companies . The company acts as an agent to sell vision devices of overseas well-known brands 、 Optical fiber devices and instrument products .

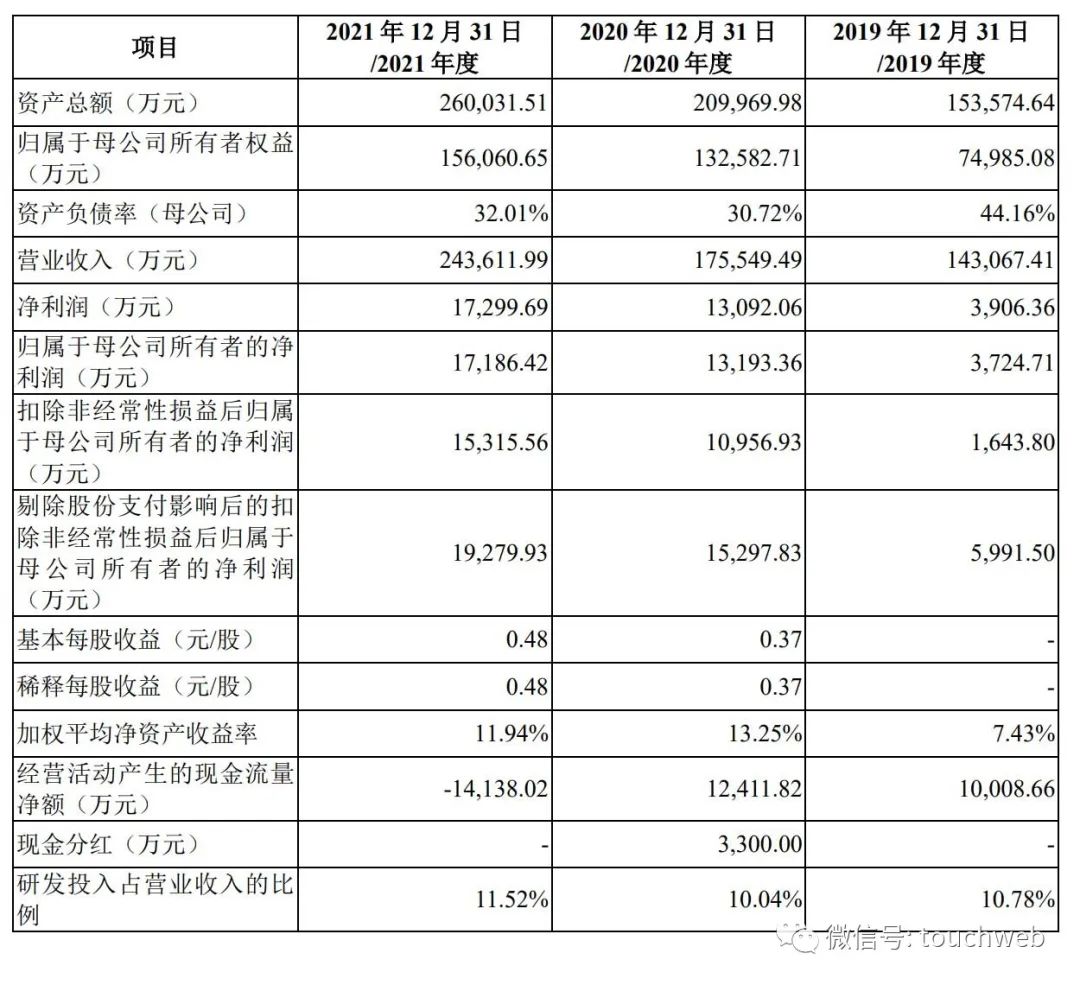

The prospectus shows , Ling Yunguang 2019 year 、2020 year 、2021 The annual revenue is 14.3 One hundred million yuan 、17.55 One hundred million yuan 、24.36 One hundred million yuan ; The net profit is respectively 3906 Ten thousand yuan 、1.3 One hundred million yuan 、1.73 One hundred million yuan .

Ling Yunguang 2019 year 、2020 Years and 2021 Annual R & D expenses plus deduction 、 The amount of tax preference such as VAT levy and refund is respectively 3695.35 ten thousand 、5431 Million and $ 8551.8 Ten thousand yuan , The amount of government subsidies included in the current profits and losses ( After deducting the value-added tax, the tax will be levied and refunded immediately ) Respectively 1587.9 ten thousand 、1476.88 Million and $ 2028.72 Ten thousand yuan , Total share of total profit ( Deduct the impact of share based payment ) The proportions of the two are respectively 60.72%、37% and 50.19%, It's high .

For Yao Yi and Yang Yi's husband and wife shop

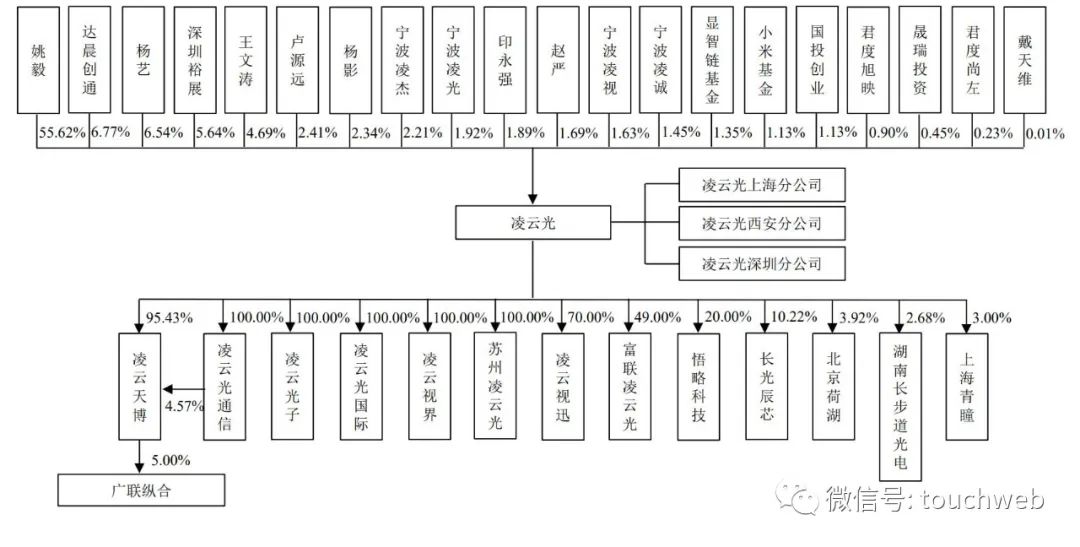

The controlling shareholder of Ling Yunguang is Yao Yi , The actual controller is Yao Yi and his spouse Yang Yi .

Yao Yi directly owns the company 200,237,818 shares , Of the total share capital of the company before issuance 55.62%; Yao Yi, as a limited partner of Ningbo Lingjie, indirectly holds the company 653,558 shares , Of the total share capital of the company before issuance 0.18%; Yao Yi, as a limited partner of Ningbo Lingguang, indirectly holds the company 130,712 shares , Of the total share capital of the company before issuance 0.04%; Yao Yi holds the company directly and indirectly 201,022,088 shares , Of the total share capital of the company before issuance 55.84%.

Yang Yi directly owns the company 23,539,767 shares , Of the total share capital of the company before issuance 6.54%.

Yaoyi and Yang Yi are husband and wife , Yao Yi and Yang Yi jointly control the company 223,777,585 shares , Of the total share capital of the company before issuance 62.16%; Yao Yi and Yang Yi hold the company directly and indirectly 224,561,855 shares , Of the total share capital of the company before issuance 62.38%.

meanwhile , Yao Yi is currently the chairman and general manager of the company , Yang Yi is currently the director and deputy general manager of the company , Can actually control the company in operation and management .

Sum up , Yao Yi is the controlling shareholder of the company , Yao Yi and Yang Yi are the actual controllers of the company .

Yao Yi ,1965 year 7 born ,1986 year 7 month , Graduated from northwest Telecommunication Engineering College, majoring in laser technology , Bachelor degree .1989 year 1 month , Graduated from Xi'an University of Electronic Science and technology, majoring in Electronic Physics and devices , Master degree .1994 year 12 month , Graduated from Northern Jiaotong University, majoring in communication signal and system , Doctoral degree .1995 year 1 Month to 1997 year 6 month , As a teacher of the optical wave Institute of Beijing Jiaotong University .1997 year 7 Month to 2002 year 8 month , Executive director of Beijing Lingyun Guangtong Technology Co., Ltd 、 The manager .2002 year 8 Month to 2020 year 9 month , Ren Yunguang, chairman of Ling Yunguang Co., Ltd .2020 year 9 Month so far , Chairman of the company 、 The general manager .

Yang Yi , Woman ,1970 year 5 born ,1992 year 7 He graduated from the Department of Engineering Physics, Tsinghua University, majoring in Engineering Physics , Bachelor degree .1992 year 7 Month to 1994 year 7 month , Serve as a technician of Beijing nuclear instrument factory .1994 year 7 Month to 1996 year 8 month , Ren us EG&G Marketing Manager of the company's China Representative Office .

Yang Yizai 1996 year 8 Month to 2002 year 8 month , Prepare for the establishment of Beijing Lingyun Guangtong Technology Co., Ltd. and serve as a supervisor after its establishment .2002 year 8 Month to 2020 year 9 month , Director of Ling Yunguang Co., Ltd 、 The manager .2016 year 5 From January to now, he has served as the director of Lingyun Tianbo .2020 year 9 Month so far , To be a director of the company 、 Deputy general manager .

Besides , Dachen chuangtong holds shares of 6.77%, Shenzhen Yuzhan holds 5.64%, Wang Wentao holds shares of 4.69%, Lu Yuanyuan holds shares of 2.41%, Yang Ying's shareholding is 2.34%, Ningbo Lingjie holds shares of 2.21%, Ningbo Lingguang holds shares of 1.92%, Xiaomi Fund 、 The shares held by SDIC venture capital are 1.13%.

IPO after , Yao Yi's shareholding ratio will be reduced to 43.53%, Yang Yi's shareholding ratio decreased to 5.12%, However, Yao Yi and Yang Yi are still the actual controllers of the company , Total controlling company 48.65% shares .

Dachen chuangtong holds shares of 5.30%, Shenzhen Yuzhan holds 4.42%, Wang Wentao holds shares of 3.67%, Xiaomi Fund 、 The shares held by SDIC venture capital are 0.88%.

———————————————

Lei Di was founded by Lei Jianping, a senior media person , If reproduced, please indicate the source .

边栏推荐

- Enterprise custom form engine solution (XII) -- experience code directory structure

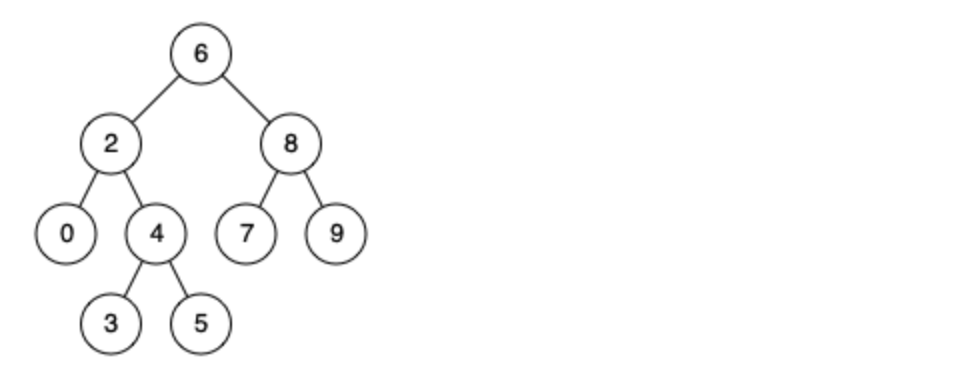

- Leetcode brush questions: binary tree 19 (merge binary tree)

- Session

- MPLS experiment

- . Net ultimate productivity of efcore sub table sub database fully automated migration codefirst

- 2022-07-07 Daily: Ian Goodfellow, the inventor of Gan, officially joined deepmind

- 2022a special equipment related management (boiler, pressure vessel and pressure pipeline) simulated examination question bank simulated examination platform operation

- 聊聊Redis缓存4种集群方案、及优缺点对比

- visual stdio 2017关于opencv4.1的环境配置

- Several ways to clear floating

猜你喜欢

Day-16 set

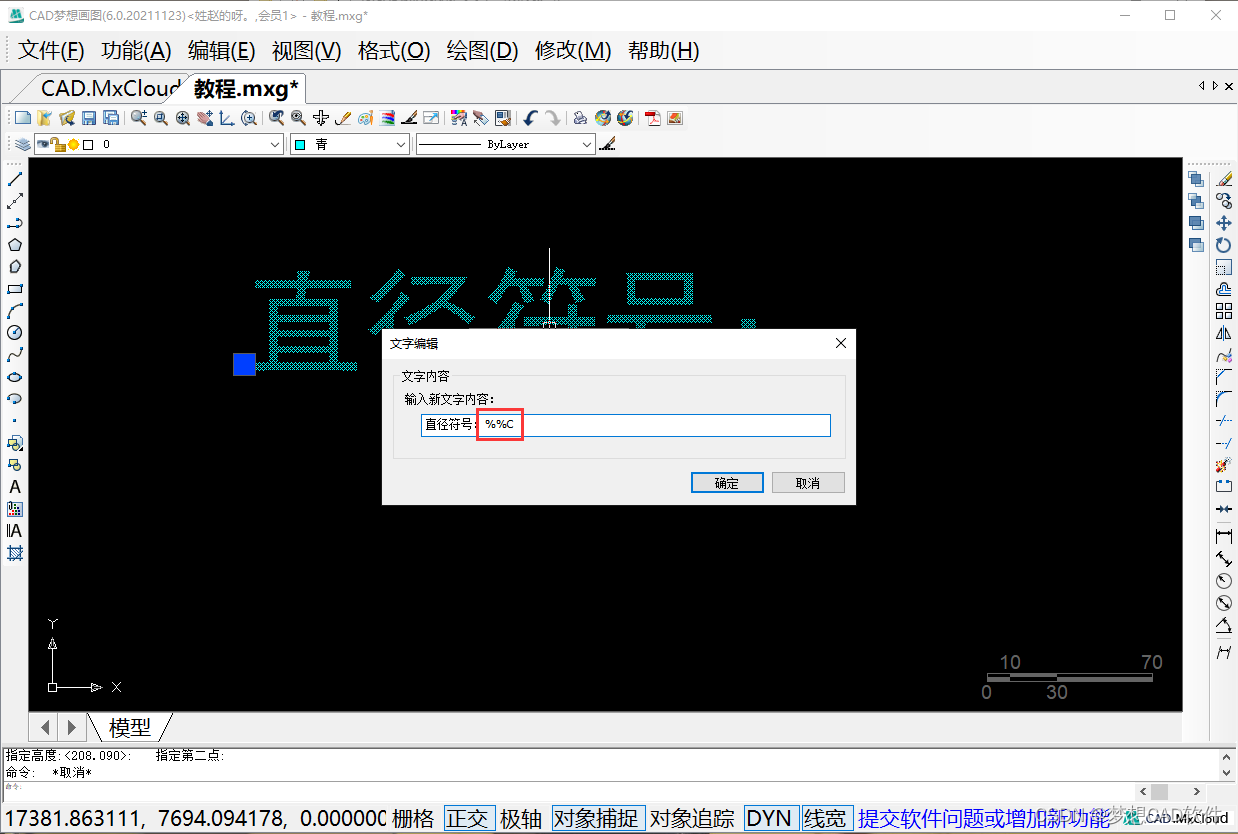

AUTOCAD——大于180度的角度标注、CAD直径符号怎么输入?

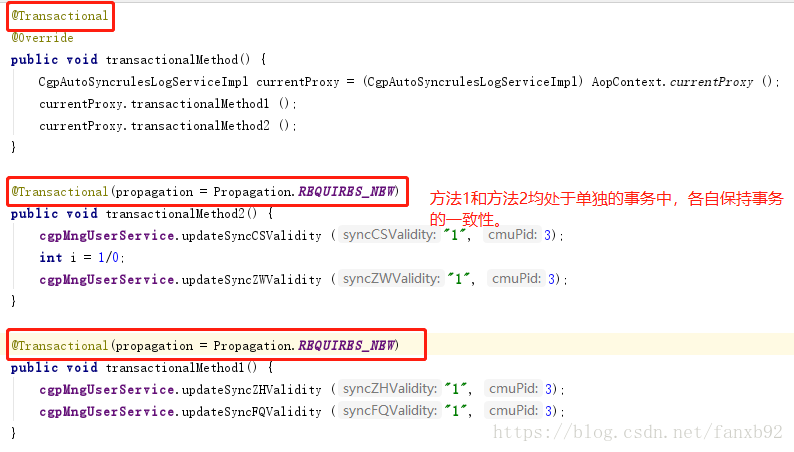

如何将 @Transactional 事务注解运用到炉火纯青?

Leetcode skimming: binary tree 23 (mode in binary search tree)

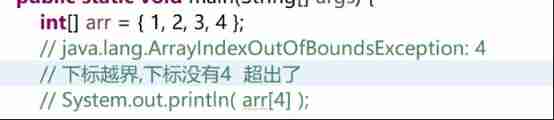

Common knowledge of one-dimensional array and two-dimensional array

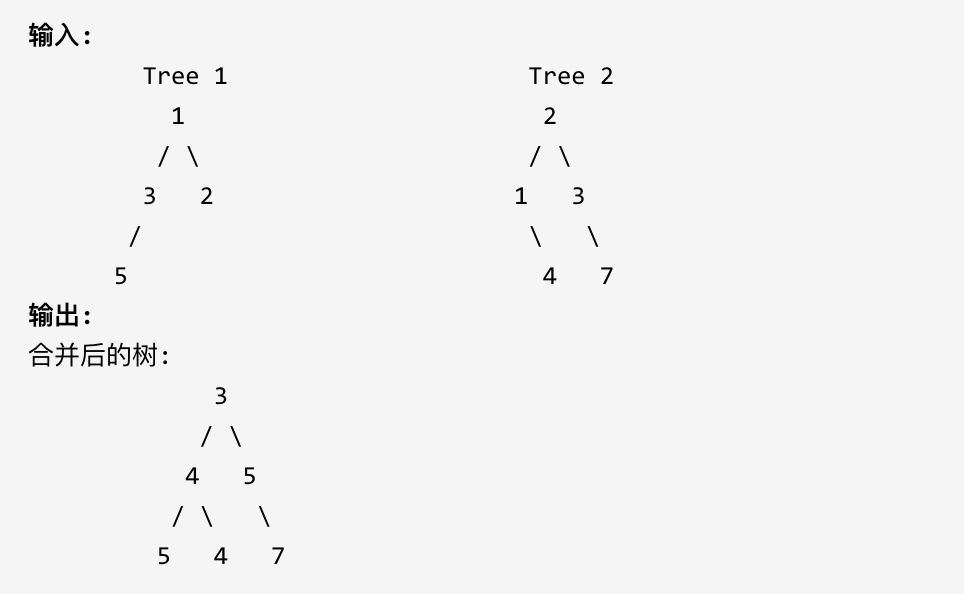

Leetcode brush questions: binary tree 19 (merge binary tree)

达晨与小米投的凌云光上市:市值153亿 为机器植入眼睛和大脑

2022 practice questions and mock examination of the third batch of Guangdong Provincial Safety Officer a certificate (main person in charge)

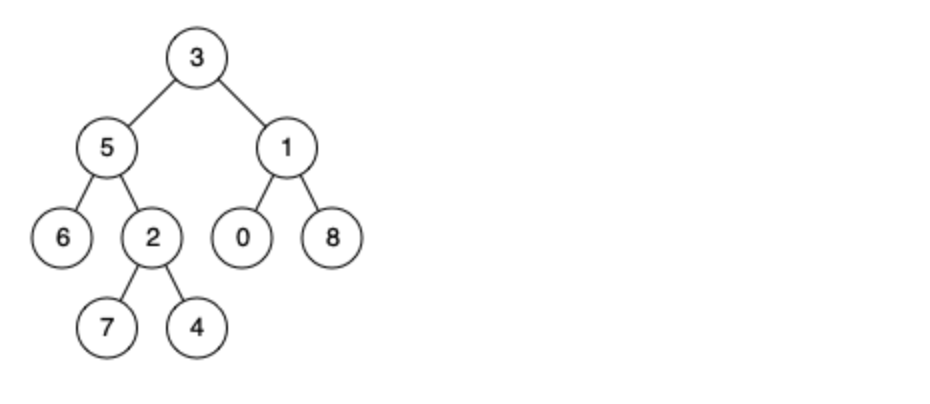

Leetcode brush question: binary tree 24 (the nearest common ancestor of binary tree)

leetcode刷题:二叉树25(二叉搜索树的最近公共祖先)

随机推荐

layer弹出层的关闭问题

[statistical learning method] learning notes - logistic regression and maximum entropy model

Common knowledge of one-dimensional array and two-dimensional array

Day-17 connection set

About IPSec

怎样重置火狐浏览器

环境配置篇

Leetcode skimming: binary tree 22 (minimum absolute difference of binary search tree)

Airserver automatically receives multi screen projection or cross device projection

[爬虫]使用selenium时,躲避脚本检测

What if does not match your user account appears when submitting the code?

Error in compiling libssl

关于 appium 启动 app 后闪退的问题 - (已解决)

2022-07-07 Daily: Ian Goodfellow, the inventor of Gan, officially joined deepmind

Preorder, inorder and postorder traversal of binary tree

Session

高瓴投的澳斯康生物冲刺科创板:年营收4.5亿 丢掉与康希诺合作

【无标题】

xshell评估期已过怎么办

How does MySQL create, delete, and view indexes?