当前位置:网站首页>Industry case | insurance companies of the world's top 500 construction standards can be used to drive the business analysis system

Industry case | insurance companies of the world's top 500 construction standards can be used to drive the business analysis system

2022-08-05 02:26:00 【Apache Kylin】

2021year is introduced Kyligence The first year of engine power,We focus on the construction and integration of the platform and the landing of some key applications,well accomplished goal.With the joint efforts of both project team members,We have completed the platform construction、集成对接、Production of the guarantee、Personnel training and other preparations;归纳出了 Kyligence Enterprise Usage Guidelines and Best Practices in Our Company;Completed the launch of multiple applications;Guarantee the successful reporting of the group business data analysis project,Gain the trust and unanimous praise of the business team.

—— 世界 500 强保险企业

1. Industry status and pain points

With the macroeconomic、行业、Constantly changing market and customer needs,叠加疫情因素,Since the insurance agent 2019 年冲上 912 After the high of 10,000 people, it will enter the downward channel,rough in the past“人海战术”难以为继.Property insurance especially auto insurance,The combined ratio has remained high for a long time,2021 In the first half of the year, the comprehensive rate of auto insurance in the property insurance industry was as high as 99.9%.For insurance companies,Constructing a management analysis system with indicators as the core、Data-driven business growth is the key to digital transformation.Metrics are essential to guide business decisions,Kyligence The insurance company it serves has built its own indicator platform in the early days,The goal is to look at the business panorama,to unify indicator management、Unified definition of caliber、The unified data services,The underlying engine of its indicator platform was originally based on Druid 创建,But with the multiple iterations of the indicator platform,Gradually the following problems arise:

- Customized development of indicators,大量重复工作:The definition of indicators requires repeated communication with the business,Customized development by the data development team;Chimney development for each indicator,定制化配置,There is a lot of duplication between development groups;

- 非标准 SQL:Druid Low support for table associations,Not friendly to dimensional model queries,增加了开发难度;

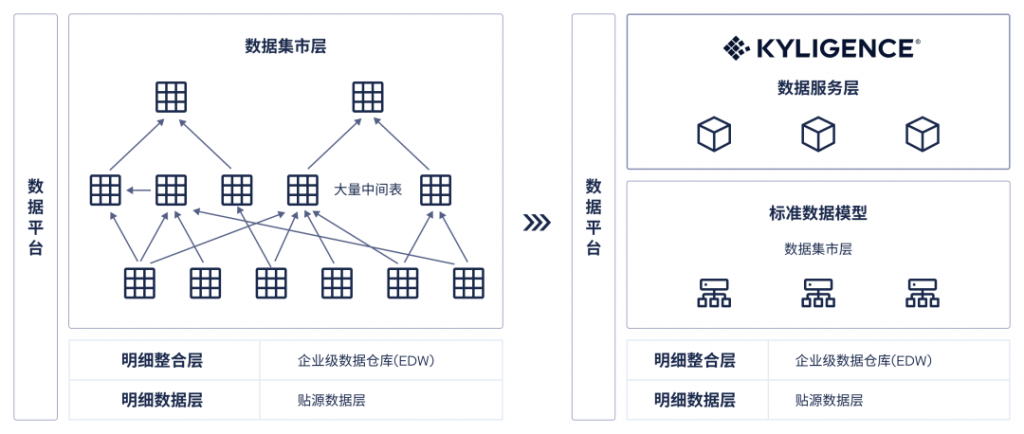

- Limited support scenarios,运维成本高:Data marts need to process wide tables in order to meet query performance requirements,Generate a large number of intermediate tables,后期运维成本高;Does not support the addition of high kidimensional dimensions,Cannot support precise deduplication scenarios.

2. Kyligence 应用场景 + 解决方案

2021年,The enterprises to choose Kyligence Intelligent Multidimensional Database Products and Solutions,Build a business analysis system with indicators as the core,Serving multiple business scenarios,以数据驱动业务增长.

应用场景 1: Business Enables Self-Service Analytics

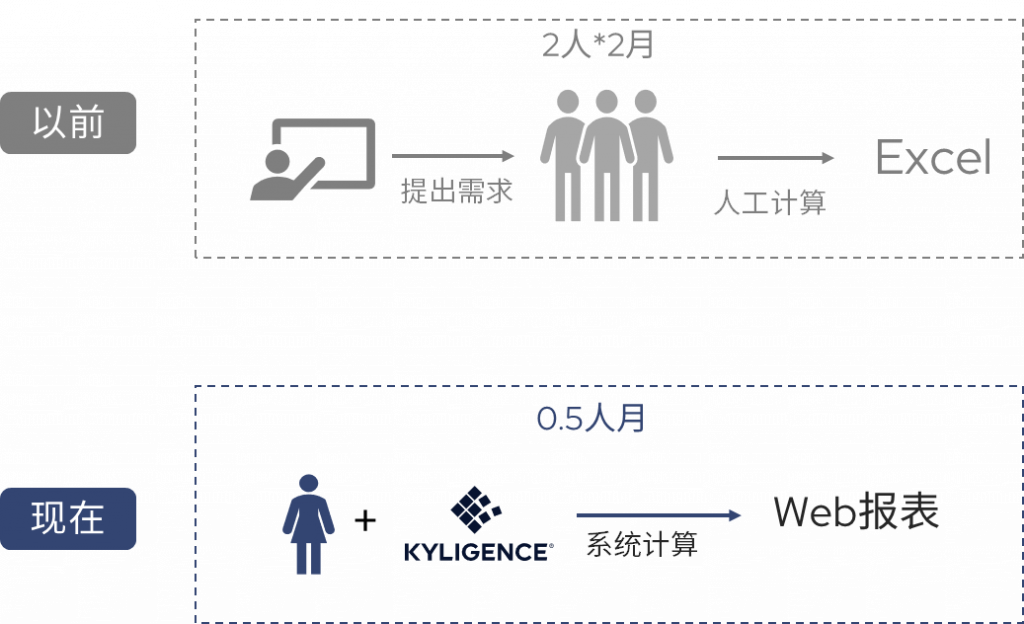

Insurers seek to control and optimize costs、提高人效,Salesperson cost analysis and other work are essential.The insurance company currently has tens of thousands of business personnel contributing to its performance,They belong to different organizations,Bringing premium income to businesses from different sources.以往,business analysts are「Artificial access + Excel 制作报表」data analysis and reporting to leadership.After roughly determining the analysis idea,需要进行以下工作:

- Data analysts need a lot of back-and-forth with data development engineers;

- Data development engineer manually fetches data;

- 数据分析师使用 Excel Make reports.

然而,This method is less efficient,And there are the following pain points:

- Analysts are often interrupted by communication and waiting to get numbers;

- 受限于 Excel Data processing capability and fetch cycle,The dimension has to be trimmed during analysis,only see a small part of the data,Difficult to perform multidimensional analysis and presentation on large datasets;

- Data analysis report display effect is unsatisfactory,Self-service analytics is not possible.

因此,The company hopes to achieve this in scenarios such as salesperson cost analysis:

- Interactive query based on massive data:The insurance company has an average annual number of insurance policies exceeding several billion,Analysts expect rapid analysis on tens of billions of data,Keep your analytical thinking coherent;At the same time, it is hoped that a flexible report will be made directly based on this data after the analysis is completed.,for reporting;

- Conduct multi-dimensional cross-analysis:When reporting data analysis results,Often explained from total to points,Requirements analysis tools can support the product、队伍类型、Flexible slicing under multi-dimensional combinations such as institutions、切块、Drill down and other analytical capabilities;

- for flexible data processing:Personnel attribution、Category attribution, etc., need to be adjusted according to different reporting purposes,Analysts want to do it themselves.

采用 Kyligence After products and solutions,The property insurance companies to realize integration of cost analysis required dimension and measurement data,在 Kyligence Landing as a multidimensional model,so as to realize the product、队伍、机构、Multiple dimension pairs such as business sourceDetailed data of tens of billions of insurance policiesDo self-service analysis,and complete the report,Improve business analysis and decision-making efficiency:

- Integrate data models:Integration of the data,get a product that contains、队伍、Multidimensional star schema for key analytical perspectives such as agency and time,Provide a richer analytical perspective;

- Minimalist Smart Modeling:通过 Kyligence 接入数据,Rapid Visual Modeling,No code throughout the development process,Significantly shorten the demand lead time;借助 Kyligence AI 增强引擎,Intelligent acceleration of critical queries,No need for tedious model design optimization;

- BI Direct connection analysis:借助 Kyligence Enterprise 的 Model as View 功能,Analytics users do not need to BI Repeated modeling on tool,direct dimension、Measure implement drag and drop analysis,并支持在 BI Perform secondary calculation in the tool to process the business source.

应用场景 2: Optimizing the middle-end structure of indicators

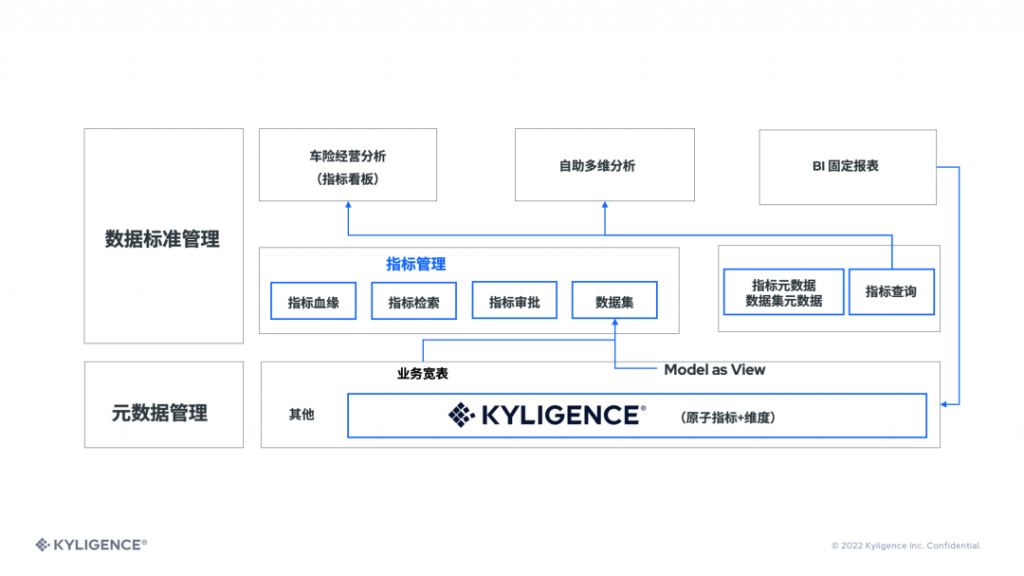

The indicator center is used to manage the definition of indicators、查找、开发、important functions such as publishing,At the same time, it also provides business front-end applications such as auto insurance business analysis. API 服务.The goal of index middle platform construction is to ensure the unified management of the caliber and index of the whole company、统一出口,The bottom layer relies on the wide table processed by the data mart as a data source for development,The development process is long.

选用 Kyligence After products and solutions,The property insurance company has gradually realized the standardized management of the index system and unified index service,Significantly improved business self-service analysis capabilities:

- Seamlessly connect business front-end applications:In the aspect of index query,利用 Model as View 能力,将在 Kyligence complex models created in,Display in the form of a wide table,Reduce wide table development,应用端 SQL No need to introduce complex table associations,即可满足;

- 精准推荐、Faster query response、自优化:利用 AI 智能推荐引擎,Collect the query behavior of business personnel,Subsequent recommendations for more accurate indexes,Support high-performance and high-concurrency queries at the same time.

应用场景 3: Market layer low-code development

Data mart as the docking layer of various analysis systems,In order to meet the query performance requirements of the application layer,Need to process a large number of large wide tables.in the insurance company,In the past, dimensions were on-demand chimney processing.,Any changes in the needs of the business unit,need to modify the code、Go through the official release process to achieve,存在以下痛点:

- IT High maintenance costs for the department,开发周期长,Data processing link length,依赖关系复杂;

- 数据烟囱多,导致数据冗余;

- Referencing each other between bazaar groups,No full design specification.

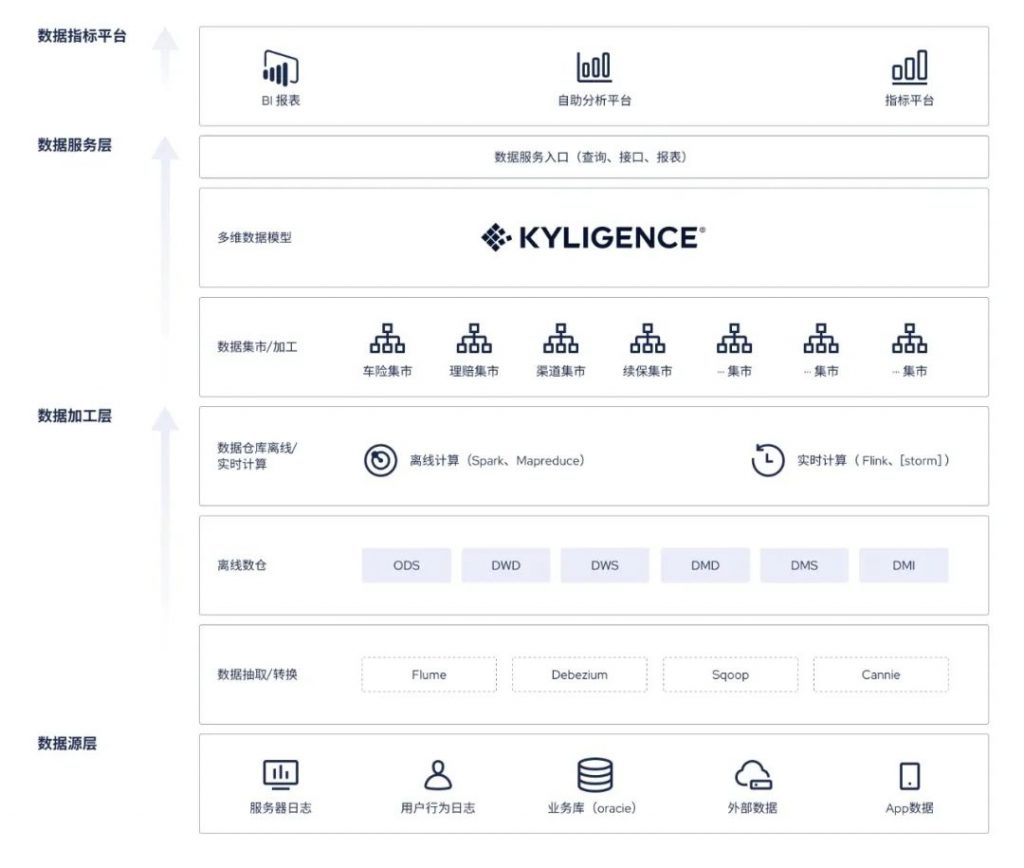

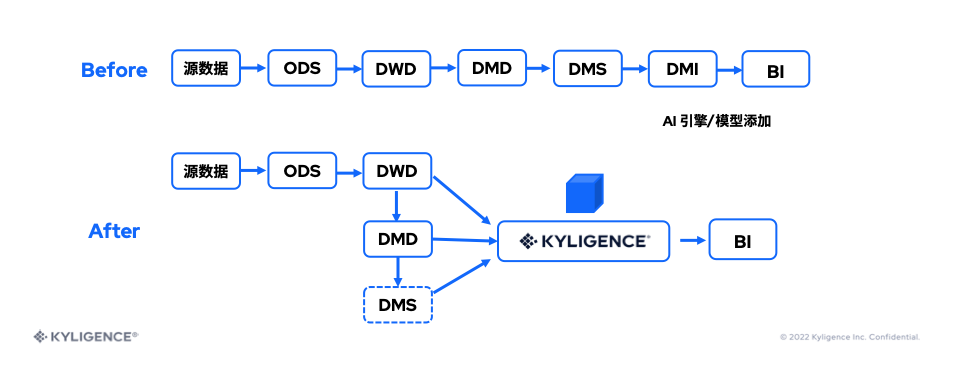

The enterprise before the number of warehouse processing link,分为 ODS 贴源层、DWD 数仓明细层、DMD Market detail layer、DMS 轻度汇总层、DMI 接口层等,Staggered cross between layers,There are references to each other.The property insurance company wants to reduce link development at the data mart layer,Building standard dimensional modeling models,The machining process after reducing the dimensional model,降低维护成本,Low code of mart layer.

选用 Kyligence After products and solutions,Enterprises can directly connect to the data warehouse detail layer、Market detail layer、和轻度汇总层,Also supports association between tables、as well as standard star and snowflake structures,之后由 Kyligence Model unified service,complete for various BI 的对接.

Through the transformation of the market floor,Reduce the development of a large number of intermediate tables and wide tables,Shorten data processing links,大约可以节约 30% 的开发成本.此外,由 Kyligence Model provides query service,Query response in seconds or even sub-second;Unified data model,Implement a set of models to interface with multiple services,Completed the unification of data caliber.

3. harvested results

自 2021 年引入 Kyligence 后,the world 500 Strong insurance companies have realized the implementation of multiple scenarios and key applications,实现了:

- Self-service analysis supporting massive data:Business self-service analytics data from the original十几万条扩展到 120亿+ 条明细数据,It meets the self-service analysis needs of business personnel and analysts for massive data;

- 提升 IT 部门的工作效率:According to have market subject statistics,减少了 30% The data mart temporary table and wide table around,减少 IT Custom development workload for personnel,实现 IT New Collaboration Models with Business;

- To improve data analysis experience:65% 查询在 1s 内响应,91% 查询在 3s 内完成,At the same time, it supports scenarios such as precise deduplication,Under the premise of not affecting the usage habits of business personnel,Greatly improve the efficiency of query analysis.

在服务众多行业领先客户的过程中,Kyligence Continuously polish its own enterprise-level products and solutions,At the same time, provide customers with continuous and reliable platform operation and technical services.如果您对上述产品及解决方案感兴趣,欢迎致电 400-865-8757 与我们取得联系.

关于 Kyligence

上海跬智信息技术有限公司 (Kyligence) 由 Apache Kylin 创始团队于 2016 年创办,致力于打造下一代企业级智能多维数据库,为企业简化数据湖上的多维数据分析(OLAP).通过 AI 增强的高性能分析引擎、统一 SQL 服务接口、业务语义层等功能,Kyligence 提供成本最优的多维数据分析能力,支撑企业商务智能(BI)分析、灵活查询和互联网级数据服务等多类应用场景,助力企业构建更可靠的指标体系,释放业务自助分析潜力.

Kyligence 已服务中国、美国、欧洲及亚太的多个银行、证券、保险、制造、零售等行业客户,包括建设银行、浦发银行、招商银行、平安银行、宁波银行、太平洋保险、中国银联、上汽、Costa、UBS、MetLife 等全球知名企业,并和微软、亚马逊、华为、Tableau 等技术领导者达成全球合作伙伴关系.目前公司已经在上海、北京、深圳、厦门、武汉及美国的硅谷、纽约、西雅图等开设分公司或办事机构.

边栏推荐

- 关于#sql shell#的问题,如何解决?

- 常见的硬件延迟

- 1349. Maximum number of students taking the exam Status Compression

- 直播回放含 PPT 下载|基于 Flink & DeepRec 构建 Online Deep Learning

- PHP技能评测

- How do programmers without objects spend the Chinese Valentine's Day

- js中try...catch和finally的用法

- 力扣-二叉树的最大的深度

- ARM Mailbox

- Live playback including PPT download | Build Online Deep Learning based on Flink & DeepRec

猜你喜欢

随机推荐

Jincang database KingbaseES V8 GIS data migration solution (3. Data migration based on ArcGIS platform to KES)

select 标签自定义样式

Flink 1.15.1 集群搭建(StandaloneSession)

树形查找(二叉查找树)

RAID disk array

select tag custom style

【存储】曙光存储DS800-G35 ISCSI各映射LUN给服务器

ARM Mailbox

CPDA|运营人如何从负基础学会数据分析(SQL)

How to simply implement the quantization and compression of the model based on the OpenVINO POT tool

没有对象的程序员如何过七夕

Pisanix v0.2.0 released | Added support for dynamic read-write separation

进程在用户态和内核态的区别[独家解析]

How do programmers without objects spend the Chinese Valentine's Day

The 2022 EdgeX China Challenge will be grandly opened on August 3

SDC简介

leetcode 15

[parameters of PyQT5 binding functions]

继承关系下构造方法的访问特点

C language basics -- pointers