当前位置:网站首页>Comics: looking for the best time to buy and sell stocks

Comics: looking for the best time to buy and sell stocks

2020-11-08 13:02:00 【I'm sorry.】

Some time ago , Xiaohui released the next two on the stock trading algorithm problem explanation , It has inspired a lot of interest from small partners .

This time, , Xiao Hui integrates these two comics together , And fixed some of the details of the error , Thank you for your advice .

————— the second day —————

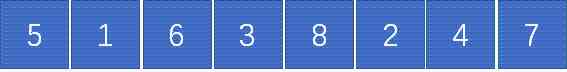

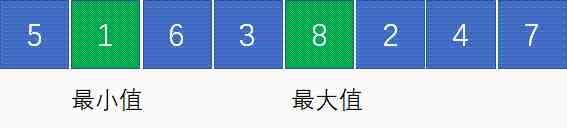

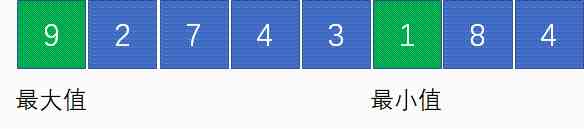

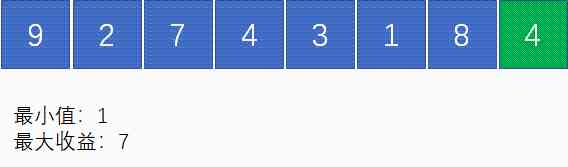

What does that mean ? Let's take an example , Given the following array :

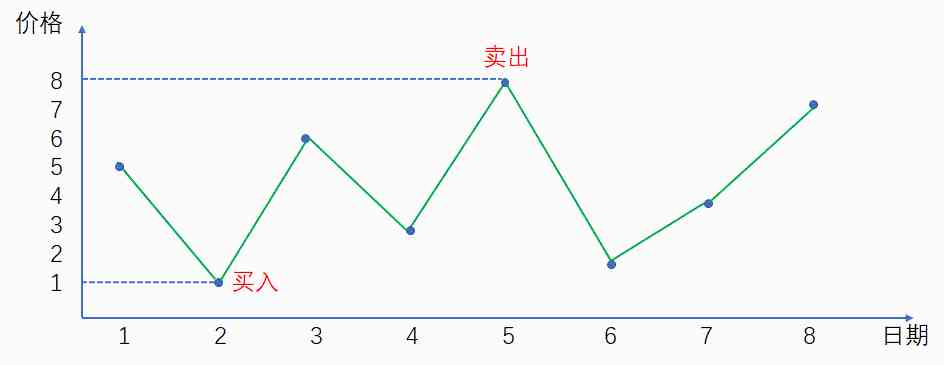

The corresponding stock up and down curve of this array is as follows :

obviously , From 2 The price is 1 Buy when , From 5 The price is 8 Sell when , You can get the most out of it :

The biggest payoff at this point is 8-1=7.

In the example above , Maximum 9 At the minimum 1 In front of , How can we trade ? We can't turn back time ?

————————————

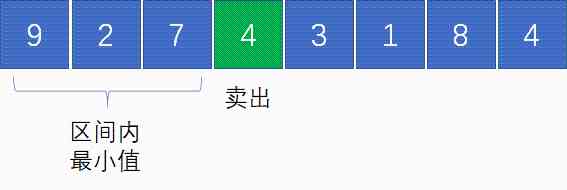

The following is an example , If we have set the price 4 It's time to sell , So which is the best time to buy ?

We have to choose the price 4 The previous interval , And must be the minimum value in the interval , obviously , The best choice is price 2 The timing of the .

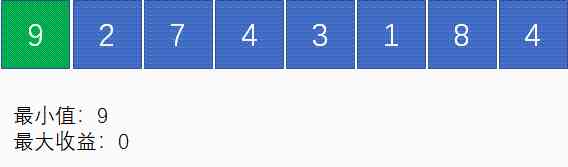

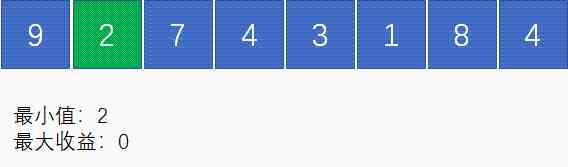

The first 1 Step , Initialization operation , Put the first 1 Elements as temporary minimum price ; The initial value of maximum return is 0:

The first 2 Step , Traverse to the 2 Elements , because 2<9, So the current minimum price becomes 2; There is no need to calculate the difference ( Because the front element is bigger than it ), The biggest benefit is still 0:

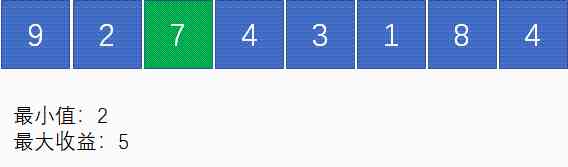

The first 3 Step , Traverse to the 3 Elements , because 7>2, So the current minimum price is still 2; As we said just now , Suppose the price 7 For selling point , The best buy point for that is the price 2, The difference between the two 7-2=5,5>0, So the biggest payoff right now is 5:

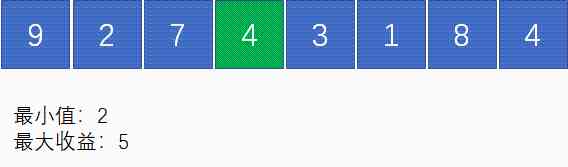

The first 4 Step , Traverse to the 4 Elements , because 4>2, So the current minimum price is still 2;4-2=2,2<5, So the biggest payoff is still 5:

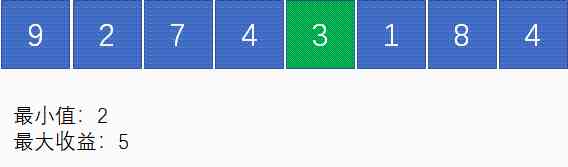

The first 5 Step , Traverse to the 5 Elements , because 3>2, So the current minimum price is still 2;3-2=1,1<5, So the biggest payoff is still 5:

And so on , We walk through the end of the array , The minimum price at this time is 1; The biggest benefit is 8-1=7:

public class StockProfit {

public static int maxProfitFor1Time(int prices[]) {

if(prices==null || prices.length==0) {

return 0;

}

int minPrice = prices[0];

int maxProfit = 0;

for (int i = 1; i < prices.length; i++) {

if (prices[i] < minPrice) {

minPrice = prices[i];

} else if(prices[i] - minPrice > maxProfit){

maxProfit = prices[i] - minPrice;

}

}

return maxProfit;

}

public static void main(String[] args) {

int[] prices = {9,2,7,4,3,1,8,4};

System.out.println(maxProfitFor1Time(prices));

}

}

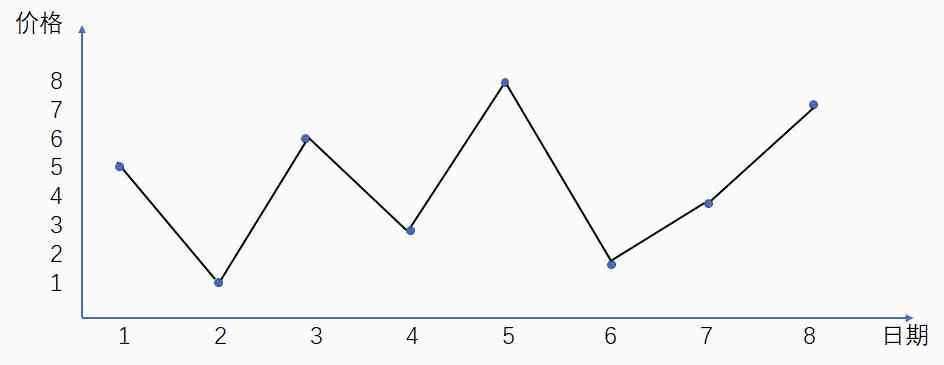

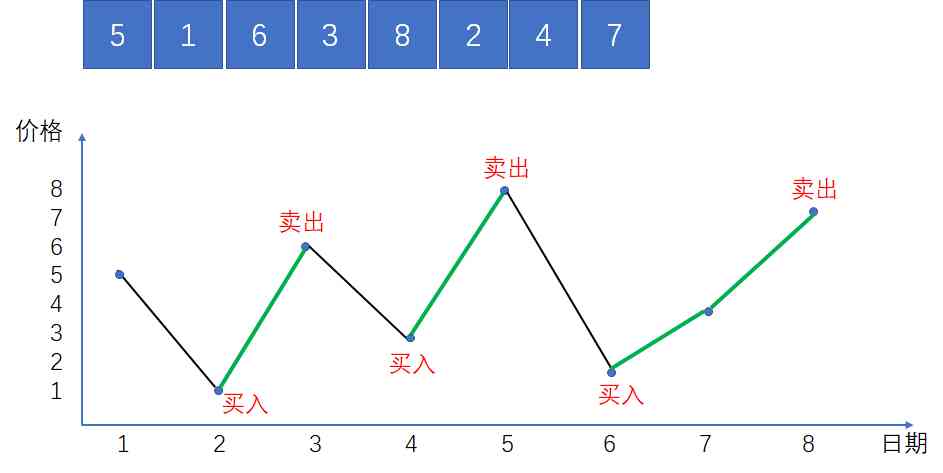

Let's take the array in the following figure for example , Take a visual look at the timing of buying and selling :

In the picture , The green line represents the stage of price rise . Since there is no limit to the number of transactions , So we can buy at every low point , Sell at every high .

thus , All the green parts are our gains , The maximum total return is the sum of these local returns :

(6-1)+(8-3)+(4-2)+(7-4) = 15

As for how to judge these green rising stages ? It's simple , We traverse the entire array , But where the latter is greater than the former , It means that the stock price is in the rising stage .

public int maxProfitForAnyTime(int[] prices) {

int maxProfit = 0;

for (int i = 1; i < prices.length; i++) {

if (prices[i] > prices[i-1])

maxProfit += prices[i] - prices[i-1];

}

return maxProfit;

}

Let's still take the previous array as an example :

First , Look for 1 The best buy and sell point under the sub limit :

It's impossible to cross the two positions , So we found number one 1 After the second trading position , Take out this pair of buy and sell points and the elements in between :

Next , We follow the same line of thinking , And then look for the rest of the elements 2 The best buy and sell point for sub - Sales :

thus , We found the most 2 The best choice in the case of sub sales :

For the array above , If we solve it twice independently , The best buy and sell points are 【1,9】 and 【6,7】, The biggest benefit is (9-1)+(7-6)=9:

But actually , If you choose 【1,8】 and 【3,9】, The biggest benefit is (8-1)+(9-3)=13>9:

When the first 1 The next best buy and sell point is determined , The first 2 What kind of situation will there be in the position of buying and selling points ?

situation 1: The first 2 Second best buy and sell point , In the 1 Buy sell left

situation 2: The first 2 Second best buy and sell point , In the 1 On the right side of the buying and selling point

situation 3: The first 1 The buy and sell range is cut off from the middle , Split it back into two deals

that , How to judge what kind of situation a given stock price array belongs to ? It's simple , In the 1 After the next maximum buying and selling point is determined , We can compare which situation brings about the largest increase in revenue :

Looking for the biggest gains on the left and right is easy to understand , What's the use of looking for the biggest drop in the middle ?

Think about it and you'll know , When the first 1 When the sale needs to be split up , The biggest drop in the trading range , It's the same as the profit increment after the split ( Similar to the bottom of the stock market operation ):

thus , We can sum up the following formula :

Maximum total revenue = The first 1 The second largest return + Max( The biggest gain on the left , The biggest drop in the middle , The biggest gain on the right )

So called dynamic programming , It is to simplify a complex problem into smaller subproblems , And then from the simple subproblem from the bottom up step by step recursion , Finally, we get the optimal solution of complex problems .

First , Let's analyze the current stock trading problem , This problem requires a certain number of days to be solved 、 The maximum return under a certain number of transactions .

Since the limit on the maximum trading of shares 2 Time , Then the stock transaction can be divided into 5 Stages :

No business

The first 1 Buy... Times

The first 1 Time to sell

The first 2 Buy... Times

The first 2 Time to sell

We set the trading stage of a stock as a variable m( Use from 0 To 4 The value of represents ), Set the range of days as a variable n. And the biggest benefit of our solution is , Influenced by these two variables , It can be expressed as follows :

The biggest gain = F(n,m)(n>=1,0<=m<=4)

Since functions and variables have been determined , Next, we're going to identify two elements of dynamic planning :

1. The initial state of the problem

2. The state transition equation of the problem

What is the initial state of the problem ? We assume that the range of trading days is limited to 1 God , That is to say n=1 The situation of :

1. If there is no business , That is to say m=0 when , The biggest benefit is obviously 0, That is to say F(1,0)= 0

2. If there is 1 Buy... Times , That is to say m=1 when , It's equivalent to subtracting the first one out of thin air 1 Day's share price , The biggest profit is negative day stock price , That is to say F(1,1)= -price[0]

3. If there is 1 Time to buy , That is to say m=2 when , The sale offsets ( Of course , It doesn't make sense ), The biggest benefit is 0, That is to say F(1,2)= 0

4. If there is 2 Buy... Times , That is to say m=3 when , Same as m=1 The situation of ,F(1,3)= -price[0]

5. If there is 2 Time to sell , That is to say m=4 when , Same as m=2 The situation of ,F(1,4)= 0

The initial state is determined , Let's take a look at the state shift . If the range of days is limited from n-1 Days increased to n God , So what happens to the maximum return ?

It depends on what stage is it now ( It's the number of buying and selling ), And for the first time n Day stock price operation ( purchase 、 Sell or wait and see ). Let's analyze the situation at each stage :

1. If there was no sale before , And the first n The sky is still watching , So the biggest payoff is still 0, namely F(n,0) = 0

2. If there was no sale before , And the first n Days to buy , So the biggest return is the negative day stock price , namely F(n,1)= -price[n-1]

3. If there was 1 Buy... Times , And the first n God chooses to wait and see , So the maximum profit is the same as before , namely F(n,1)= F(n-1,1)

4. If there was 1 Buy... Times , And the first n Days to sell , So the biggest payoff is 1 The negative return on the second purchase plus the share price of the day , That is to say F(n,2)= F(n-1,1)+ price[n-1]

5. If there was 1 Time to sell , And the first n God chooses to wait and see , So the maximum profit is the same as before , namely F(n,2)= F(n-1,2)

6. If there was 1 Time to sell , And the first n Days go on 2 Buy... Times , So the biggest payoff is 1 The second sale income minus the share price of the day , namely F(n,3)= F(n-1,2) - price[n-1]

7. If there was 2 Buy... Times , And the first n God chooses to wait and see , So the maximum profit is the same as before , namely F(n,3)= F(n-1,3)

8. If there was 2 Buy... Times , And the first n Days to sell , So the biggest payoff is 2 The second buy income minus the share price of the day , namely F(n,4)= F(n-1,3) + price[n-1]

9. If there was 2 Time to sell , And the first n God chooses to wait and see ( I can only wait and see ), So the maximum profit is the same as before , namely F(n,4)= F(n-1,4)

Last , We put the situation 【2,3】,【4,5】,【6、7】,【8,9】 Merge , It can be summed up as follows 5 An equation :

F(n,0) = 0

F(n,1)= max(-price[n-1],F(n-1,1))

F(n,2)= max(F(n-1,1)+ price[n-1],F(n-1,2))

F(n,3)= max(F(n-1,2)- price[n-1],F(n-1,3))

F(n,4)= max(F(n-1,3)+ price[n-1],F(n-1,4))

From the back 4 In the equation , We can sum up the relationship between the maximum return of each stage and the previous stage :

F(n,m) = max(F(n-1,m-1)+ price[n-1],F(n-1,m))

From this we can conclude that , The complete state transition equation is as follows :

In the table , Different lines represent the maximum return under different day limits , The different columns represent the maximum returns at different stages of trading .

We still use the array from the previous example , Fill in the table on this basis :

First , We fill in the initial state for the table :

Next , We're starting to fill in the 2 Row data .

When there is no business , The maximum benefit must be 0, therefore F(2,0) The result is 0:

According to the previous state transition equation ,F(2,1)= max(F(1,0)-2,F(1,1))= max(-2,-1)= -1, So the first 2 Xing di 2 The result of the column is -1:

F(2,2)= max(F(1,1)+2,F(1,2))= max(1,0)= 1, So the first 2 Xing di 3 The result of the column is 1:

F(2,3)= max(F(1,2)-2,F(1,3))= max(-2,-1)= -1, So the first 2 Xing di 4 The result of the column is -1:

F(2,4)= max(F(1,3)+2,F(1,4))= max(1,0)= 1, So the first 2 Xing di 5 The result of the column is 1:

And then we go on with the state transition equation , Fill first 3 Row data :

Next, fill in the 4 That's ok :

And so on , We've been filling in the entire form :

As shown in the figure , The last data in the table 13, It's the biggest benefit of the whole .

// The maximum number of transactions

private static int MAX_DEAL_TIMES = 2;

public static int maxProfitFor2Time(int[] prices) {

if(prices==null || prices.length==0) {

return 0;

}

// The maximum number of rows in a table

int n = prices.length;

// The maximum number of columns in a table

int m = MAX_DEAL_TIMES*2+1;

// Record data using a two-dimensional array

int[][] resultTable = new int[n][m];

// Fill in the initial state

resultTable[0][1] = -prices[0];

resultTable[0][3] = -prices[0];

// Bottom up , Fill in the data

for(int i=1;i<n;++i) {

for(int j=1;j<m;j++){

if((j&1) == 1){

resultTable[i][j] = Math.max(resultTable[i-1][j], resultTable[i-1][j-1]-prices[i]);

}else {

resultTable[i][j] = Math.max(resultTable[i-1][j], resultTable[i-1][j-1]+prices[i]);

}

}

}

// Return the final result

return resultTable[n-1][m-1];

}

// The maximum number of transactions

private static int MAX_DEAL_TIMES = 2;

public static int maxProfitFor2TimeV2(int[] prices) {

if(prices==null || prices.length==0) {

return 0;

}

// The maximum number of rows in a table

int n = prices.length;

// The maximum number of columns in a table

int m = MAX_DEAL_TIMES*2+1;

// Record data using a one-dimensional array

int[] resultTable = new int[m];

// Fill in the initial state

resultTable[1] = -prices[0];

resultTable[3] = -prices[0];

// Bottom up , Fill in the data

for(int i=1;i<n;++i) {

for(int j=1;j<m;j++){

if((j&1) == 1){

resultTable[j] = Math.max(resultTable[j], resultTable[j-1]-prices[i]);

}else {

resultTable[j] = Math.max(resultTable[j], resultTable[j-1]+prices[i]);

}

}

}

// Return the final result

return resultTable[m-1];

}

In this code ,resultTable From a two-dimensional array to a one-dimensional array . Because the maximum number of transactions is constant , So the spatial complexity of the algorithm also varies from O(n) Down to O(1).

public static int maxProfitForKTime(int[] prices, int k) {

if(prices==null || prices.length==0 || k<=0) {

return 0;

}

// The maximum number of rows in a table

int n = prices.length;

// The maximum number of columns in a table

int m = k*2+1;

// Record data using a one-dimensional array

int[] resultTable = new int[m];

// Fill in the initial state

for(int i=1;i<m;i+=2) {

resultTable[i] = -prices[0];

}

// Bottom up , Fill in the data

for(int i=1;i<n;i++) {

for(int j=1;j<m;j++){

if((j&1) == 1){

resultTable[j] = Math.max(resultTable[j], resultTable[j-1]-prices[i]);

}else {

resultTable[j] = Math.max(resultTable[j], resultTable[j-1]+prices[i]);

}

}

}

// Return the final result

return resultTable[m-1];

}

—————END—————

Friends who like this article , Welcome to the official account Programmer Xiaohui , Watch more

Order one [ Looking at ], It's the biggest support for Xiao Hui !

版权声明

本文为[I'm sorry.]所创,转载请带上原文链接,感谢

边栏推荐

- Major changes in Huawei's cloud: Cloud & AI rises to Huawei's fourth largest BG with full fire

- Summary of template engine

- Flink: from introduction to Zhenxiang (3. Reading data from collection and file)

- Top 5 Chinese cloud manufacturers in 2018: Alibaba cloud, Tencent cloud, AWS, telecom, Unicom

- Implementation of verification code recognition in Python opencv pytesseract

- Python basic syntax

- On the confirmation of original data assets

- Adobe Lightroom /Lr 2021软件安装包(附安装教程)

- [Python 1-6] Python tutorial 1 -- number

- PMP experience sharing

猜你喜欢

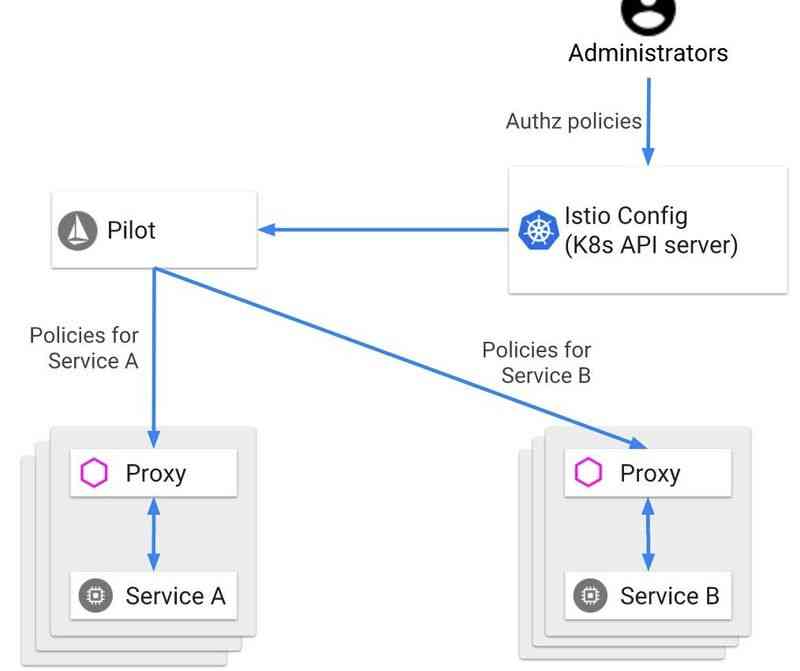

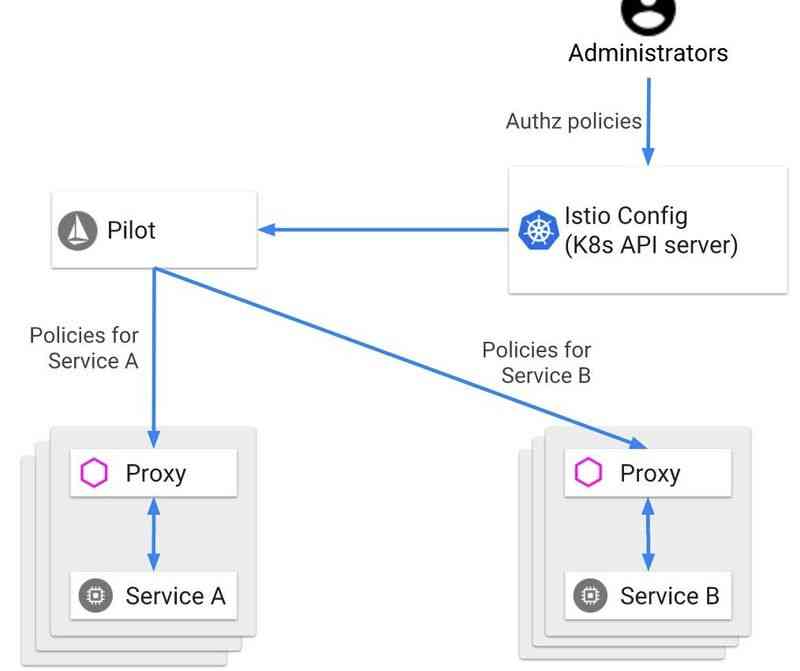

解析Istio访问控制

Flink from introduction to Zhenxiang (10. Sink data output elasticsearch)

Flink: from introduction to Zhenxiang (3. Reading data from collection and file)

笔试面试题目:求丢失的猪

Analysis of istio access control

Written interview topic: looking for the lost pig

Don't look! Full interpretation of Alibaba cloud's original data lake system! (Internet disk link attached)

Harbor项目高手问答及赠书活动

新型存算一体芯片诞生,利好人工智能应用~

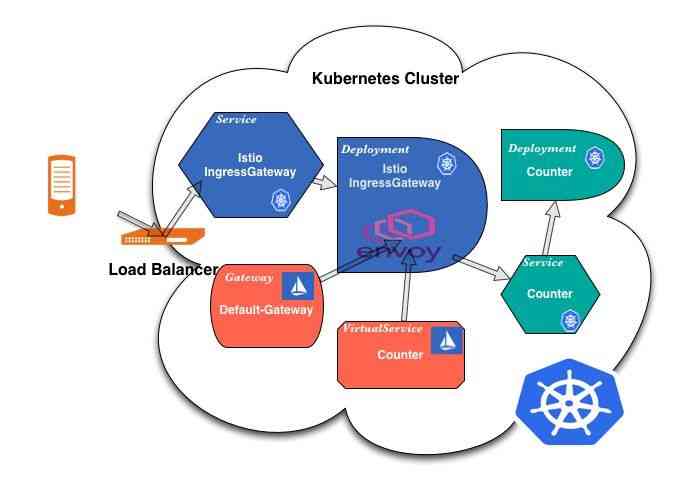

Istio流量管理--Ingress Gateway

随机推荐

On monotonous stack

Google's AI model, which can translate 101 languages, is only one more than Facebook

Hematemesis! Alibaba Android Development Manual! (Internet disk link attached)

Windows10关机问题----只有“睡眠”、“更新并重启”、“更新并关机”,但是又不想更新,解决办法

OR Talk NO.19 | Facebook田渊栋博士:基于蒙特卡洛树搜索的隐动作集黑盒优化 - 知乎

svg究竟是什么?

Flink: from introduction to Zhenxiang (6. Flink implements UDF function - realizes more fine-grained control flow)

PMP experience sharing

谷歌开源能翻译101种语言的AI模型,只比Facebook多一种

2035我们将建成这样的国家

为 Docsify 自动生成 RSS 订阅

当Kubernetes遇到机密计算,看阿里巴巴如何保护容器内数据的安全!(附网盘链接)

C language I blog assignment 03

浅谈单调栈

用科技赋能教育创新与重构 华为将教育信息化落到实处

Research on WLAN direct connection (peer-to-peer connection or P2P) and cross platform research of IOS

Adobe media encoder / me 2021 software installation package (with installation tutorial)

笔试面试题目:求丢失的猪

What is the database paradigm

Xamarin deploys IOS from scratch Walterlv.CloudKeyboard application