当前位置:网站首页>FEG founder rox:smartdefi will be the benchmark of the entire decentralized financial market

FEG founder rox:smartdefi will be the benchmark of the entire decentralized financial market

2022-07-05 00:50:00 【Hydrocarbon shell blockchain】

2021 year , We have witnessed the fast pace of the encryption market , The whole field of encryption is surging , Detonated the whole market in a short time , But with the overexploitation of one project after another , Steal pool , Running and other conditions occur frequently , After the carnival, a chicken feather , Conventional DeFi The market has evolved into a “ Lousy play ”, After that DeFi All kinds of innovations have been carried out , But the pace is very slow . In this context ,FEGex founder ROX Mr. thought of SmartDefi Concept , Through a series of new mechanisms, the relationship between liquidity providers and participating users is changed, and finally an intelligent , Secure platform system . Although its durability needs to be tested by the market , But its arrival made it clear DeFi The market is actively carrying out new exploration and reform .

DeFi The reason for its existence is the democratization of the financial world , Decentralization is desirable , Because it makes it difficult for organized groups to collude and manipulate the rules in their favor , It is not a public interest .DeFi Promise to create an unlicensed financial world , Ordinary users are authorized to pursue their financial freedom . However, more and more projects use this concept to start sneaky activities , Driven by the environment , Protecting the security of user assets has become FEG founder ROX Sir's primary goal , Time consuming 8 Months ,SmartDefi emerge as the times require .

SmartDefi agreement

SmartDefi By FEG Chief developer FEGrox A blockchain designed independently coin agreement . be based on SmartDeFi Each project issued under the agreement has a built-in base price pool - Behind every project is BNB,ETH Or the supporting assets of stable currency , These assets will be for each SmartDefi The project provides value endorsements . The base price pool is built into SmartDeFi Agreement contract , Not managed by any third party . The assets of the base price pool come from SmartDefi Every deal ,SmartDefi The project deployer can configure the purchase order / A fixed percentage of sales allocated to the base price pool .

The role of the base price pool

When every time SmartDefi coin Transaction time , Buy or sell , The assets of the base price pool will increase , This makes each SmartDeFi coin The benchmark will never fall - It can only rise ! And benefit from FEG Ecological fWrap Dividend mechanism , Even in SmartDefi coin When the trading volume is zero , The base price pool is fwrap Our supporting assets will also be rising passively .

If the market price falls below the benchmark , Investors can burn coin Take out the corresponding supporting assets in the token base price pool to realize arbitrage , This mechanism can ensure that the market price of each project will hardly be lower than its base price pool price . all SmartDefi Holders can 100% Safely hold SmartDeFi coin, Because of every SmartDeFi coin Will always have value —— Even if the market price falls to zero (0)

SmartDefi coin The base price pool is transparent on the blockchain , Investors can estimate the risk of investment even before trading . By comparing the premium between the market price and the base price , And the transaction volume of the project coin Future base price trend , We can finally answer When Moon( When will we land on the moon ) That's the question .

all SmartDeFi coin With its own deflation dividend mechanism . Already burning coin( Inside the black hole address ) It will forward its corresponding base price pool assets to coin, Over time , Burning in a black hole coin Will increase gradually , This will increase the exchange ratio of the base price pool corresponding to each item in the circulation market , So as to accelerate the growth rate of the project base price .

SmartDefi Other features

- Support self-service deployment of third-party projects , adopt fegdeployer Website , Anyone can deploy with one click SmartDefi project , Save development expenditure and time cost

- all SmartDefi coin Built in flow pool , The liquidity pool is permanently locked , Completely avoid the risk of flow pool extraction ( Some time ago, the squid coin ran away in SmartDefi Our world will never happen ). Because the flow pool is built-in , all SmartDefi coin There is no need to go through a third party, such as uniswap or pancakswap etc. AMM To realize the transaction

- Built in intelligent interest free lending function .SmartDefi Investors can hold by mortgage at any time SmartDefi coin Take out the supporting assets corresponding to the base price pool , This will greatly improve the utilization of capital . The loan agreement does not need to rely on third-party market prices ( The loan uses the built-in base price pool price ), Sure 100% Avoid the risk of price Oracle attack . During the loan period , Users can also lend at any time by repaying the loan and then lending coin The corresponding growth amount of supporting assets .

summary

DeFi The reason why risk management in is so challenging , Because it is not consistent with the traditional risk management theory in financial instruments . For decades, , The capital market has been developing around the risk management model of market factors such as volatility , Now? , By using automated financial technology ( Intelligent contract ) Replace these intermediaries , DeFi It has achieved an unprecedented level of financial Automation , But it also introduces a new risk vector that we have never seen before , This shows the future Defi The development trend must be to pay attention to safety , Reduce the risk of each project ,SmartDefi The birth of , It will change the traditional law of the previous market , Become the benchmark of the whole decentralized financial market .( notes :2022 year 2 month 16 Japan ,SmartDefi The agreement will be formalized in FEGex go online .)

边栏推荐

- 【Unity】InputSystem

- User login function: simple but difficult

- Specification for fs4061a boost 8.4v charging IC chip and fs4061b boost 12.6V charging IC chip datasheet

- 多模输入事件分发机制详解

- There is a new Post-00 exam king in the testing department. I really can't do it in my old age. I have

- 基本放大电路的学习

- 6. Scala operator

- (script) one click deployment of any version of redis - the way to build a dream

- Verilog tutorial (11) initial block in Verilog

- RB technology stack

猜你喜欢

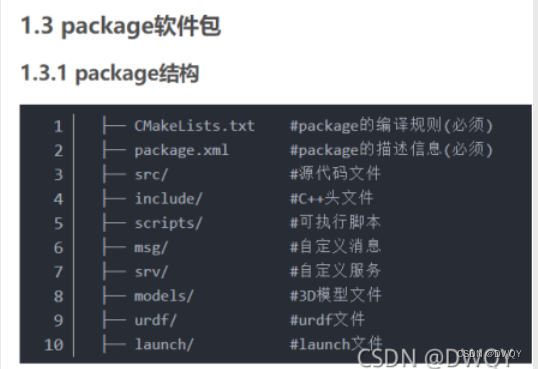

初识ROS

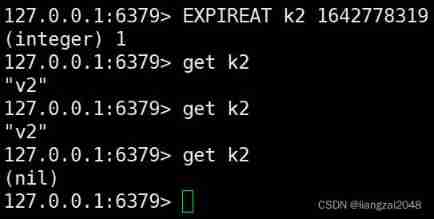

Basic concept and usage of redis

What if the programmer's SQL data script coding ability is weak and Bi can't do it?

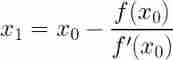

Visual explanation of Newton iteration method

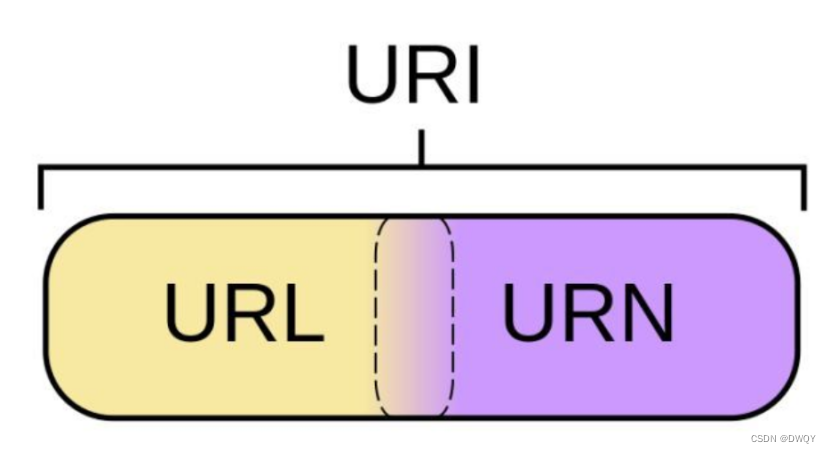

URL和URI

Complete knapsack problem (template)

POAP:NFT的采用入口?

Hill sort of sorting

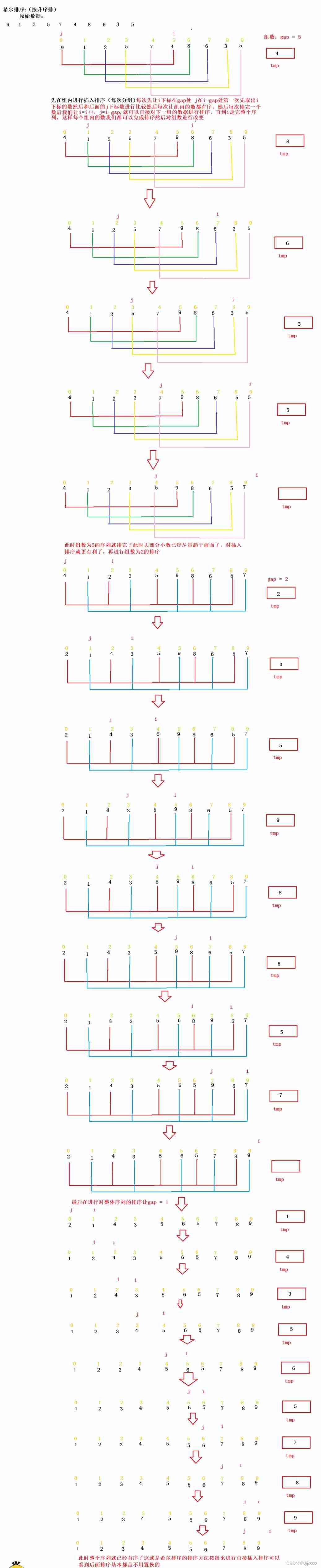

2022.07.03 (LC 6108 decryption message)

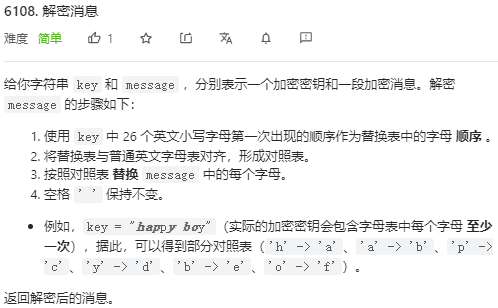

2022.07.03(LC_6111_统计放置房子的方式数)

随机推荐

Implementation steps of master detail detail layout mode of SAP ui5 application

(脚本)一键部署redis任意版本 —— 筑梦之路

MongoDB系列之学习笔记教程汇总

【selenium自动化】常用注解

GDB common commands

每日刷题记录 (十三)

Playwright recording

Query for Boolean field as "not true" (e.g. either false or non-existent)

【报错】 “TypeError: Cannot read properties of undefined (reading ‘split‘)“

Liangzai's first program life and annual summary in 2022

AcWing164. 可达性统计(拓扑排序+bitset)

初识ROS

const、volatile和restrict的作用和用法总结

P4281 [ahoi2008] emergency assembly / gathering (LCA)

大专学历,33岁宝妈又怎样?我照样销售转测试,月入13k+

“薪资倒挂”、“毕业生平替” 这些现象说明测试行业已经...

The most complete regular practical guide of the whole network. You're welcome to take it away

“薪資倒掛”、“畢業生平替” 這些現象說明測試行業已經...

【C】 (written examination questions) pointer and array, pointer

Fs8b711s14 electric wine bottle opener MCU IC scheme development special integrated IC