当前位置:网站首页>B. protocal has 7000eth assets in one week!

B. protocal has 7000eth assets in one week!

2020-11-10 08:34:00 【Gavin talking about defi】

B.protocal The aim is to include MakerDao The liquidation of all the collateral assets in the agreement in extreme cases , The market has 20 Billion dollars , This is the time to do toB The market plate is not too big , But it will rise with the growth of the business it serves . although B.protocal It's still in its infancy , There are many unknowns , But for the following reasons, I think it's worth paying attention to :1. They asked the right questions , There are very few projects that do this ;2. With key partners MakerDao Keep a close relationship ;3. founder Yaron Velner Experience in encryption projects , Once in the Kyber Network For two years CTO, It's also WBTC Co designer of the agreement .

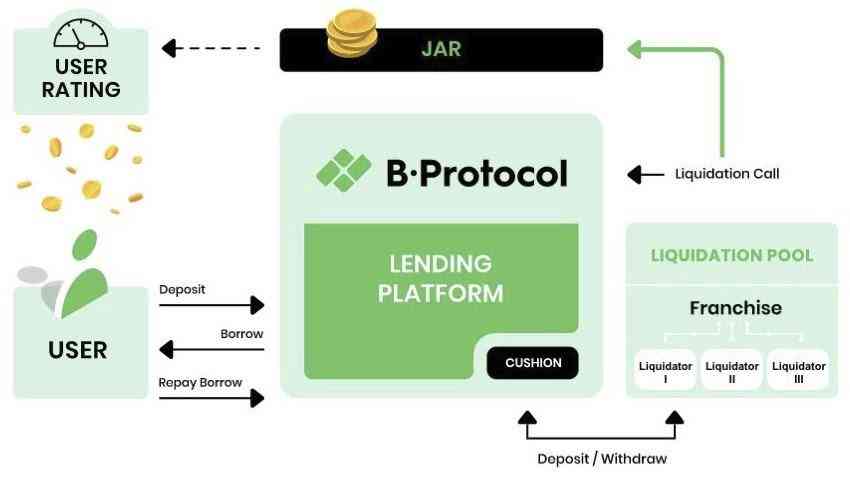

10 month 27 Japan , be based on MakerDAO Of B.Protocal Published online .B.Protocal It's an extreme market situation ( Like this year 3 month ) Settlement agreement , It can protect the mortgage of borrowing users as little as possible : When the debt of users who mortgage and borrow in the platform exceeds their collateral , It will trigger the liquidation mechanism ,B.Protocal Allow the liquidator to pay the debt of the borrowing user in exchange for some collateral , At the same time, liquidity providers are encouraged to share profits with borrowing users , In exchange for priority .

By the end of 11 month 5 The day has come 7000ETH from MakerDAO Import to B.Protocal in .

About B.Protocol

B.Protocol By encouraging liquidity providers to allow the liquidation of uncollateralized loans , And transfer the profits extracted by miners back to the users of the platform , So as to make the lending platform more secure .B.Protocol from Yaron Velner found , He was Kyber Network Of CTO and WBTC Co designer of the agreement .

Since earlier this year “ Black Thursday ” Since the price crash ,DeFi The field faces the risk of large-scale liquidation .B.Protocol Through innovative incentive mechanism to solve this problem .

Although this is MakerDAO Integrated lenders provide potential benefits , but B.Protocol After last week's launch , There's a part of the sound that gets Maker Of oracle I'm worried about the right to vote .

B.Protocol The founder of Yaron Velner I answered about this week B.Protocol、 lately MakerDAO Voting and the potential for future cooperation between projects .

interview

**Nate:** What is? B.Protocol, How it works ?

Yaron: B.Protocol By providing clarity to participants 、 Quantifiable incentives , send DeFi The lending platform is more stable , At the same time, the extractable value of the miner (MEV) Transfer to users , So that users can get more income from their lending platform , At the same time, it helps to protect its funds .

A week ago , We are MakerDAO For the first time , up to now , There has been a 7000 individual ETH Of the mortgage assets from MakerDAO The vault has been imported into B.Protocol.

User pass B.Protocol Smart contract management interface can import MakerDAO Vault , Gain and MakerDAO The same clause in 、 You can share the clearing proceeds and get voting rights in the next agreement upgrade .

Nate:B.Protocol How is it with MakerDAO Implementation of the interface , To call which parts of the system ?( for example Vaults Vault ,oracle etc. )

Yaron: B.Protocol Integrate with the vault system in a non licensed way , In order to enable the liquidators to share the liquidation profits fairly , We use MakerDAO Of OSM modular , The module determines in the vault system one hour in advance ETH / USD The price of .

MakerDAO Governance decisions allow OSM Integrate , It may be that you want to monetize it at some point , Be similar to Chainlink The profit model of .

**Nate:** What makes you want to create B.Protocol?

**Yaron:** exceed 40 Million dollars DeFi Funds rely heavily on reasonable liquidation procedures . In the traditional financial world , Such a platform forms a professional “ brace ”, That means they inspire experienced people algo Traders , Make them willing to take on a certain amount of liquidation in a market crisis .

stay DeFi in , The way is to outsource the process to the public . This unlicensed approach is very much in line with the spirit of blockchain , But it leads to almost zero incentives to build a real clearing system that can handle large amounts of money . Besides , Because there will be competition among the liquidators , Any attempt to encourage the clearing price premium form , Will eventually transfer a lot of value to high gas The miners .

This leads to events like Black Thursday , The liquidation process failed , This makes DeFi The platform has a high daily demand for collateral agents . for example , stay MakerDAI in , Every time you lend 100 The dollar has to have 150 Dollar collateral , And in the Bitmex, borrow 100 The dollar just needs to have 101 Dollar deposits . therefore ,Bitmex Allow you to be in ETH Be long on the price x100 times , and MakerDAO Only x3 The lever of .

In order to make DeFi The platform provides such terms , It needs a real backing .

Nate: Borrowed tokens are used to vote for the most recent MKR Administrators . Can you describe how the process works ? for example , Borrowing and trading order

**Yaron:** Technically speaking , First ETH It's from dYdX The flash loan ( Because they provide about 2000 Thousands of dollars in ETH Money , And there's no charge for flash loans ). And then this ETH Be deposited Aave, MKR On loan ( In the process, the service charge is almost 0, It's not a flash loan 0.1% Service Charge ). then ,MKR By “ lock ” stay MakerDAO In the voting contract , Have the right to vote , And a vote was taken . then “ lock ” Of MKR Be released , Back to Aave, then ETH Was taken out , Back to dYdX. It all happens in one thing .

** Nett :**B.Protocol Why vote with borrowed votes ?

**Yaron:** And MakerDAO After system integration , We had to go deep into the code . It was originally for the liquidation process , And then when our proposal is put to the vote , We are curious about the way the voting process works .

We quickly realized that it was lightning friendly . After months of understanding MakerDAO After the team and the ecosystem , We're pretty sure they know about this feature , And it's a false assumption that they're willing to tolerate . We decided to show it , So it can start some technical discussions , And as a by-product , It can also push for approval of proposals .

Voting is deploying B.Protocol Smart contract executed by the same account , We have no intention of hiding our actions . What we didn't realize was that , It is also possible that the day's attacks were carried out for malicious purposes . result ,MakerDAO The foundation had to take emergency measures .

For let MakerDAO 's team works under pressure , And no more responsible disclosure , We apologize .

**Nate:** If not in 10 month 26 It was passed on Monday ,MakerDAO The monthly governance cycle may be delayed B.protocal Vote for ( Because it's every month since that day MIP Administrative voting ). Are you worried about this ?oracle How does the delay in whitelist affect your release ?

Yaron: MakerDAO Voting is not yes/no,MKR The holder can only vote for the proposal , You can also vote for it . The bill with the most votes at present is called hat, It can be executed .

As far as we know ,MakerDAO Has never been rejected , But maybe I was wrong . Besides , The introduction of a new proposal may attract more attention , Because there's a pending proposal that needs to be voted on . That is to say , I only learned last week that MakerDAO Voting mechanism , And it can be wrong to assess how things are going .

Delayed approval will delay our release , Because the white list process is long , It's been postponed 2 Zhou . But we are MakerDAO Everyone consulted on the team told us , These tickets will always pass in the end .

**Nate:** If MakerDAO Experienced malicious governance , That would be right B.Protocol And what impact does it have on its users ?

**Yaron:** adopt B.Protocol management MakerDAO The users of the vault are essentially MakerDAO user . therefore , If MakerDAO Experience of malicious behavior can lead to loss of funds , It also affects B.Protocol.

B.Protocol Almost completely consistent with its integrated protocol , To make them more stable . Any attack on them could also harm our users . because B.Protocol There's no control over the user's money , Therefore, the security of their deposits depends entirely on MakerDAO The security of .

Nate: B.Protocol How the scoring mechanism works ?

Yaron: B.Protocol Allow liquidators to share revenue with users . This is done according to the user's score , The score depends on the degree of interaction between the user and the protocol .

stay MakerDAO Integrating , The right measure is based on the user generated over time DAI Number . say concretely , Have 1000 individual DAI Debt users will get about 1 New points .

In the first month after launch , The cumulative rate of users is 2 times ( We have been 10 month 27 Daily start , So users still have time to enjoy this policy ).6 After a month , The proceeds will be distributed according to the score , Users can also use scores to vote for protocol upgrades .

The score is not ERC20, And it's not transferable . It's just records kept on the blockchain .

** Nett :** In addition to compliance , Do you think there is any advantage in making the score non transferable ?

Yaron: B.Protocol The best interest in having organic MakerDAO user . Because there is no initial liquidity required to start , The platform was never intended to be used at all MakerDAO Of the users . These users won't help us improve MakerDAO The security of , And the lack of organic activity will give supporters 0 profits . therefore , Our approach is to MakerDAO Users provide the additional benefits they initially get , But it's impossible to quantify it , So it doesn't encourage human behavior .

** Nett :** Start up 6 After a month ,B How the governance of the agreement will work ?

Yaron: 6 After a month , Users can vote to upgrade the program sharing mechanism . The mechanism determines the liquidator ( supporters ) How to choose , Their commitment and how they share the benefits .

There will also be new scoring mechanisms , In particular, how to deal with accumulated scores . It doesn't decide what to do with user deposits , These deposits will be kept entirely by them , And subject to the rules of the underlying loan platform .

**Nate:** How to see B.Protocol The community subsequently participates in the governance of the underlying protocol ? Is there any chance of cooperation ?

Yaron: B.Protocol The long-term goal is to help make the underlying agreement more stable , And through B.Protocol The more underlying protocols of governance are deposited , The safer it is .

The underlying protocol community will have a strong interest in establishing stricter support conditions , This in turn will make it more stable .B.Protocol The community's motivation is to make the underlying protocol more administrator friendly , So as to increase its income . See the interaction between the two communities , And whether the underlying agreement will try to take over at some point B.Protocol government , It's going to be fun .

B.Protocol By motivating liquidity providers ( The holder ) Promise to liquidate the uncollateralized loans and transfer the profits drawn by miners back to the users of the platform , So as to make the lending platform more secure .B.Protocol from Yaron Velner found , He was Kyber Network Of CTO and WBTC Co designer of the agreement .

About

UBI.city - Agreement on future organizational structure , We will release more about UBI.city The conception and design mechanism of , Welcome interested blockchain technology enthusiasts 、 Community initiator 、 Study and analyze people and <span style='color:#BB8719'>Gavin、Iris</span> contact , Discuss together UBI The possibility of the future .

ChinaDeFi - ChinaDeFi.com It's a research driven DeFi Innovation organizations , From all over the world every day <span style='color:#BB8719'>500 A good source of information </span> Close to <span style='color:#BB8719'>900 Content </span> in , seek <span style='color:#BB8719'> Think more deeply 、 It's more systematic </span> The content of , Provide decision-making assistant materials to the Chinese market at the fastest speed

版权声明

本文为[Gavin talking about defi]所创,转载请带上原文链接,感谢

边栏推荐

- 吴恩达《Machine Learning》精炼笔记 4:神经网络基础 - 知乎

- After seven years of pursuing, nearly one billion US dollars of bitcoin was eventually confiscated and confiscated by the US government

- The length of the last word in leetcode

- Mongodb index management of distributed document storage database

- CSDN bug10: to be added

- Collection of blockchain theory [31]

- 大专学历的我工作六年了,还有机会进大厂吗?

- 区块链论文集【三十一】

- CSDN bug5: to be added

- Incomplete Polyfill of proxy

猜你喜欢

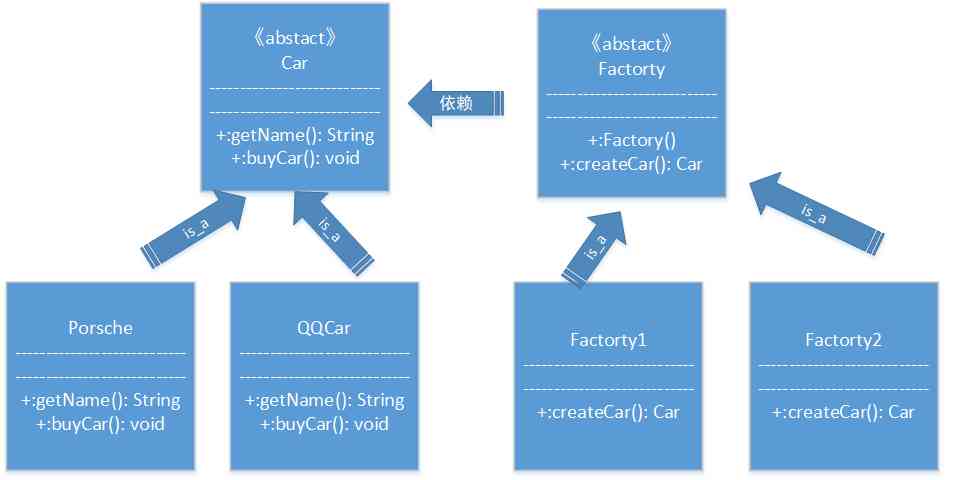

工厂方法模式

getIServiceManager() 源码分析

浅谈字节最新开源联邦机器学习平台Fedlearner

Hong Kong listed companies transfer cards to acquire 42.5% equity of chuangxinzhong and plan to speed up the distribution of marketing services

csdn bug6:待加

将Map中对应的key和value赋值到对象中

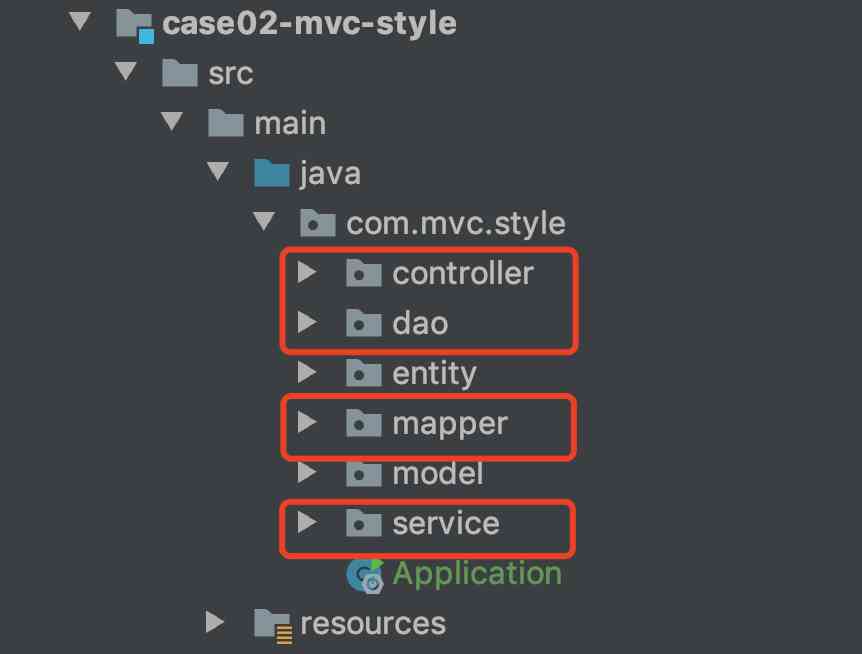

Coding style: SSM environment in MVC mode, code hierarchical management

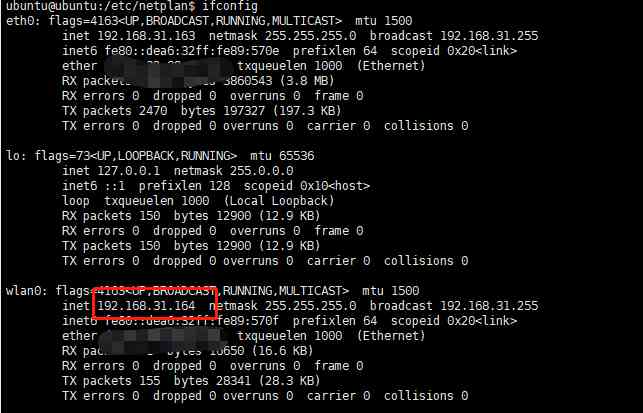

Raspberry pie drum set WiFi

《Python Cookbook 3rd》笔记(2.1):使用多个界定符分割字符串

编码风格:Mvc模式下SSM环境,代码分层管理

随机推荐

Enter C abstract to understand the similarities and differences between abstract classes and interfaces

自己上手写性能测试工具(二)

mac终端Iterm2支持rz和sz的解决方案

CSDN bug8: to be added

YouTube subscription: solve the problem of incomplete height display of YouTube subscription button in pop-up window

Coding style: SSM environment in MVC mode, code hierarchical management

Experiment 2

csdn bug7:待加

利用尾巴作为时间序列进行处理来识别鲸鱼

Solution of MAC terminal iterm2 supporting RZ and sz

Factory approach model

One image can hold 16x16 words! ——Transformers for large scale image scaling recognition (a brief review of ICLR 2021 papers)

js label语法跳出多重循环

pytorch训练GAN时的detach()

The length of the last word in leetcode

关于centos启动报错:Failed to start Crash recovery kernel arming的解决方案

从零开始学习 YoMo 系列教程:开篇

图-无向图

iNeuOS工业互联平台,WEB组态(iNeuView)增加工程视图导入、导出功能,及优化和修复,发布:v3.2.1版本

Difficulties in heterogeneous middleware implementation of Bifrost site management (1)